An insurance cancellation letter is a formal letter written by a policyholder to an insurance company when they decide to discontinue their policy due to any reason. Writing this letter is essential to ensure that there are no legal or financial ramifications. You must go through your policy for specific cancellation provisions before drafting this letter.

Table of Contents

Important components to include in an Insurance cancellation letter:

Your insurance cancellation letter must include the following essential elements;

Insurance company information

To ensure that your letter is directed to the right individual or department, provide the following details;

- Complete name of the insurance company

- The department name

- The name of the contact person or representative

Your personal and policy details

State your complete name and your policy number clearly in the letter. Write the coverage period as mentioned on the declarations page of your policy. The insurer can quickly identify your account by having these details.

Date of cancellation

Mention the effective date from which you want your policy to be canceled.

Non-authorization of premium withdrawals

Write a statement that states after a cancellation date the insurer isn’t authorized to continue withdrawing premiums from your account. This statement prevents you from any unwanted charges.

Request for a premium refund

Request for a premium refund that you have been paid in advance (if applicable). Moreover, you need to be specific while requesting the amount you expect to be refunded.

Request for written confirmation

To keep a record of your policy termination, you should ask for a written confirmation of the cancellation to be sent to you on a particular date.

Reason for cancellation

It would be recommended to concisely state your reason for cancellation. It can be helpful if it is relevant to service issues or changes in your coverage requirements.

Contact details for follow-up

Provide your contact details so that the recipient can contact you for any further communication required during the policy cancellation.

Closing

Close your letter by stating ‘Sincerely,’ which is then followed by your signature and printed name.

How to write an effective insurance cancellation letter?

For a smooth termination process, your cancellation letter should be crafted professionally and clearly. Consider the following pointers to ensure your letter is effective;

- First, start your letter by stating your decision to cancel the policy. This information should be stated clearly in the first paragraph.

- State that you want to cease premium payments from the effective cancellation date so that there is no ambiguity regarding future payments.

- To make it easier for the insurer to easily locate and process your request, provide the following details;

1- Your policy number

2- Effective dates of your policy

3- The intended date of cancellation - Your cancellation letter should be brief and focused that inform the insurer of your decision to cancel the policy. Don’t include any unnecessary details that are irrelevant to the main purpose of the letter.

- Type the letter instead of handwritten to make sure legibility and professionalism. This is because typed letter looks more formal and are easy to read.

- You have to keep a respectful and professional tone throughout the letter even if you aren’t satisfied with their service.

- Check the letter thoroughly before sending it for any spelling or grammatical errors. Remember that an error-free letter indicates your seriousness and attention to detail.

- Keep a copy of the cancellation letter for your record. It proves very helpful in case of any disputes or delays in the cancellation process.

