A durable power of attorney form is a legal document that allows an individual to entrust their financial management with someone else, including property. An agent or attorney-in-fact is the individual that entrusted with power of attorney.

On the other hand, the principal is the individual that sets limited or comprehensive options on the financial powers of the Agent on the durable power of attorney form. The durable power of attorney is only applied to competent persons who are 18 years and older. The principal must be mentally stable while writing and signing the durable power of attorney form.

Moreover, the following financial tasks and purposes can be handled by the durable power of attorney;

- Deposits, withdrawals, and inter-account transfers

- Lending and borrowing

- Safe deposit boxes

- Government and statutory benefits

- Retirement plans and packages

- State and federal taxes

- Legal advice and proceedings

- Real estate

- Personal pieces of property

- Gifts

- Insurance

Table of Contents

Understanding durable power of attorney:

A durable power of attorney needs the principal’s full comprehension of specific technicalities like;

When it takes effect

Upon signing or in the event of the principal’s incapacitation, a durable power of attorney may come into effect. Spring powers are the future events like incapacitation that may prompt a power of attorney to come into effect.

Agent certification

Agent certification is an option form. It certifies facts relating to a power of attorney. The certification form signed by the Agent and used as a fraud deterrent. It helps in verifying the validity of a power of attorney. Furthermore, the agent has to make a sworn statement under penalty of prejudice. This proves that a power of attorney is valid with the principal’s authorization to act on his or her behalf. You may also like Financial Power of Attorney Form.

Agent’s power

Power of attorney allows an agent power whether it is extensive or limited over the principal’s finances, real estate business, or legal matters. The Principal may provide the Agent as much or as little power as they require. These powers may include the following;

- To pay for everyday expenses for them and their family, use the principal’s assets

- Make investments

- Managing banking activities

- Overseeing contractual responsibilities

The Principal, according to Uniform Power of Attorney, can grant standard authorization over all or some of the following financial power;

- Real property

- Tangible Personal Property

- Banks and Other Financial institutions

- Operations of Entity or Business

- Insurance and Annuities

- Estates, Trust, and Other Beneficial Interests

- Claims and Litigations

- Personal and Family Maintenance

- The advantages from Government Programs, Civil or Military service

- Retirement Plan

- Stocks and bonds

- Taxes

Agent liabilities

If an agent violates the principal’s guidelines, or legal responsibilities then he is likely to be penalized.

Ending of financial power of attorney

Death ultimately ends durable power of attorney. If an agent named as an executor in their will, he can only be granted authority to wind up a principal’s affairs.

If Revoked-As long as the principal are mentally competent then they have freedom to revoke a durable power of attorney. There must be the authorization of a revocation form for the power of attorney to be canceled. Here are the most common reasons of revocation; You may also see Real Estate Power of Attorney Form.

- For power of attorney, principal losing the desire

- Change of agent

- Once the desired purpose is achieved

- Unacceptable completion of requirements by Agent

- To hold a power of attorney, the agent has lost a desire

Some other reasons are;

- Divorce

- Invalidation of the document by a court

- An agent’s unavailability

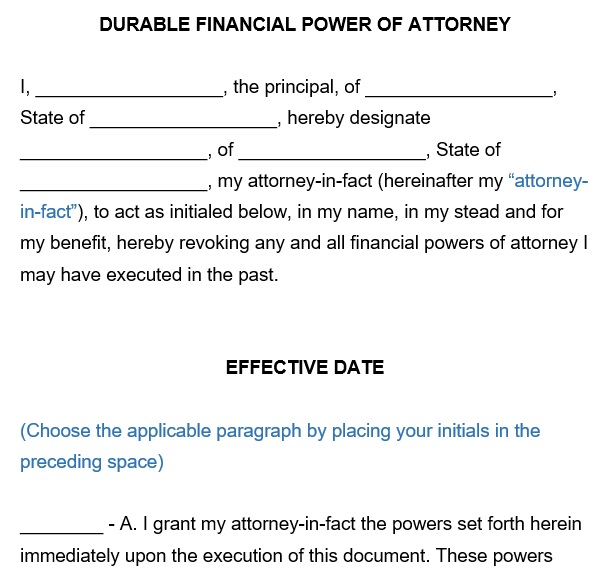

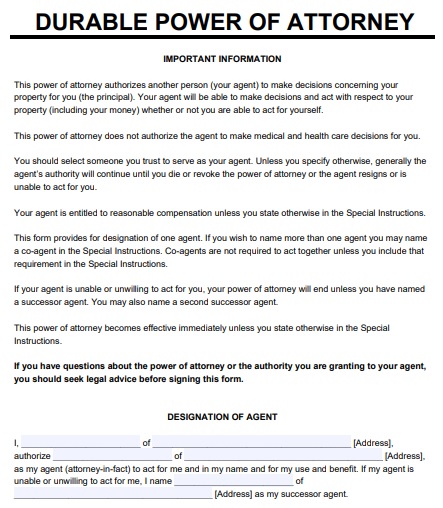

Free Durable Power of Attorney Form

Fillable Durable Power of Attorney Form PDF

Conclusion:

In conclusion, a durable power of attorney form is a document signed by the Principal that enables the Agent to manage their financial affairs while alive. This form protects the principal’s healthcare and finances with a trusted person. However, this document differs from state to state.