A payslip template (Excel, Word, PDF) is utilized for specifying the pay points of interest of workers of an association. It contains the insights about the measure of pay that is paid to a representative on the month to month or consistent schedule. Each representative of an association has his own and the novel pays lip whether his compensation is the same or not quite the same as different workers.

Table of Contents

What is a Payslip and Why Your Business Needs It

A payslip (also known as a pay stub or salary slip) is a document that an employer provides to an employee each time they’re paid, showing the details of their earnings, deductions and net pay. According to industry sources, in many jurisdictions providing an itemised payslip is a legal requirement.

Why it matters

Transparency: Employees want to know exactly how their salary is composed. Clear breakdowns of basic pay, overtime, allowances and deductions help avoid misunderstanding.

Record keeping: Payslips serve as proof of income and can be important for bank loans, tax audits or employment disputes.

Compliance: Many labor laws require that payslips be issued at each pay period, within a certain timeframe, and must include specific information.

Efficiency: A good template reduces errors, saves time and helps payroll staff work more efficiently.

Importance of Payslip Template

- The Salary slips have fundamental significance for each representative and in addition to the associations.

- The slip fills in as a legitimate record of compensation that is allowed to a representative by the association.

- No worker can guarantee that he/she has not gotten the pay for a specific period when the compensation slip has been given to the representative.

- The Salary slip likewise fills in as a substantial verification of the work of a man in an association. In this way, the Salary slips are now and then eluded as valid apparatuses for check and distinguishing proof of a man.

Payslips are given to clients at the season of pay installment and as indicated by work laws getting a payslip is a fundamental right of each representative. Payslip can be a printed bit of paper or delicate duplicate sent to the representative by means of email. Payslips are normally arranged for workers when they get compensation as an immediate store.

Payslip helps representatives to watch whether the organization or worker is making installment precisely or not. Payslip to serve representatives as fundamental compensation records to track pay installments got by the organization or business for getting ready to wage government form or for different purposes.

Get Professional Payslip Templates (Excel, Word, PDF)

All business foundations and organizations make payslips to report in composing that representatives have been paid by the organization as indicated by administrations given to the prosperity of the organization or business. The assortment of various PC projects and programming is accessible in the market that a business or business can use to make mechanized payslips.

In the event that you would prefer not to purchase costly programming for making payslip then just go for the base of the page and locate an appropriate payslip format to make payslips with organization name and logo. With the help of the compensation slip format, you will feel freedom when making pay lips yourself.

The real reason for the payslip template is to give an efficient separation of a worker’s pay in the straightforward arrangement and this helps a considerable measure in the computation of assessment and numerous different purposes.

Well-made payslips with every vital detail give workers an approach to monitor their installments on another hand helps a ton a bookkeeping officer to keep up a record of pay rates. A compensation slip may incorporate the name of the worker, aggregate sum earned by the representative, working days, paid sum, remittances, and commitment deducted and installment date, and so forth.

