Most of us have taken or given a loan to someone at least once in our life. And although in a lot of these cases, the other person was mostly someone close. When it comes to monetary dealings, one cannot be too careful, even if it is with someone you are very close to. The loan agreement templates we offer you here are designed very specifically in a way that they encompass every point one would require in a loan agreement document.

Like we mentioned before, keeping a loan agreement, even if you are close to the person you are dealing with, is important. As it is a written document, the record could never be misplaced, and could never be fabricated against anyone of you. You may also like a standard operating procedure template.

Before we get into the process of writing a loan agreement, I would like to explain to you what a loan agreement actually is and why it is so important.

Table of Contents

What is a Loan Agreement?

A loan agreement is a written, recorded agreement between a lender and a borrower. The borrower is given a specific amount of time to pay back the money he has been given, the repayment could be in one go or in different installments. As a lender, this document is extremely useful because it legally enforces the borrower to repay the loan, and if done otherwise, it allows the lender to hold the borrower responsible.

For the borrower, this is a way to hold the lender accountable as well if they decide to act unjustly. This loan agreement template is often used for business, personal, land, and student loans.

Situations in which a Loan Agreement would be required

You would definitely require a loan agreement in official situations like getting a loan from a bank, or a mortgage, or maybe even financial aid. A loan agreement would be made in these circumstances without even having to ask for one.

The situation of lending and borrowing money from a family member, a close one, or a friend, is in a slightly grey area. Would you have them sign a loan agreement with you? Why would you do that when you trust them? The thing is, a loan agreement does not have a lot to do with trust, it is inevitably a monetary exchange and can result in consequences if not dealt with carefully and legally.

So, yes it is good to adopt the habit of preparing a loan agreement even if the exchange is with someone you are close with. You should also check the hold harmless agreement template.

