A cash payment receipt template is used to generate a cash receipt when a vendor accepts cash from a customer. A copy of the cash receipt is given to the customer as proof of purchase and a copy is retained to the seller as evidence of the completed transaction. Moreover, depending on the type of transaction completed, the content of the cash receipt typically varies.

Table of Contents

What are the benefits of using a cash payment receipt?

A cash payment receipt provides the following benefits;

- A cash payment receipt provides all the relevant information that helps business owners keep track of their customers’ purchases. Also, you can use it to support warranty claims in case of customer disagreements or disputes. With the help of cash receipts, you can identify the need for product offerings, promotions, and special deals as it informs you how often the type of products are sold.

- Using cash receipts enables you to record transactions and keep track of business essential data. It can save you from potentialities like losing valuable information if it isn’t recorded accurately.

- You can streamline your business processes by issuing a cash receipt when you complete a sale. In addition, it makes sure that with sales transactions your inventory is up-to-date.

- For business tax reporting and accounting, cash receipts are crucial. They enable you to track accurate sales records, which as a result, reduce your business tax liabilities. While filing profit and tax reports, they provide the necessary details.

- A cash receipt prevents the business from fraudulent activities by proving the business is an honest organization that does not overcharge customers.

How do you write a cash receipt?

Consider the following key components while writing a cash receipt;

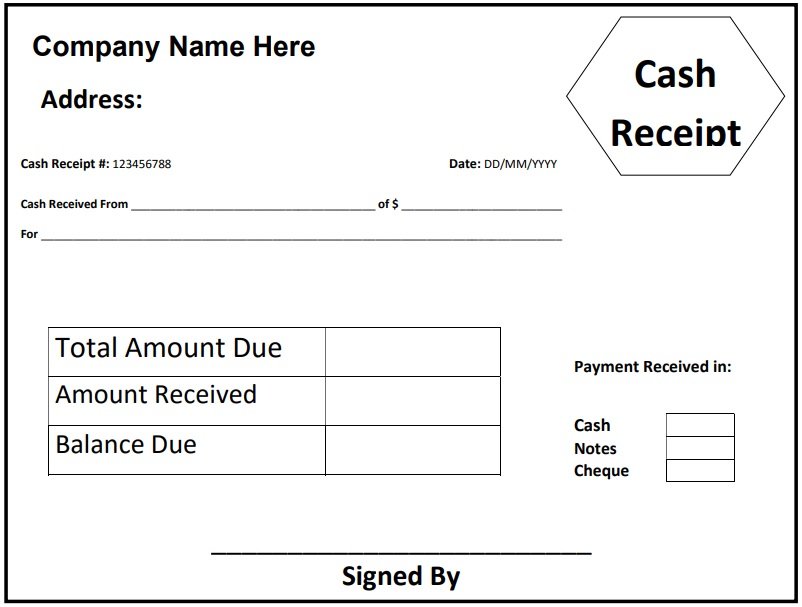

The seller’s details

First, you need to include the seller’s information in the receipt including;

- Company Name

- Street Address

- Phone Number

- Email Address

- Website

Documentation

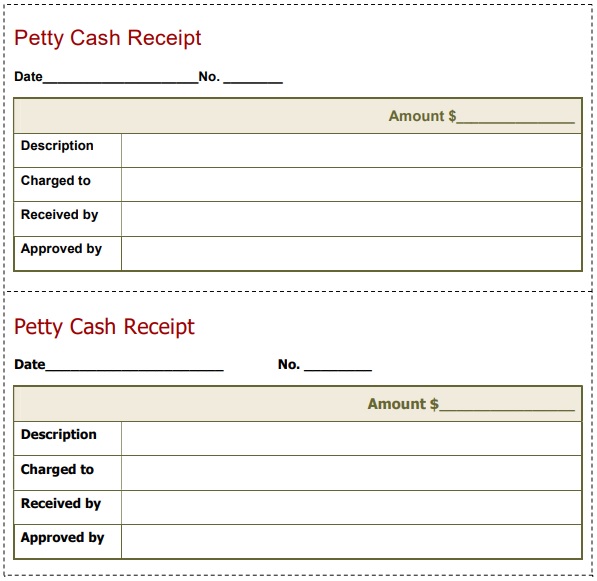

Provide a clear and informative description of the item/service offered in a cash sale receipt. This section should include the following details;

- The transaction date: the cash payment receipt must include the date on which the transaction was completed. This information helps to build when the transaction took place.

- Product/service details: include a clear and definitive product/service description in the receipt. This helps you distinguish the product and/or services.

