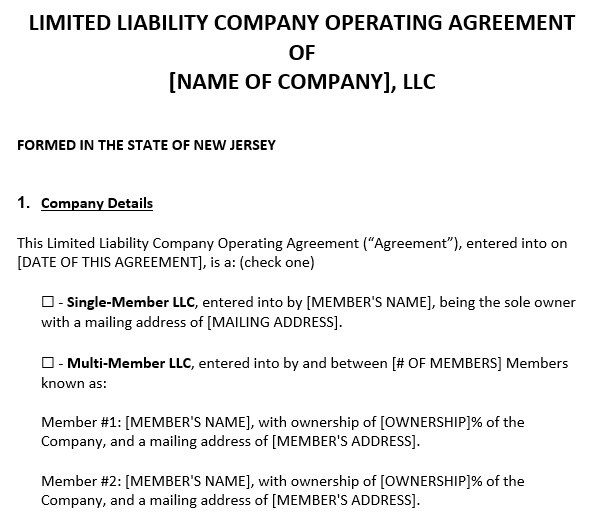

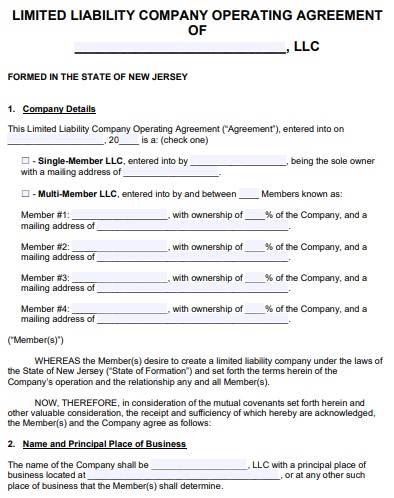

A New Jersey LLC operating agreement template is a formal document that outlines the internal structure of a company. The operating agreement includes the company’s daily operations and management structure. In case of any legal actions against the business, this agreement can protect company members’ private assets from losses.

Table of Contents

Revisions in New Jersey operating agreement:

Usually, the company members who have registered with the LLC draft the New Jersey LLC operating agreement on the basis of the LLC Act in the Statutes database of New Jersey State. Furthermore, this agreement currently governs by the Revised LLC Act as of 2014. Company owners should be aware of the amendments made to the Act by having this in mind.

Some of the revisions made contain the following;

Agreement amendment method

The Revised LLC Act allows companies to make their operating agreements although New Jersey State offers operating agreements for LLCs. This is to make sure that by having an oral or implied agreement, companies can override the state.

Member resignation practices

A resigning LLC member is allowed to maintain their shares according to Revised LLC Act but they don’t have the right to vote in any company decisions. Consequently, these disassociated members will get their profits from the distributions made but they don’t receive it immediately after they have resigned.

Fiduciary duties

All LLC members have to determine their Fiduciary duties. However, the Revised LLC Act enables modifications concerning these duties. Therefore, all members must faithfully uphold their Fiduciary duties without any amendments made in the agreement.

Indemnification

In case, the company has no operating agreement, Revised LLC Act allows for member indemnification and New Jersey State laws apply in the matter. However, no indemnification is allowed if the operating agreement exists.

How to form operating agreement?

In New Jersey, company members should strive to have an operating agreement. Members should go through the State’s Records before forming an LLC operating agreement in New Jersey to confirm that their LLC name is unique and isn’t same to the names of any previously filed LLCs.

Here are the steps to follow for company owner(s) in New Jersey who wish to have an operating agreement and to form a valid LLC operating agreement in New Jersey and benefit from the contract;

Registered agent

To represent the company and handle all the processes, the company’s managing members should elect a registered agent. Make sure that the registered agent should be a resident of New Jersey. In addition to this, they must have the ability to conduct business in the state.

LLC type

Then, the agent will select a domestic or foreign LLC type on the basis of the company’s filing situation. A domestic LLC has to file a new LLC within the state and on the other hand, a foreign LLC has to file an existing LLC made outside the state.

File the application

In the next step, through New Jersey’s Online Portal, file the domestic or foreign LLC. Finally, alongside a foreign LLC, a Certificate of Existence should be filed.

Fee

Filing fee for LLC applications, you have to pay the required fee of $125. There will be a step for online filing that needs payment before filing is complete. Proof of payment should be filed alongside the application in case of using mail.

LLC operating agreement

At this step, the LLC operating agreement can be drafted. New Jersey LLC operating agreement can be a single-member, multi-member, member-managed or manager-managed operating agreement.

EIN

An employer Identification Number is required by the IRS in order to track company tax reports.

New Jersey LLC Operating Agreement

Free New Jersey LLC Operating Agreement Template

Conclusion:

In conclusion, a New Jersey LLC operating agreement template is a legally binding document that protects the company owner(s) from any legal issues that may affect the company. The agreement provides business credibility as well as increases the LLC flexibility.