A proof of funds letter is written to prove that you have the money before making large purchases like those of homes and cars. A bank drafts this letter and directs to the seller of the expensive commodity. Sometimes, along with this document you also have to attach the bank statements and other financial verifiers.

Table of Contents

How to write a proof of funds letter?

Let us discuss step-by-step how to write a proof of fund letter;

Check the Account of the Client:

At first, check the account details of the person whose funds you are going to verify. Simply remove the database of the affected person. Then, check whether the outstanding balance is equal to or greater than the one that is being asked for. If the precondition is satisfied then you can proceed.

Verify other Commitments:

At that time, the client has enough money in his bank account but he can also meet other financial engagements as well. In case, the meet other financial engagements as well then you may decline the verification altogether.

Write the letter:

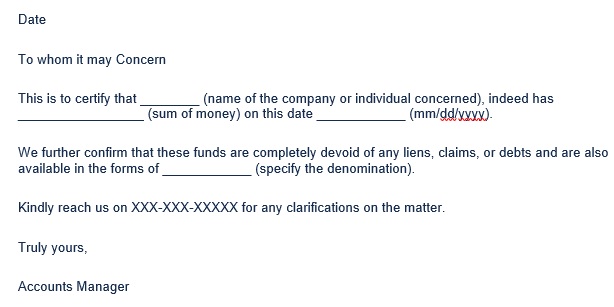

Now, you get down for writing the letter. to draft the letter, use the formal tone and structure. Moreover, use the official letterhead of the institution. Include the following information;

- Write the date and the subject

- Provide the name of the branch of the institution for whom you are drafting the letter

- State the subject of the letter

- Mention the name of the account holder

- Mention any limitations

- Spell out the validity period

Sign the letter:

You have to sign the letter to give it the official character. Also, specify the date in which the letter is drafted. Then, close the letter with your designation.

Notarize the Document:

Some jurisdictions may state that the letter is notarized. Search for whether yours indeed require it.

What to include in a proof of funds letter?

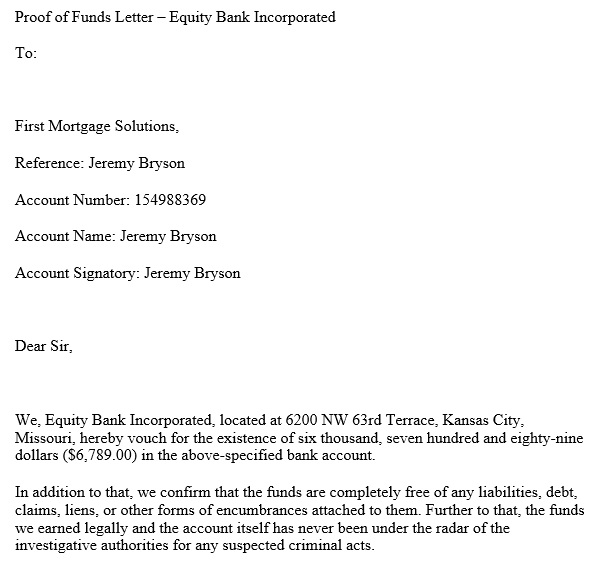

Name and address of the bank:

Firstly, provide the name and the address of the banking institution that holds the requested funds. This information clearly indicates that who exactly is processing the funds.

Official Bank Statement:

This letter is naturally followed by an official bank statement naturally. This statement indicates the availability of the funds in the bank account. In the statement, you have to be reflected all the facts and figures in the letter.

Copy of Money Market Statement and Balance:

Some account holders contain more than one account along with the stated financial institution. If this exists then they too have to be taken good care of. If needed, provide information regarding these additional bank accounts.

Bank Certified Financial Statement:

The pieces of information that are provided for have to be certified by the bank. This certification should be carried out by an official preferably from the state.

Copy of an Online Banking Statement:

You have to provide the copy of an online banking statement to lend more credence to the information provided.

Signature of an Authorized Bank Employee:

The document should contain the signatures of the authorized bank employees. You may also like Proof of Employment Letter.

Free Proof of Funds Letter

Sample Proof of Funds Letter

Things to consider:

- Never request for funds if there are insufficient funds in the account.

- Before the same is finally accepted as a bona fide, the documents have to be verified.

- Everything has to happen within a particular time period. Therefore, the important pieces of information are bound to fluctuate with time.

- Before any subsequent course of action, the requesting entity has to demand that they be furnished fully.

- Your letter has to be drafted on the official letterhead of the issuing bank.

Conclusion:

In conclusion, a proof of funds letter is a formal letter written to prove that you have the money. To make it effective, include all aforementioned elements in the letter. It is suggested to make use of provident funds such as your pensions and retirement benefits.