- Payment details: the amount paid, and a description of what the payment is made for should be included here.

Payment Breakdown

A section must be included in a receipt that shows a breakdown of the payment made;

- The subtotal

- Tax rate

- Total amount due

- Amount paid and the

- The remaining balance

With the help of this information, you can calculate income tax returns and keep track of installment payments.

Payment method

The cash payment receipt should also include the mode of payment. The mode of payment helps one keep their finances as all cash sales aren’t made by exchanging physical cash for an item/service. Moreover, the payment method can be cash, electronic cash transfer, and more.

Signatures

The seller must affix their signature to acknowledge that they hand over the goods/service to the buyer and that the payment has been made. At the bottom of the receipt, the seller must print their name and sign against their name.

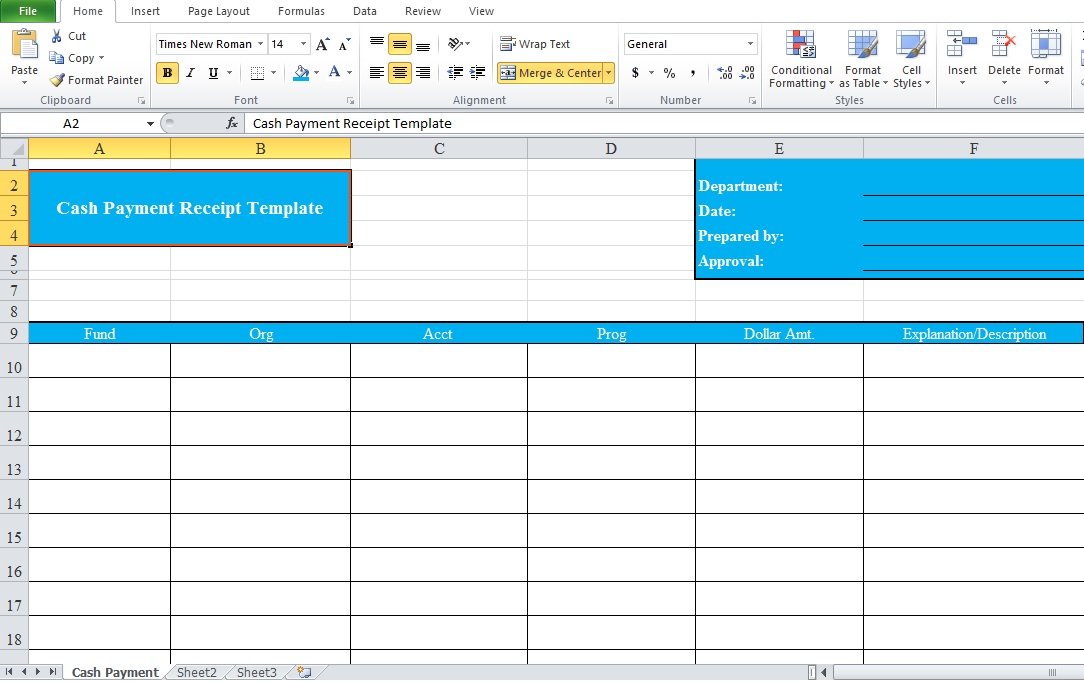

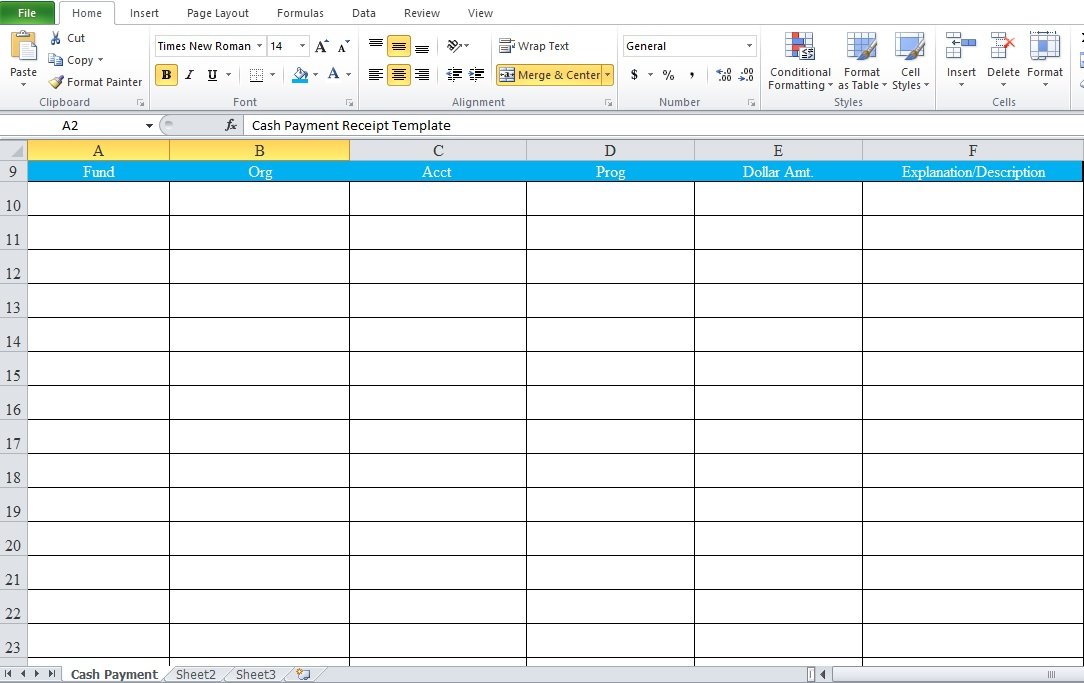

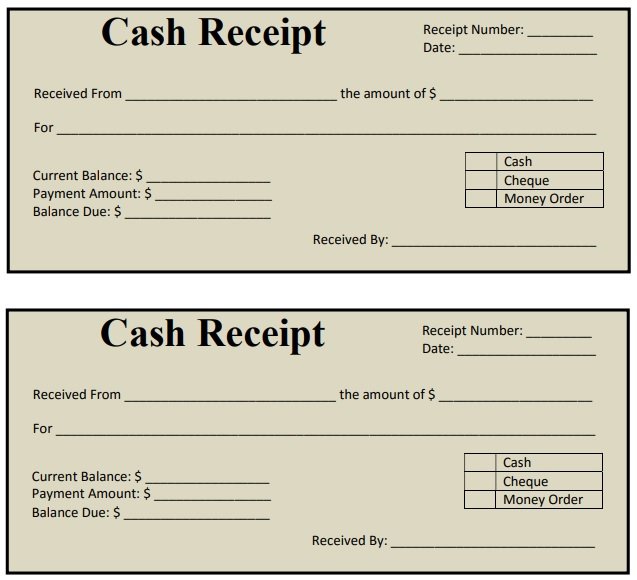

Printable Cash Payment Receipt Excel Template

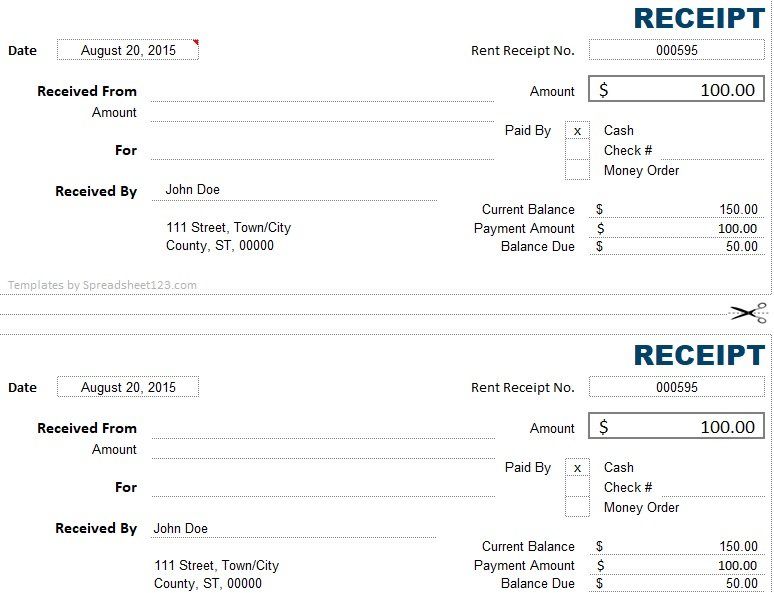

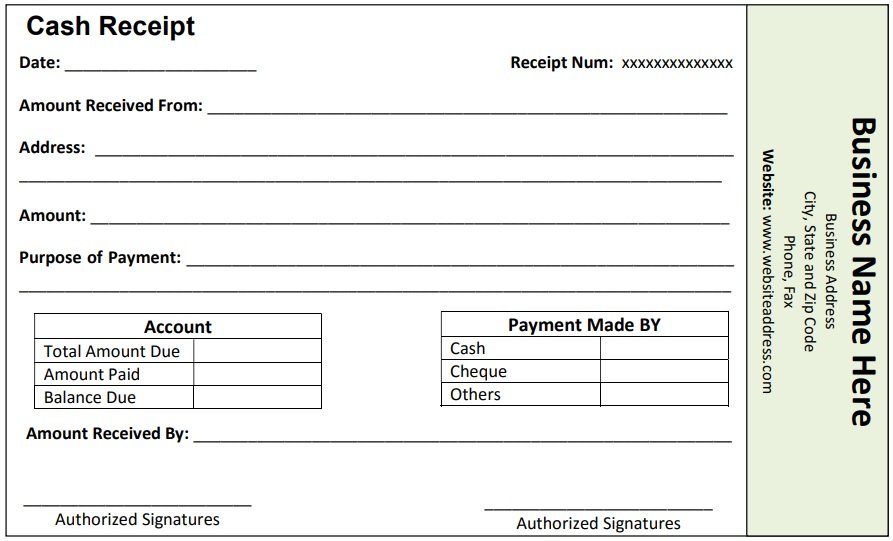

Cash Payment Receipt Sample

Cash Payment Receipt Template Excel

Cash Payment Receipt Template Word

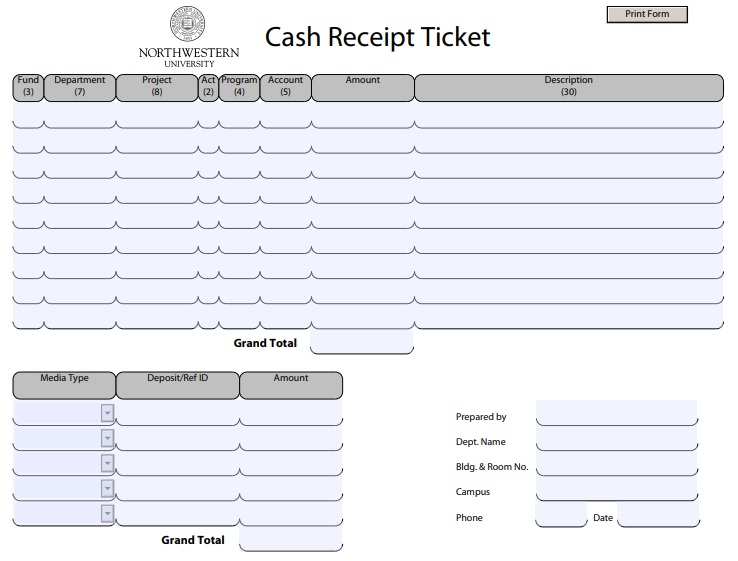

Cash Receipt Ticket Template

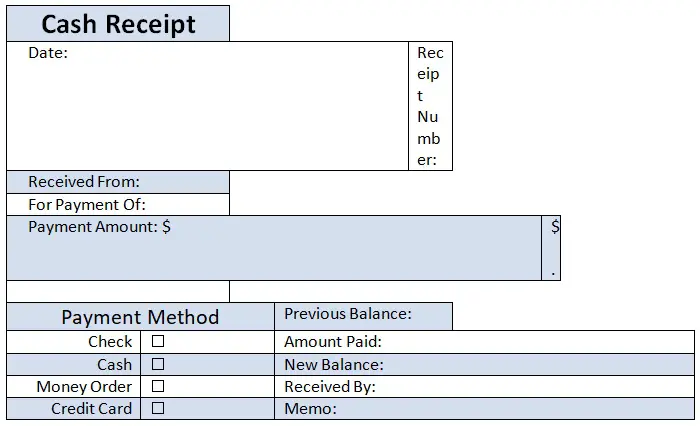

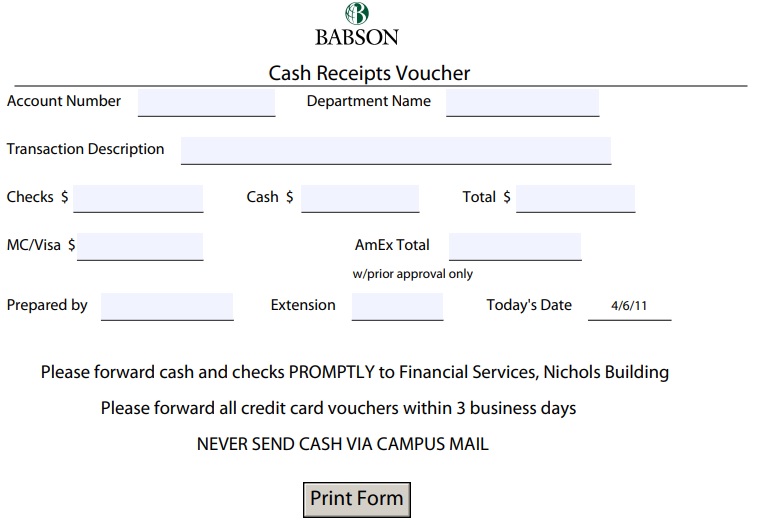

Cash Receipt Voucher Sample

Examples of Receipts for Cash Payments

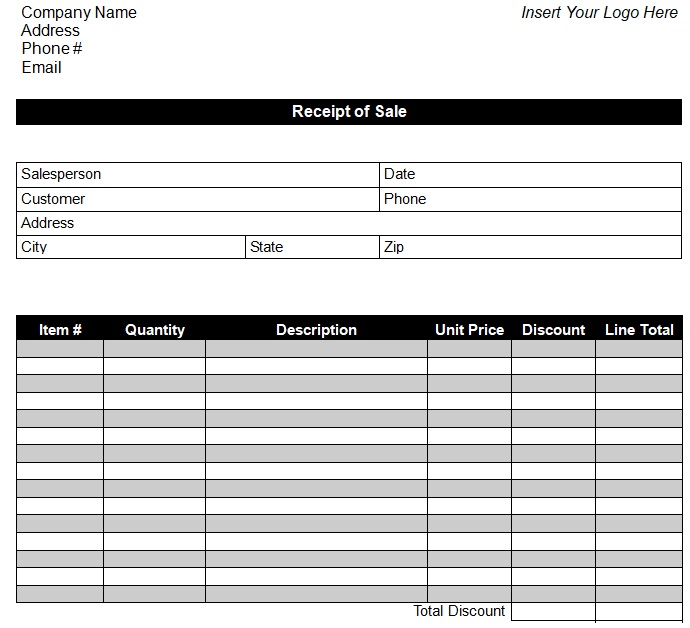

Free Sales Receipt Template

Horizontal Cash Payment Receipt Form Template

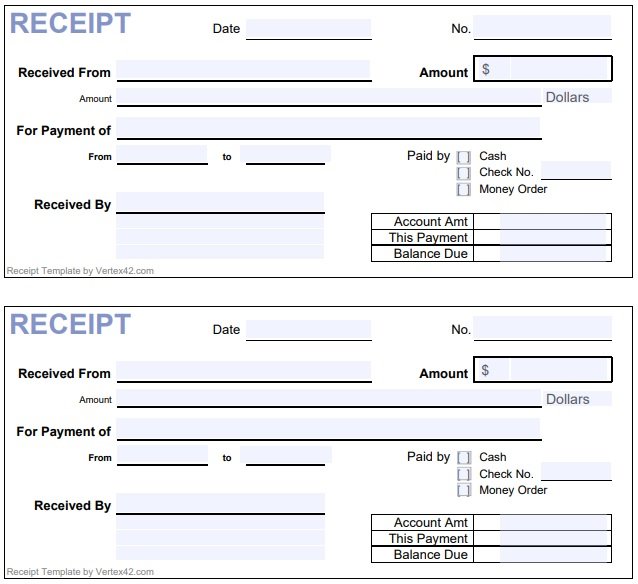

Printable Receipts for Payment

