Payday shouldn’t feel like decoding a puzzle. A clear, consistent UK payslip template helps you (and your team) see exactly what’s been earned, what’s been deducted, and what hits the bank—without guesswork. In this guide, I’ll show you how to structure a professional payslip, what to include for UK compliance, and how to build a template in Excel or Google Sheets that’s easy to maintain and scale.

Table of Contents

Why a UK Payslip Template Matters

A good template does three big jobs:

- Clarity: Employees understand their pay and deductions at a glance.

- Consistency: Every payslip looks the same, which reduces questions.

- Efficiency: You spend less time reformatting and more time double-checking the numbers that matter.

Whether you’re a small business, a one-person operation paying subcontractors, or a growing team, the right template keeps payroll tidy and trustworthy.

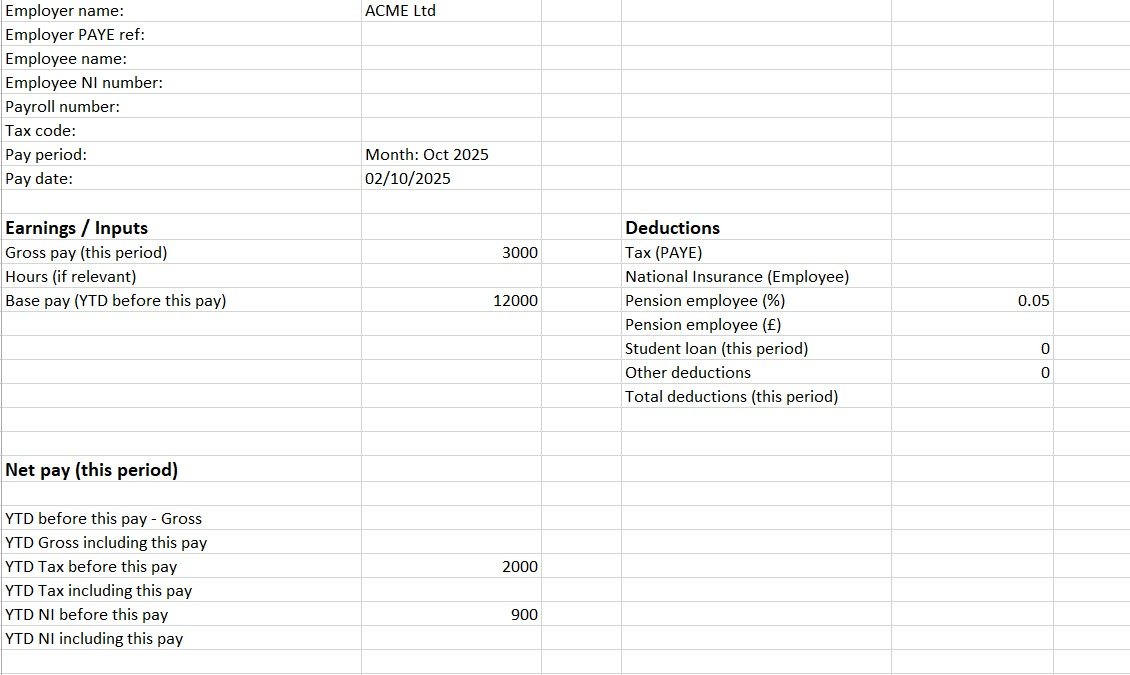

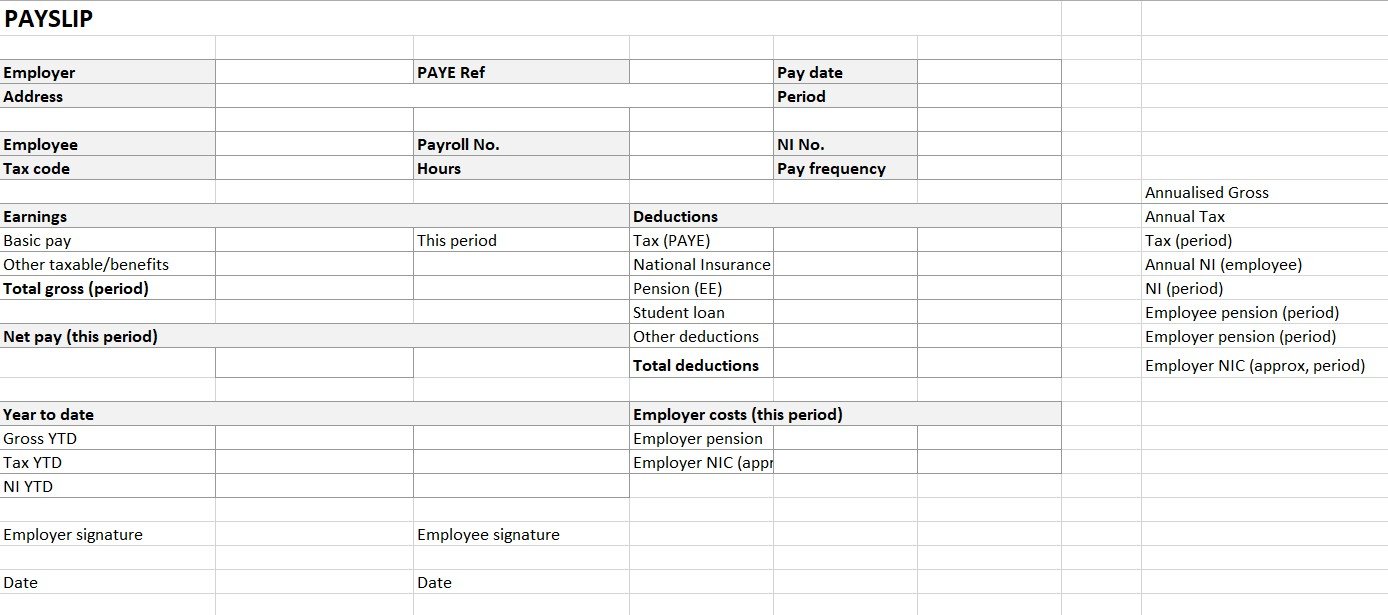

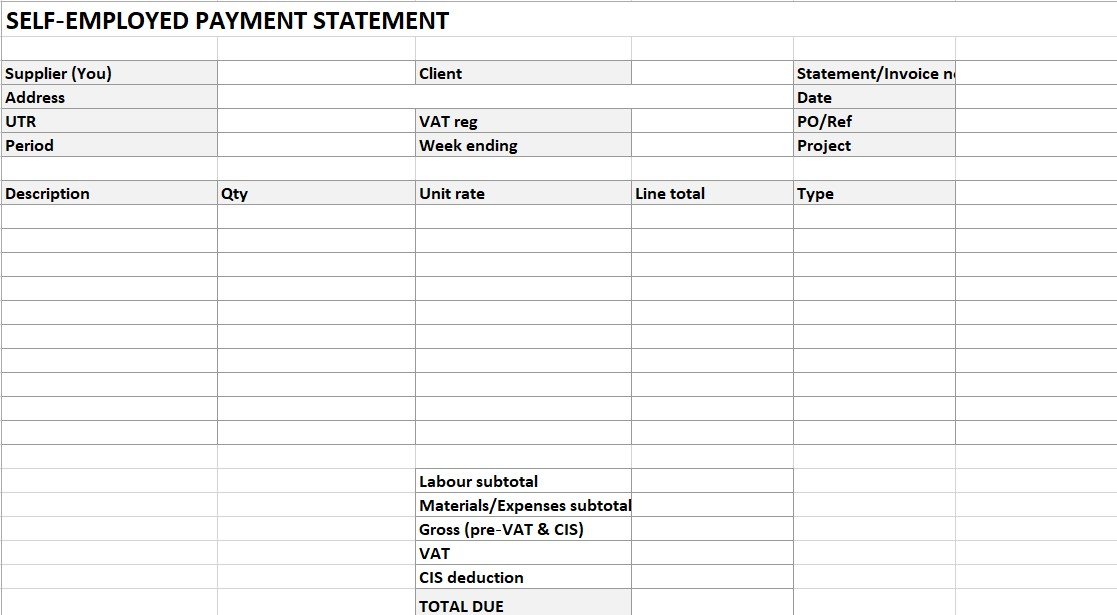

Must-Have Sections in a UK Payslip Template

1) Header: Employer & Employee Details

- Employer name and address

- Employee name and (optional) payroll/employee number

- (Optional but useful) National Insurance number

- Company logo (keeps it professional and easy to recognise)

2) Pay Period & Pay Date

- Pay period label (e.g., “Monthly: 1–31 Oct 2025” or “Week 40”)

- Pay date (the date funds are paid)

3) Tax & NI Settings

- Tax code (e.g., 1257L)

- NI category letter (e.g., A, B, C)

These aren’t legally required to appear in every format, but showing them prevents confusion.

