A release of earnest money form is a wavier document that both the seller and the buyer have to sign before an earnest money deposit towards a home that may be released. In case, the transaction fails before it is finalized, the earnest money may be returned to the buyer and both parties may agree on the terms.

This can be because of the buyer’s voluntary backing up of the transaction or not able to meet the terms of the agreement. For example, in case, the buyer gets into an agreement to buy a property contingent and the roof is found to be in an improper condition during the inspection. Then, the buyer may request to cancel the agreement or to release his/her earnest money.

Generally, the earnest money is head in an escrow account the third-party. Until the buyer and seller are in agreement or a local attorney provides a judgment, the third-party holding the money isn’t allowed from releasing the money.

Table of Contents

Handling the disputes:

At first, you have to consult the purchase contract over whether the money will be returned to the buyer. If yes, then in what conditions. The terms of the agreement guide the next step for both parties. The agreement states that the parties involved to attend arbitration before bringing a proposal to recover the money.

Furthermore, the parties can also consult the escrow holder. The escrow holder has a standard procedure or can provide a piece of advice on what would happen next. In most states, there is specific laws on how the escrow will handle the disputes on earnest money.

If the attorney is good at negotiations then it is advisable to consult them about your earnest money. You can take the matter to court if the parties exhaust their pre-litigation requirement and have not yet reached an agreement. You may also like Proof of Funds Letter.

Basic elements of a release of earnest money form:

Here are the basic elements of the earnest money release form;

Date

The document starts from this section. Under the date, you have to first mention the month, then day and year when this form has been filled.

Name of the buyer

You have to write down the name of the buyer as indicated in the original contract. If, it has more than one buyer, include all their names.

Name of the seller

Mention the name of the seller as mentioned in the original contract.

Contract signature date

In this section, specify the contract signature date to show when both parties signed the original contract.

Name of the escrow agent

If an escrow agent was involved in the deal and since they are the holder of the escrow account so you have to recognize the escrow agent by filling his/her name.

Property details

Next, you should provide the details of the property. The details that are recorded in the original contract, mention them here as it is such as the street, city, zip, and building number. You should make sure that you exhaust all the available details for this property.

The receiver of the earnest money

Here, you should specify the receivers of the earnest money. To whom the escrow agent will release the earnest money, write down his/her name.

Signature

Both parties has to sign this document and indicate the current of the signatures.

