The debt release letter is a formal letter which tells the parties that there is no longer any financial obligations between the creditor and the debtor. It is sent by the creditor to the debtor along with any third party.

When the debtor make their final payment, they request a debt release letter. The creditor gives an acknowledgement through this letter that the debtor has cleared the debt. Hence, after receiving this letter, the credit reporting agency or any other third party remove the debtor from their credit report.

Table of Contents

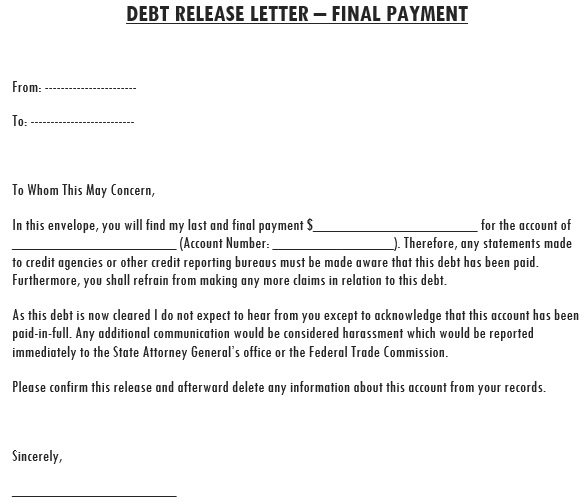

What to include in a debt release letter?

A debt release letter should include the following information;

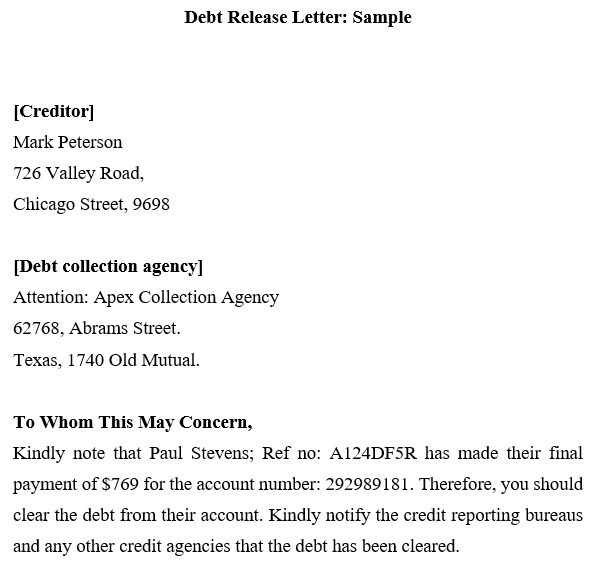

- The name and address of the creditor

- The name and address of the debtor/any third party

- The loan reference number or account number

- The date of debt payment

- The total amount paid

- A closing signature

What are the laws for debt collection?

The creditors have to collect every debt owed by their clients. There are specific methods that you have to use to collect the debt as per the Fair Debt Collection Practices Act. You have also right to call the debtor and ask for payment.

- The amount of debt you owe with your employers, family, and friends, the law doesn’t allow the collection agency to discuss it.

- The use of abusive words, threats, slurs or insults, or even profane language while collecting debts is prohibited by the law. In case, there is an evidence of harassment, the debtor can always file a complaint in court.

- The debtor is also allowed to pay the debt slowly. Furthermore, they can also ask the creditor to make installments of the amount owed and its interest rates.

- The debtor shouldn’t ignore the creditor or the collector completely.

- The creditors should introduce themselves with the debtor to their first contact. The debtor must know the following;

1- Who they are

2- The agency or creditor they are representing

3- Your outstanding balance

4- Contact details on how you will get in touch with them - If the negotiation is done over the phone then request a written document for future reference.

The advantages of obtaining a debt release letter:

Let us discuss below the advantages of paying off your debts and having a debt release letter;

Better credit score

After paying off your debts, your credit score may improve significantly. This way, the chances of getting another loan increases. Additionally, the debt release letter can also use to tell any credit reporting agencies remove any negative listings on your credit report.

