When you start a business, you need a bookkeeping template to keep your finances organized and accurate. With this tool, it becomes easier to track, record, and analyze your financial transactions. It can help you reduce errors while managing financial records.

Table of Contents

What is a bookkeeping template?

A bookkeeping template is a pre-designed accounting document that makes it easy for you to organize, track, and visualize your daily transactions. It helps you to stay on top of your business’s financial health.

Moreover, the bookkeeping template streamlines your bookkeeping process and enables you to focus on high-value activities in your business. This document helps in maintaining a budget and generating financial reports by tracking income statement docs and expenses.

Some examples of bookkeeping templates:

Here are some examples of bookkeeping templates or accounting worksheet templates;

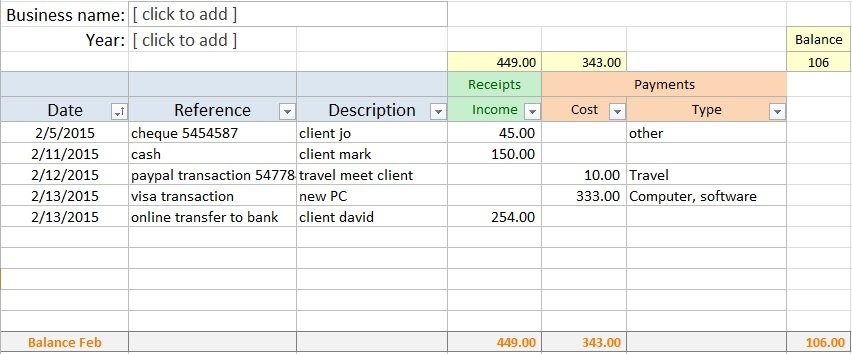

Cash flow statement template

Businesses need a cash flow statement template to manage their cash flow and make strategies for future expenses. This document becomes very important if you want to scale up your business.

Income statement template

An income statement template helps you to record a summary of your business’s entire income over a specific period. This type of bookkeeping is also known as a profit and loss statement. It provides you with a complete picture of your business’s revenue, expenses, and net income.

Managerial accounting template

Business owners use this template to track and analyze financial data that helps them to make fully-informed decisions. It provides you with a complete overview of your business’s financial performance. Furthermore, it contains sections for the following;

