You have to sign a third party financing addendum while buying a home and applying for a mortgage. This is a credit or loan agreement received from someone other than the main or parent contributors. For instance, when buying a home, to finance the payment required to buy the home, you may use a lender or other source.

Table of Contents

What is a third party financing addendum?

A third party financing addendum is a document that outlines the terms of a mortgage that the buyer agrees upon in order to buy a property. It is attached to the original contract. The sales agreement would normally be contingent upon a buyer getting a mortgage loan as mentioned in the addendum. Furthermore, the sales contract becomes void in case a buyer doesn’t meet the terms as outlined mentioned in the addendum and doesn’t receive the mortgage loan.

Types of a third party financing addendums:

You can use the following different types of a third party financing addendums;

Seller financing addendum

This type of financing addendum is used when the buyer is getting a loan from the seller of the property.

Conventional financing addendum

This is used for a buyer to outline the funds required for closing and is provided by the Association of Realtors.

FHA/VA financing addendum

While financing is coming from a VA or FHA loan, this is used.

Reverse mortgage financing addendum

It is used for the people who are 62 years old or over. It informs the seller of the property obtain funds in exchange for the homes’ equity.

USDA financing addendum

When buying a property in suburban and rural areas, this is used and who aren’t able to qualify from a traditional loan.

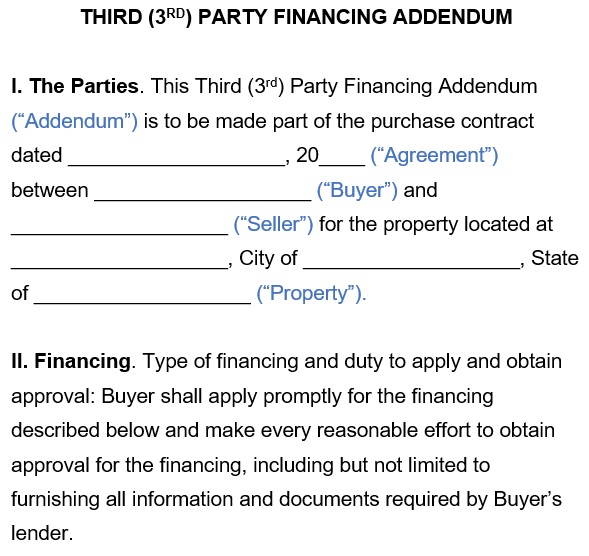

What to include?

Every addendum will vary on the basis of the terms and type of financing. However, you should include the following key elements in the addendum;

Heading

The first step is used to record the date of the original contract. It should introduce all parties involved. The complete legal names of the buyer and the seller and the full address of the property that is being sold should be included.

Financing type

This section should indicate the type of financing being used.

Lender and property approval

In some situations, the approval of the lender will be needed to gain financing. You would have to provide the date that this approval is needed in case the approval of the lender is required. You will also require to provide the date that the buyer must give approval of the property that is provided by the lender.

Execution of addendum

The addendum requires the signatures of both the buyer and the seller as well as their full names. Also, include the date that the addendum is being signed.

How does the third party financing addendum work?

The main purpose of this document is to provide a buyer the ability to terminate a sales contract in case they aren’t able to obtain loan approval or if after home inspection, there are issues. This document makes the buyer able to have any earnest money refunded back to them. However, if the buyer hasn’t provided timely notice, then they may be in breach of the sales agreement. In most States, at least 3 days before closing, the buyer needs to give notice.