Business Loan Agreement Template

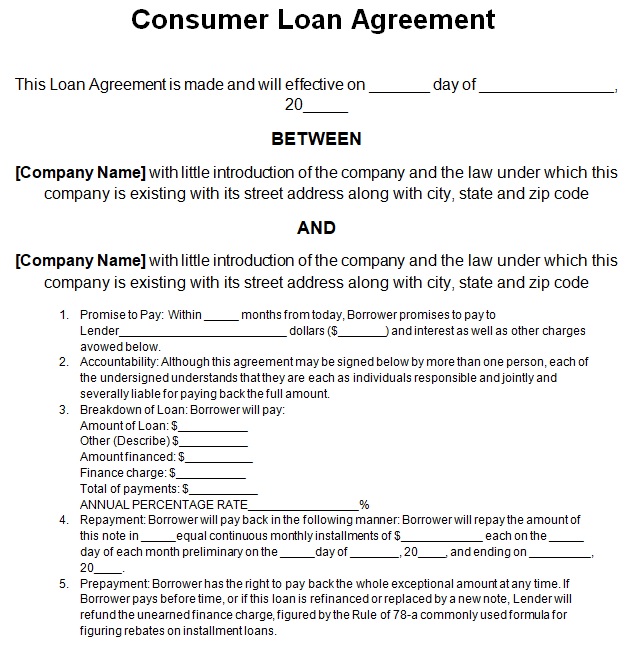

Consumer Loan Agreement Template

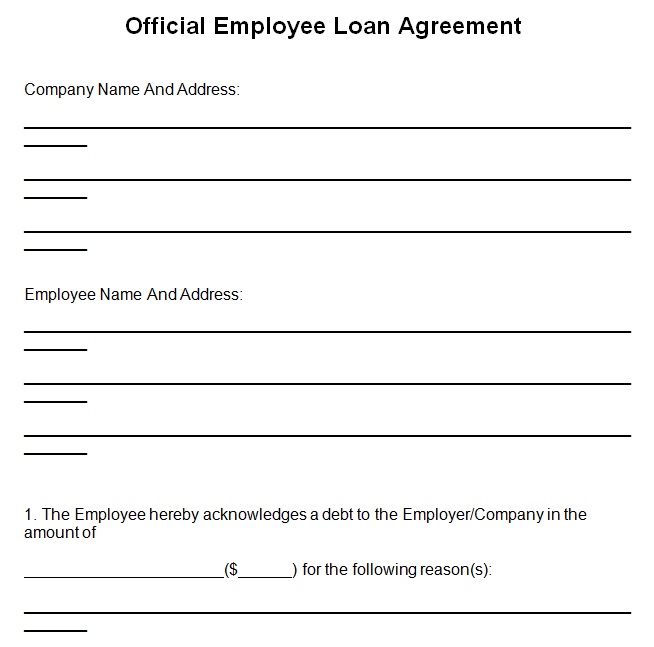

Employee Loan Agreement Form

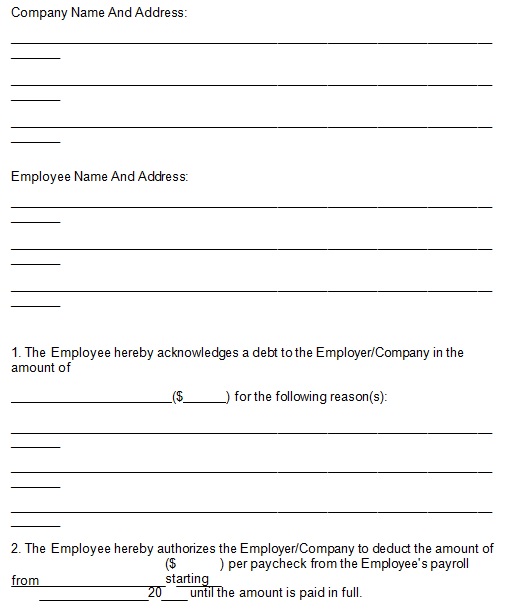

Employee Loan Agreement Template

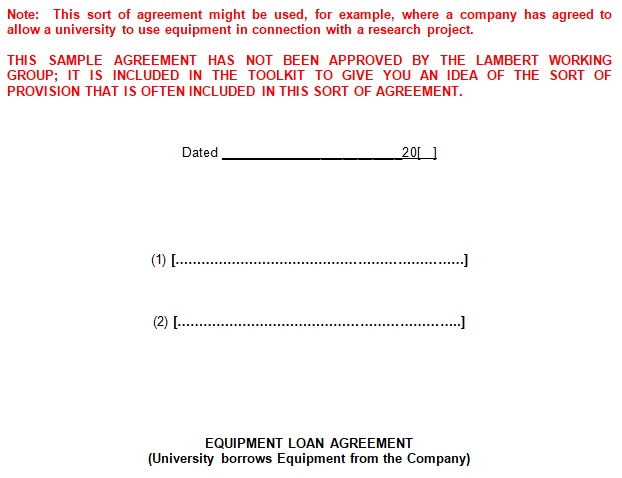

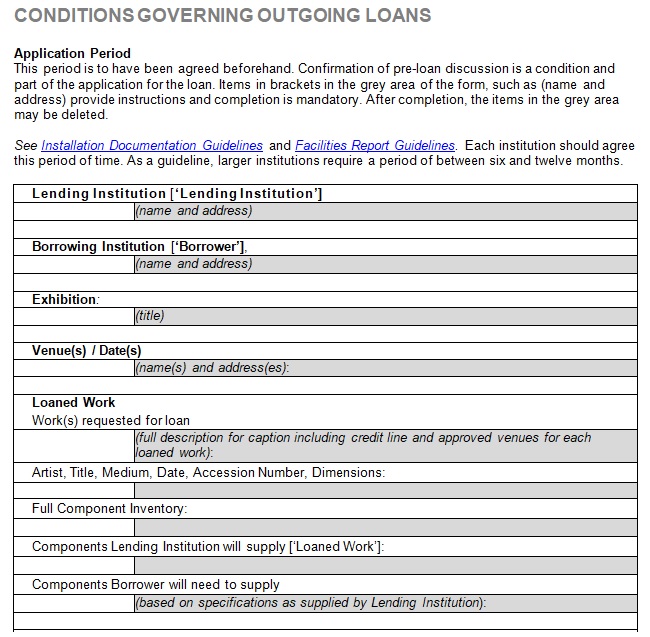

Equipment Loan Agreement Template

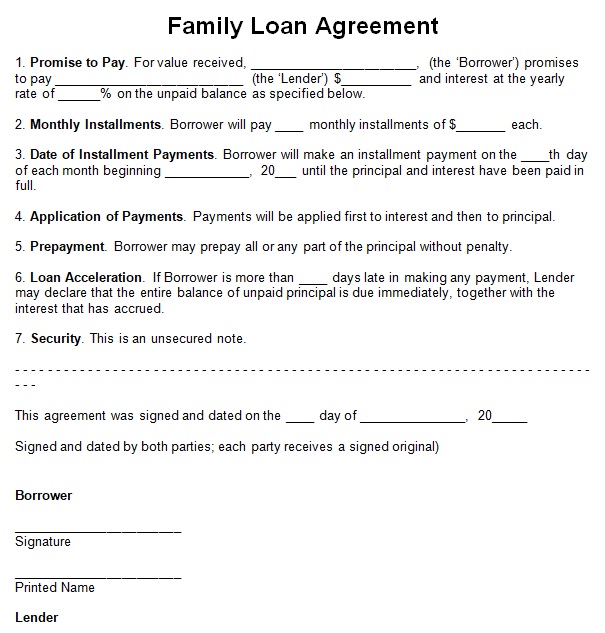

Family Loan Agreement Template

