Landlords use a rental receipt template to provide rent receipts to their tenants. They also use it to track rent payment dates. This document also ensures that both the landlord and the tenant are on the same page about the payment of the rent.

Table of Contents

What is a rental receipt?

A rental receipt is a written slip provided to the tenant by their landlord after paying the rent. This slip proves that the tenants have paid their rent. It also comes in handy when a tenant’s payment method is challenging to track. Moreover, the rent receipts can be used for all types of residential and commercial tenants. Some other names of this receipt are;

- Rent payment receipt

- Receipt for rent payment

- Renter’s receipt

- Rent paid receipt

- Proof of rent payment

The benefits of using a rental receipt:

The benefits of using a rental receipt:

Consider the following benefits of a rental receipt if you are trying to decide whether you want to use the rent receipt or not;

- Maintain a professional experience with renters.

- It helps you track tenant payments.

- It can be needed by law in your state.

- The receipt ensures the renters that their rent payment was received.

How to fill out a rental receipt?

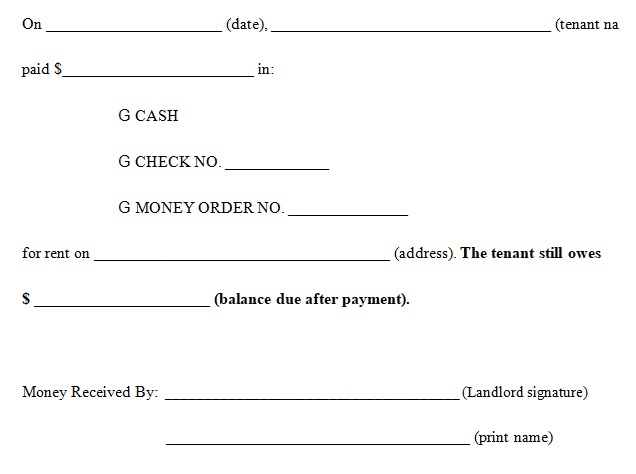

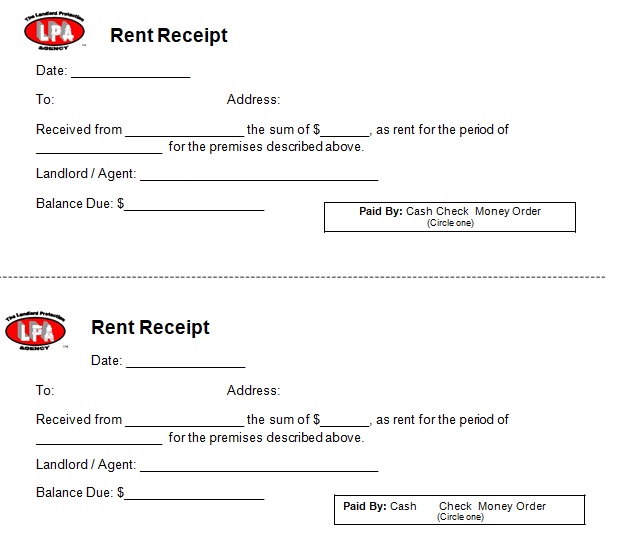

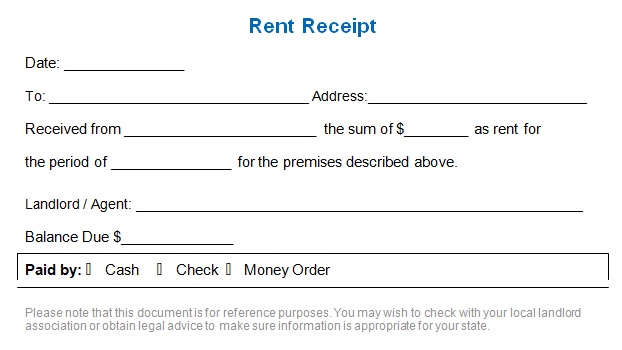

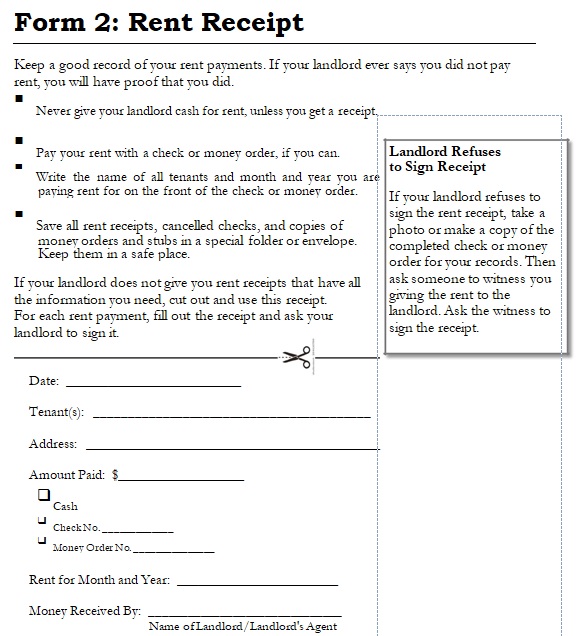

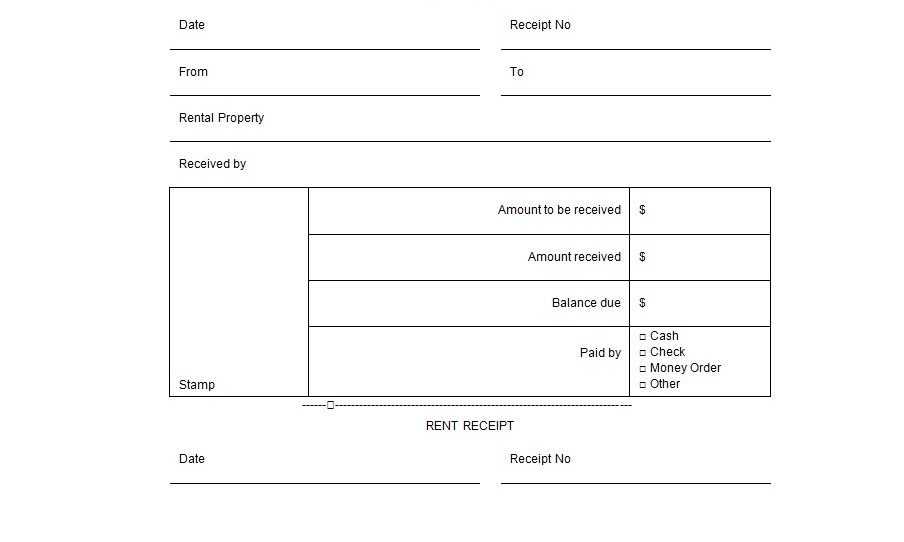

A rental receipt should include the following details;

- The payment method

- The payment date

- The payment amount

- The remaining balance (in case of a partial payment)

