You will require a Montana vehicle bill of sale form while selling or purchasing a vehicle in the state of Montana. It serves as a legal document that records the sale and will be required while registering the vehicle.

If there be any issues with the sale of the vehicle, then it can be used as proof. It must be signed by both the seller and the buyer in order for a Montana vehicle bill of sale to be valid. You don’t need to have the bill of sale notarized in Montana.

Table of Contents

The elements to include on a Montana vehicle bill of sale:

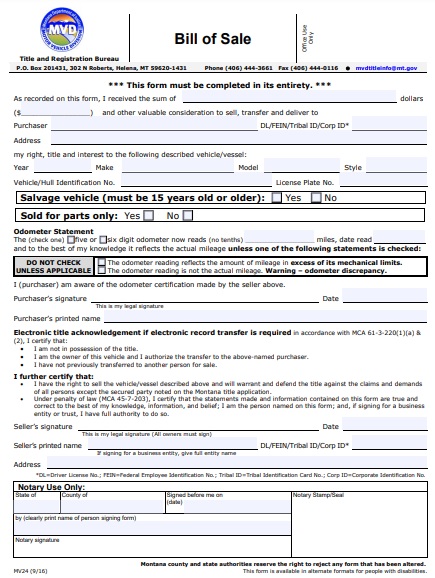

You can download a Montana bill of sale from the Montana Department of Justice’s website for your convenience. If you want to make your own Montana vehicle bill of sale, you will have to ensure that it includes the following key details;

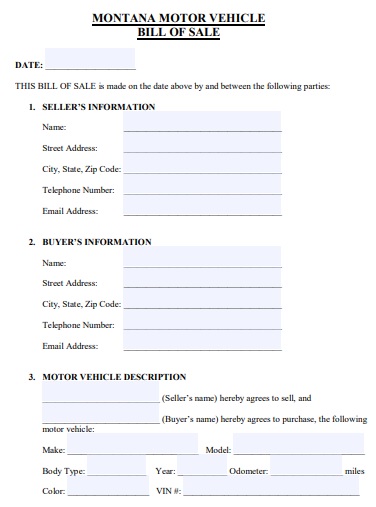

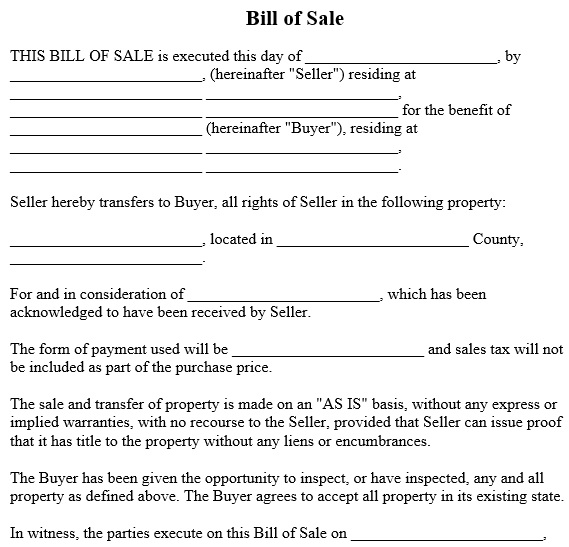

- The seller and the buyer legal names

- A seller’s and a buyer’s contact information

- The date of sale

- The sold price of the vehicle

- Details regarding the vehicle such as the make, model, year, VIN, odometer reading, style, and license plate number

- The seller and the buyer signatures

- Notarization, if needed

How to register a vehicle in Montana?

The buyer has 60 days in which to have their vehicle registered according to Montana code 61-3-311. To Montana residents and those who have recently moved to the state of Montana, this is applicable. For either one or two years, you can register your vehicle. Furthermore, the vehicles that are over 11 years allowed to have permanent registration. Every one to two years, all other vehicles will have to renew their registration.

You can use your current registration if you are moving to a different Montana county until it is time to renew. At your local County Treasurer’s office or via Motor Vehicle Davison online service, you can do the registration face to face.

The Montana Vehicle Services Bureau handles the titling and registering a vehicle. So, it indicates that you can’t title your vehicle without it being registered. They both have done simultaneously.

In Montana, titling a vehicle:

At your local County Treasurer’s Office, you can apply for a vehicle title. For registration for the previous year, you will have to submit an out-of-state title or receipt. The dealership will take care of the paperwork and send it to your county treasurer’s office if a vehicle has been purchased from a dealership.

In some situations, by completing Form MV100, you may be required to clarify some facts about the purchase. For titling and lien/security interest, you will also have to cover fees. Your vehicle will be registered and you will be issued with license plates when you have completed the titling process.

In addition, you will be given a temporary permit for 40-days in case you have requested plates that are not available at the time of registration until the plates are made available. By law, as stated in Montana Code 61-6-301, you have to keep a copy of your registration receipt in your vehicle and your evidence of insurance.

Bonded titles:

You can apply for a bonded title with Form MV10 if a title record cannot be found for a vehicle as per Montana Code 61-3-208. You will have to specify on this form how you acquired the vehicle, the vehicle’s value, as well as you have to indicate whether there are any liens against the vehicle. Also, you will require the following documents;

- Proof of a vehicle ownership

- Form MV20 (VIN Inspection Certificate)

Montana Vehicle Bill of Sale Form

Free Montana Car Bill of Sale Form

Fillable Montana Motor Vehicle Bill of Sale Form

Conclusion:

In conclusion, a Montana vehicle bill of sale form is a legal document that serves as proof of sale. This document is also required while registering the vehicle. Both the seller and the buyer have to sign vehicle bill of sale in order to make it valid.