Key Components of a Payslip Template

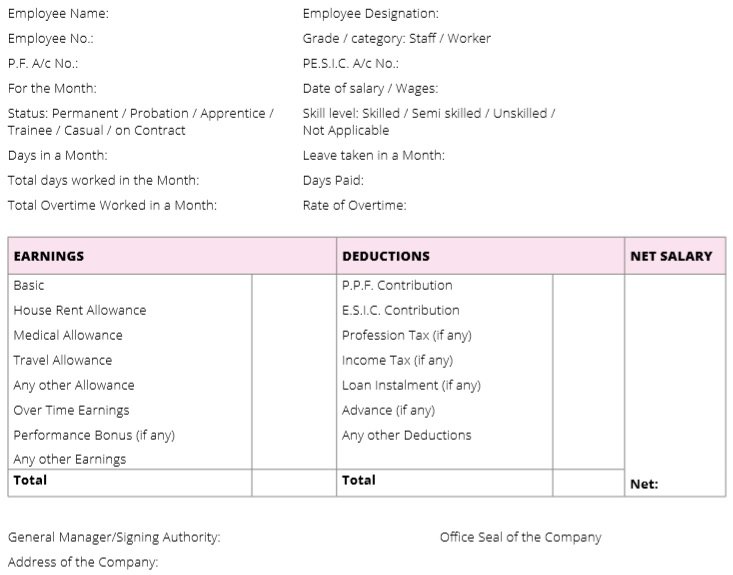

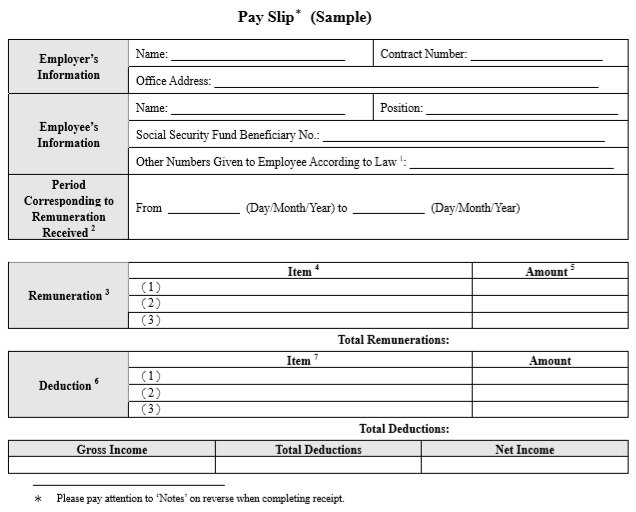

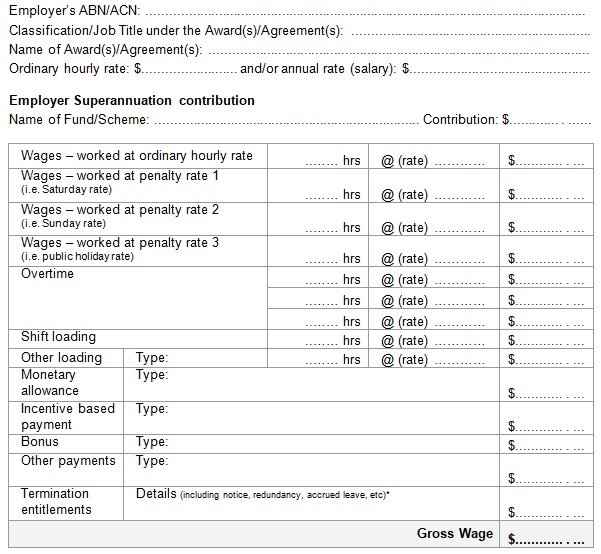

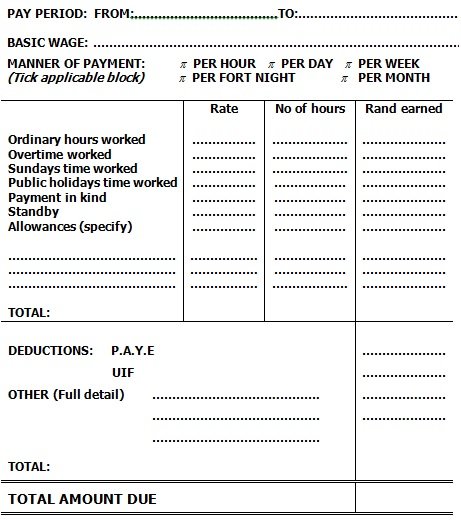

When designing or choosing a payslip template, ensure it contains the essential fields so you meet legal and practical payroll needs.

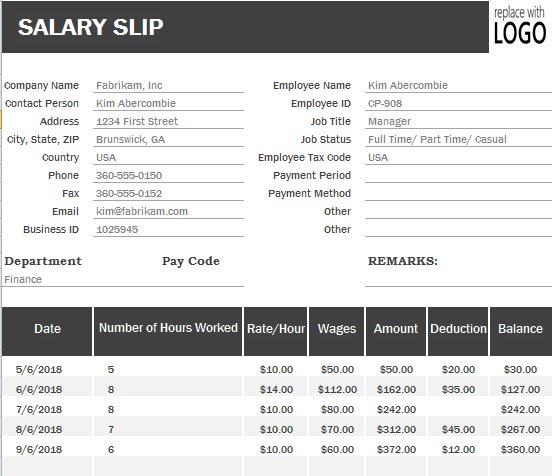

Employee & Company Information

- Company name and address

- Employer identification number / registration details (if required)

