Lenders such as banks and credit unions use a business loan application form to gather information from potential loan applicants. Interested business owners use this form whenever they want to take out a loan. They fill out it with relevant details and submit it to the lender.

Table of Contents

The process of business loan application:

The process of loan application involves three phases. First, interested business gathers the information requested on the application form and submit it. After receiving the data, the lender performs initial background checks and decides whether or not to pursue the business loan application.

If the lender accepts your application, they ask you to provide additional information and invite you for an in-person meeting. To check for unusual risks in lending priorities, both parties do further research. The lender makes an offer that includes a loan payment and repayment terms if they believe the loan is a good investment.

What to include in a business loan application form?

A business loan application form should include the following sections;

Cover page

The cover page of a business loan application form includes your name, the name of your business, and the bank you submit the loan to. Write your name under the heading ‘submitted by’ and the bank name appears under ‘submitted to.’ In the first paragraph, state your intention to borrow money from the bank. The second paragraph provides your business background. Specify your plan for your business in the last paragraph. After the cover letter, include a table of contents.

Background of the business

Provide an extensive background of your business to the bankers. State when your business was built and how it came into existence. Furthermore, specify why it was built and the market you target.

The amount of business loan

In this section, specify the amount of money you want to borrow from the bank and where it will be used. If you are planning to renovate your store then mention the materials that you need. Also, write an estimated amount of money that you want to take as a loan from the bank.

Market information

Here, you need to mention the products that you sell to our clients. Give the bankers the following details;

- A breakdown of each product

- The prices

- The target market of your business

- The success of your business in the selected target market

- Plans of the business

- The new products and services

Financial history

Include the financial history of your business including profit and loss. The bank wants your financial history to determine whether you deserve to have the loan. In addition, write the financial projects of your company which consist of the following documents;

- Income statement

- Cash-flow statement

- Balance sheet

Collateral

Set a way of backup repayment if you can’t pay the money you loaned. The market value of each collateral should be well-determined and have a clear explanation.

Personal financial statements

The bank or lender wants to evaluate your financial statements like your tax returns and net worth. However, there are some additional documents that you need to attach to the application form;

