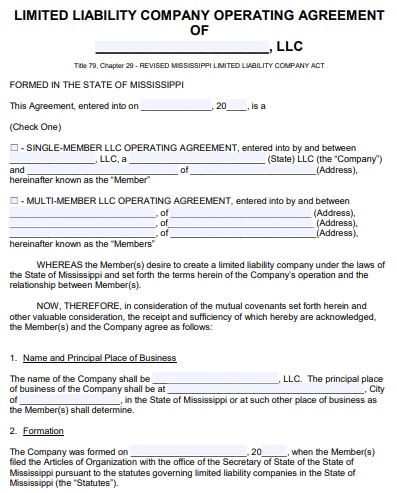

The business partners should obtain a Mississippi LLC operating agreement form when they come together and start an LLC. This agreement has important information regarding the business and the terms of their partnership.

Furthermore, every owner’s respective equity, the criteria for sharing profits and losses, voting rights, and the techniques of business operations are included in the operating agreement. It is highly suggested to prepare this document for the many benefits it presents, while, the state does not need LLC owners to file the document legally.

Table of Contents

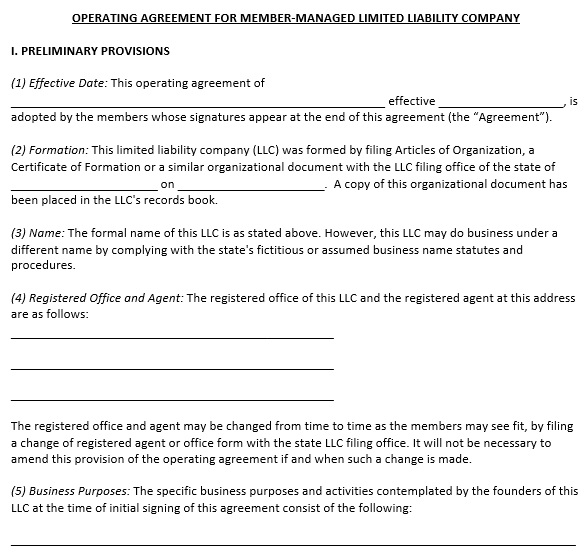

What to include in a Mississippi LLC operating agreement?

Here are the important elements that should be included in an operating agreement;

Company formation

Start with the company formation segment when you are ready to draft your Mississippi operating agreement. The general information of your business as it mentioned on the certificate of formation you filed while creating the company is included in this section.

Distribution of ownership

The owners should specify in this section how they share the ownership of the company. For instance, an LLC’s sole owner should specify that they possess 100% of the company’s equity interest.

Duties of the members

This part will safeguard you in the future from being subjected to the default, general LLC laws of Mississippi. Include the following information here;

- The management setting of the company

- The qualifications that a manager must have

- The sphere of authority

- Every member or those of the hired manager’s responsibilities

- The procedure for creating and approving important business decisions

There are two structures of LLC management, first-one is a member-managed LLC and the second is a manager-managed structure.

Voting rights and responsibilities

For identifying the voting power of the owners, there are no fixed rules. However, getting their voting rights in line with their equity is the standard way of doing it.

Capital contributions

This section contains information regarding how much money or resources every member contributed to the start-up. Contributions besides money may contain hands-on services, skills, and property like land and cars.

Distribution of profits

LLC’s each member has a right to receive profits. That’s why, you should indicate how the owners will share the profits along with filing the ownership equity and capital contributions.

Taxation procedures

This segment includes details regarding the taxation preferences as agreed upon. For instance, as a C corporation or an S corporation, you might decide to be taxed. Conventionally, as a sole proprietorship, the IRS taxes single-member LLCs.

Succession planning

A procedure to handle the departure of a member, either by choice or by death should also be featured in the operating agreement. Specify whether members can freely sell their equity to new members. Furthermore, writing the rules governing the sale of equity to existing members would be best.

Buyout and buy-sell rules

When a member decides to resign or retire in case of bankruptcy or when an owner dies or not able of being part of the business for various reasons, the operating agreement should outline directions for such scenarios as the future is filled with uncertainties. In addition, if a member divorces, the document should feature what will happen.

Dissolution

Typically, for several reasons, partnerships may come to a halt such as the mutual agreement to stop business due to excessive losses. The document should be able to guide the whole process in case the day to close the business comes. The agreement should also state that after clearing all debts and obligations as required by law, how the owners will share assets and other resources.

Severability clause

In contractual agreements, the severability clause is commonly used. According to this clause, by the invalidation of one segment of an operating agreement, the other parts of the document shouldn’t render invalid. You should also check the Mississippi Car Bill of Sale Form.

Mississippi LLC Operating Agreement

Mississippi LLC Operating Agreement Form

Mississippi LLC Operating Agreement Template

Conclusion:

In conclusion, a Mississippi LLC operating agreement form is an internal document that maintains your limited liability dignity in a law court. This document can be used to find fair solutions to disagreements among members of an LLC.