When selling a home, the sellers use a property disclosure statement form to tell their buyers about any issues with the home.

Table of Contents

What is a property disclosure statement?

The seller uses the Property Disclosure Statement as a set of documents. They use it to disclose any defects, current and past issues, and past repairs of the home. They have to be honest and up-front about these facts as it is a requirement by law. When the property disclosure statement has been signed, it is attached to the purchase agreement.

Moreover, the property disclosure statement has various purposes. Some of them are as follow;

- Tell the buyer of issues with the home.

- Legally securing both parties from a potential future lawsuit

- It enables a buyer to file a lawsuit in case the seller not disclose an issue with the home. You may also like a Letter of Authorization from property Owner.

The issues that must be disclosed:

By law, the following details must be addressed in the document;

- Whether the home is located in an area of special zoning

- Near a military base

- In a flood plain area

- Was the home used for illegal activities

- Without getting a permit, if construction has been done

- The repairing of any electrical wiring that were not done to code

- Mold issues

- Termite issues

- Leaky doors, windows, and pipes

- If lead-based paints were used

- Fire hazards

- Issues with neighbors

- Liens on the home

- Hazards

- HVAC, appliance, and electrical malfunctions

- Disputes about zoning or property lines

- Construction and noise problems

- The deaths that have occurred on the property

- Issues with unusual odors

- Issues regarding wild animals or pets

- Any damage that was done by weather

- Whether the property was damaged itself

How do you make a property disclosure?

Every state has its own rules or laws regarding property disclosure. Most of these forms will provide you a checklist and extra room to provide more details regarding any issues. When the seller has accepted an offer, this is provided to a buyer. However, depending on what is disclosed, the buyer can back out and not lose any deposit.

There are main areas and details that require to be supplied on the basis of how detailed the form is. In the first paragraph of the property disclosure statement, you have to include the following details;

- Full name of the seller

- The complete address of the property being sold

- Property information like the type of property it is and the year it was build

- The duration that indicate how long you have owned the property

- Whether the home has been surveyed

Property inspection:

In your next step, inspect your home both inside and outside, for any issues. Tick off any issues to be disclosed as you go long. You can sign the form when you are done and it will go to the buyer when an offer has been made. When the buyer is ok with the issues, then they will sign off the disclosure form. It is better to disclose issues instead of hoping they will be missed upon an inspection as buyers will have the home inspected. You should also check the Permission Letter to Use Property.

In addition, the property disclosure should include the details regarding the following;