- The picture of your business location

- A copy of the contract for the new equipment

- The contract of the lease agreement

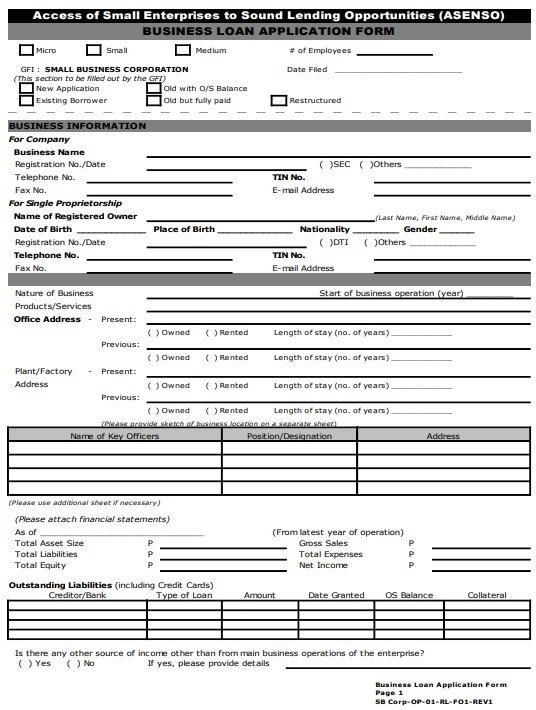

asenso business loan application form

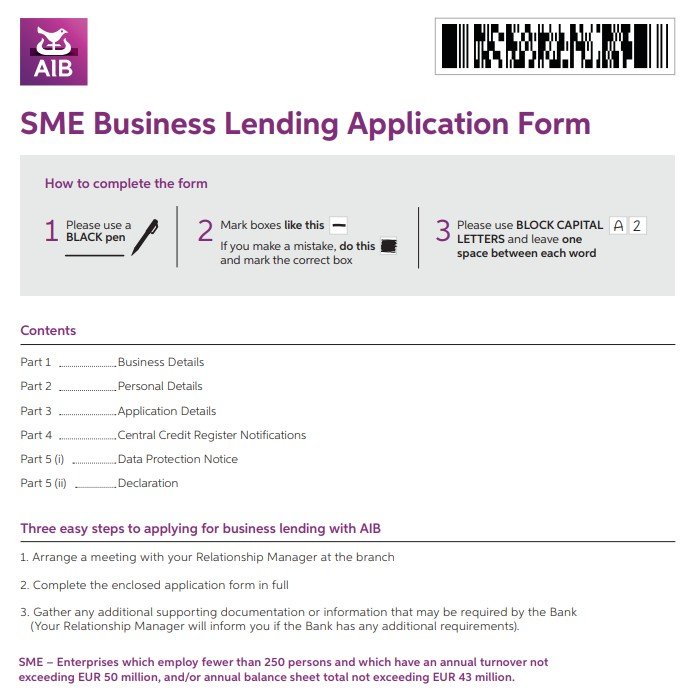

sme business lending application form

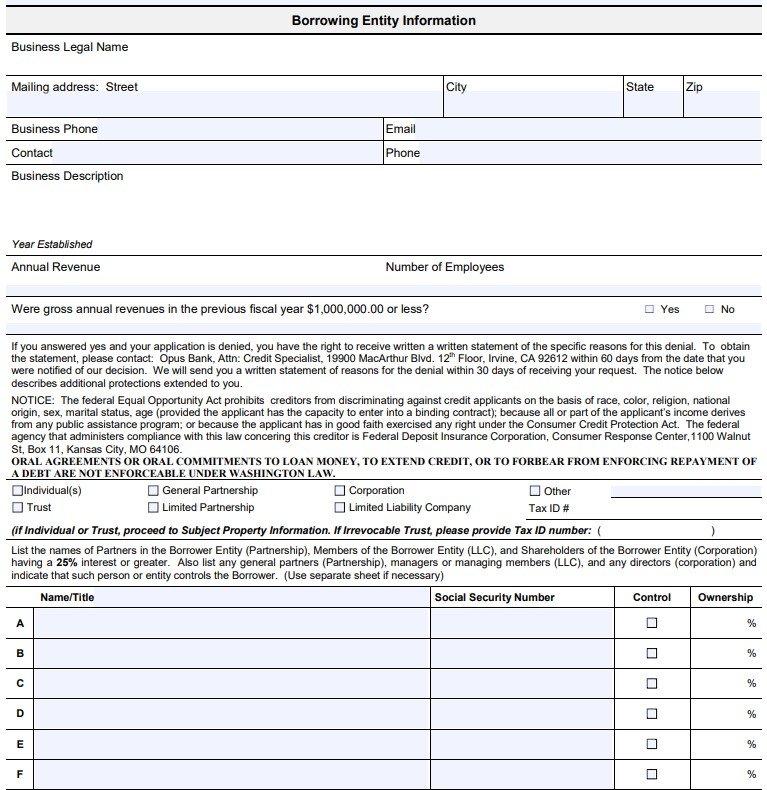

business banking loan application form

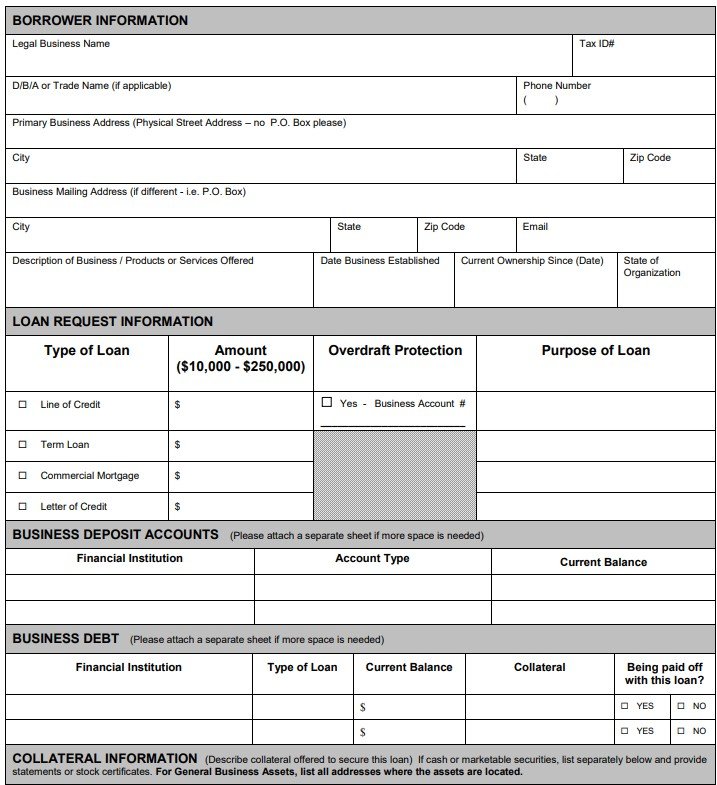

business loan application form

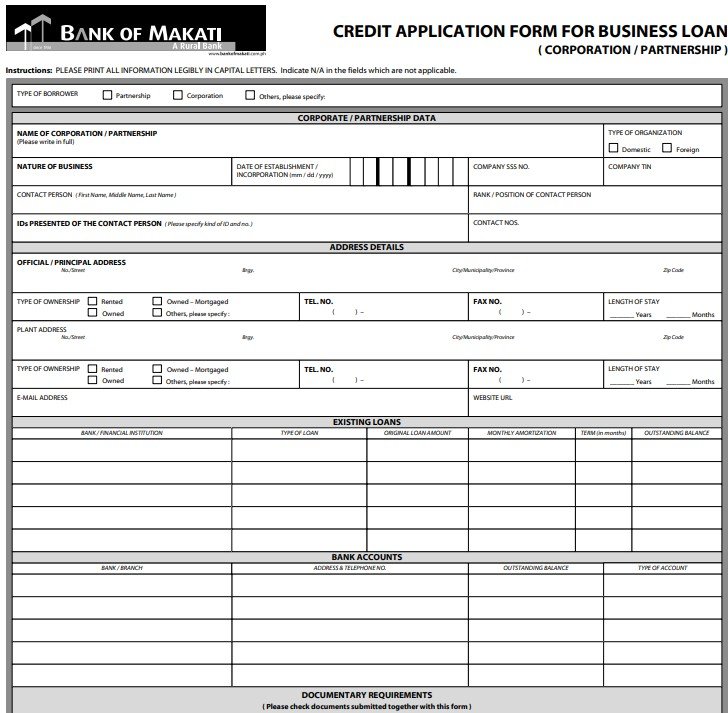

credit application form for business loan

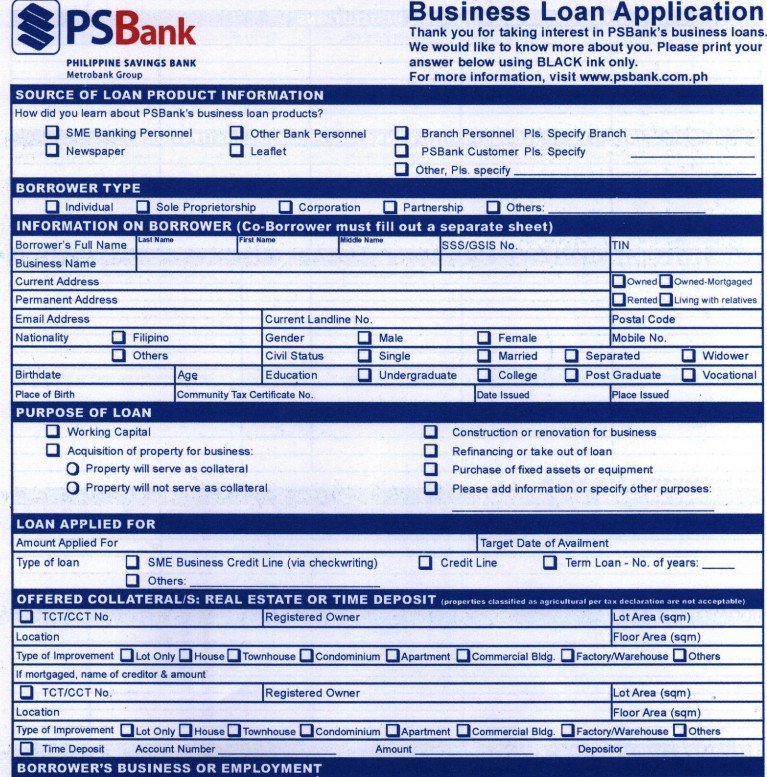

