Whatever is the scale of business, what matters is how much profit it gives at the end of the day. Companies keep track their income and expenses with projected income statement template for a certain period depending on the scale of business e.g. shopkeepers do a calculation of what they have spent and what they have earned at the end of each day while in large cooperate sectors monthly closing schemes are followed by accounts department for evaluating the performance of a business.

Income Statement shows income, expenses, and net income or loss of business for a specific time. This can be done daily, weekly, monthly, quarterly, semi-annually, or annually depending on company scale and policies. Usually for developing business, owners prefer to monitor business statements weekly it helps to evaluate business performance. You can also like Quickbooks deposit slip template.

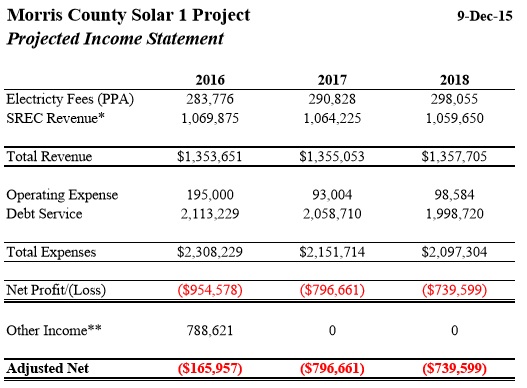

The income projection template is an estimate of the financial results of the business in a future time. It’s often presented in the form of an income statement. Statistical tools are applied to historical data to forecast future incomes.

Table of Contents

Strategies to make the best income plans

For making the projected income statement of a business, different statistical forecasting methods are used to get estimates of future sales. The following are the four types of forecasting methods used by analysts for the estimation of future sales and variable costs of business. You can also see the production schedule template excel.

- Straight Line Method

- Moving Average Method

- Simple Linear Regression Method

- Multiple Linear Regression Method

- Following are the key elements of the income statement should present,

- Total Sales or Revenue

- Total Expenses or Costs (Variable and Fixed)

- Contribution Margins

- Net Income (Profit or Loss)

Read about the Income statement.

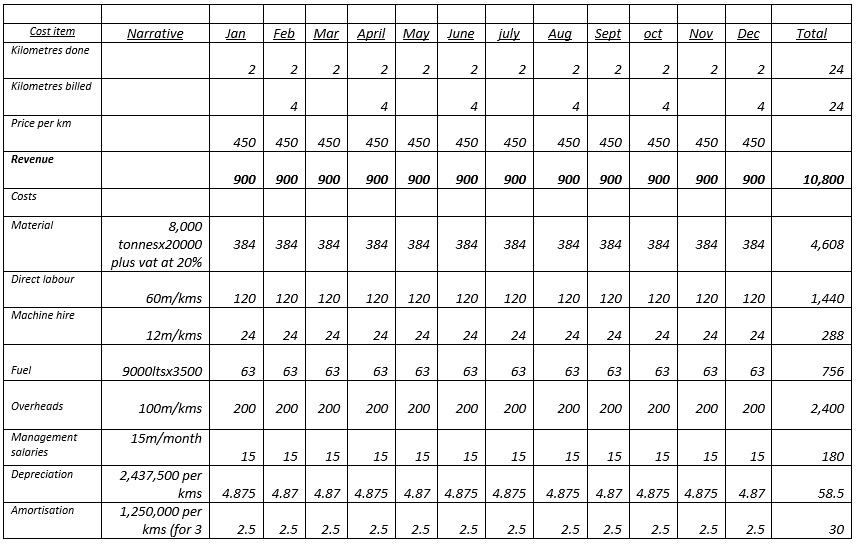

For making projected income statement template excel spreadsheets are used most commonly. After getting projections of future sales and expenses one can easily make projected income statements out of it.

