Table of Contents

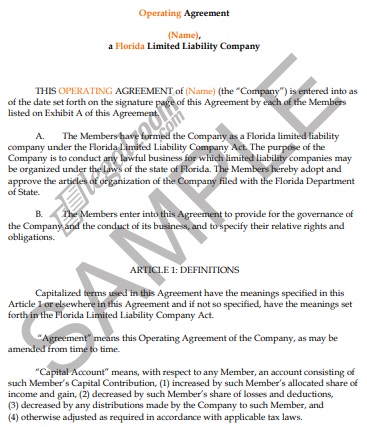

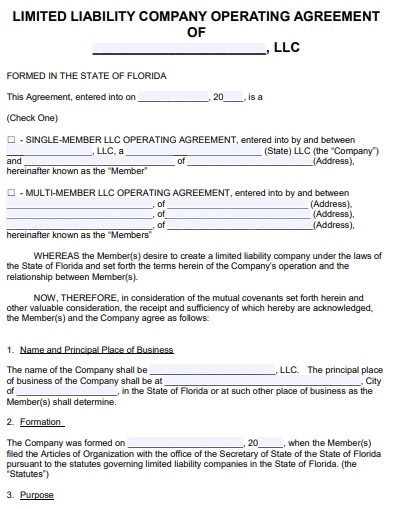

The significance of the operating agreement:

A Florida LLC operating agreement plays an important role in indicating how an entity is run and its governing structures. That’s why, assisting the business indicates banks and lenders that its operations are well organized. In the eyes of investors or partners that may request to see an operating agreement, it assists you to form a legitimate perception of the business.In a lawsuit against the entity, the operating agreement protects the personal assets of LLC members or owners. Since responsibilities, roles, and expectations are well outlined in writing, so foreseeable conflicts among members are also reduced.The Florida LLC operating agreement also assists in protecting the LL status of the entity. Therefore, it makes sure that it is not subject to default rules and regulations set by state law.Usage of agreement:

To protect assets, there are two ways in which a Florida LLC operating agreement can be used. They include the protection of members’ assets from claims filed against the LLC in court and claims made against LLC members. Furthermore, the operating agreement makes sure that liability relevant to the business is only limited to the assets of the LLC when used to protect claims made against the LLC.Since member’s assets are separate from the business, they are not exposed to the LLC’s liabilities. To get benefit from this protection, members with multiple investment assets are suggested to separate each asset from the LLCs.There are some expectation that applied to the protection from claims made in court. They state that when members are allowed to use their assets to guarantee the LLC and when the LLC is found to have only been developed defraud creditors. Members’ assets can be used to cover the accountabilities of the LLC in both of these scenarios. Moreover, the claims that are made on the primary assets by the creditors, the Florida LLC operating agreements can also be used to protect LLC members from them.Florida LLC:

Particular legal considerations should be made by the business members while forming an LLC in Florida. The made legal considerations should make sure that LLCs operate within the state specifying laws and requirements. When starting an LLC, you should made the following two legal considerations;Limitations

There are specific laws in Florida regarding the formation and operation of an LLC. They restrict which provisions can be mentioned in LLC owner’s operating agreements. For example, the Florida State Statute Section 608.432(2) contains limitations. According to them, the LLC operating agreement is not allowed to;- Eliminate the duties

- Care

- Loyalty between business associates

- Access to LLC records

- Restrictions of the rights of the people that are not a manager or member of the LLC