- Utilities

- Physical structure

- Environmental conditions

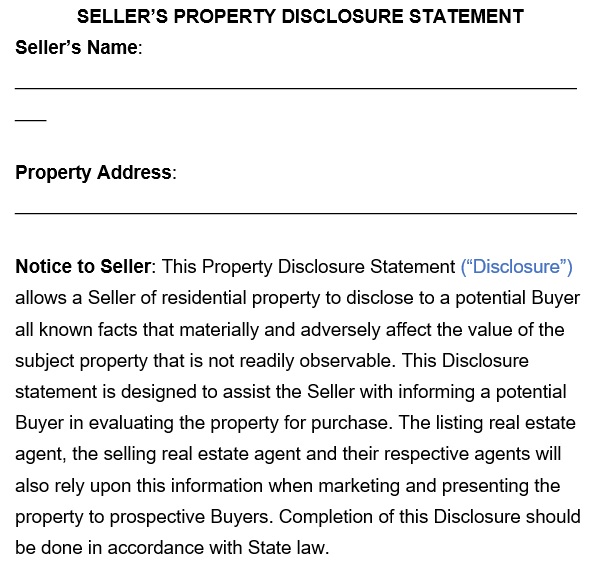

Sellers Property Disclosure Statement Form

Free Property Disclosure Statement Form

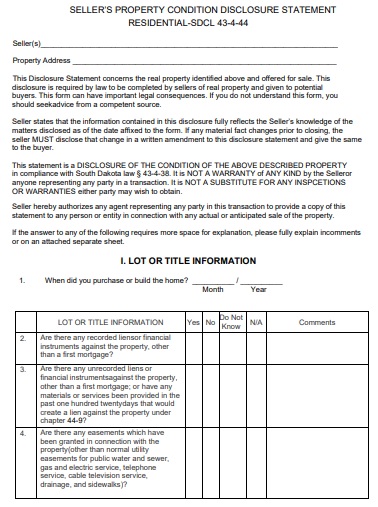

Residential Property Condition Disclosure Statement Form

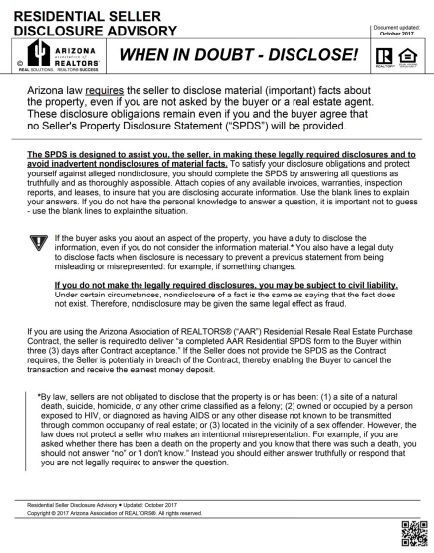

Residential Sellers Property Disclosure Statement Form

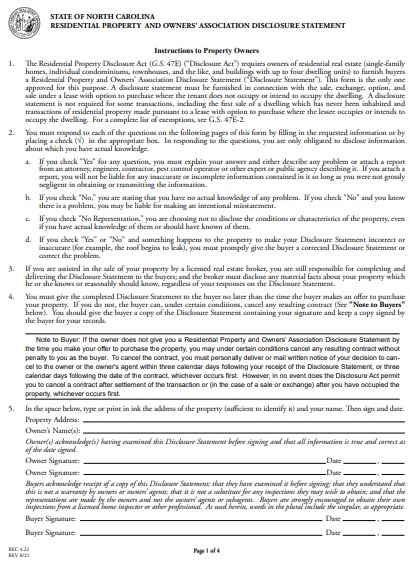

Residential Property and Owners Association Disclosure Statement

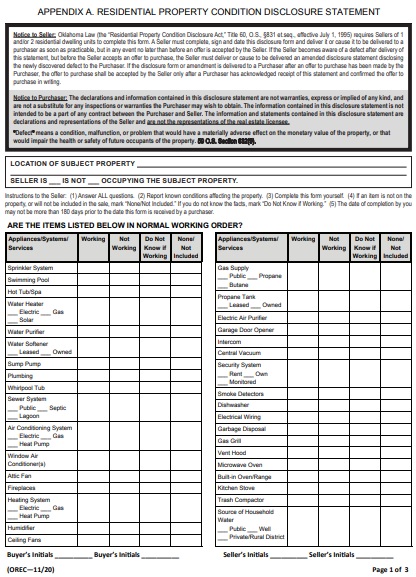

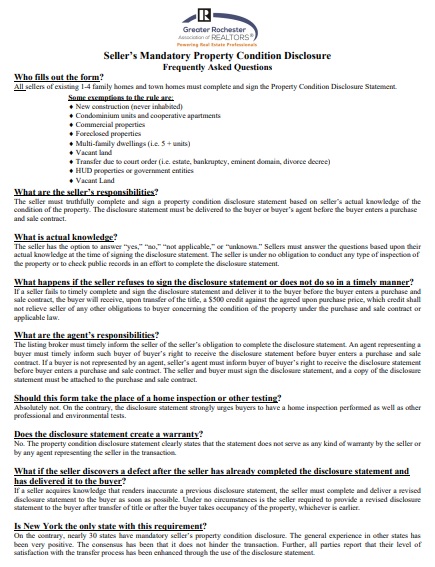

Sellers Mandatory Property Condition Disclosure

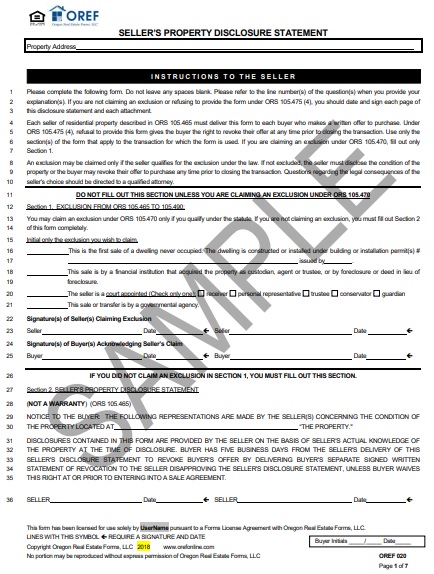

Sample Sellers Property Disclosure Statement Form

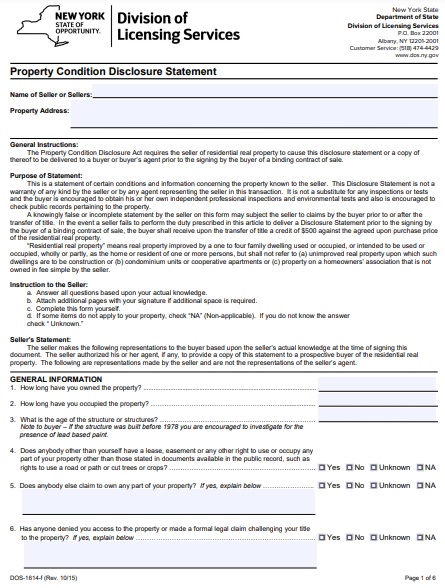

Property Condition Disclosure Statement Form

Faqs (Frequently Asked Questions)

If a seller has failed to disclose any hazards or damages within the home, then a buyer may be able to sue a seller him for damages.

This depends on where you live. Generally, it is good for 10 years in most cases. This means, if they did not disclose an issue at the time of the sale, they can be held liable during that period.