To achieve success in the insurance agency industry, use an insurance agency business plan template. This tool outlines the vision for your company and helps you improve your strategy and raise funding.

Table of Contents

What is an insurance agency business plan?

An insurance agency business plan is a formal document that outlines your business growth strategies and includes a comprehensive evaluation of the insurance market. This business plan enhances the necessary funding for your insurance agency venture by indicating your in-depth understanding of the insurance industry.

Furthermore, investors, banks, or financial institutions require this business plan when you seek financial support from them. It also convinces them that you will become a successful venture.

How to create an effective insurance agency business plan?

Let us discuss step-by-step how to create an effective business plan;

Determine your business’s vision and mission

Determining your business’s vision and mission statements is the first step that you need to take while creating this type of document. The reason behind this is that you will use them as a basis for the strategies you create for your business. In addition, it serves as a reminder for you and your employer how important it is to fulfill your responsibilities.

First, think about your business’s mission statement i.e. what your business wants to do. The main objective is to provide protection to your customers which is equivalent to the price they paid. Your business type of protection depends on the type of insurance your business offers.

After that, write your vision statement by considering what kind of success you want to achieve in a few years. This statement will give you something to work towards and to look forward to.

The kind of insurance your business will provide

Think about what kind of insurance your business will provide before starting to open up your own business. Your business can specialize in different types of insurance such as;

- Home-based businesses

- Product liability insurance

- Vehicle insurance

- Business interruption insurance

- Professional liability insurance

- Property insurance

- Worker’s compensation insurance

After figuring out what kind of insurance you will provide, write it into your business plan.

How much it will take to start your insurance business

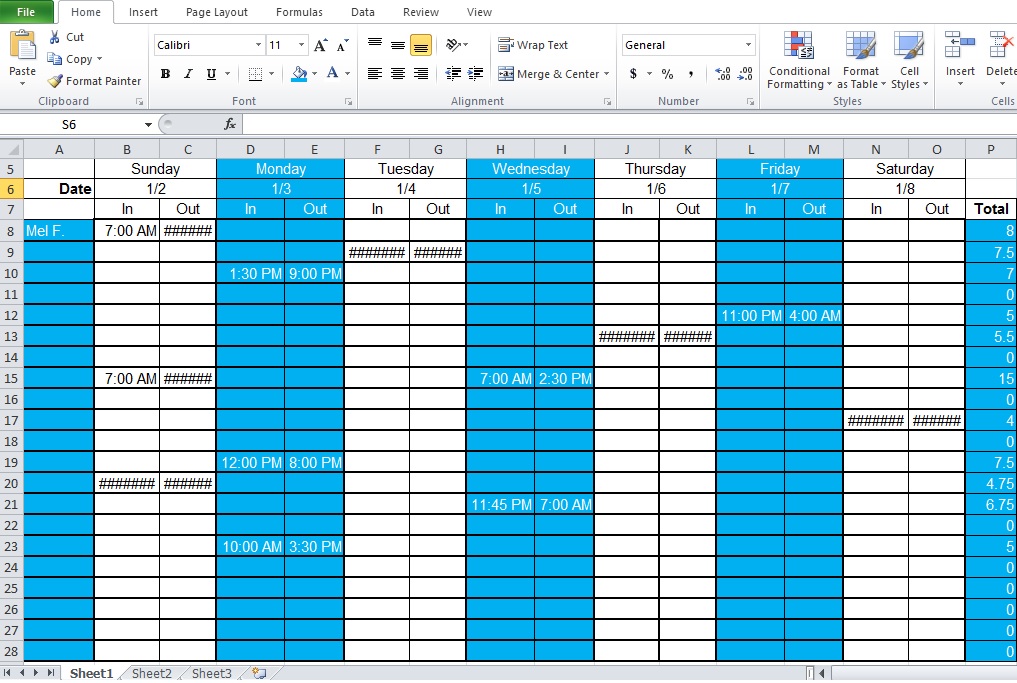

In this section of the insurance agency business plan, you need to specify how much it will take to start up and run your own insurance business. Your potential investors also want to know this information to determine whether your business is a good investment or just an unnecessary expense.

For the first few months of operations, think about the costs. Next, you need to figure out how much it will take to register your business. Then, consider the tools, equipment, and resources that your business needs to ensure it can function. After creating a list of all the items, pointing out the amount of each expense is the next thing that you have to do. It is important to determine exactly how much each item on the list will cost.