- Employee’s name, employee number or ID, department

- Pay period (start and end date) and payment date

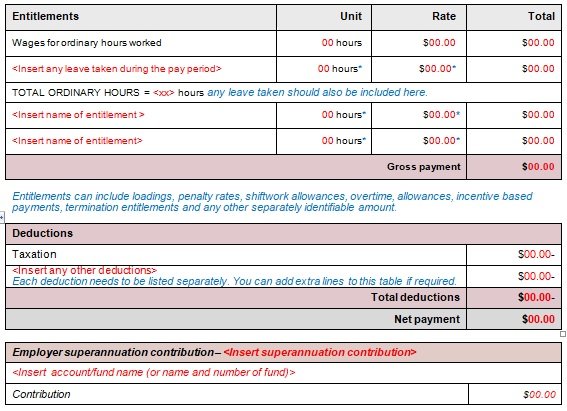

Earnings Section

This should list all the income components, for example:

- Basic salary

- Overtime pay

- Bonuses or allowances (e.g., housing, transport)

- Any other payments (commission, shift premium)

Deductions Section

List all items subtracted from gross pay, such as:

- Tax withholdings

- Social security / pension / retirement fund contributions

- Insurance premiums

- Other company-specific deductions

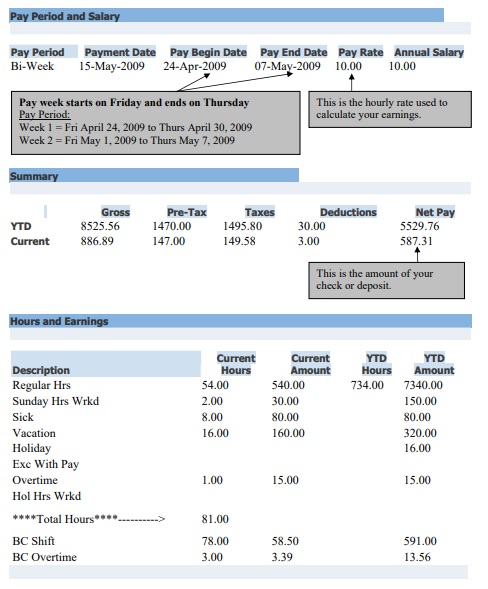

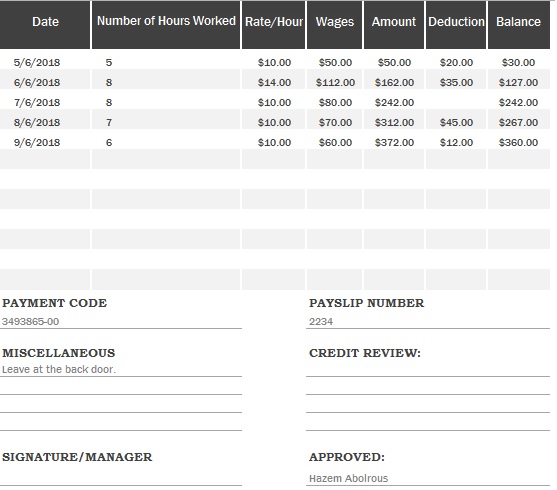

Net Pay & Year-to-Date Totals

- Net pay: the amount the employee actually takes home.

- Year to date (YTD) amounts: many template guides recommend showing cumulative earnings and deductions for the fiscal year.

Additional Fields & Optional Info

Depending on your jurisdiction or company policy you may include:

- Leave balances (vacation, sick leave)

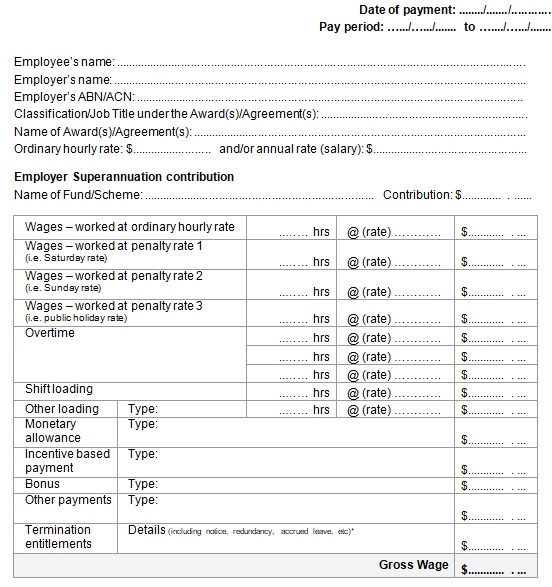

- Hourly rate and number of hours worked (especially for hourly or unionised workers)

