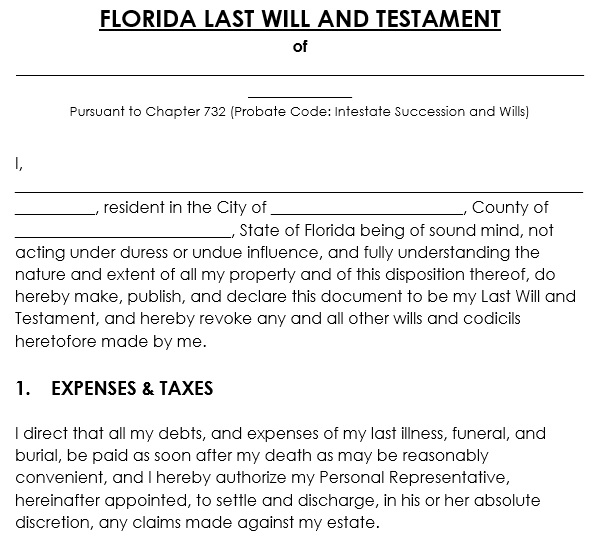

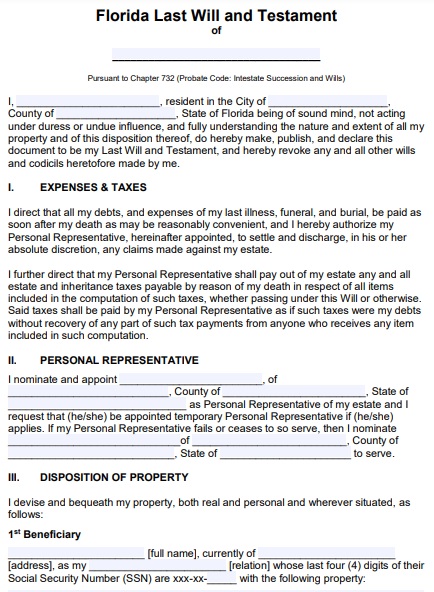

A Florida last will and testament template is an effective tool used to specify how one’s possessions, assets, and estate will be distributed in case of their death. The last will and testament in Florida also highlights many other practical details that govern distribution. When an official representative has signed, witnessed, and notarized the last will then it becomes valid in Florida.

Table of Contents

In Florida, do you need a Last will and Testament?

It is necessary to have your last will and testament as it dictates your final wishes regarding the distribution of your assets after you pass away. You can clearly explain in this document what you want to happen to each asset and how by describing who will be entitled to inherit any particular asset.

Furthermore, as the testator, the last will and testament makes you able to appoint trusted individuals in order to execute your directives. For minors, you can make long-term trusts for property left behind. You can appoint a guardian for the children in such a case.

If there is no last will and testament then the assets of deceased are distributed under Florida’s intestacy laws. Hence, their assets are distributed among their spouse and children. If the deceased has no spouse and children, their assets go to the next available next of kin.

What are the basic requirements of a last will and Testament?

Consider the following basic requirements while making a last will and testament in Florida;

Restrictions on property distribution

In Florida, there are some restrictions to the types of assets that can be distributed via a last will and testament. You can’t include the property which is owned jointly through joint tenancy. The reason behind it is that it ultimately passes to the survivorship.

The spouse of the deceased typically inherits the family homestead and the rest is distributed to the descendants. An elective share can be claimed by a spouse in the will.

Executor and testator requirements

The testator must be eighteen years of age or older as well as a Florida resident and has a sound mental state. They must have the mental capability to comprehend the practical implications of the last will and testament. Also, you have to be the sole owner of the property having no shared interests. You can’t sign a will in Florida in case you are not legally competent to sign a contract.

The testator selects the executor who carries out your will and after your death distribute your assets as per your final wishes. Likewise testator, the executor should be 18 years or older and mentally able to carry out the duties assigned to them.

Signing requirements

The last will must be signed by the people who have a professional relationship with you. So, you should choose the disinterested parties that are not entitled to any portion of the estate. Witnesses have to attest that without coercion or persuasion, you signed freely and voluntarily. The Florida state permits the use of electronic wills and it can be signed remotely.

Moreover, witnesses’ testimony isn’t required by a self-proved last will. A self-proving affidavit must be signed by you and the witnesses as well as it must be notarized.

Writing

The last will and testament in Florida State must be in writing. Also, make sure that it is witnessed. Your proper identification including your name, address, age, and occupation must be mentioned in the will.

Free Florida Last Will and Testament Form

Florida Last Will and Testament Template

Faq’s (Frequently Asked Questions)

No, after the death of someone, Florida does not have the jurisdiction to tax their assets. You should go through federal tax laws as they may be applicable.

You don’t require a lawyer to make your last will and testament. However, when it comes to the probate of your will in Florida, you have to get the legal assistance of a lawyer. The lawyer assists you in making sure that whether your will is valid and legal.