A New Mexico LLC operating agreement template is a legally binding agreement that outlines the structure, management power, and responsibility of all the company members. This business agreement is an important step in making sure smooth operating procedures.

The agreement has all the policies and procedures of the company. Furthermore, it also contains details regarding how to handle any potential issues like disagreements, payouts, future expansion of members, and many more.

Table of Contents

Reasons for making operating agreement:

Here are the reasons to make the operating agreement in New Mexico;

Clarity in verbal agreements

All the time, misunderstandings happen. Therefore, to avoid poorly interpreted verbal agreements, you should make an LLC operating agreement. This contract states all member’s duties and responsibilities. All of the LLC company members are in agreement. Thus, avoiding potential disputes, disagreements, and financial trouble. It is important to make sure that the very foundation of a business is well-developed.

Protects limited liability status

The LLC operating agreement makes sure that the company can uphold its legal limited liability status. By doing this, the members separate their personal and business finances. This prevents courts from merging the two. This is important for single-member LLCs. Moreover, the document specifies the company’s structure and duties.

It makes the members able to secure their limited liability status by maintaining their control over their responsibilities. It will secure the company from referring back to generic Nevada LLC statutes.

Recommendation by state

For all LLCs, the state of New Mexico explicitly states the significance of entering into an operating agreement. The benefits genuinely outweigh any possible inconveniences though the state does not technically need them.

Protect the agreement

The operating agreement safeguards a business from undesirable rules being applied to them in order to avoid having New Mexico’s standard LLC rules applied to every company. The standard New Mexico rules are reasonable. However, they are highly unspecific.

Prevent conflicts

The New Mexico operating agreement will help avoid potential conflicts by stating clear guidelines that all members should follow. No misunderstandings may result in conflicts because all members should review and agree to the conditions stipulated.

How do you file LLC operating agreement?

Here are the steps to file an operating agreement;

Registered Agent

An agent should be selected to get all legal demands that can be served to the LLC. In New Mexico, they should be a third-party agent who handles this process.

LLC type

In the next step, you have to know the type of LLC which is being filed. The LLC can be classified as either domestic or foreign. A Certificate of Existence should also accompany the documentation in case a Foreign LLC is being filed.

Documents

Different documentation should be provided to the Secretary of State on the basis of the LLC type. The documents may only be filed online for Domestic LLCs. However, the Foreign LLCs have to file in a physical paper format.

Fee

Different fees are applied on the basis of LLC type. The state needs Domestic LLCs to include a $50 check or money order in order to complete the application process. In case of Foreign LLCs, it should be $100.

Operating Agreement

The operating agreement isn’t technically required. But, the application process requires to attach the operating agreement reviewed and signed by each member. It is, therefore, important to include an operating agreement corresponding to the type of LLC.

EIN

To carry out financial transactions, the Employer Identification Number is a prerequisite for the company. This number is crucial for tax reporting. You can get this number free of charge on the IRS website.

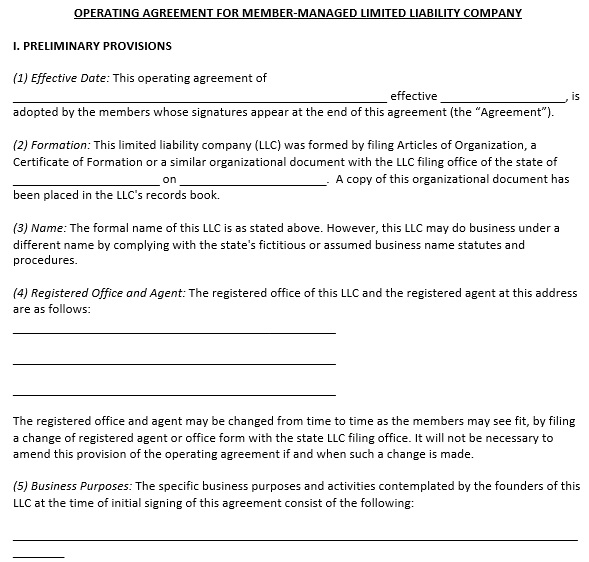

New Mexico LLC Operating Agreement

Free New Mexico LLC Operating Agreement Template

Conclusion:

In conclusion, a New Mexico LLC operating agreement template is an important document for maximum legal protection. It safeguards all the members of the company by separating them financially from the company.