PS bank business loan application form

universal small business loan application form

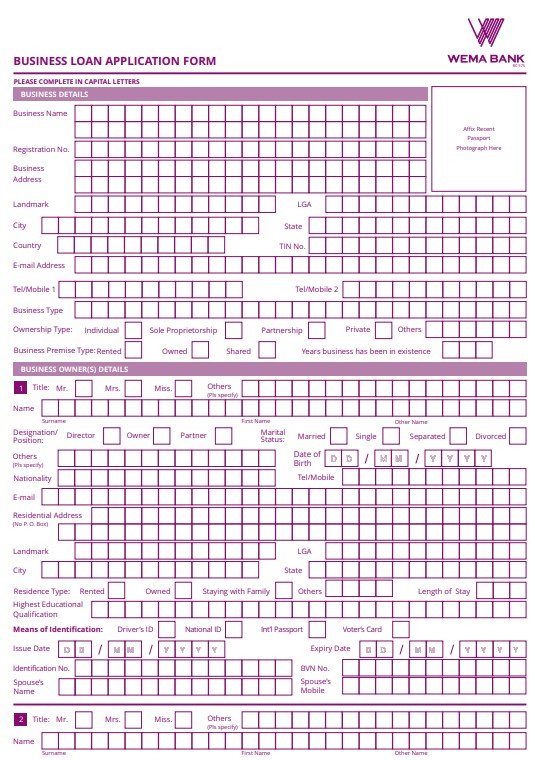

wema bank business loan application form pdf

FAQ’s:

What documents should I need for a business loan?

You need the following documents to get a business loan;

- Credit report

- Income statement

- Tax returns

- Bank account statements

- Business plan

- Business licenses

- Proof of address

How to write a business loan application?

It should include the following information;

- Your name, contact number, and address

- Business plan

- Reason why you need the loan