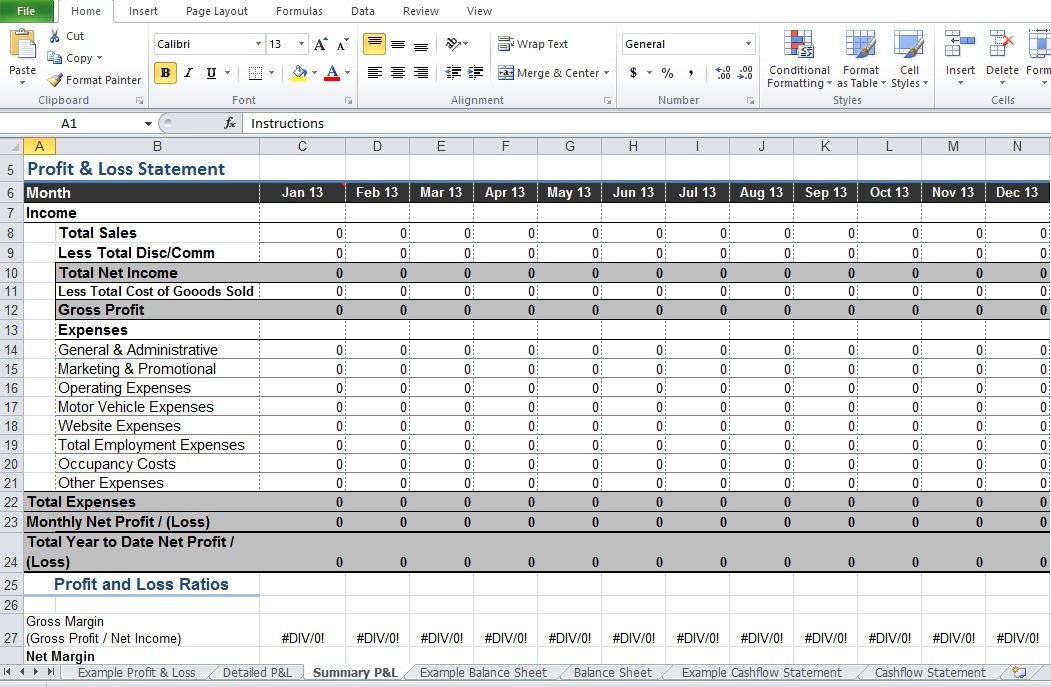

This Salary Breakdown Excel Template helps you in figuring and keeping up the records of pay and derivations for every worker. You can keep up an exceedingly classified worker enroll where you can record representative data like name, address, and date of joining, yearly pay, government recompenses, pretax property, post-charge findings, and numerous more subtle elements. For ascertaining the finance of a representative you will require extra data like:

- Gross pay of a worker before derivations

- Taxable sum

- All statutory installments made

- Taxable advantages and costs

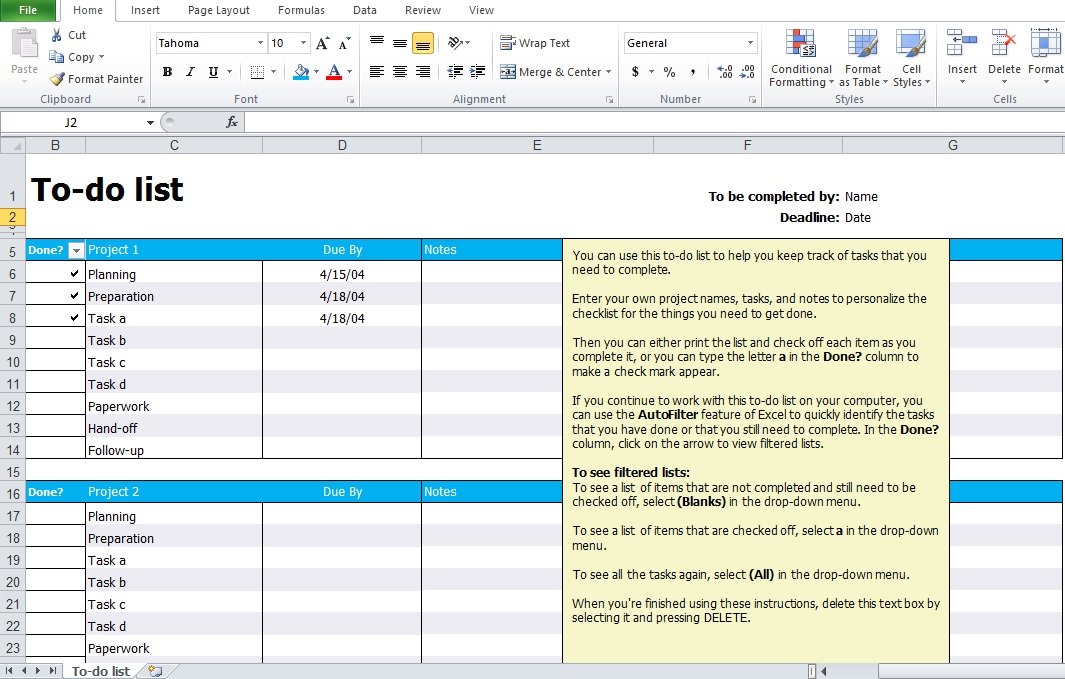

Using the Salary Breakdown Excel Template

Step 1. Incorporate General Information

Right off the bat, you have to guarantee that you round out the organization subtle elements, for example, organization name, address, area, and telephone number. At that point, you could determine the office for which the representative accepting this wage slip is working in. You may also like salary slip template.