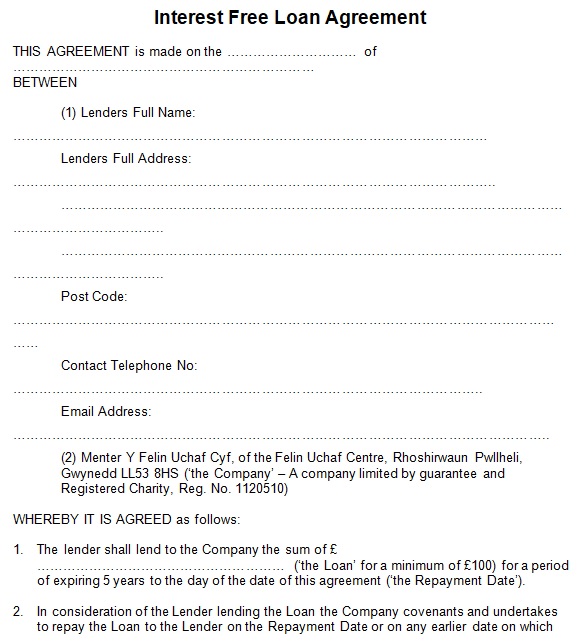

Interest Free Loan Agreement

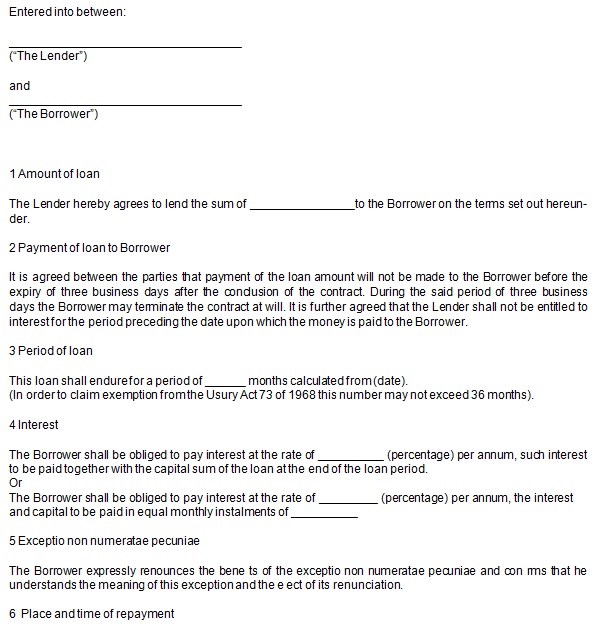

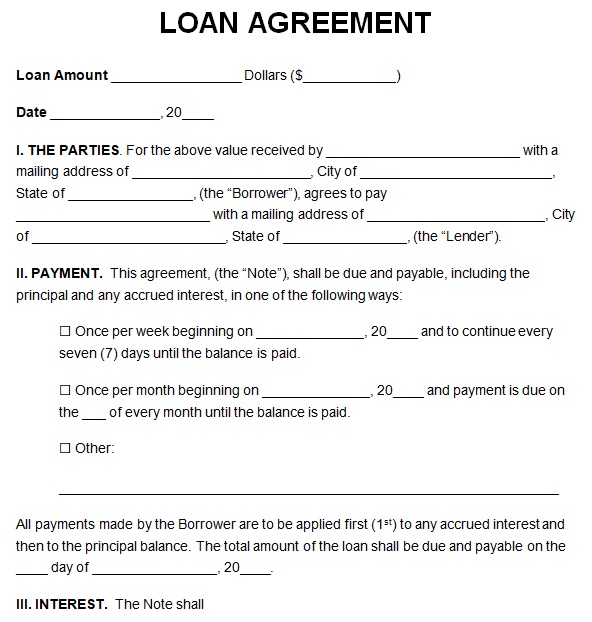

Loan Agreement Between Individuals

Loan Document Template

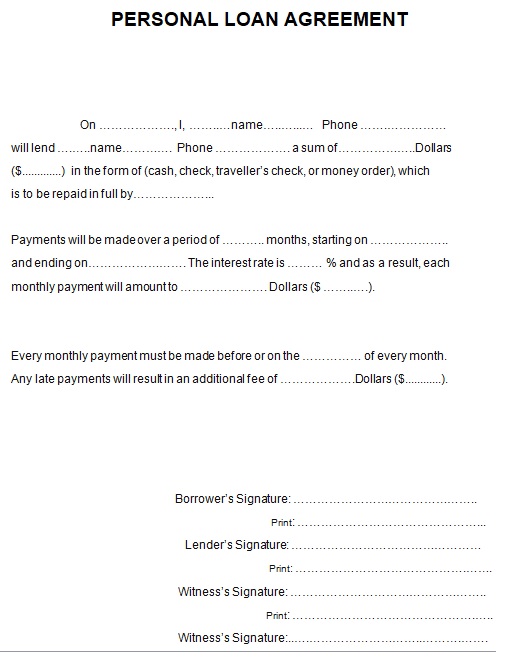

Personal Loan Agreement

Personal Property Loan Agreement

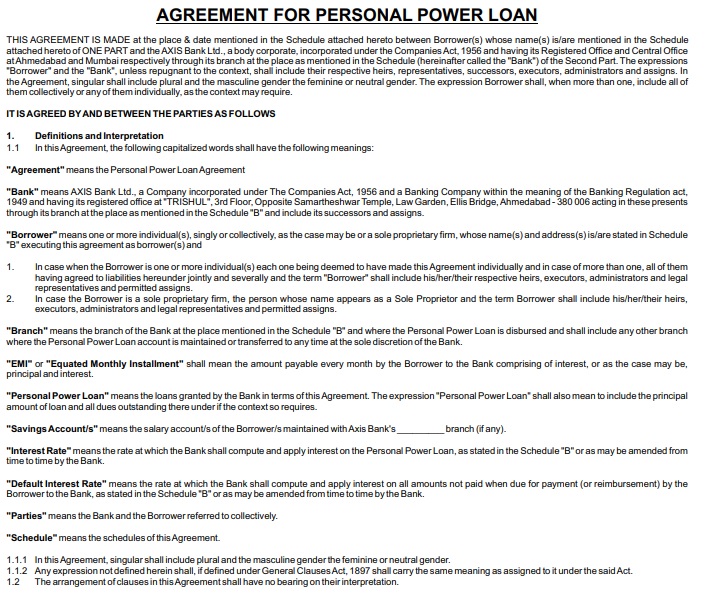

Power Loan Agreement Sample

Printable Loan Agreement Form

Reimbursable Loan Agreement