- The rental period in which the payment applies

- Any late fees

- Name and contact details of a landlord or property manager

- The tenant’s name

- The rental property address

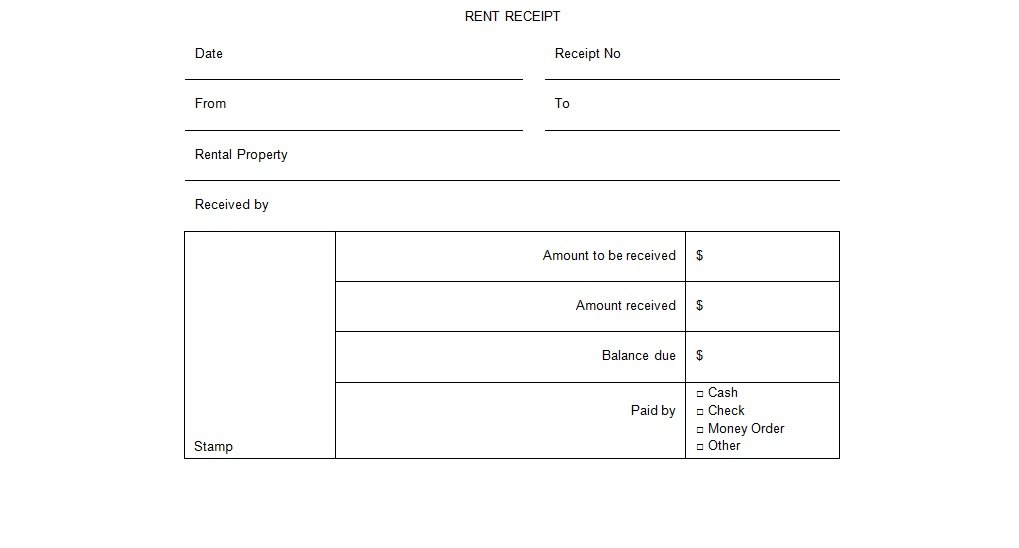

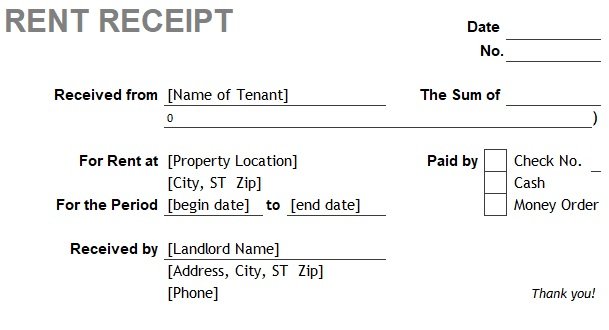

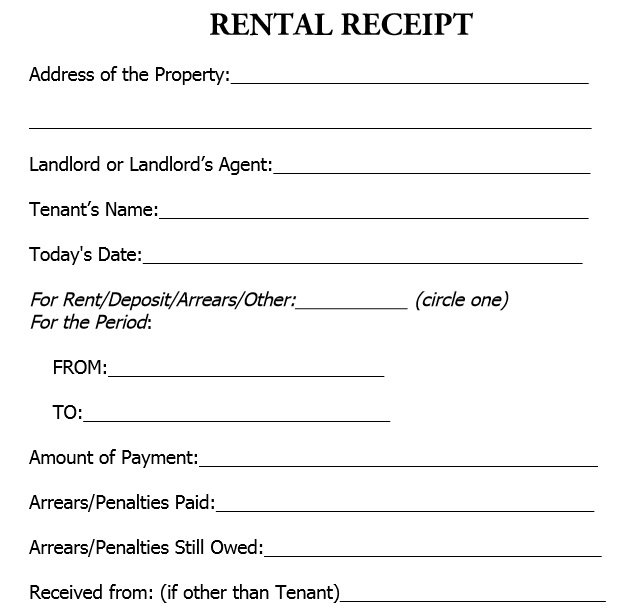

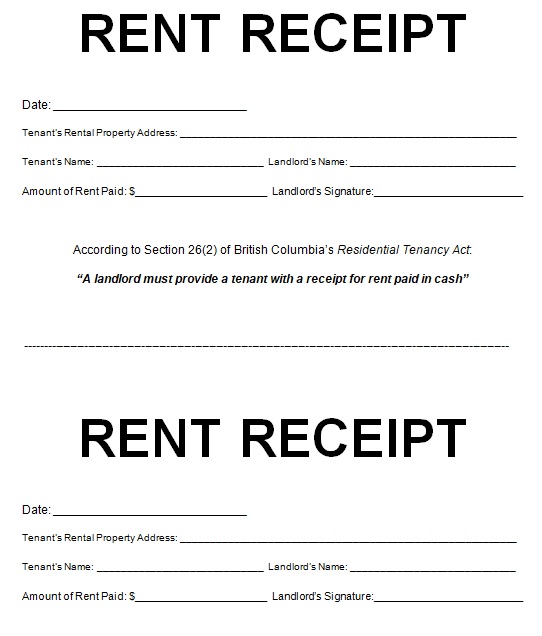

Free Rental Receipt Template

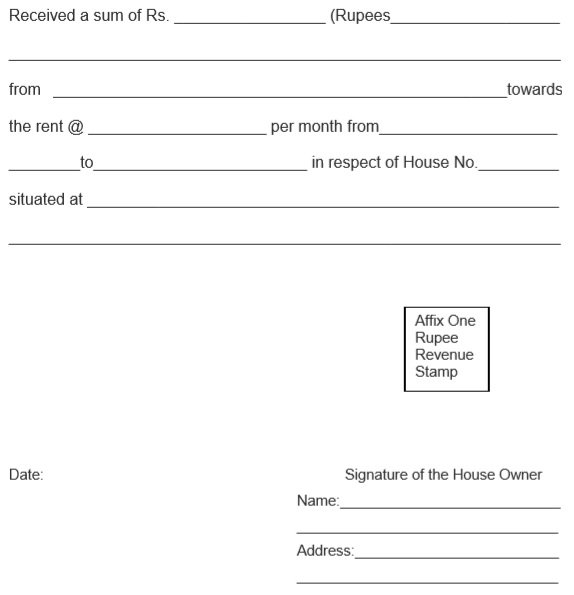

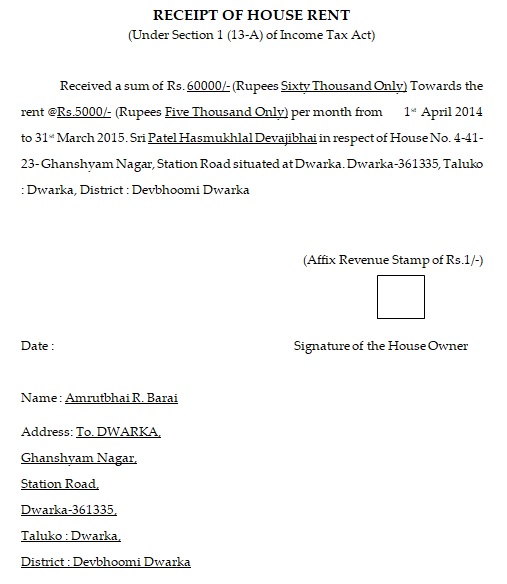

House Rent Receipt Template Format PDF

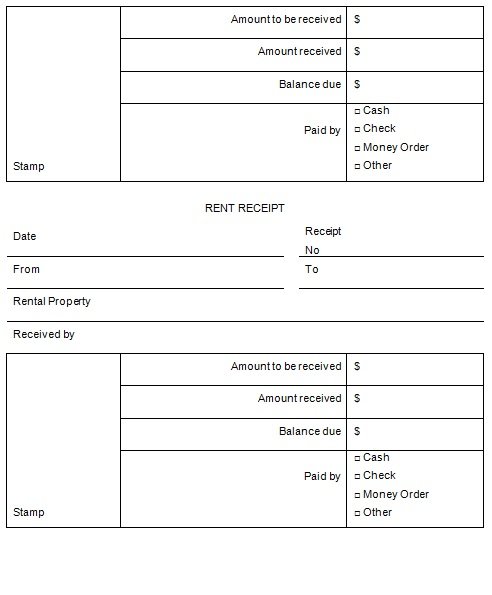

Free Fillable Rent Receipt Template

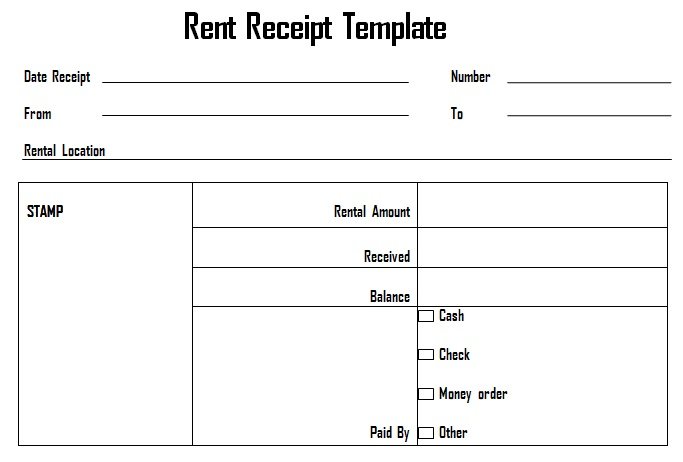

Printable Rent Receipt Template

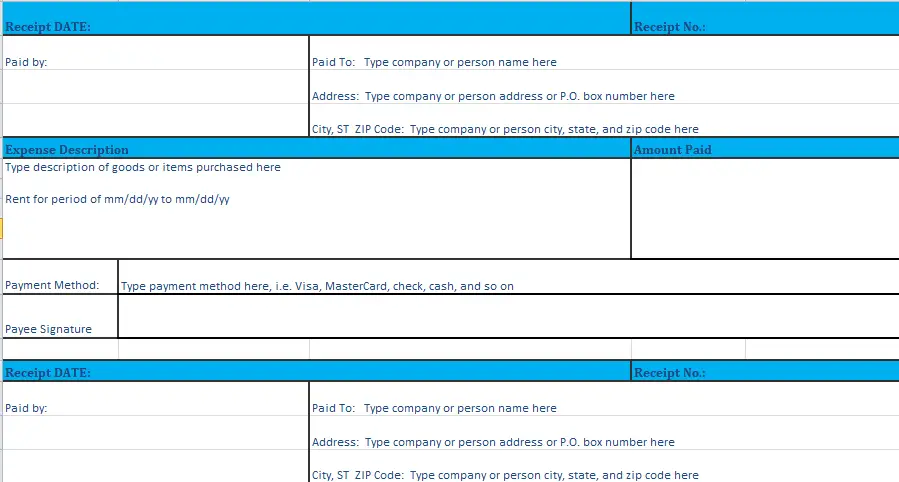

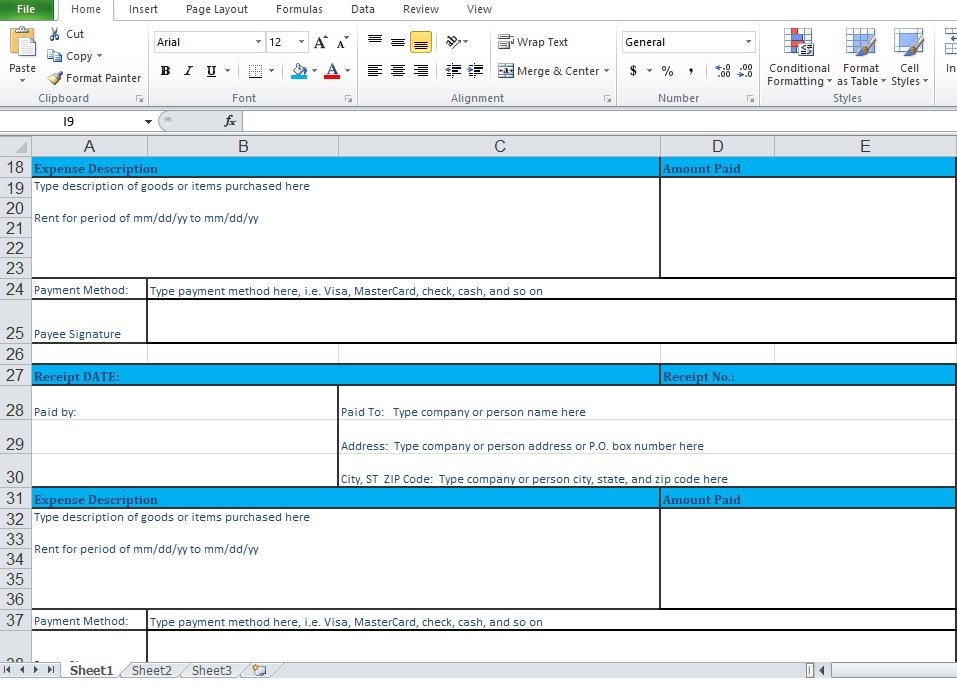

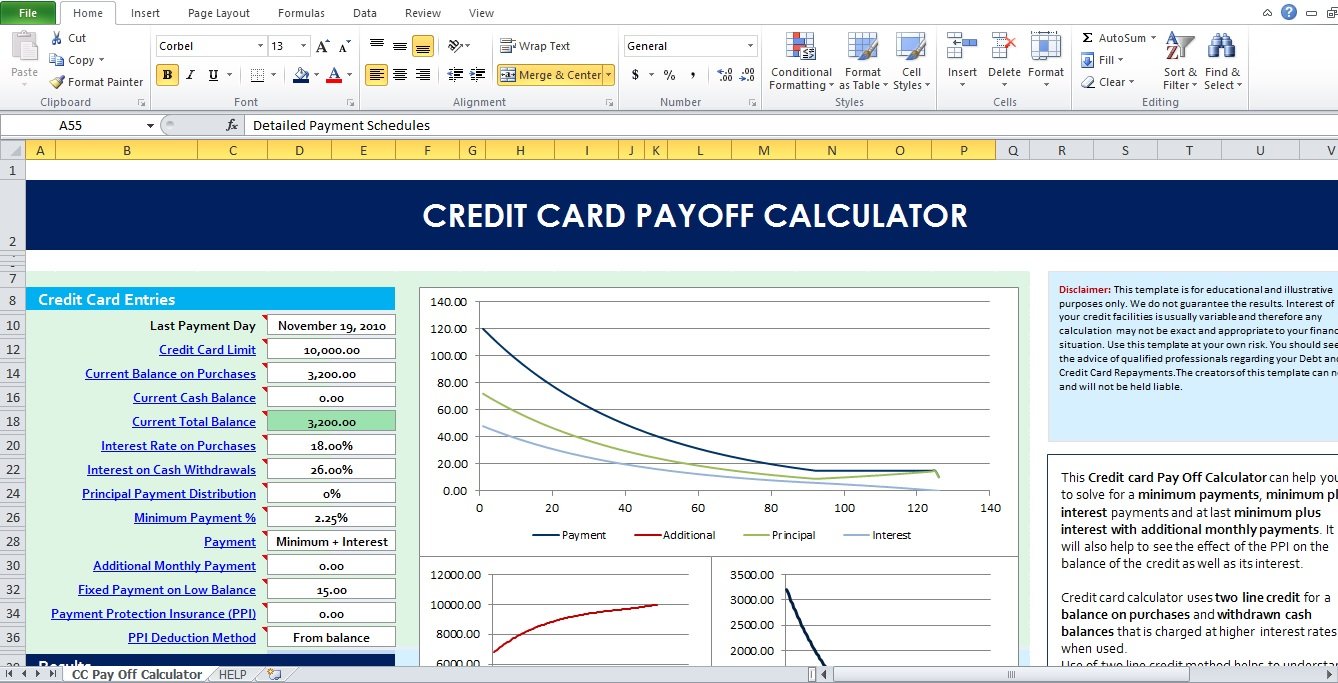

Download Car Rental Receipt Template Excel

Rental Payment Receipt Example

How often should you send out a rental receipt?