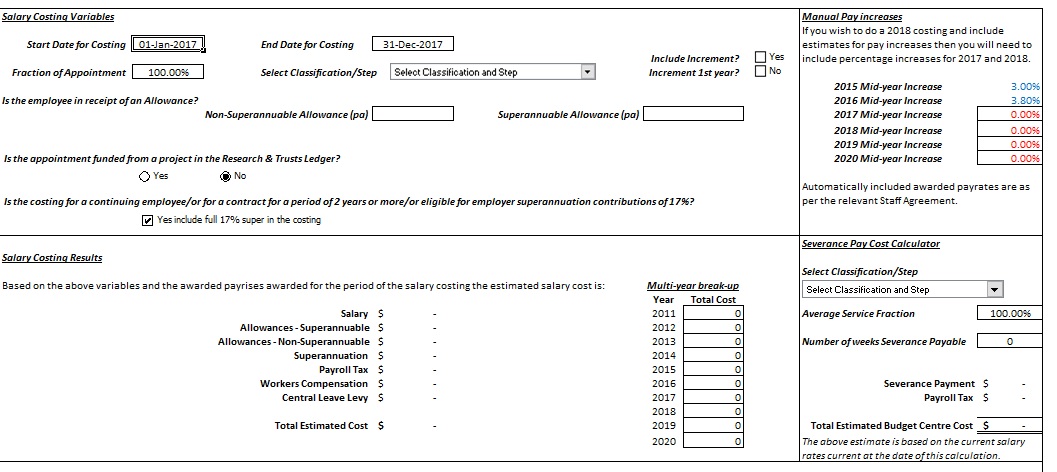

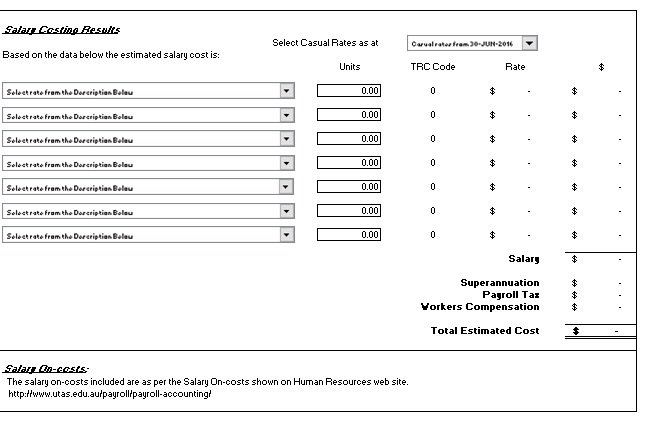

Step 2. Incorporate the Pay Period

This is a truly imperative area on the payslip layout and is the one that requires consistent refreshing. The “Begin Date” is the date on which the payroll interval began. In this manner, on the off chance that you are paying a representative for working for as long as two weeks, take note of the date that began two weeks back. The “End Date” is the finish of the worker’s payroll interval. It is normally set for the seventh or the fifteenth or the 30th of every month. The end date is likewise alluded to as the compensation date. It is the date on which a check or some other installment strategy is being issued to a representative. This will be the same as an “end date” or maybe a couple of days ahead or behind.

Step 3. Incorporate Vital Employee Information

Normally, there are two snippets of data that you should round out about the worker. This incorporates the worker’s name and the representative’s id. You have to guarantee that you utilize their full name while indicating their points of interest. It is a smart thought to apportion a worker id. This will make it simple to distribute a standard and snappier reference to the workers. You should also check the petty cash receipt template.

Step 4. Incorporate Crucial Tax Data

This segment will just show extremely broad data as to which assessments are being paid. It will record your compensation-related duty filings. Contingent upon your individual current expense circumstance, you might need to assert a couple of exclusions or withhold an extra sum from going towards assessments. Along these lines, if for example, a representative is wanting to give a part of their pay towards a beneficent association, it doesn’t progress toward becoming assessment deductible. Rather, it might end up noticeably qualified to assert an exception ahead of time. Something else, each representative will be exhausted at the overarching charge framework rate. For different expense related matters, it is a smart thought to employ the administrations of an educated bookkeeper for expert counsel!

Step 5. Incorporate the Employee’s Earnings

Income can take different structures. Be that as it may, the most widely recognized headings are as per the following: You may also see the sales receipt template.

Additional Reading: Understand Salary Breakup, Gratuity, Pay Scale & Tax Calculation (link)

Customary Salary: This incorporates the consistent compensation earned by a worker through hours worked amid a predefined payroll interval.

Reward: Although each payroll interval does exclude a payout as a reward, it should be checked independently in a period where the reward is paid.

Grants: If your association proclaims financial honors amid the year which perceives some additional endeavors or other remarkable accomplishments, you will be required to record it utilizing the salary breakdown excel template exceed expectations format.