An Indiana LLC operating agreement template is a legally binding document used by investors, banks, and other people associated with the business to evaluate the company properly. This document details the order of operations, company profile, and other relevant information.

Moreover, the agreement also gives the members of a business regardless of the business size a proper outline of the company’s operational procedures and other aspects.

Table of Contents

Why LLC operating agreement in Indiana?

Here are the reasons that why create an LLC operating agreement in Indiana;

Resolve disputes

You have to consider that the members have different backgrounds, business mentalities, financial capabilities, and other disparities while running your Indiana LLC. There may also come a time when disputes occur. So, the operating agreement highlights all reports on profit sharing, managerial roles, and other company internal regulations and this will make sure that the disputes are promptly resolved.

Flexible LLC

Making your Indiana LLC operating agreement can assist you in running your business the way you have always want rather than conforming to rigid rules and regulations. To achieve your goal and objectives, you can draft what is best suited for you.

Protect LLC status

This agreement can protect you from legal hassles. This document informs the court and other authorities that your Limited Liability Company is instructed by a set of rules that have to be consistently upheld.

Financial accounts

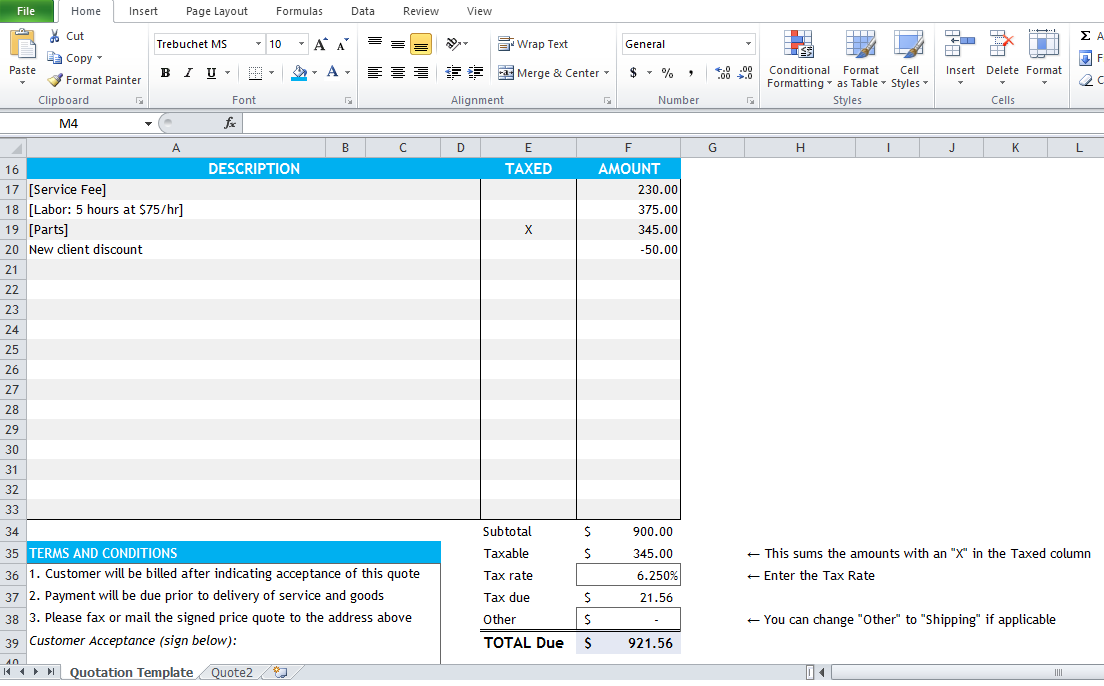

For your Indiana LLC, banks and other financial companies may request proof of an operating agreement. When you are looking to open an account or request funding for a project, the LLC operating agreement adds to the credibility of your name.

Rules

Each business requires to run on a clear set of principles, precepts, rules, or regulations that make sure each member understands the complete extent of their operations.

Recommended by state

It isn’t mandatory by the state of Indiana that you have an LLC operating agreement. However, it is highly suggested for the smooth running of your business. It will assist you in expediting many operations for you. These may include loans, investments, profit sharing, and dealings with the state.

How do you file for LLC status?

The below mentioned information clearly states whether or not you have an LLC in Indian;

Registered Agent

You, as an Indiana LLC, have a registered agent who can contact your business. Also, the agent will assist you in obtaining annual state filing and other important correspondence on your behalf. Additionally, the registered agent must be resident of Indiana. It also must be an incorporated business in Indiana.

Entity type

In this disclosure, there are two entity types, the domestic and foreign. An LLC formed in Indiana, the domestic entity relates to it and on the other hand, the foreign refers to an expansion of an LLC into Indiana. You will be required to submit an Article of Organization for Domestic LLC and for the foreign LLC, submit a Certificate of Authority.

Fee

For both the domestic and the Foreign LLLC, the fees differ. You must pay $95 for an online application if you have a domestic LLC and $100 goes for an Adobe PDF application. In case of Foreign LLC, the costs $105 for an online application and for an Adobe PDF application, an extra $20.

Operating Agreement

The state doesn’t require it but is important for the smooth running of internal affairs in the business.

EIN

The EIN (Employer Identification Number) is issued so that tax information can be appropriately reported to the IRS (Internal Revenue Service). without EIN, you may not be able to carry out some financial transactions.

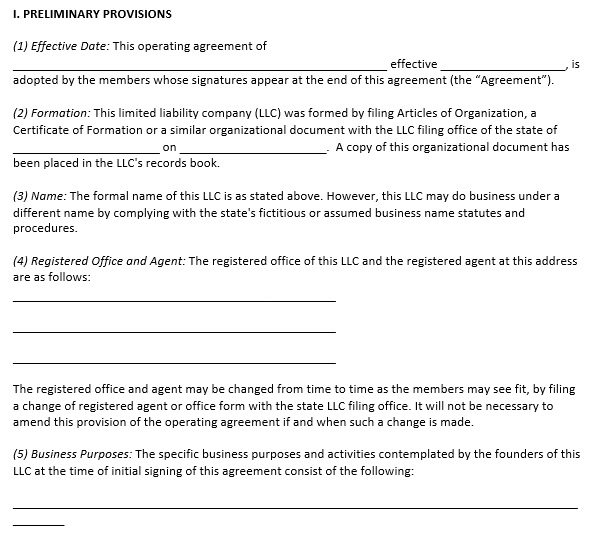

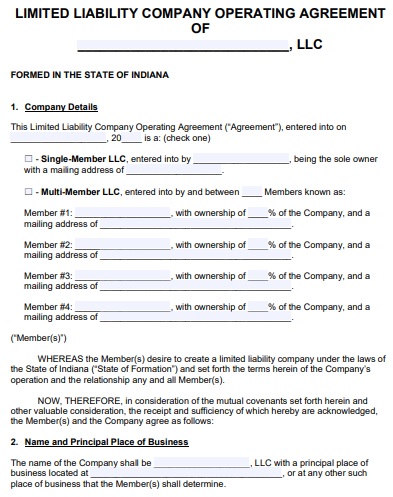

Indiana LLC Operating Agreement

Indiana LLC Operating Agreement Template

Free Indiana LLC Operating Agreement Template

Conclusion:

In conclusion, an Indiana LLC operating agreement is an important document that allows for transparency and effectiveness in running a business. When you are newly starting out your LLC, it is best to make an Indiana LLC operating agreement.