- Tax code or tax rate

- Bank account/payment method details

- Signature / authorised signatory (if printed)

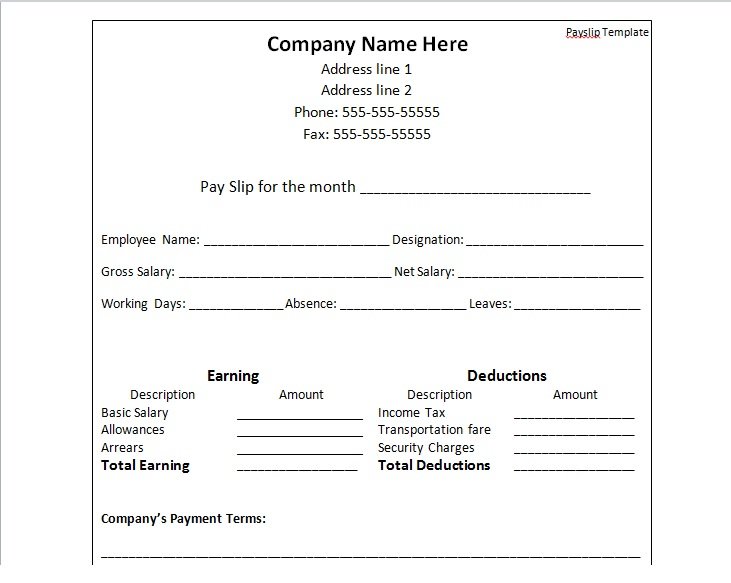

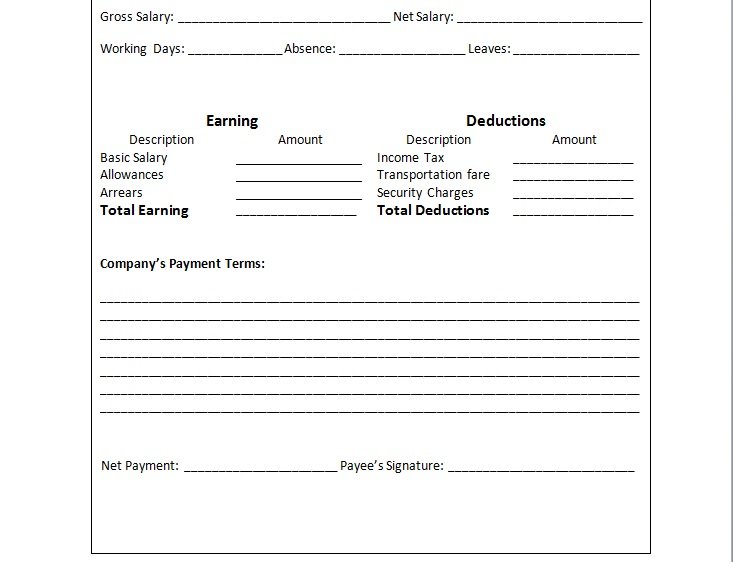

Free Printable Payslip Template

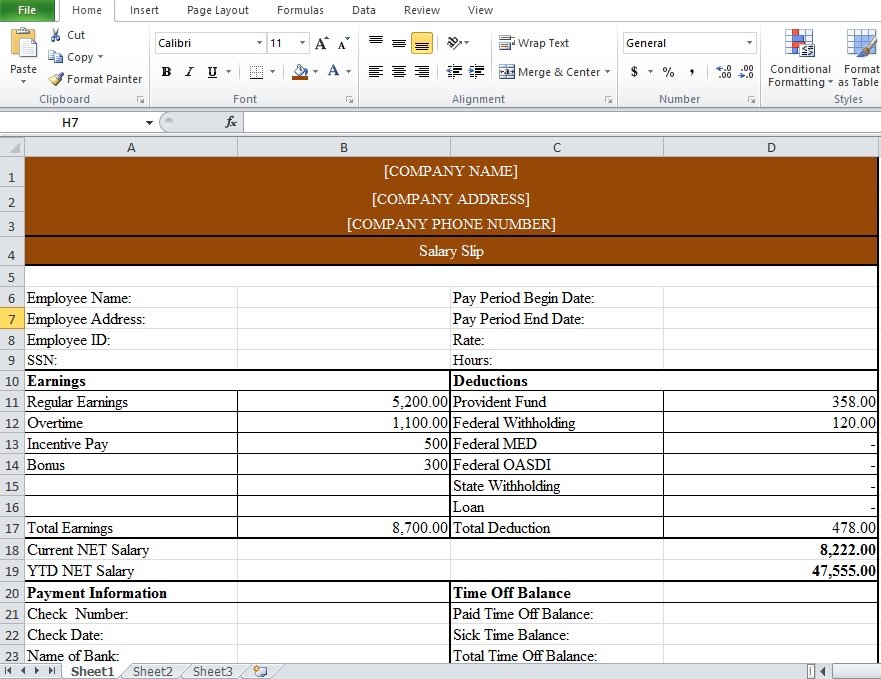

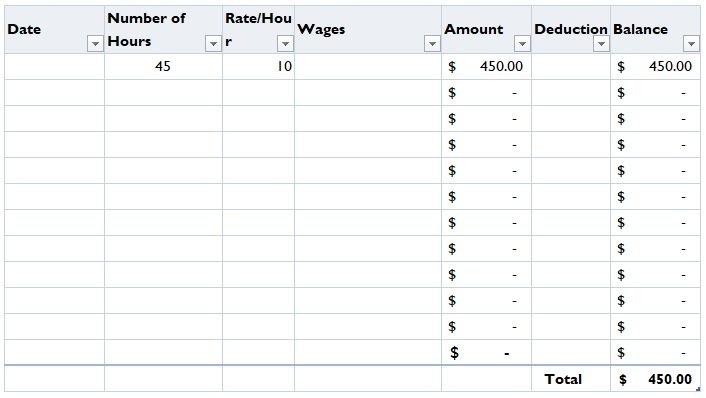

Payslip Format in Excel

Complete Payslip Template

Free Payslip Template Word

Online Payslip Template

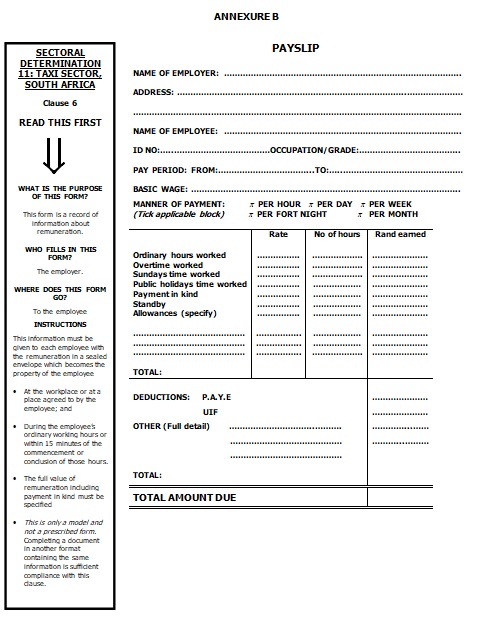

Taxi Workers Payslip Template

A compensation slip may require by a bank or some other money-related association on the season of giving advance to a worker. All sort of businesses is legitimately obliged to give representatives a separated payslip template at whatever point they are paid however some of them don’t make it genuine.

There is an extensive number of users, programming, and frameworks accessible that businesses can use to plan payslip for their representative yet utilization of such systems can expand the cost for a private venture. Subsequently, payslip templates are likewise reachable on the web to get readily viable payslip in a brief time.

If you are liable for the creation of payslips for the corporation or industry, you are recommended to take aid from this easily and simply editable payslip template. It gives you an appropriate and exact way & format to make payslips in a specialized look. Being conscious of your responsibility for giving payslips to workers is an equally vital job just like other commercial operations, so don’t forget to make use of a suitable format while building payslips. You may also see a salary slip format in excel.

Employers present workers with a document when providing their wages or salaries which is recognized as a payslip. A payslip informs a worker how much salary is earned by him or her throughout a particular time era. payslip template excel is provided to the member of staff after a month when the boss paid the worker salary. This slip is utilized for writing the information of the salary like title name of employer & employee, date of payment, day & total sum of payment allowances & other vital information regarding the employee salary. You may also like the driver’s salary receipt template.

You can download free payslip templates from this website exceltmp.com. This slip is set up in an expert way it is for the most part utilized as a part of business association and organizations. Presently we are putting forth you to utilize our readied and decent payslip format in excel which is uniquely made by our expert architect. With the assistance of our made layout, you can compose your required format.

