You have to create a LLC operating agreement template while starting a Limited Liability Company. This agreement demonstrates the workings of your company as well as separate the business owner’s finances from the company. The LLC agreement secures them against liability claims.

A limited liability company, in simple words, blends the features of a traditional corporation and a partnership. It provides the business owner better liability protection. Moreover, it is very simple to manage.

On the basis of the following factors, the details mentioned in an LLC Operating agreement will vary from one situation to the other;

- Tax considerations,

- Structure of management

- Member investments

- Number of members

- Sharing of profits

The LLC Operating Agreement is a legally binding document that illuminates the rights and obligations of every member/owner of the company and the company’s rules of operation. Other alternative names of this agreement are Operating Agreement, LLC Partnership Agreement, and LLC Agreement.

Table of Contents

What to include in a LLC operating agreement?

The LLC operating agreement covers the following information;

General information

In your operating agreement, you should include the following information;

- Business purpose

- All members names and their signatures

- The interest percentage of each member

- Financial contributions each member has made towards the company

- The date of annual meetings

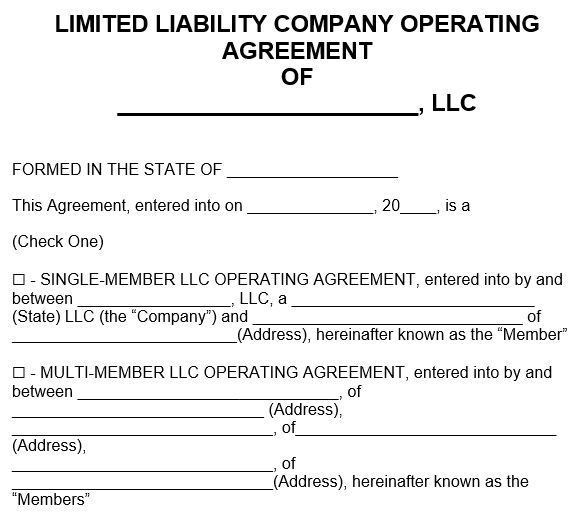

On the basis of whether you are a Single-Member LLC or a Multi-Member LLC, you should also outline the following areas;

- Binding authority

- Officers and members

- Admission of new members

Documents to be added

Owners are required to provide additional documents for the company to be considered as an LLC. These include the following;

- Articles of organization: these are the set of documents that are used by the business owners to declare their intention to set up an LLC in the state.

- Type of LLC: The types of LLC depends on the number of members involved in the company and this could be either of the two i.e. the single member operating agreement and the multi-member operating agreement.

Statement of intent

A statement of intent is a formal statement states that the owner(s) have a serious intention to develop the business when all the formalities have been followed.

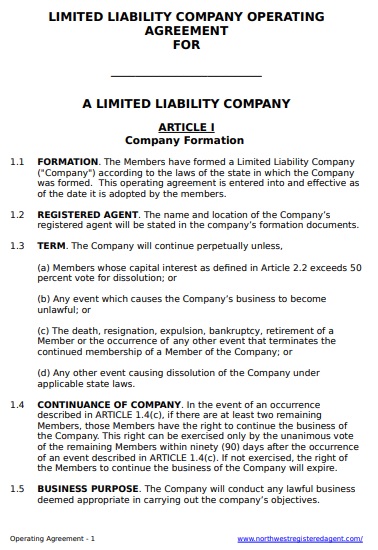

Company formation

The company information contains its name, address information, location of the principal business office, and services description. Two companies shouldn’t have the same name. Therefore, it is essential to verify your company’s name through the Secretary of State’s office. This section should include the following;

- Operating agreement amendment

- Dissolution

Capital contributions

Capital contributions can be categorized into;

- General capital contributions

- Additional capital contributions

Profit, loss and distribution

Here, you have to address the distribution of money earned or lost by the LLC among members. This normally depends on each member’s percentage ownership, tax brackets or financial requirements of the LLC members.

Management

The organization, coordination, planning, entrepreneurship, budgeting and control of a company’s resources are involved in the management. Below aspects are addressed by the operating agreement in the following ways;

- Duty of loyalty

- Indemnification

- Meetings

- Liability

- Life insurance

- Management structure

- Prohibitions

- Voting

Compensation

In a manager-managed LLC, the compensation may be necessary in cases such as reimbursement and management fee.

Bookkeeping

Bookkeeping is an important part of any type of business success. It is also addressed in an LLC operating agreement;

- Accounting

- Annual report

- Tac purposes documentation

- Auditing

- Records

- Tax

- Tax matters partner

- Valuation

Transfers of interest

The operating agreement specifies how the transfer of interest should be handled.

Death of a member

The provisions regarding handling company interests of departed members should be given in the agreement. Interest can be purchased by other members in the event of a member’s death.

Dissolving the business

For both SMLLC and MMLLC business, if you decide to dissolve or close the business, you should have a clear outline regarding what should be done. You should also check standard operating procedure template.

LLc Operating Agreement Template

Limited Liability Company Operating Agreement Template

Conclusion:

In conclusion, LLC operating agreement template is a legally binding document for businesses that specifies how the company will be managed and the structure of the business. It also outlines its day-to-day operations, members, and their percentage of ownership.