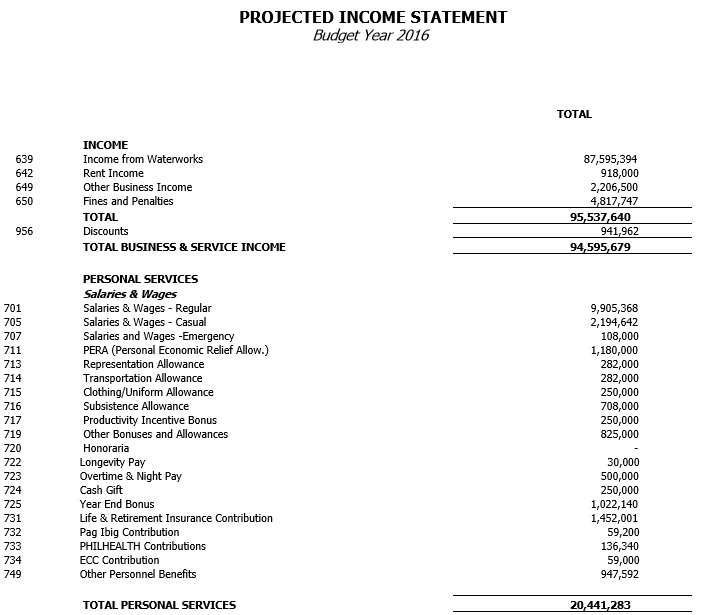

Simple Projected Income Statement Template Pdf

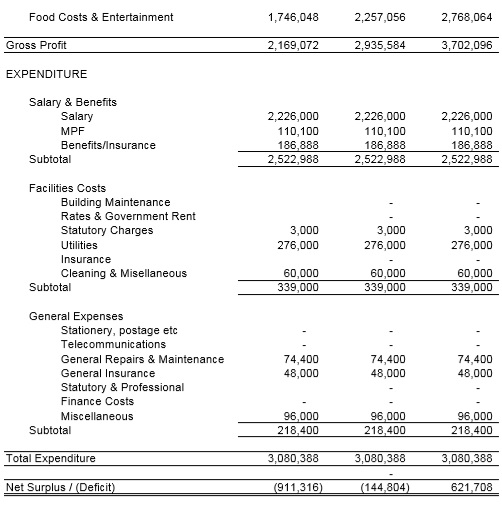

Projected Income and Expenditure Statement Template

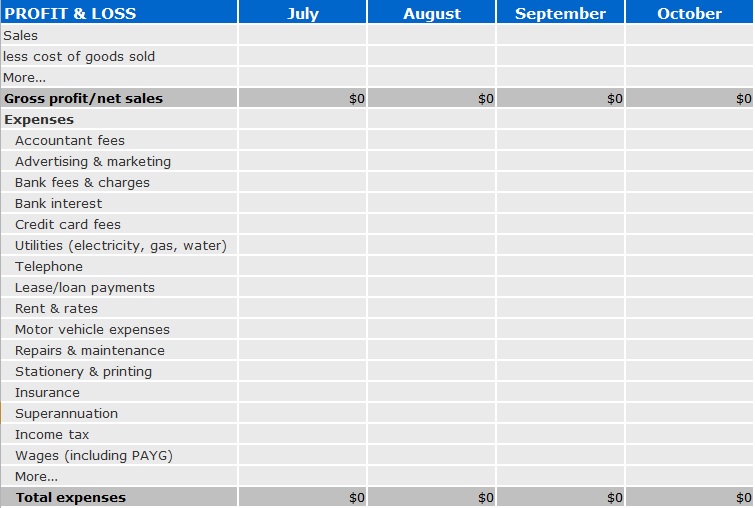

Projected Profit and Loss Statement Template Excel

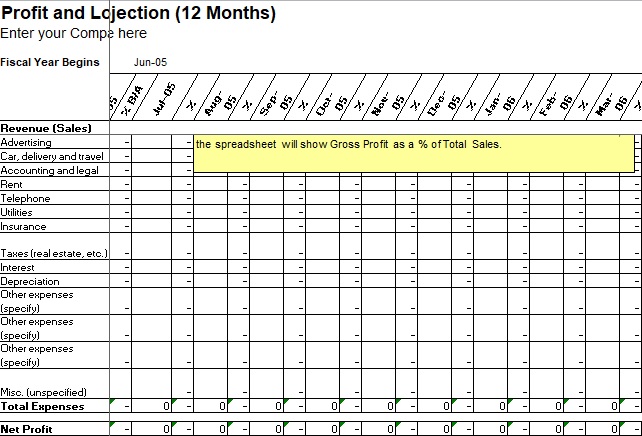

Projected Profit and Loss Statement Example

Projected Financial Income Statement Template

Projected Profit and Loss Statement Template

How lengthy the projected income statement sheet is, it depends on the nature of the business and forecasting method adopted to predict future projections. Projected income statements can be very simple to complex based on how many variables are taken into consideration. Income statements are also sometimes referred to as profit and loss statements.

One good Projected Profit and Loss Statement Examples investment feasibility analysis. It is performed by investors before investing in a business. It utilizes the historical performance of the business to predict future profit and loss using forecasting methods. You can also check a simple project management template excel.

Listed are strategies to make the Projected Profit and Loss statement template using the excel spreadsheet,

- At the top mention time for which income statement is under construction.

- Write down the total sales revenue value in the next row.

- Enlist breakups and total of all variable costs like raw material cost, electricity cost, maintenance cost, and another administrative cost.

- Write down contribution margins in the next row. Contribution margin is calculated as CM = Total Revenue – All Variable Costs

- Enlist breakups and total of all fixed costs like salaries, rental payments, depreciation, interest, and taxes.

To calculate net income (Profit or Loss), subtract fixed costs from contribution margins. Just to evaluate if Net Income results as a positive value it’s a profit while negative value reflects loss equivalent to the resultant amount.

Repeat all the above steps for historical periods which are used to forecast projections and for projected data of future time.