Editable Payslip Template For Employees

Underneath you see the appealing sneak peek of our composed payslip layout. We have outlined this layout in MS Word so you effectively alter this format while utilizing include/erase alternatives. On the off chance that you need to download this format for your claim utilize so you only a single tick on this catch and download layout for your own particular use. You cannot pay any expense of charges for downloading this layout since this format is thoroughly free from any expense of installment. You may also check the salary breakdown excel template.

Basic Payslip Template Free Download

Payslip with Additional Notes Template

Example of Payslip Template

Payslip Template for Taxi Workers

Editable Payslip Template Excel

Simple Weekly Payslip Template

How to Choose or Build the Right Payslip Template

Here are steps and considerations to help you pick or create a payslip template that works for your business.

1. Assess your business needs

- How many employees do you have?

- Are there multiple pay rates, overtime, commissions etc?

- Do you pay monthly, bi-weekly or weekly?

- Are there specific statutory requirements in your country for what the payslip must include? (Yes — for example Australia’s Fair Work Ombudsman sets minimum requirements.)

2. Decide on format (Excel, Word, PDF or payroll software)

- Excel: Excellent for automation and handling large datasets, especially useful if you have many employees or many pay components.

- Word: Simpler layout, fewer calculations, good for smaller businesses.

- PDF: Ideal for distributing digital payslips that maintain layout across devices.

- Payroll software: Often comes with built-in templates and automatisation, but you must check if you can customise fields.

3. Customise the template

- Insert your company logo and brand colours to make it look professional.

- Modify the earnings and deductions headings to reflect your actual pay components.

- If using Excel, set up formulas so that net pay = total earnings – total deductions automatically.

- Make sure the date, employee ID, pay period fields are dynamic (i.e., update each pay cycle).

Common Mistakes to Avoid

Here are frequent mistakes businesses make when using payslip templates—and how to steer clear of them.

- Missing mandatory fields: Failing to show payment date, pay period or employer identification may breach local laws.

- Incorrect calculations: For example net pay may be wrong if overtime or bonus formulas are off.

- Using generic templates without customising: A template built for one region may not comply in your country unless modified.

- Poor layout making it hard to read: If an employee can’t quickly see their net pay, you risk questions and mistrust.

- Neglecting record-keeping: Not keeping payslip records for the required retention period can lead to legal issues.

- Distributing insecurely: Sending unprotected digital payslips or leaving printed ones in an unsecured area can compromise confidentiality.

Frequently Asked Questions (FAQs):

What information must a payslip include?

While requirements vary by country, a payslip typically must include: employer and employee names, payment date, pay period, gross earnings, deductions, net pay, and often year-to-date totals. If your jurisdiction mandates specific fields (e.g., tax code, pension contributions), ensure they appear.

Can I issue payslips electronically (via email or PDF)?

Yes—in many jurisdictions electronic payslips are acceptable provided they are secure, readable and can be stored and accessed later. Always check local regulations for any stipulations.

How often should I provide a payslip?

Generally at each pay period (weekly, fortnightly, monthly) when you make payment. Failing to provide a payslip within the required timeframe can lead to non-compliance.

Can I use a standard online payslip template for my business?

Yes—you can download many free or paid templates (Excel, Word, PDF). But you must customise them to match your pay components, legal requirements and company branding.

How long should I retain payslip records?

That depends on your jurisdiction. Many regions require retention of payroll records (including payslips) for several years.

What are the benefits of using Excel as the template format?

Excel offers automation (formulas for earnings/deductions), ease of batch updates, ability to handle multiple employees and pay components, and simpler export to PDF/print. It’s a robust choice especially when you have multiple employees or more complex pay structures.

Is a payslip different from a salary certificate?

Yes—a payslip is given for each pay period showing detailed breakdown of that period’s payment; a salary certificate is a separate document (often annual) summarising your earnings in a year for lending/tax-proof purposes.

What should I do if I find an error on an employee’s payslip?

If an error is found (wrong hours, wrong deduction, missing bonus etc), you should issue a corrected payslip for the pay period, adjust the payroll records, and if necessary communicate the correction to the employee. Maintaining accuracy is critical for trust and compliance.

Can I include overtime, shift differential or commission in the payslip?

Absolutely—and you should. Any element of pay that the employee is entitled to must appear in the earnings section, clearly labelled. For instance, overtime hours and rate should be visible so the employee understands how their pay was calculated.