- Revenue

- Expenses

- Profits

- Losses

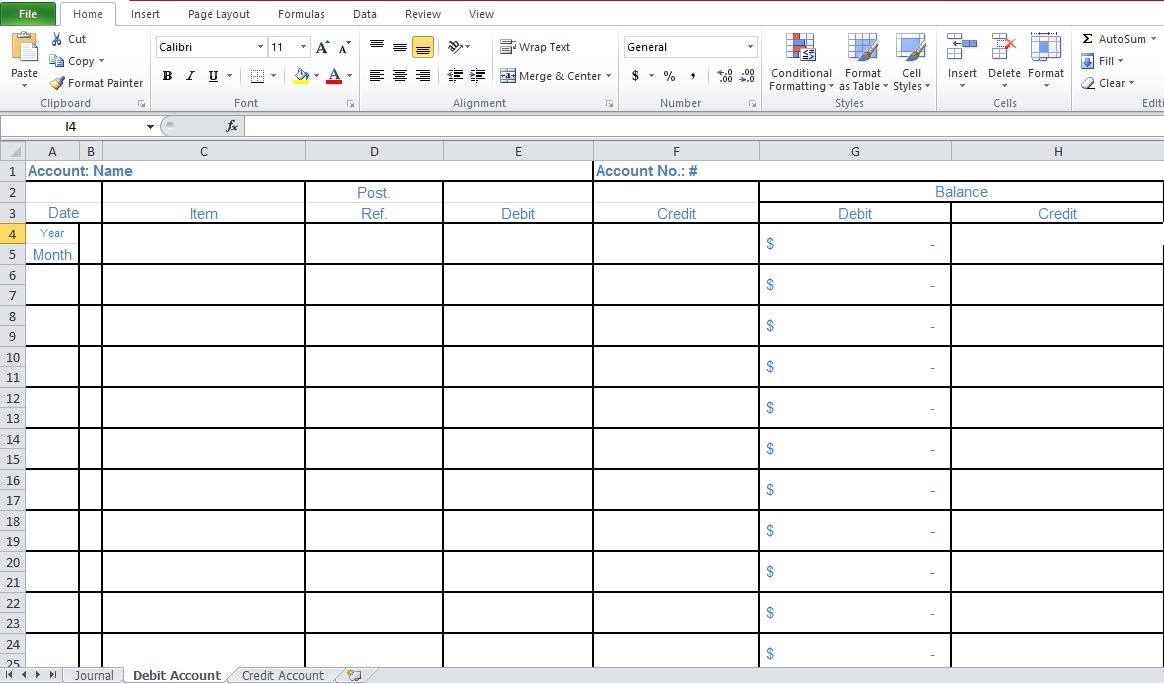

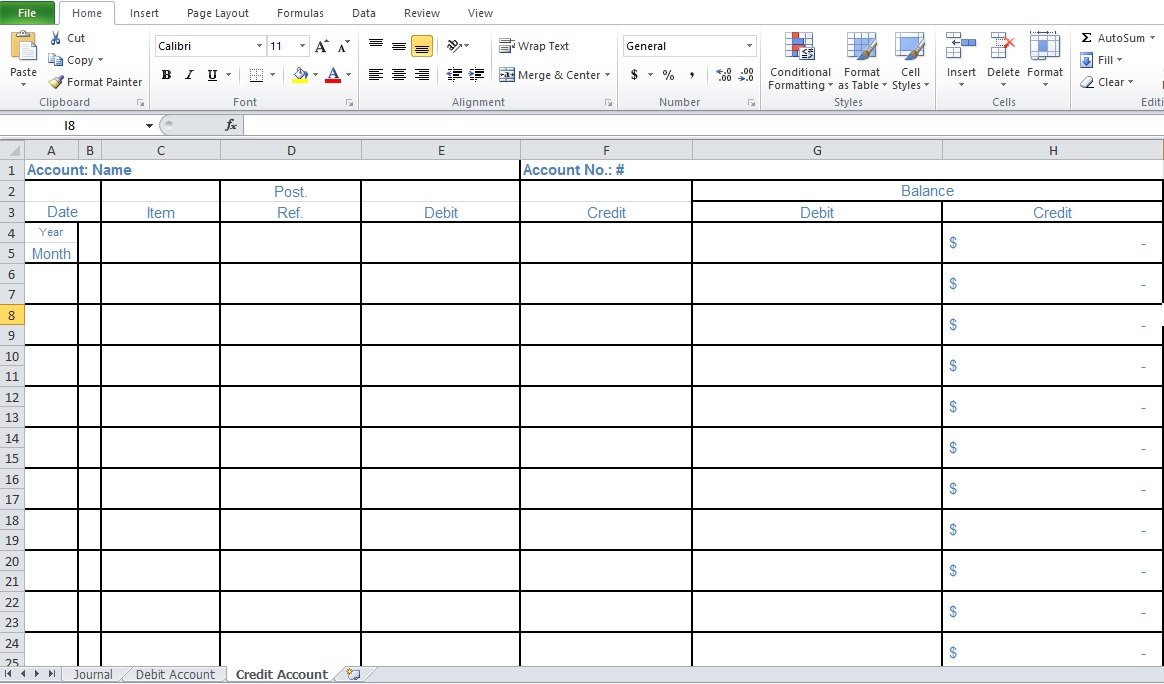

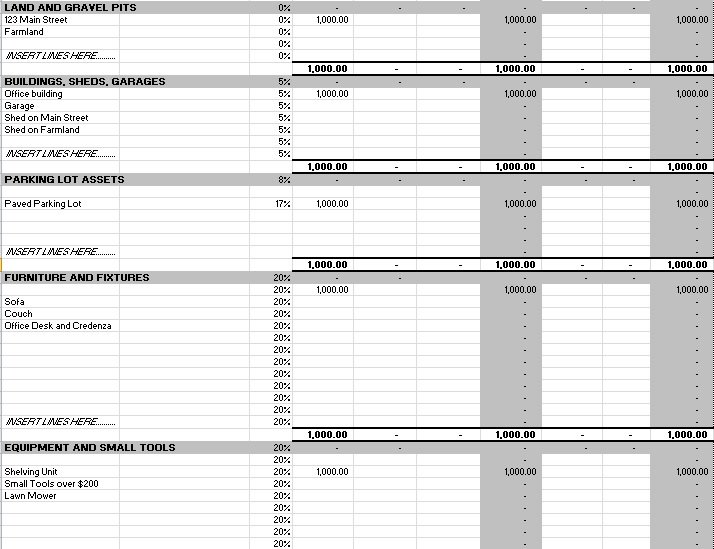

Balance sheet template

A balance sheet template is used by business owners to take a snapshot of their financial well-being. It demonstrates a business’s financial standing at a specific moment. This sheet contains a list of assets, liabilities, and equity.

Accounts payable template

The accounts payable template enables business owners to record their outstanding debts and payments to vendors. Using this template can help them manage their accounts payable and avoid late fees. Generally, it includes the following details;

- The vendor’s name

- The amount due

- The due date

- A record of payment history

How to create a bookkeeping spreadsheet?

Creating a bookkeeping spreadsheet is the best way to manage your business account. The spreadsheet can be used to modify currencies, dates, numbers, decimals, and fractions.

Here are the steps to create a bookkeeping spreadsheet;

Download an Excel bookkeeping template

Instead of creating from scratch, you should download an Excel bookkeeping template. You just need to fill in the information or customize it to fit your needs.

Select your best accounting method

There are two main accounting methods that companies can use;

- The accrual method

- The cash accounting method

The main difference between them usually appears when you record your business expenses and revenue. However, both these methods work well for your business.

Create your chart of accounts

In your bookkeeping template, the chart of accounts records all lists of your business’s financial activities. This document should list all the financial activities. You can track your income and expenditure effectively by using this template.

