A self-employment verification letter is drafted by a self-employed person. Basically, this letter displays your income and the benefits you get from a business venture. Tax preparers prepared this letter. Moreover, this document provides the following information to a potential lender or financer;

- At first, it determines your business. It gives all the relevant pieces of information related to your business. This piece of information includes the official name of the business, the nature of the business, the date of incorporation, and the place where it is registered.

- Next, it verifies your total length of time in the business.

- It tells the business income levels that the business receives in a particular trading year.

- Furthermore, it also informs about your tax obligations. It explains to a lender or financer that how much tax you are officially bound to pay to the Internal Revenue Services. You may also like the Proof of Employment Letter Template.

Table of Contents

What information should include in the verification letter?

The following pieces of information should include in the verification letter;

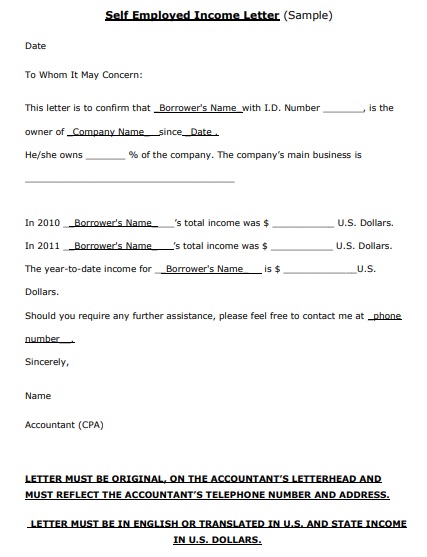

Tax preparer’s letterhead: The verification letter must be printed on the letterhead of the tax preparer. This is because it makes the letter official that is acceptable by the board.

Contact information: The letterhead also contains the contact information of the tax preparer. Hence, this information is important to accelerate future references and support.

Business information: In the body of the letter, there is a name and address of the business that the lender wants to own. In addition, the letter can also contain the physical address of the business, its nature, and other important details related to the business.

Proprietor information: Next, the name and address of the proprietor must be displayed on the letter clearly. The income and self-employment status of the proprietor will be verified. These pieces of information contain the share of ownership, length in the business, and name of other partners. You may also see Employee Handbook Template.

Business venture details: The letter should also describe details of the business venture. This part explains the nature of the business wherein it operates. Moreover, it also specifies the kinds of goods the business produces.

Closing: In the end, the letter must include the signature, date, and stamp that when it was drafted and sent out to the other parties.

What things you should bear in mind while drafting a letter?

If you want to do a great job then you should keep following things in mind while drafting a letter;

- At first, you should try to be truthful all the while. During drafting a letter, don’t over-exaggerate facts and figures.

- You should also contain the backup of your statements with proper documentation. For this purpose keep the bank slip, registration certificates, tax return forms, etc.

- Some applicants generally demand unique information from you. So, to fulfill these requirements read and understand them before drafting a letter. You should also check the Employee Clearance Form Template.

Free Self Employed Income Letter Template

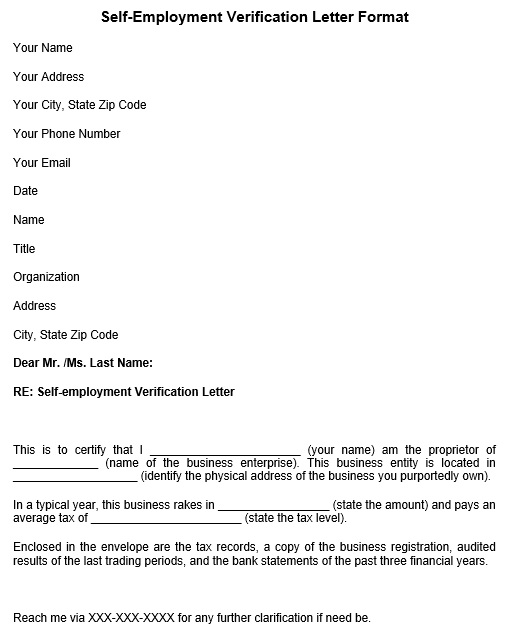

Self-Employment Verification Letter Format

Self-Employment Verification Letter Sample

Conclusion:

Hence, we conclude that if you draft a good verification letter then you can easily achieve your goal. Therefore, during drafting this letter, treats it seriously. Also, back your statements with the help of relevant documents as mentioned above.

![Free Employee Reprimand Form Templates [Letters & Samples]](https://exceltmp.com/wp-content/uploads/2021/07/employee-reprimand-form-150x150.jpg)