Writing a Receipt for Cash Payment

How to accept cash payments?

Here are some pointer that helps you in accepting cash payments properly;

Make a deal

The seller and the buyer must agree on a mutually beneficial deal while doing any type of sale/purchase. They both agree on the product/type of service to be offered and the dates on which the transaction shall be done. Usually, the seller issues the cash receipt completion of the transaction.

Exchange of goods and cash

Both the buyer and seller need to do their part if they want a cash sale to be completed successfully. The seller must have the required products or services and the buyer must have enough cash.

Issue the cash receipt

The seller must issue the cash receipt to the buyer after providing the required products/services and receiving the payment. Also, the receipt must contain all the transaction details including the amount paid and a description of the offered product/service.

Send money electronically

Instead of using physical cash, the payment can be made using electronic cash transfer and any other available cash transfer methods online.

FAQ’s:

What information should a cash receipt include?

A cash receipt should include the following details;

- The date that shows when the transaction is made

- Receipt number

- Information about the individual who made the payment

- Amount paid in words and numbers

- Subtotal with tax

How do I issue a cash receipt?

Different methods are used to issue the cash receipt, some may issue these electronically, and some provide a handwritten cash receipt to the buyer.

![Printable Volunteering Certificate Template Free [Word]](https://exceltmp.com/wp-content/uploads/2021/04/sample-volunteer-certificate-template-150x150.jpg)