Less stress

When you pay off debt, a huge weight off your chest reduces. When you know that have been cleared of any financial obligations, you can sleep more comfortably.

Fewer risk

You don’t have savings to fall back on when you have to pay debt. You can lose your assets by having bad debts like your home, car, and more.

Higher self-esteem

Paying off debts increases your confidence and you get relieved from the burden of calls or evens letters from the collecting agency. If there arise any issue with the creditor or the credit reporting agencies then you can refer to your debt release letter.

Free Debt Release Letter

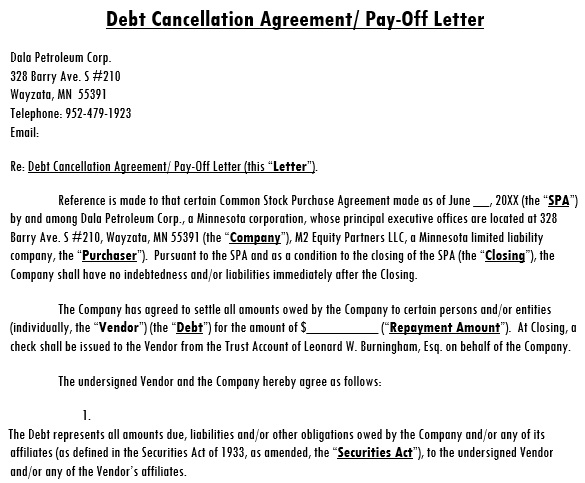

Debt Cancellation Agreement or Pay Off Letter

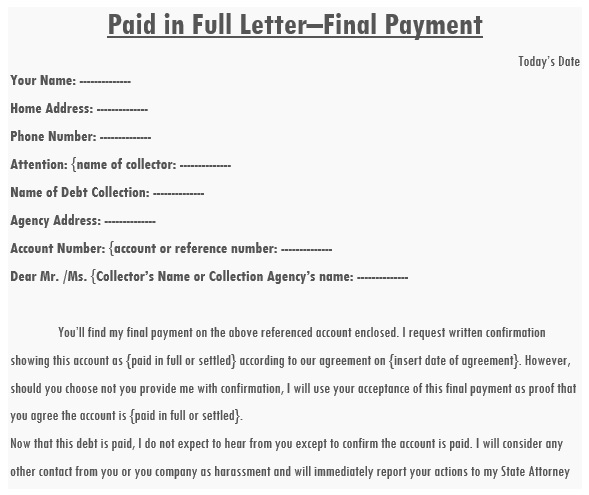

Paid in Full Letter – Final Payment of Debt

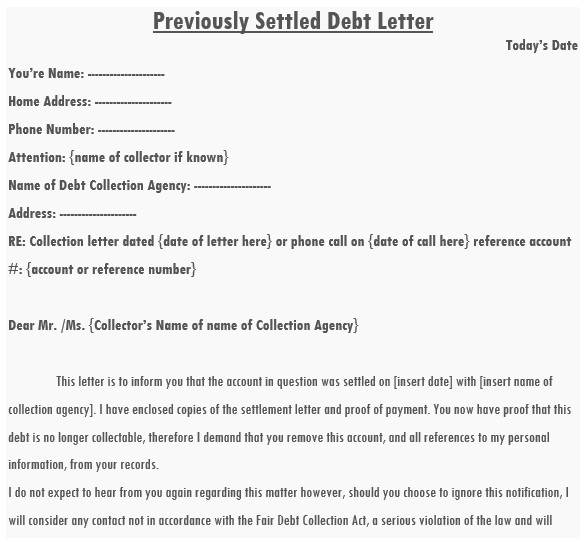

Previously Settled Debt Letter Sample

Printable Debt Release Letter

Conclusion:

In conclusion, a debt release letter is an official letter serves as a future reference for the debtors that they have paid the debt amount. This letter proves that there is no financial obligation among the creditor and the debtor.