Reverse Mortgage Loan Agreement

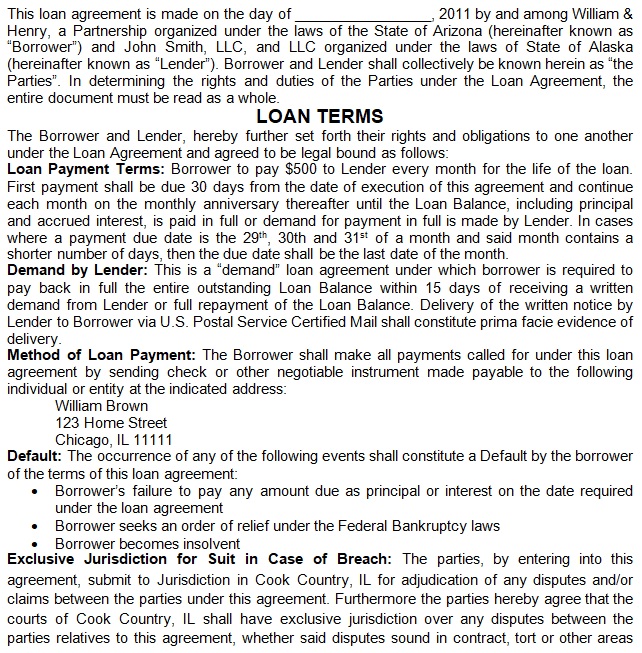

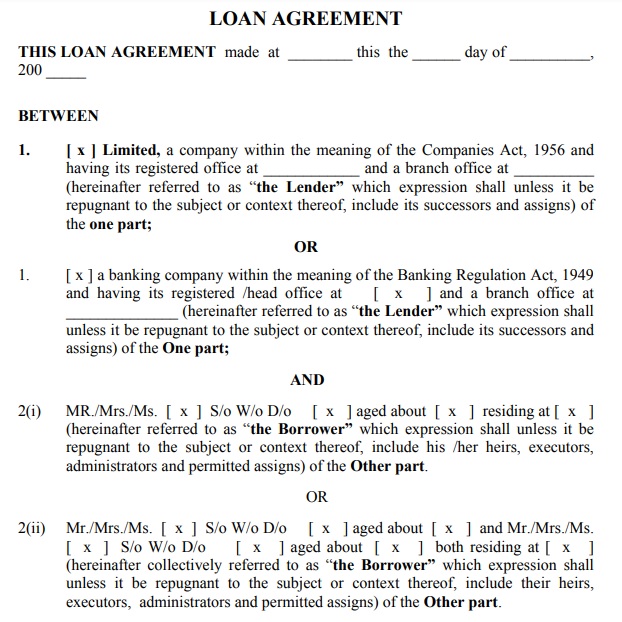

Sample Loan Agreement Between Two Parties

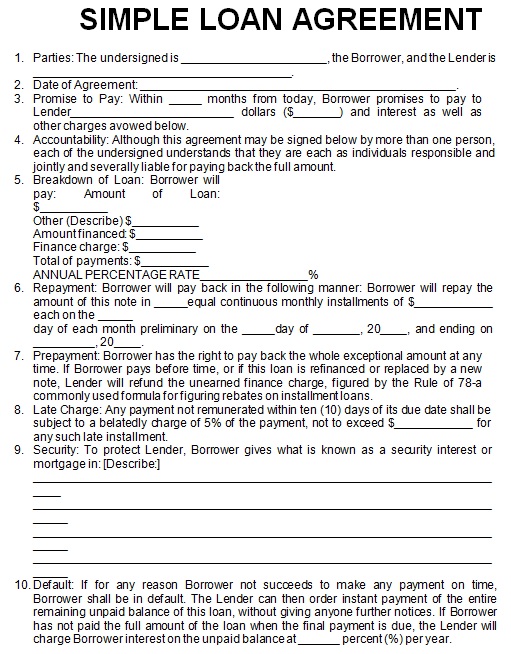

Simple Loan Agreement Sample

Elements in a Loan Agreement Template

To have a legally appropriate loan agreement document, you have to have the following points in your loan agreement:

- Time and Date of the exchange

- Names of the lender and the borrower

- Amount of money borrowed

- Repayment time (and number of installments if required)

- Penalty (if both parties agree)

- You may also see the car lease agreement template.

Depending on the quantity of cash that’s borrowed the lender may plan to have the agreement authorized within the presence of a notary. If the amount of cash borrowed exceeds a certain limit (different for different countries) for the small courts.