A Singapore payslip template is more than just a salary record – it is a mandatory document under the Employment Act. Since 2016, all employers in Singapore must issue itemized payslips to employees, either electronically or in print. Having a professional payslip format ensures compliance, transparency, and trust between employers and employees.

If you are an HR professional, business owner, or startup founder, using a Singapore payslip template in Excel can simplify payroll processing while meeting legal requirements.

Table of Contents

Why Do You Need a Payslip Template in Singapore?

A payslip is proof of income and a breakdown of how salary is calculated. It benefits both employers and employees in several ways:

- Legal compliance: Mandatory by MOM (Ministry of Manpower).

- Transparency: Shows a clear breakdown of earnings, deductions, and contributions.

- Proof of income: Required for bank loans, visa applications, and financial verification.

- Payroll efficiency: Standardized templates save time for HR and finance teams.

Essential Components of a Singapore Payslip Template

A professional Singapore payslip template should include the following:

1. Company & Employee Details

- Company name, UEN, and address.

- Employee name, designation, employee ID, and pay period.

2. Earnings

- Basic salary.

- Overtime (OT) pay.

- Allowances (transport, meal, housing, etc.).

- Bonuses, incentives, or commissions.

3. Deductions

- Employee CPF contribution (based on official CPF rates).

- Income tax (if applicable).

- Other deductions (insurance, advances, etc.).

4. Employer Contributions

- Employer CPF contribution.

- Additional company-paid benefits.

5. Net Pay

- Final take-home pay after deductions.

6. Year-to-Date Summary (Optional)

- Monthly accumulation of earnings, CPF, and deductions for record-keeping.

Benefits of Using a Singapore Payslip Template

✅ Time-saving: Automates CPF and net pay calculations.

✅ Error-free: Reduces manual mistakes with formulas.

✅ Professional look: Branded templates enhance company image.

✅ Flexible: Adaptable for full-time, part-time, and contract staff.

Best Practices for Payroll Compliance in Singapore

To avoid penalties and disputes, employers should:

- Always update CPF rates and salary ceilings according to CPF Board updates.

- Clearly state pay date and pay period.

- Maintain payslip records for at least two years.

- Provide payslips promptly, even for electronic salary transfers.

