A tax invoice template is used in financial transactions to show the taxes on products sold and services rendered. This document plays an important role in places where tax is charged on the value added at each production stage.

Table of Contents

What is a tax invoice?

A tax invoice is an itemized list of charges and the indirect tax payment for products sold and/or services rendered. This invoice details the product or service description, transport mode, price charged, applicable taxes, and more. Depending on the country or region, the tax invoice may also be known by different names;

- Sales invoice

- VAT invoice

- Commercial invoice

- Bill

- Receipt

What is a tax invoice used for?

A tax invoice is used for the following purposes;

Taxation

The tax owed or payable by the buyer and seller is calculated and reported using the tax invoice. They are vital in countries with VAT/GST systems, where tax is charged on the value added at each production stage.

Accounting

The tax invoice is used to record the following details;

- The amount charged for the products sold or services offered

- The applicable taxes

- Any discounts or adjustments

Legal compliance

The law of many countries requires the tax invoice to support the buyer’s claiming of input tax credit. Moreover, the buyer may face penalties or fines if they fail to comply with invoicing requirements.

Auditing purposes

To determine potential fraud or errors, tax authorities can verify compliance with tax laws. This minimizes tax evasion risk and promotes fairness in the tax system.

Business operations

Tax invoice is used by businesses to record sales, monitor inventory, and manage cash flow. The invoice also keeps a record of goods sold or services rendered, and the payment received.

What information does a tax invoice include?

A tax invoice includes the following details;

- Invoice number

- Invoice Date

- Customer name

- Shipping and billing address

- The term “Tax Invoice” must be mentioned clearly

- A description of the offered products or services

- Total Tax on the subtotal

- Discount (if any)