4) Earnings Breakdown

Create line items so people can see the why behind the total:

- Basic pay (salary or hourly × hours)

- Overtime (specify the multiplier, e.g., 1.5x)

- Commission/bonus

- Allowances (e.g., travel, on-call)

Pro tip: Split overtime by rate (1.5x vs 2.0x) to make audits painless.

5) Deductions

- Income Tax (PAYE)

- Employee National Insurance (NI)

- Pension (employee contribution)

- Student Loan / Postgraduate Loan (if applicable)

- Other deductions (salary sacrifice, court orders, etc.)

6) Totals

- Gross pay (sum of earnings)

- Total deductions

- Net pay (take-home)

7) Year-to-Date (YTD) Summary

- Gross YTD, Tax YTD, NI YTD

- Pension YTD (if you run a scheme)

This section dramatically reduces “Can you confirm my totals?” emails.

8) Helpful Extras (Optional)

- Employer pension contribution

- Holiday pay balance (casual/zero-hours)

- Pay run number / reference

- Message box for notes (e.g., “Backpay for July overtime”)

How to Build a UK Payslip Template in Excel (Step-by-Step)

Step 1: Structure the Sheet

- Row 1–6: Header (logo, employer/employee info, pay period/date, tax code, NI letter).

- Rows 8–16: Earnings table with columns: Description, Units, Rate, Amount.

- Rows 18–26: Deductions table.

- Rows 28–30: Totals & Net pay.

- Rows 32–36: YTD summary.

Step 2: Add Formulas

- Gross Pay = SUM(Earnings[Amount])

- Total Deductions = SUM(Deductions[Amount])

- Net Pay = Gross Pay – Total Deductions

- YTD columns = last YTD + current period (or reference a year-to-date calc sheet)

Protect your formulas. Lock the totals and calculation cells. Leave input cells unlocked for easy editing.

Step 3: Make It Foolproof

- Data validation (drop-downs for pay frequency or NI letter).

- Consistent number formats (two decimals, £ symbol).

- Fit to A4 width for printing and set a print area.

- Conditional formatting (optional) to highlight negative adjustments.

Step 4: Create a Clean PDF

- Save a master workbook.

- For each pay run, duplicate the sheet, fill inputs, export to PDF, and email the employee securely.

Common Mistakes to Avoid

- One big “Earnings” line. Break things out; it prevents disputes.

- Manual totals. If someone can override a formula, they will—by accident. Lock them.

- Forgetting YTD. It’s the #1 way to earn employee confidence.

- No audit trail. Keep a pay run number and a PDF archive.

- Unclear overtime. Specify the multiplier and hours.

Final Thoughts

A professional UK payslip template communicates clearly, calculates reliably, and looks consistent every time. Build it once with protected formulas, simple data validation, and crisp formatting. The payoff is real: fewer payroll emails, fewer mistakes, and happier paydays.

free UK payslip template

professional uk payslip template

self employed uk payslip template

FAQs: UK Payslip Template

What is a UK payslip?

Is a payslip legally required?

Yes. UK employees must receive an itemised payslip on or before payday. It can be digital or paper.

What should a UK payslip include?

- Employer & employee details

- Pay period and pay date

- Earnings (basic pay, overtime, bonuses, allowances)

- Deductions (PAYE tax, NI, pension, student loan, etc.)

- Gross pay, total deductions, net pay

- (Recommended) Year-to-date (YTD) totals for gross, tax, NI, pension

Should the payslip show YTD totals?

It’s not mandatory but strongly recommended. YTD (from 6 April to 5 April) helps employees verify tax/NI across the tax year.

![Free Law Student Cover Letter Word & PDF [Samples+Examples]](https://exceltmp.com/wp-content/uploads/2021/04/law-student-cover-letter-email-150x150.jpg)