Table of Contents

What is a debt settlement agreement?

A debt settlement agreement is an agreement among the debtor and creditor. This agreement allows them to negotiate an agreement for paying off or re-negotiating a debt. In some circumstances, the debtor and creditor will agree to smaller repayments unless the debt is fully paid. In other cases, in order to settle it, they will arrange to pay a percentage of the debt. This lets the creditor recoup some of the losses of the debt. Furthermore, a debtor can also use a debt settlement agreement to propose an amount and a way to resolve the debt. He usually use this agreement when he is unable to afford to pay off the full amount. The debtor commonly offers 50 to 70% of the amount owed, to settle and close out the debt.How to write a debt settlement agreement?

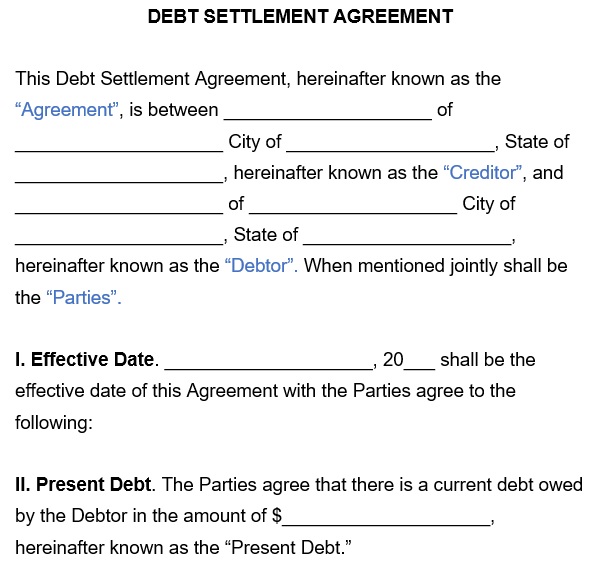

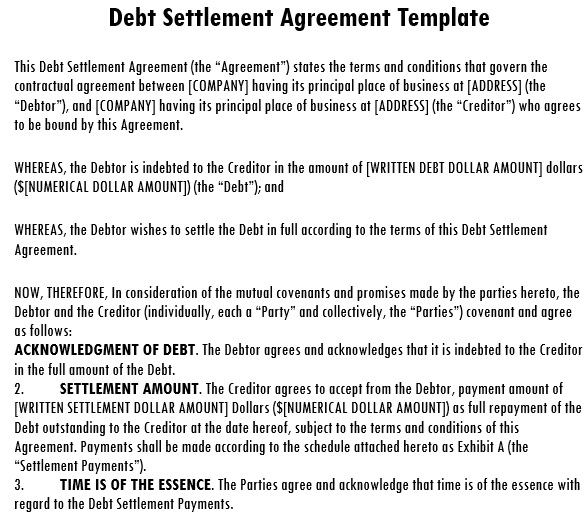

Here are the specific things that should be included in a debt settlement agreement;The first section

- At first, include the creditor’s details such as the creditor’s legal name and their full address.

- Then, include the full name and address of the debtor.

- Mention the effective date that provides the date the agreed-upon terms will become active.

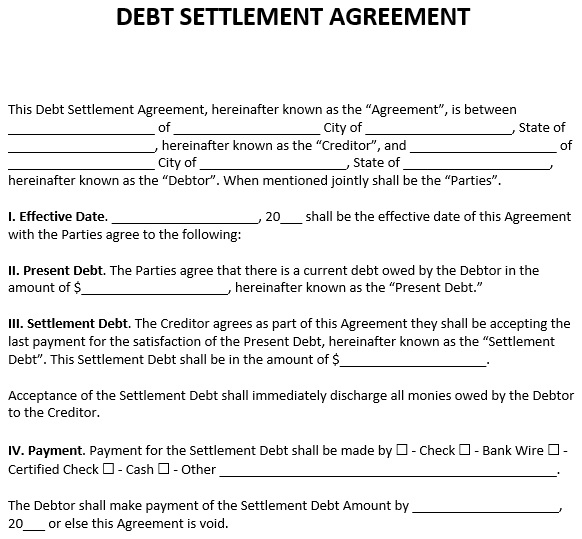

The second section

- Present debt: this is the amount that is still owed to the creditor by the debtor.

- Settlement debt: in order for the creditor to accept and settle the debt, this is the adjusted amount of the debt that the debtor is offering to pay.

- Payment: this indicates how and when the debt will be paid. This section also include the date that the payment must be made.

- Governing law: here, you have to include the state in which this debt is being enforced.

The last section

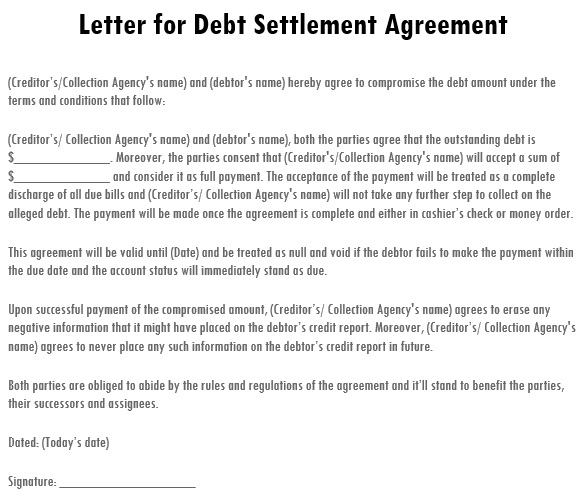

In the last section, both parties will sign the agreement. This makes it a binding contract. Both parties have to sign and date the document when they agree to the terms of the agreement. There should be a space for both the debtor and creditor to sign and date. Under their signatures, they have to print their names.Things to consider:

During creating a debt settlement agreement, there are some things that you have to consider;For debtors

- This agreement is used for unsecured debts. The lender or creditor has the right to take the property in case a debt is secured.

- In case, any debt forgiven of $600 or more, a creditor must report to the IRS.

- If you have a good score then creditors can report a debt settlement to the credit bureau that can have a big negative impact on your credit score.

For creditors

- When the creditor accepts the debt settlement agreement. It means the creditor will recoup some of the debt. This also indicates that the creditor is no longer able to go back to get the full amount owed.