A Texas LLC operating agreement template is an official document that highlights the ownership structure of a company. This agreement establishes its procedures and policies. Texas doesn’t need a company to create an operating agreement to form an LLC. However, this document’s execution is highly recommended.

Table of Contents

The importance of operating agreement:

Let us discuss below the importance of operating agreement;

Harness the flexibility

On the structuring of ownership and management of LLCs, Texas has very few restrictions. With little paperwork or expenses arising from many of the state’s, the restrictions make it easy to form and maintain a Limited Liability Company. The hassle associated with the compliance of adhering to a corporate business structure, flexibility relieves owners from them.

Bring credibility

The LLC operating agreement in Texas assists in establishing the legitimacy of the company to third parties. This agreement proves that the company is following state and federal laws. Banks, potential investors, tax professionals, attorneys, lending companies, and courts are considered third parties that can request to see a company’s Texas LCC operating agreement in order to make sure the credibility of the company’s operations.

Formalize spoken agreements

The operating agreement allows the company members and owners to formalize the verbal agreements. Written LLC operation agreements make sure that when disputes arise, company owners can refer back to the contents of the documents.

Furthermore, the Texas LLC operating agreement can also use by the Company owners and members to prove the original agreement made on ownership structure, procedures, and policies.

Keep the state out of the business

This document keeps the state out of a company’s business. In the LLC operating agreement, the company’s management structure, operational procedures, and the division of profits are all internally formulated and mentioned by the business owner.

Protection from personal liability

The Texas LLC operating agreement is used by the LLC’s members to protect themselves from any personal liability arising from lawsuits or bankruptcy of the business. This means that when demanding debt payment by the business, creditors cannot peruse the owner’s assets.

How to form operating agreement?

Here are the steps to form an operating agreement;

Registered agent

You have to first select the registered agent. They are the individuals appointed by an LLC. They accept tax and legal documents on a company’s behalf. An individual, residents, or organizations who is authorized by Texas to engage in business transactions can be a registered agent.

LLC type

Secondly, when filing with the Secretary of State, a business must apply for the right LLC type. It can either be domestic or foreign. The company use a domestic LLC within the state of Texas. On the other hand, in case of a foreign LLC, a company initially formed outside the jurisdiction of the state.

File for registration

Thirdly, the business has to file for registration of the LLC. The form filed is based on the type of LLC a company applied. You can file the form online or sent via mail.

Fee

Next, the required fee should be paid. In case of a domestic LLC, companies will pay $300, while a foreign LLC will pay a fee of $750.

Operating agreement

Then, it is important to implement an operating agreement. However, this agreement is optional but it is suggested to enable a company owner to allow a suitable management structure and operating procedures.

EIN

Finally, the Internal Revenue Service issue an employer identification number. This number is a nine-digit code. It determines business entities operating within the United States. For tax operating, IRS uses it to determine businesses.

Texas LLC Operating Agreement Template

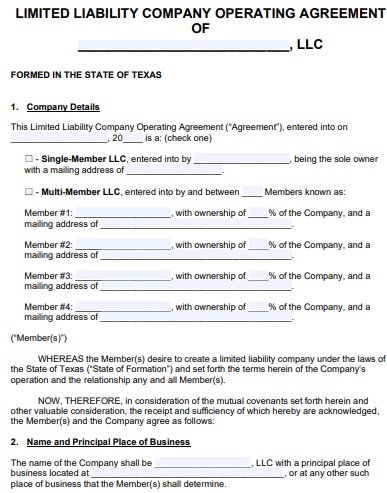

Free Texas LLC Operating Agreement Form

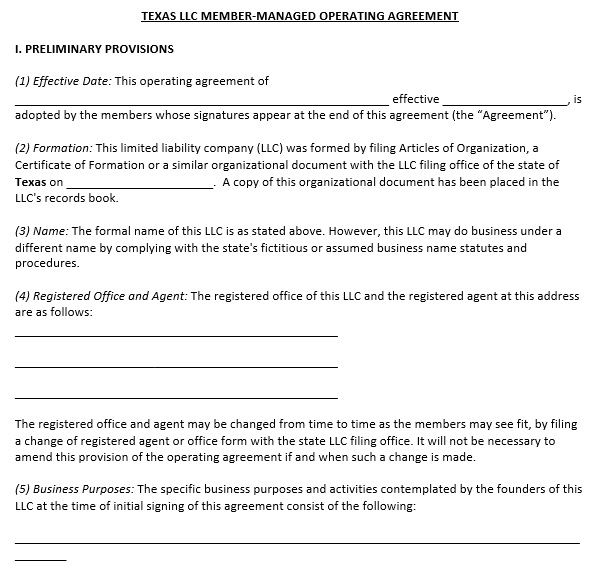

Texas LLC Member-Managed Operating Agreement

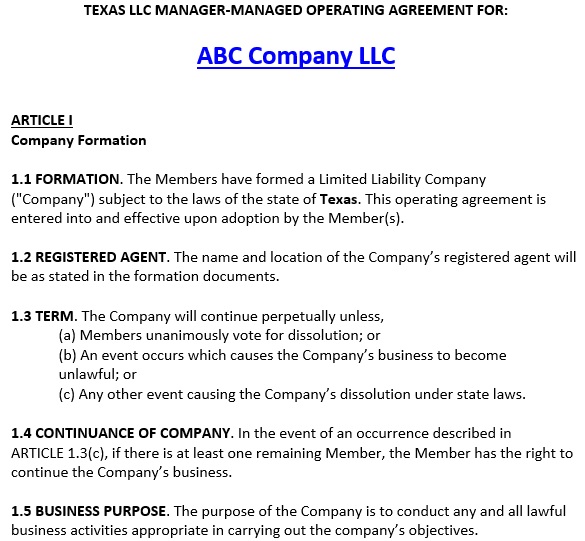

Texas LLC Manager Managed Operating Agreement

Conclusion:

In conclusion, a Texas LLC operating agreement template is a legal document that plays an important role in securing the company owner and members’ assets and financial accounts. It is an internal document that response to legal issues that may arise.