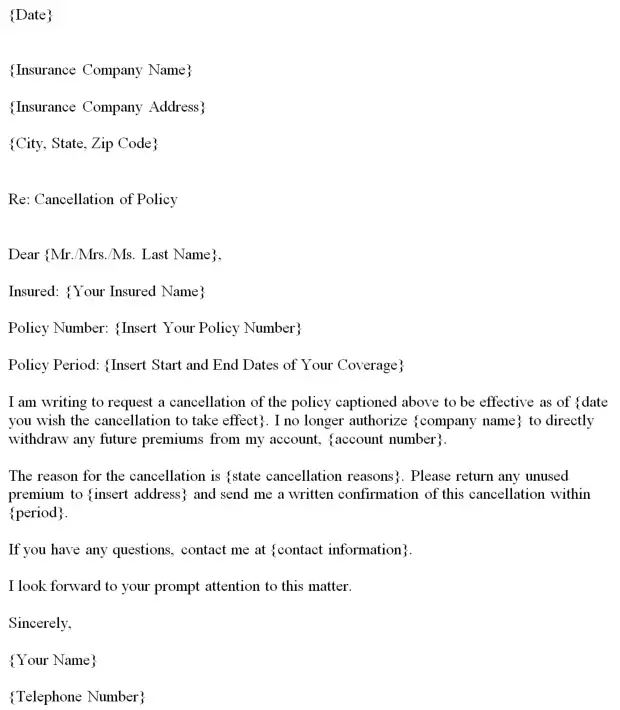

Insurance Cancellation Letter

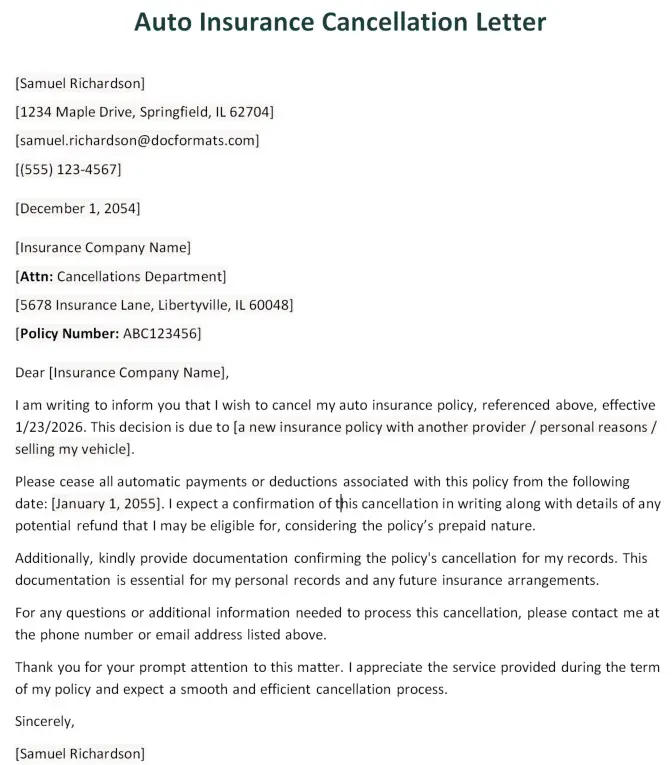

Auto Insurance Cancellation Letter

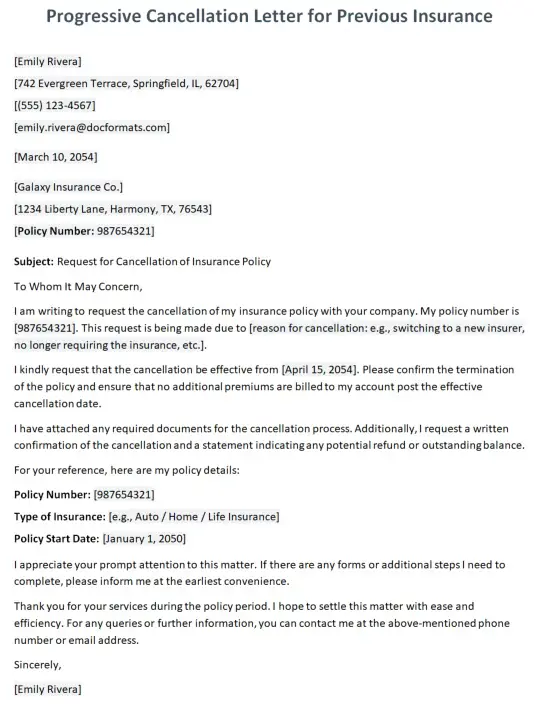

Progressive Cancellation Letter for Previous Insurance

Sample Insurance Cancellation Letter

What considerations should you make before canceling?

Here are some critical considerations that you make before canceling;

- You need to ensure that you’re aware of any financial penalties before starting the cancellation process.

- If you cancel the policy in the mid-term, it indicates that you’re not entitled to a full return of your premium. Therefore, consider the financial implications of your cancellation date before proceeding.

- Ensure that there is no gap in your coverage if you are canceling for reasons other than don’t need insurance.

- Speak with an insurance advisor or broker to get personalized advice (especially if you are uncertain).

FAQ’s

These are as follows;

1- A more competitive policy

2- Changes in personal circumstances

3- Dissatisfaction with current services