You receive a Mortgage Lien Release form when you have defaulted on your mortgage. A mortgage lien is usually done when you are taking out a secured loan (mortgage). It is a legal claim that prevents the lender in case the borrower fail to make the payment.

Table of Contents

What is a mortgage lien release form?

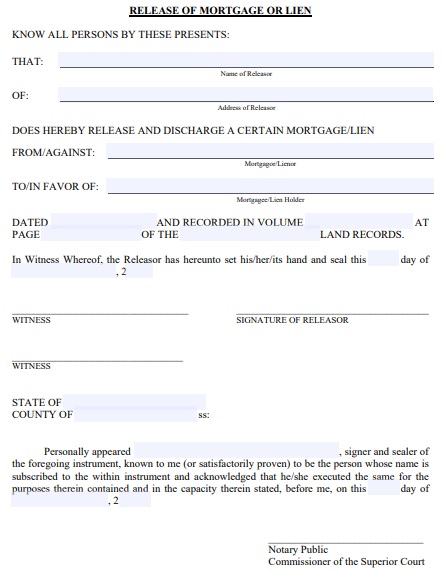

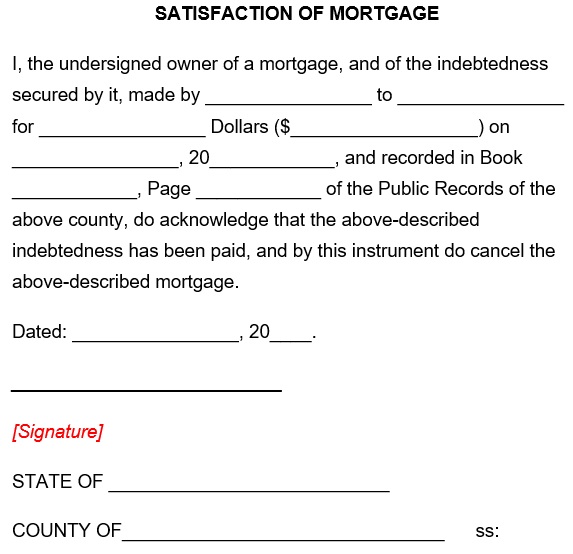

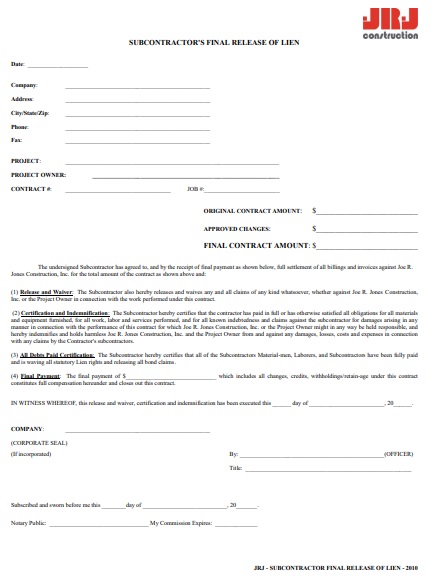

A mortgage lien release form is a formal document issued by the mortgage lender to the borrower. It confirms that the borrower has paid the debt completely. Then, this form will be filed with a county or land registry. It provides the owner of the land a title that is clear. Also, it states that the line on the property will be removed.

What to include in a mortgage lien release form?

The information to include in a mortgage lien release form may vary from state to state. However, the following key details must be included in it;

- Name of the payee

- Mortgage holder owner

- Amount of mortgage

- Mortgage’s date of execution

- Complete legal details of the property including the tax parcel number

- An acknowledgment which states that payments have been made in full

- A statement confirms that the lender is released from filing a lien on the property

- The signature of all important parties

- The date when the mortgage lien release form was signed

Furthermore, the borrower must sign the Mortgage Lien Release form after receiving it. To remove the lien, they have to send this document to the County Recorder or Land Registry Office. This form may have to be notarized and signed by a witness. Some States require both a notary public and a witness signature. These are;