You should send a rental receipt to your tenants as soon as they are made by your renters. In case your manager takes rent payments on your behalf then ensure that they send out rent receipts for you. In addition, you still need to deliver a rent receipt document if the rent is paid in one lump sum at the end of a year or six months.

Never send out the rent receipts weeks after payment was made. Instead, ensure that your rent receipts are sent out right after payments are made and received. These receipts are an essential part of the documentation that you give your renters. It keeps everyone on the same page about the payment process each month.

In which States rental receipts aren’t required by law?

Every state has different regulations regarding the requirements of the rental receipts. You may include certain details as per state laws or you just need to provide rental receipts when a tenants pay with cash.

You must go through the rent receipt policies in your state. If you want to continue the process of renting out properties in your state of residence then you can’t ignore the legalities of the rent receipt process. If you aren’t providing the right rent receipt documents to renters on your properties, you may face penalties and other associated issues that can crop up with the law.

If you are not clear about the requirements in your state then speak with a legal expert about the laws regarding rent receipts in your state. A key for landlords who are renting out properties of any kind is to ensure that they know what the law says about rent receipt documents. Additionally, you must know the business rental regulations in your state if you rent out a business location. There are entirely different laws and regulations regarding these kinds of properties. To avoid legal action being taken against you by your tenant, it is essential to determine the difference between the two kinds of properties.

Rental Receipt Template Excel

Free Print Landlord Rent Receipts Template

Free Printable Rent Receipts of Payment

Microsoft Word Rent Receipt Template

Printable Rent Receipt Word

Rent Payment Receipt Template

Rent Receipt Example

Rent Receipt Format Word

House Rent Receipt Letter

Can you use rental receipts at tax time?

Yes, you can use rental receipts to make things clear at tax time. If you have hired an accountant to handle your taxes then they will appreciate you after seeing clearly what payments were made for rent throughout the year. Furthermore, using rental receipts can make everything about your tax filing process easier especially if you manage more than one property.

If you have your payment receipts, you can access tax deductions and other kinds of perks. It also enables you to track what you have been paid in rent. It would be recommended to collect more documentation that tracks the processes related to your rental properties. The rent receipt is also beneficial in states where the law does not expressly require you to create these records.