- Subtotal with Discount

- The Total value including Tax

- Signature of the buyer and the seller

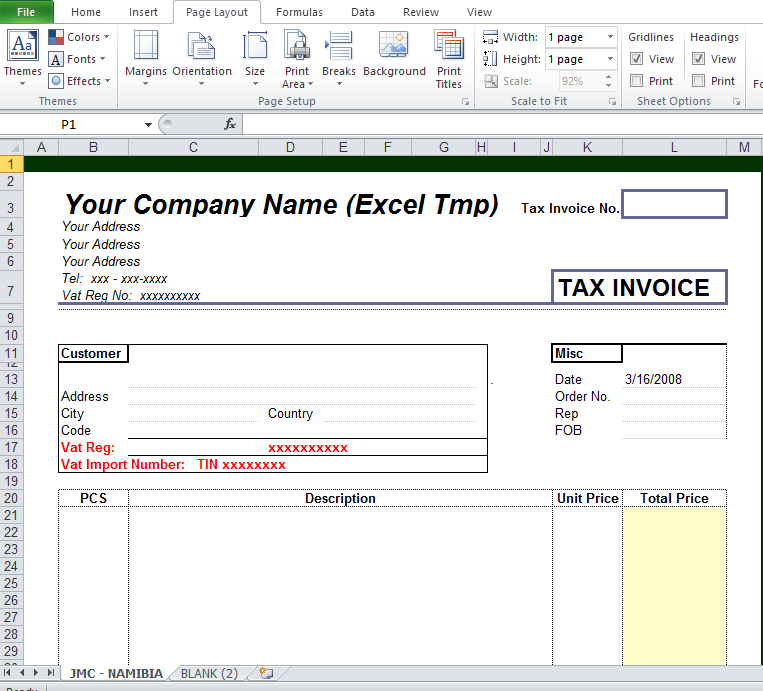

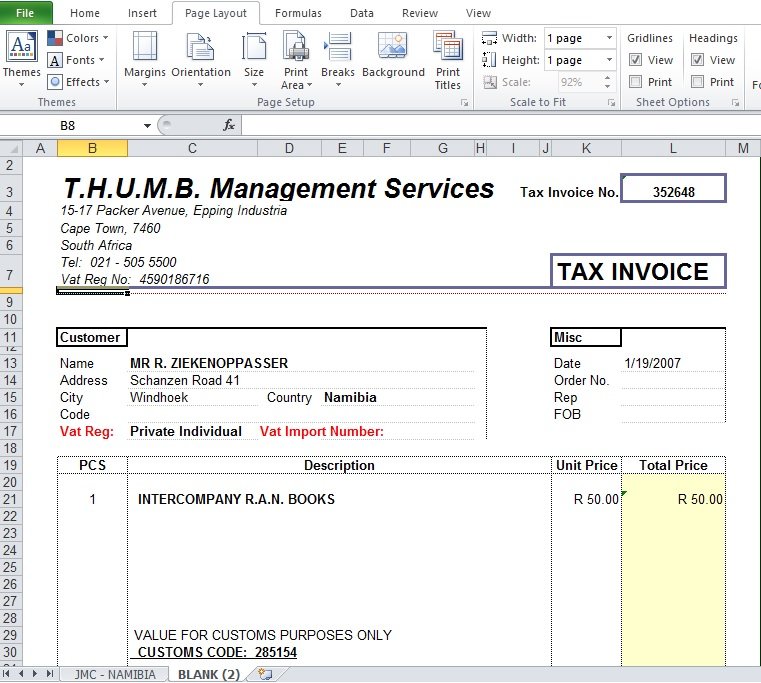

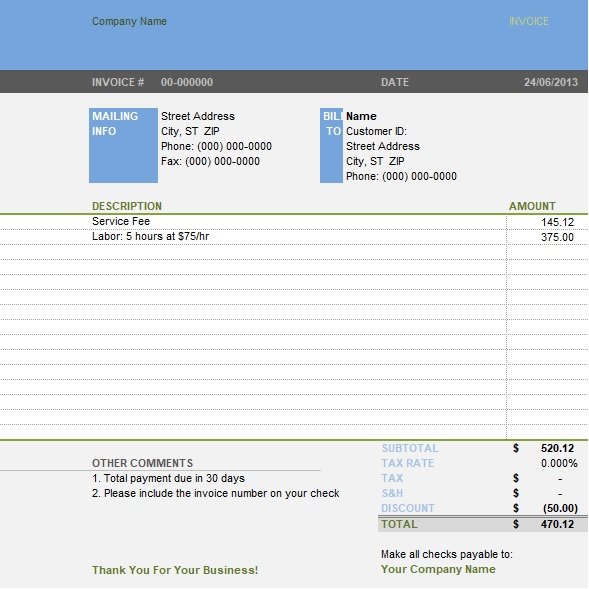

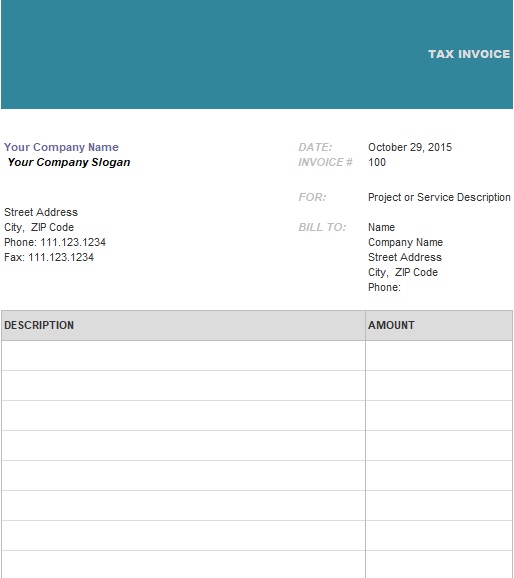

What is the format of a tax invoice?

