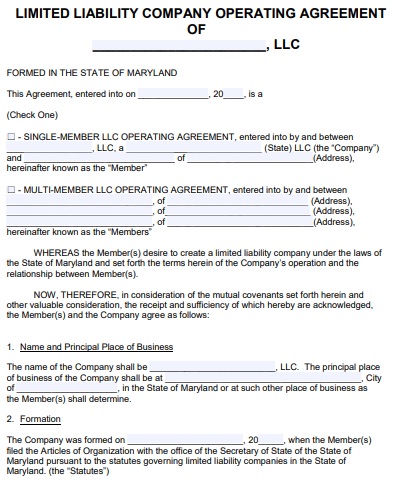

A Maryland LLC operating agreement template is a legal agreement that for sole proprietors and multi-member companies outlines company operations and business structure. However, this agreement is not required in Maryland. But, it is beneficial for companies to have it.

Without the operating agreement, in case of bankruptcy or legal issues against the company, company members in Maryland State are likely to lose their assets. Company members by having this document will have their private assets secured and get tax benefits.

Table of Contents

The benefits of operating agreement:

Let us discuss below the benefits of having a Maryland LLC operating agreement;

Legitimize LLC

You must have an LLC operating agreement for parties like banks, investors, or lenders in case you wish to have any transactions with them. For instance, lenders will not provide loans to companies that don’t have this agreement. Also, if you wish to open a company bank account, you will require to present this agreement to the bank.

Before investing in the company, investors will want to see the LLC operating agreement. The parties can break down by having this document what they are about to deal with.

Verbal agreements

Company members need this document as it assists them in having all the decisions they made and agreed upon in writing. You can include all the verbal agreements made to prevent misunderstandings with an LLC operating agreement. Moreover, you can also make a reference in case of future disputes.

Avoid state interference

Companies in Maryland State do not experience interference from the state laws by having the LLC operating agreement. Without interference from the state laws that govern companies, they can operate their businesses and solve any legal issues.

Flexibility in LLC

When it comes to business operations, LLCs are flexible. However, these companies have more flexibility in running their business with this LLC operating agreement. The reason behind is that company members have opportunity to write down how they have to run their daily operations.

Asset security

Since the agreement helps separate personal assets from business assets so the company members can have their assets secure in case the business faces bankruptcy or any other legal issues. Additionally, the company is referred an entity of its own. This indicates that company owners are secure from business liability and losses.

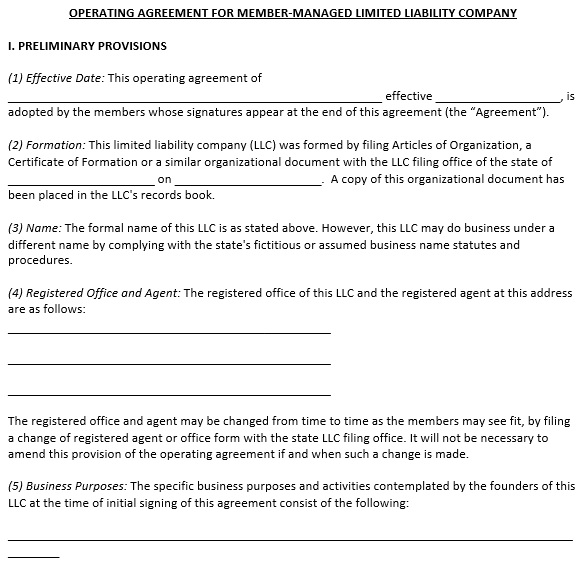

What to include in a Maryland LLC operating agreement?

You should include the following components in your operating agreement;

LLC name

In the agreement, specify the LLC name as it appears in the Articles of Organization. The LLC name should be legally recognized by the State of Maryland.

Ownership

The operating agreement should specify the ownership of the company. This might be depend on an equal division of the company or percentages of the contribution created by every member.

Duties of members

To avoid future disputes, every member and manager must be aware of their duties. These duties must be indicated in the agreement.

Voting rights and responsibilities

In the LLC operating agreement, the voting rights of the company members must also be highlighted. In case of dissolution or to make decisions, voting may be done.

Distributions

Distributions refers to the splitting of profits and losses among company members. The agreement clearly specify that whether the distributions will occur on an equal or a percentage of ownership basis.

Holding meetings

For most companies, regular shareholder meetings are common. Thus, the operating agreement should clearly mention scheduled meetings for specific reasons.

Some other elements to include in an LLC operating agreement are as follow;

- Buyout and buy-sell rules

- Succession planning

- Dissolution

- Possible modifications

- Severability provision

Maryland LLC Operating Agreement

Maryland LLC Operating Agreement Template

Free Maryland LLC Operating Agreement Template

Conclusion:

In conclusion, a Maryland LLC operating agreement template is an official document that contains all the information about the company’s operations, ownership, daily business affairs, and processes. To make the document legally binding, all the members should have sign the document.