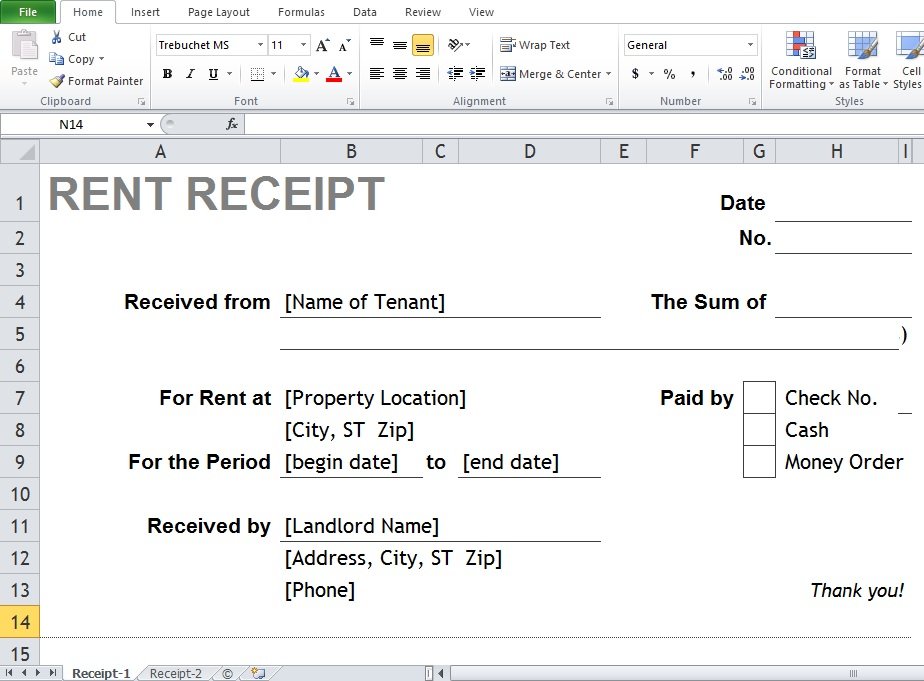

Details about how your customers will avail of the insurance

Your customers want to know the details about availing of the insurance and payment. This section tells them how to avail the insurance and how they are going to pay for it. Here, you should describe the complete procedure that your customers have to follow. You should state the agreements that they have to sign to ensure that they have managed to get the insurance.

Another important thing to include here is the method of payment. The common method that every insurance company follows is deducting the funds from their customer’s bank account every month when the payment is due. Additionally, you should also specify clearly how much they will be required to pay.

Share your marketing strategies

Use this section to share with your investors and stakeholders how you’re supposed to market your insurance business. They want to learn about it because this will tell them whether you are marketing your business in a way that will lead your business to success.

In this section of the business plan, you need to point out the strategies that you are going to use and the promotional content that you need. Also, you need to know where you should focus on your strategies towards as you are coming up with them.

Next, consider what kind of promotional material you need. While explaining this, you need to point out the type of insurance, how much will be paid, and the payment method. Along with these details, you should also specify where customers can avail of the insurance.

Write the executive summary

Writing the executive summary is the last step that you need to do. This section is typically created for readers who just want to get an idea of the plan. Your executive summary should contain all important details and everything about your plan.

Free Insurance Agency Business Plan Template

Introduction to Business Planning for Microinsurance

Sample Business Plan for Insurance Agency Template

independent insurance agency business plan template

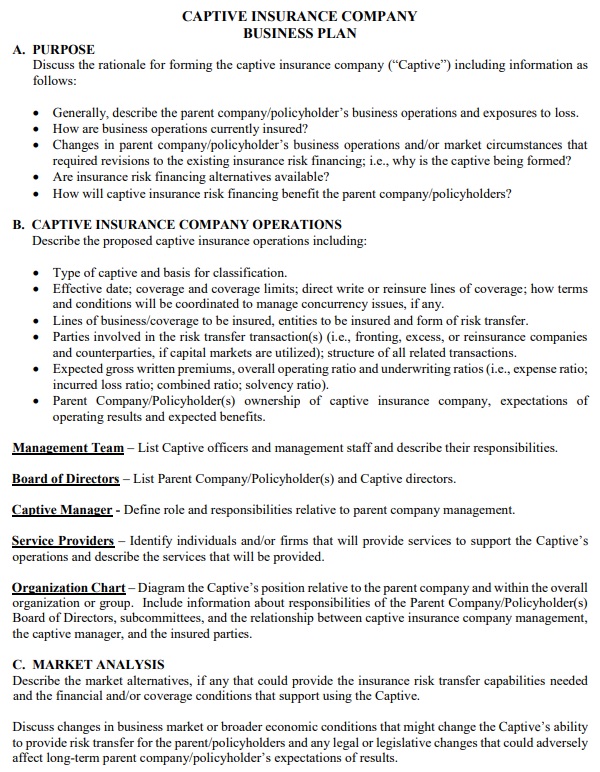

Captive Insurance Company Business Plan Template

FAQ’s

There are 7 main sections of a business plan;

1- Executive summary

2- Company description

3- Products and services

4- Market analysis

5- Strategy and implementation

6- Organization and Management Team

7- Financial plan and projections

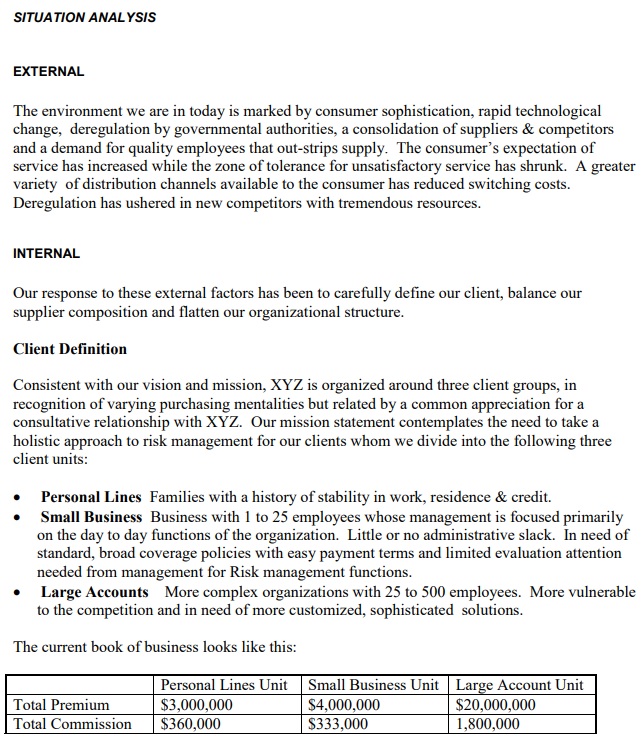

An insurance business plan highlights the business strategies, goals, and plans for achieving them. It also specifies the company’s financial projections, market research, and mission statement.