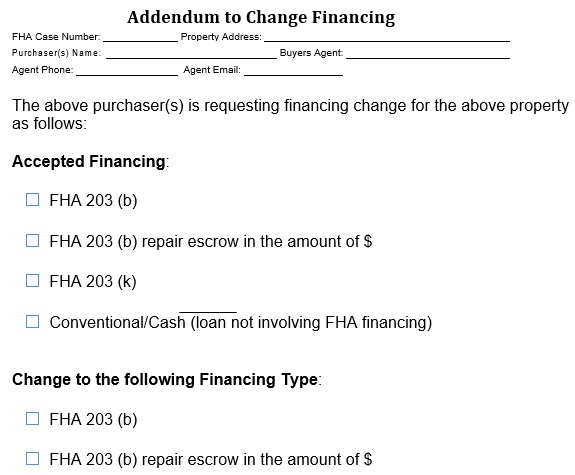

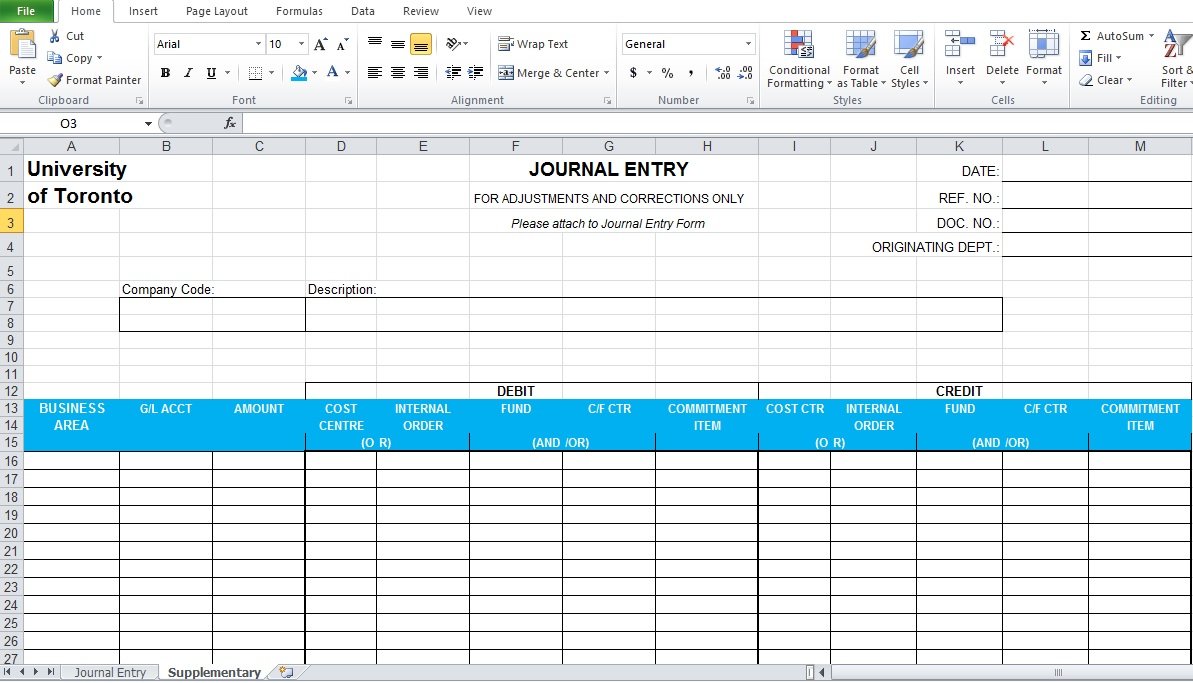

Addendum To Change Financing

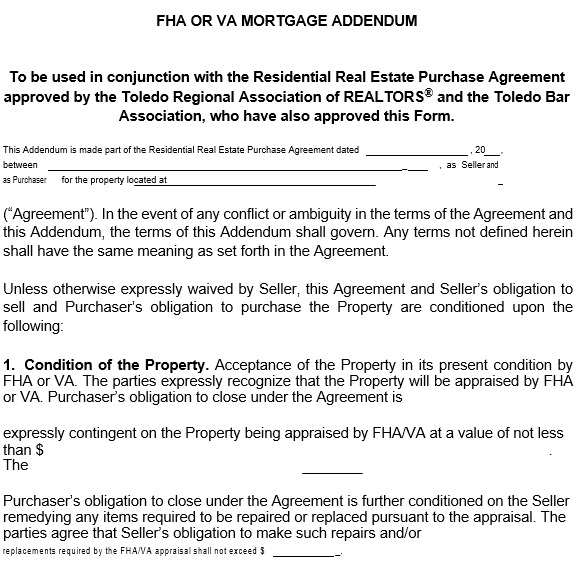

FHA or VA Mortgage Addendum

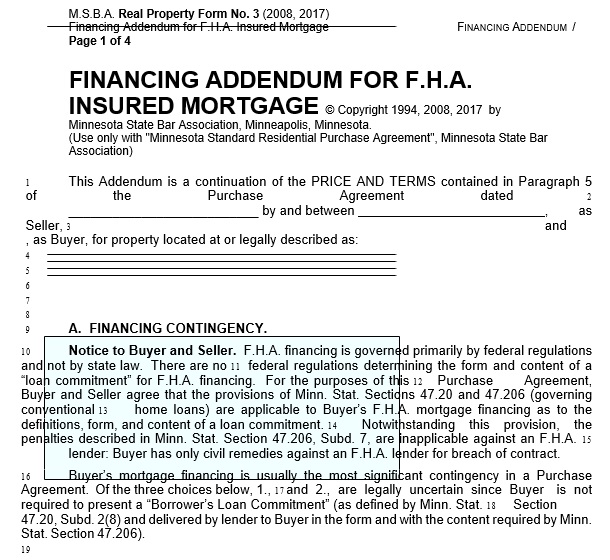

Financing Addendum for F.H.A Insured Mortgage

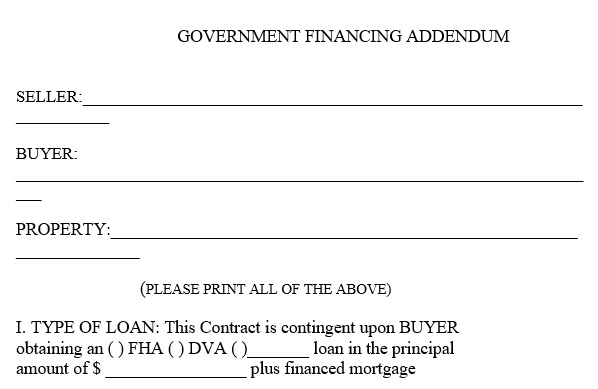

Government Financing Addendum

Third Party Financing Addendum Template

Third Party Financing Condition Addendum

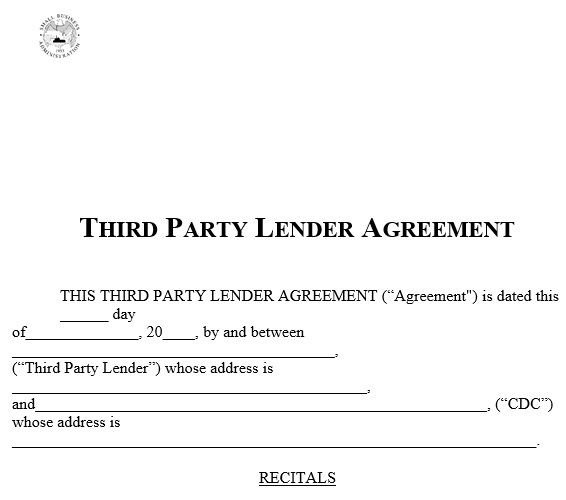

Third Party Lender Agreement

Faqs (Frequently Asked Questions)

The approval is required for the buyer to get funding so that they can close on the sale of a home. This can be either government or lender approval.

Yes, the buyer or the agent will require to give written details about why that appraisal did not meet the requirements for financing.

The third party financing addendum contingencies part needs that the property being sold must meet the approval of the lender’s underwriters. This is done via a home appraisal.