Create your income and expenditure spreadsheet

You didn’t have to create a new sheet while creating your income and expenditure spreadsheet. If you want to achieve a consistent bookkeeping culture then the income and expenditure spreadsheet is necessary.

Additionally, when the transactional receipts come in and the receipts are filled immediately enter the record into the spreadsheet. When the time for auditing and tax filing comes, these documents are crucial. Nowadays, companies get both electronic and paper receipts. Paper records aren’t safe as compared to electronic records. You may want to take photos of your paper receipts to improve the security of your records filing and then store them in your electronic files. However, creating a filing system that works best for your company is the best idea.

Create your optional bookkeeping reports

To create a bookkeeping report, you may develop the Excel accounting template. With this report, you can keep your company’s financial health in check.

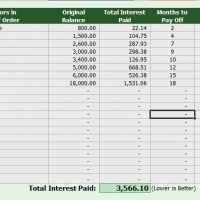

Bookkeeping Excel Template For Small Business

Simple Bookkeeping Spreadsheet Template

Free Bookkeeping Spreadsheet

Bookkeeping Template for Self Employed

What benefits does a bookkeeping template provide your company?

The bookkeeping template provides businesses with several benefits whether you create an accounts payable spreadsheet or other types of bookkeeping sheets;

- It is a pre-made document in which almost all fields are created. You just need to enter information according to the fields created. Also, it is easy to edit some fields and insert your information.

- Every time you want to update your fields or add new information, you don’t need to download a new bookkeeping spreadsheet template. You can add new data daily after downloading the template first time. Based on the formulas you have created, the template will keep updating the totals automatically. Thus, this spreadsheet saves your business a lot of cost.

- The bookkeeping spreadsheet has multiple functions such as additions, multiplications, insert formulas, etc. You don’t need to create new functions.

- To present your company’s performance from different angles, you can create different graphical presentations like pie charts, tables, etc. by using the accounting spreadsheet template.

- Different workers in your accounting department can share this spreadsheet.

FAQ’s

There are 5 stages of bookkeeping;

1- Financial transactions

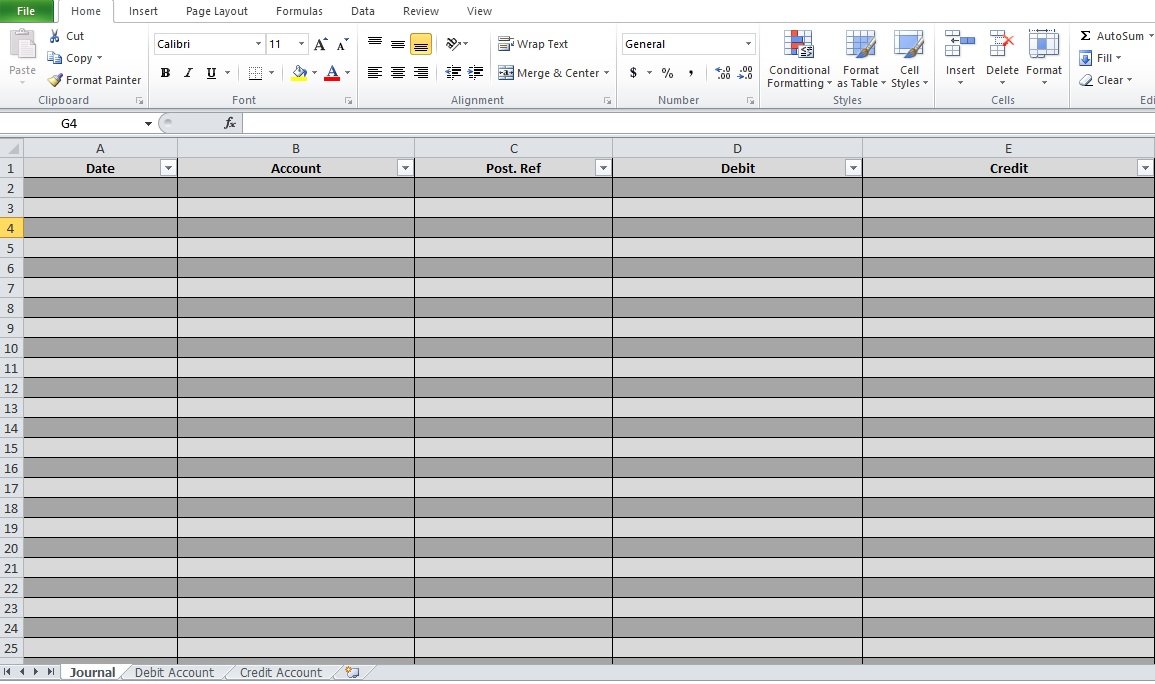

2- Journal entries

3- Posting to the ledger

4- Trial balance period

5- Report period with financial report and auditing

The three golden rules of bookkeeping are;

1- Debit all expenses and losses, credit all incomes and gains

2- Debit the receiver, credit the giver

3- Debit what comes in, credit what goes out