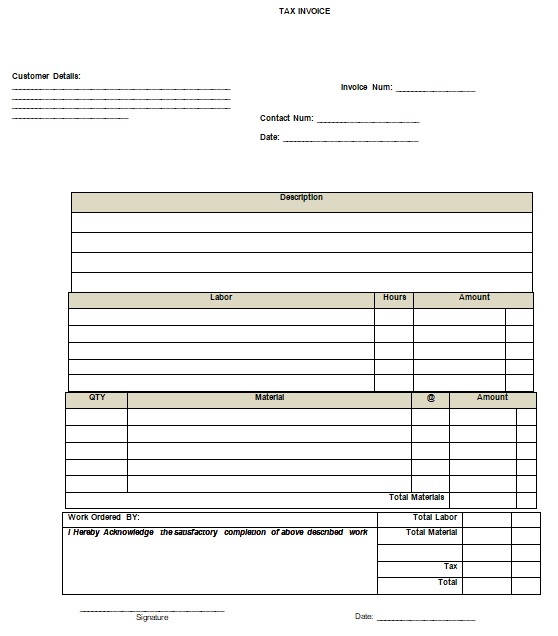

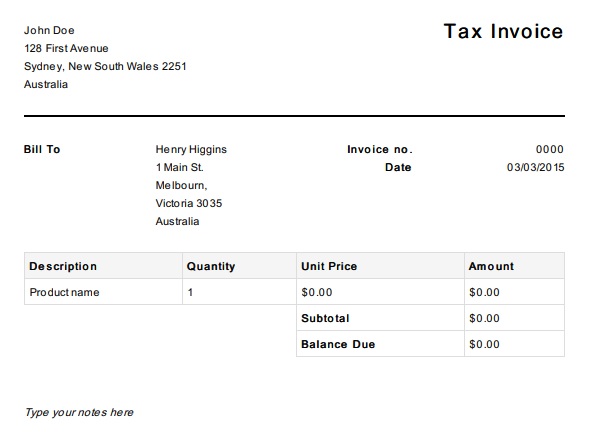

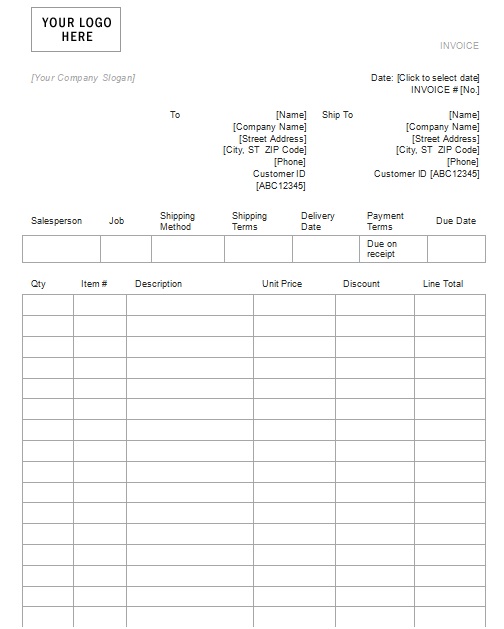

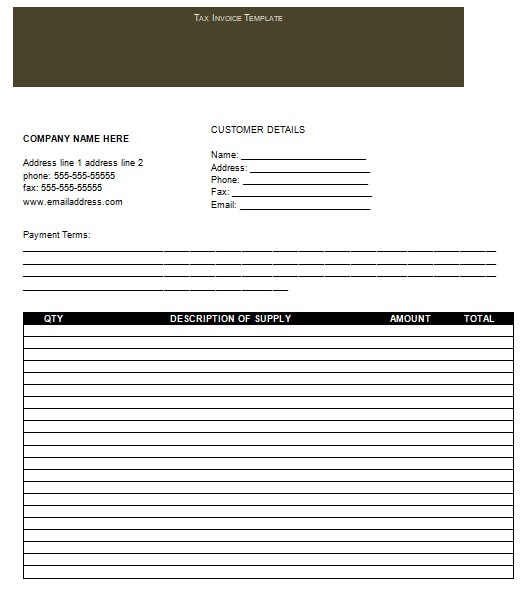

Let us discuss the basic features of a tax invoice format;

Company details

In the left corner of the tax invoice, write the company details including the name, address, phone, email, and website. Also, you can add your company logo. Furthermore, the title of the invoice must contain the term ‘Tax Invoice.’ The invoice details are included on the right-hand side of the tax invoice. Other details to include are;

- Invoice number

- Customer ID

- The Invoice date

- The due date for settlement

Biller details

The biller refers to a person to whom the Invoice is given. The invoice should include the following information about the biller;

- Name

- Contact number

- Address

Description of the goods sold or services rendered

Include the description of each item sold such as quantity, unit price, and total amount.

Billing details

This section includes the billing details including tax, discounts, and/or shipping fees.

Signature

Before affixing the signatures of the supplier or buyer, you can also include a section of additional remarks where you can include some rules of your company applicable to the invoice.

Blank Tax Invoice Template Excel

ATO Tax Invoice Template

Blank Invoice Template Excel

Commercial Tax Invoice Template Excel

Editable Tax Invoice Template

Free Tax Invoice Template Australia

Printable Tax Invoice Form

Tax Invoice for Printing Shop

Tax Invoice Template Word

FAQ’s

What is the purpose of a tax invoice?

The main purpose of a tax invoice is to record a transaction between a supplier and a buyer. The invoice shows the selling details the applicable taxes and the amount due.

Is there any difference between an invoice and a tax invoice?

The main difference is that a tax invoice is issued by businesses registered for VAT/GST, while a regular invoice is used by businesses that aren’t registered for goods and services tax (GST). Hence, we can say that every tax invoice is an invoice but every invoice isn’t a tax invoice.

![Free Printable Certificate of Recognition Template [Word]](https://exceltmp.com/wp-content/uploads/2021/04/certificate-of-recognition-template-word-150x150.jpg)