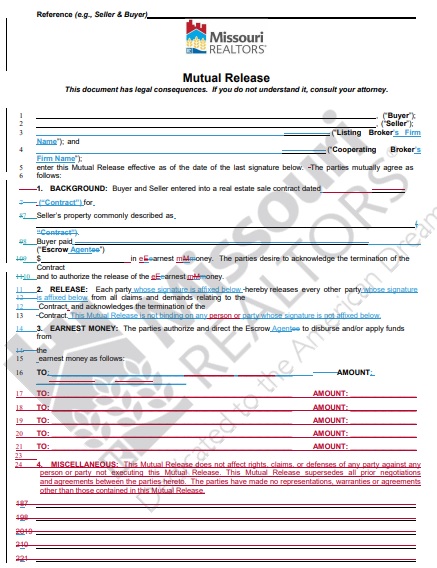

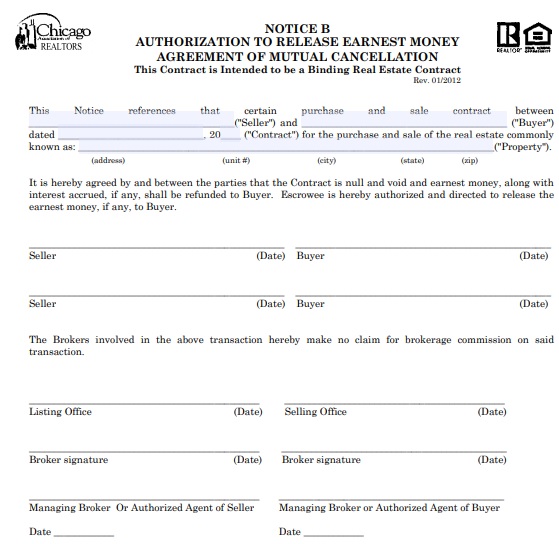

Mutual Release of Earnest Money Form

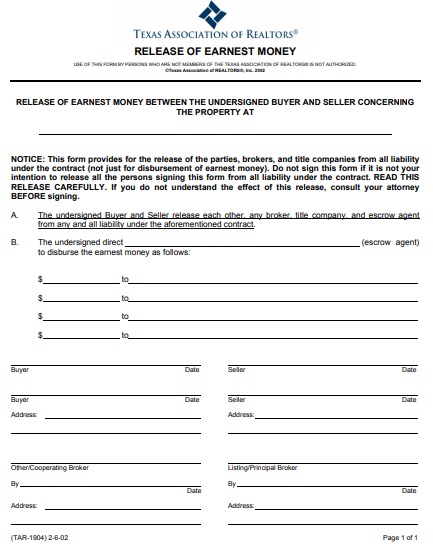

Realtors Release of Earnest Money Form

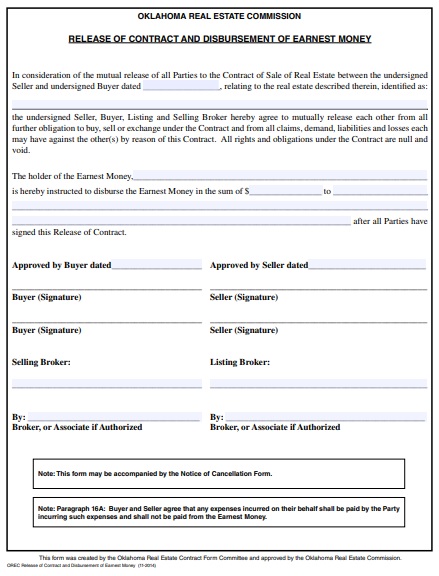

Release of Contract and Disbursement of Earnest Money Form

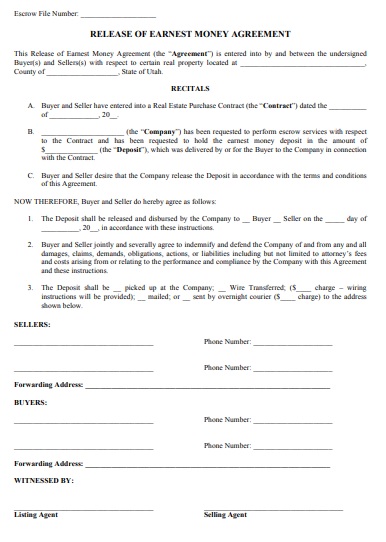

Release of Earnest Money Agreement Form

Release of Earnest Money Authorization Form

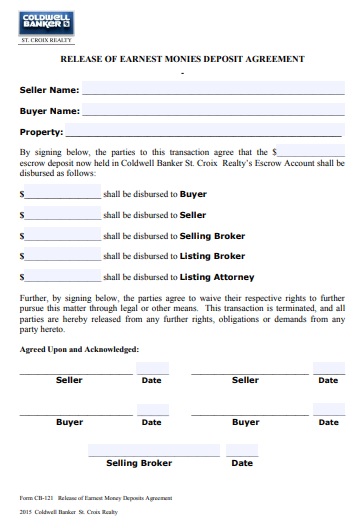

Release of Earnest Money Deposit Agreement Form

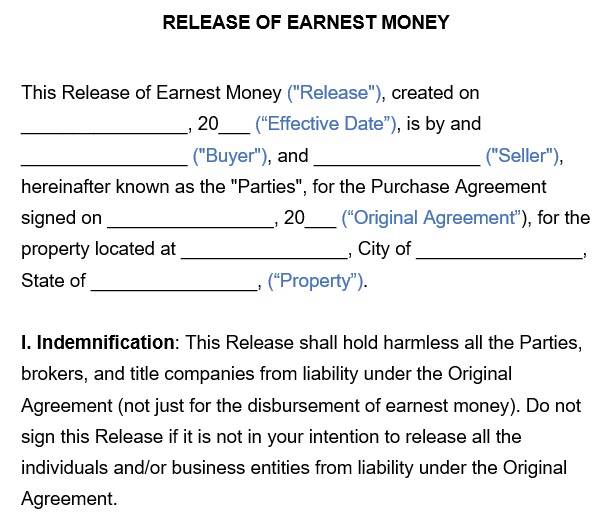

Release of Earnest Money Form

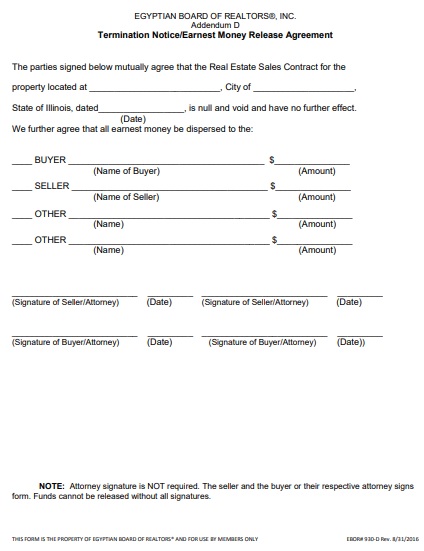

Release of Earnest Money Termination Notice Agreement Form

Faqs (Frequently Asked Questions)

It typically takes 15-2- business days. Until the funds have cleared in banks and have not bounced, Escrow will not release the money back to you.

If a party can make a written demand to the third party, then it will must provide a copy of this demand to the other party. Within 15 days, if the escrow agent does not get the written feedback to the demand, then the earnest money is disbursed to the party who made the demand.

![Free Letter of Support Template [Word]](https://exceltmp.com/wp-content/uploads/2021/02/letter-of-support-template-150x150.jpg)