Download a Free Singapore Payslip Template

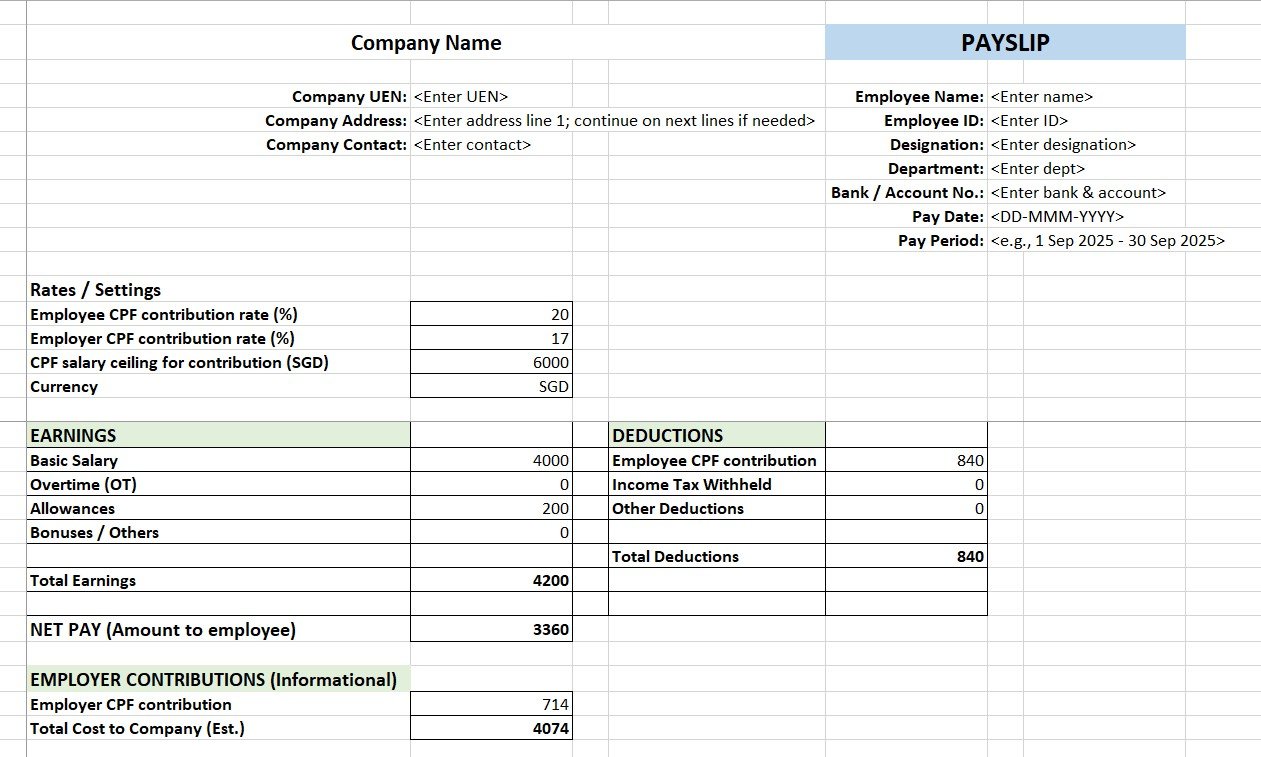

A ready-to-use Singapore payslip excel template can help you stay compliant and organized. Our professional template includes:

- Editable employee & company details.

- Automated CPF deduction formulas.

- Net pay and employer CPF contribution calculation.

- Year-to-date summary sheet.

Singapore payslip template

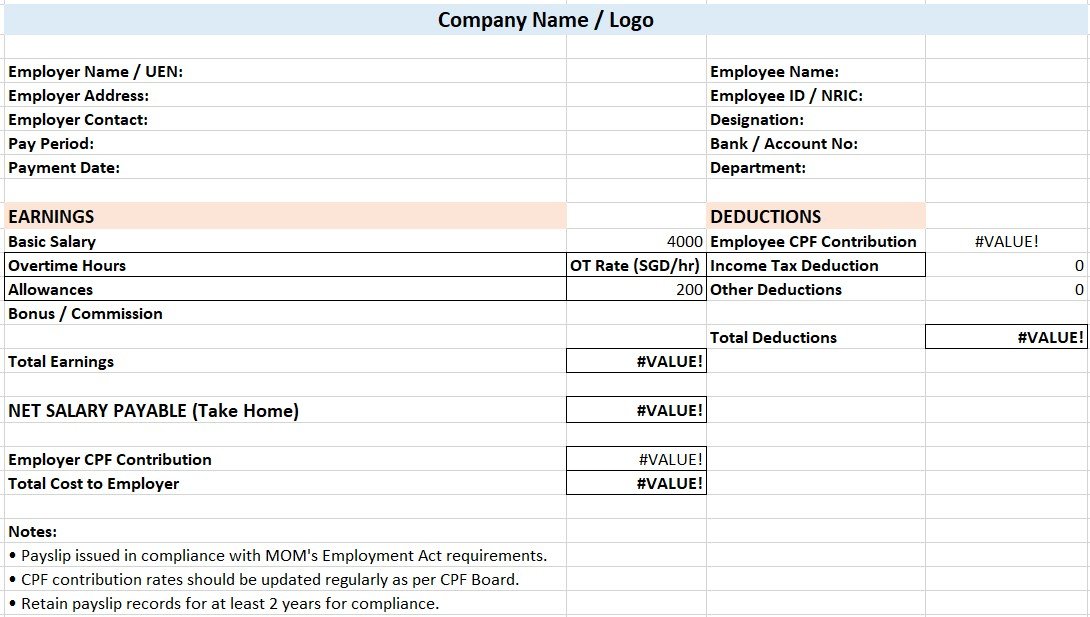

Singapore MOM Payslip Template

Final Thoughts

Issuing payslips is not just a compliance requirement – it’s a smart business practice. A clear and professional Singapore payslip template builds trust, ensures accuracy, and makes payroll smoother for both employers and employees.

Whether you run a small business or a large enterprise, adopting a standardized payslip format ensures you meet MOM requirements while maintaining professional HR records.

Frequently Asked Questions (FAQs) About Singapore Payslip Template:

Is it mandatory to issue payslips in Singapore?

Yes. Under the Employment Act, all employers in Singapore must issue itemized payslips to employees. This can be in hard copy or electronic format, and records must be kept for at least two years.

What should be included in a Singapore payslip?

A compliant payslip must show:

- Employer and employee details (name, UEN, NRIC/ID).

- Pay period and payment date.

- Basic salary, overtime hours/rate, allowances, bonuses.

- Deductions (CPF, tax, others).

- Net salary payable.

- Employer CPF contribution (recommended for transparency).

How do I calculate CPF contributions on a payslip?

CPF contributions are based on total wages, subject to the CPF salary ceiling.

- Employee CPF: deducted from gross salary (varies by age group).

- Employer CPF: paid by the company in addition to salary.

Rates are updated periodically by the CPF Board, so employers should always check the latest official rates.

Can I use Excel to create payslips in Singapore?

Yes. Excel is a popular choice for small and medium businesses. A Singapore payslip template Excel can include formulas to automatically calculate CPF, net salary, and deductions. This reduces manual errors and ensures compliance.

How long must employers keep payslip records in Singapore?

Employers are legally required to keep payslip records for at least two years. This ensures compliance during audits and protects both employer and employee in case of disputes.