- Arkansas

- Georgia

- Michigan

- Ohio

- South Carolina

- Vermont

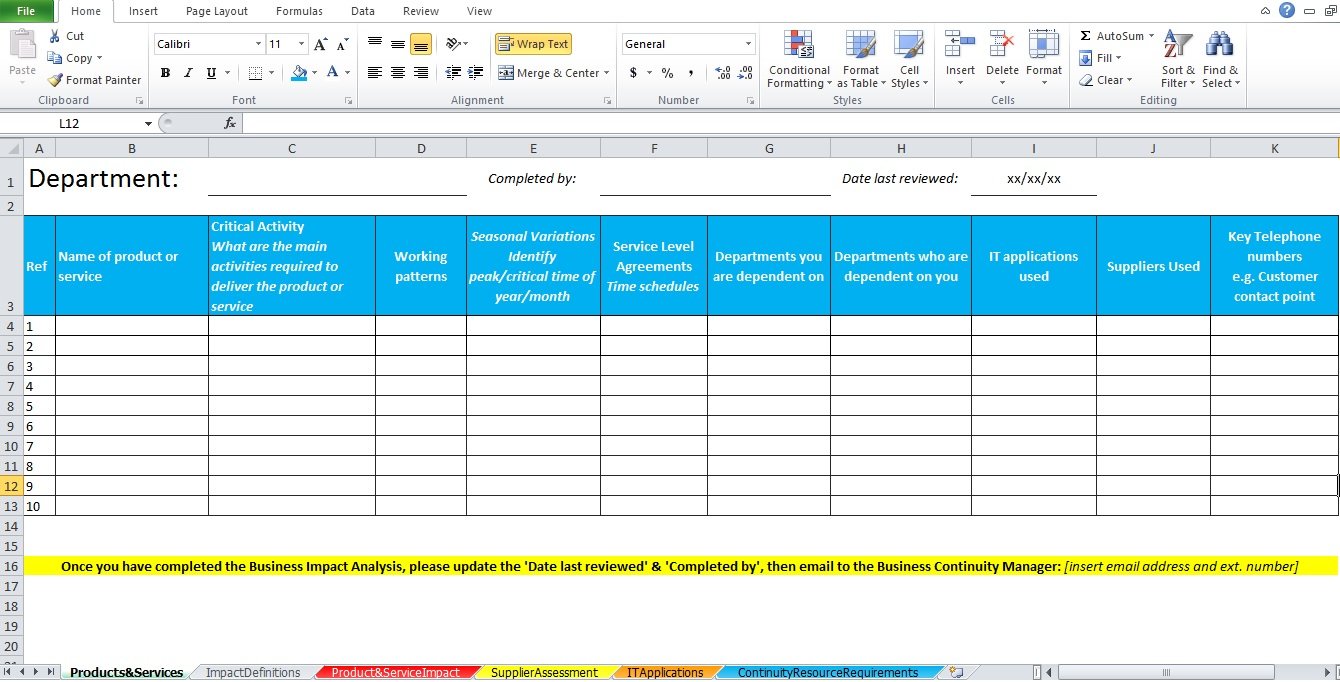

Free Mortgage Lien Release Form

Satisfaction of Mortgage Lien Release Form

Subcontractor Release of Lien Form

What to do if the lender has not sent a mortgage lien release?

A mortgage lien release must issue by the lender to the borrower when the debt has been satisfied as per the law. The lien can’t be released without this document. Typically, up to 3 weeks may require to receive the paperwork for a Mortgage Line Release. However, you may have to release the line from your end if you haven’t received one. You may have to bring documentation to prove that you have paid the debt in full;

- The Deed of Trust or Recorded Mortgage

- Recorded assignments

- Recent title commitment or attorney’s title opinion

- Proofs such as payment check copies, settlement statements, paid notes, etc. that show the mortgage has been paid in full

Faqs (Frequently Asked Questions)

In case, you have lost your lien release then you can get a replacement of the Mortgage Lien Release from the company that holds the lien.

They both have the same purpose. A deed of Reconveyance is used when you transfer the property title back to the borrower. The main purpose of this document is to confirm that all payments and contingencies have been met. This document can be used when the borrower will be refinancing their mortgage.

Yes, you should have it notarize in order to make sure that the document was authenticated by a registered official who is appointed by the state.

![Free Employment Separation Agreement Template [Word, PDF]](https://exceltmp.com/wp-content/uploads/2021/08/free-printable-employment-separation-agreement-template-150x150.jpg)