An Arizona LLC operating agreement template is an agreement used by LLCs based in Arizona. This agreement is an internal regulatory document that outlines how the LLC is organized and how it will be managed.

Table of Contents

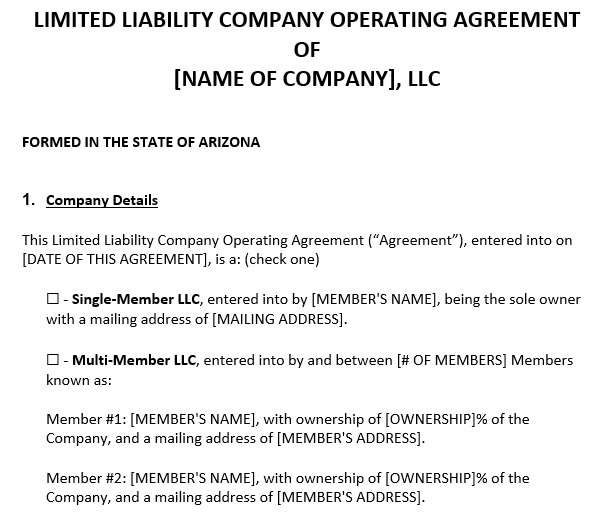

Types of LLC operating Agreement:

In Arizona, there are the following two types of LLC operating agreements;

Single-member LLC operating agreement

This type of LLC operating agreement is meant for single-member LLC companies. A single-member LLC has one owner. This document highlights the roles and responsibilities of the owner and management. It also declares operation policies and regulations.

Multi-member LLC operating agreement

This type of operating agreement is meant for multi-member LLCs. It is owned by more than one member. This agreement outlines percentage ownership of the members, member and management obligations, governing rules, regulations, and more.

How to draft LLC operating agreement?

Here are the steps that you should follow while drafting your agreement;

Name of LLC

At first, name the LLC. You have to select a unique name that will be used as the identity of the company. Then, perform a name search in order to identify whether the name is available for use. The “LLC” or “Limited Liability Company” must be attached to the company. Moreover, it has to comply with business names state requirements. This means it can’t have words such as Treasury, City Hall, etc., that are used by government agencies.

Registered Agent

Appoint a statutory agent with an operating address or residence in Arizona when the name has been registered and reserved. On the behalf of the LLC, the agent has to receive legal and tax documentation. Within the state of Arizona, a registered agent or statutory agent can be an individual or organization. The Statutory Agent Acceptance Form must be submitted together with the LLCs Articles of Organization.

Type of LLC

Next, specify the type of LLC being made. An LLC is of two types;

- A domestic LLC (founded within Arizona)

- A foreign LLC (founded outside Arizona)

The management structure and the type of LLC being formed are the two factors that influence the paperwork required to form the company. Additionally, the agreement should declare whether the LLC is a single-member or a multi-member LLC.

Filling fee

When all the relevant documents have been received, they can be filed with the Arizona Corporations Commission via mail or online. Domestic LLCs have to pay $50 filing fee. On the other hand, foreign LLCs have to pay $100.

Publication requirements

After the approval of the LLC’s Articles of Organization, within 60 days, Arizona LLCs are obliged to publish a notice of LLC formation. Within the LLC’s County, the publications must be with an accredited newspaper. They run for three consecutive weeks and in case of failure, the LLC may result in the dissolution of the LLC.

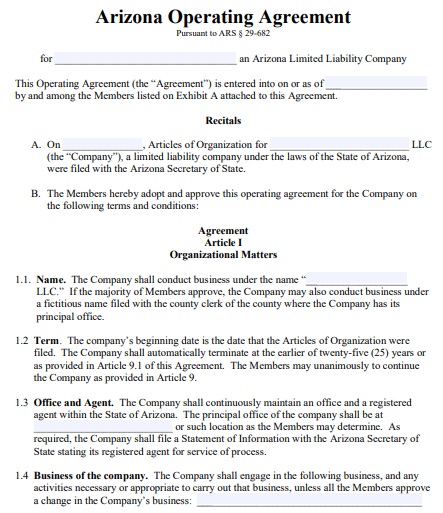

Operating Agreement

to craft their Arizona LLC operating agreement, the LLC is recommended not instructed or else be subjected to default LLC state laws. The agreement has to highlight the operating structure adopted by the LLC. It describes business policies and decision-making processes in order to run the company. Furthermore, the agreement should include the following;

- The legal LLC name

- Ownership

- Management structure

- Obligations of members and managers

- Voting rights

- Contributions

- Distributions

- Meeting procedures

- The buyout and buy-sell regulations

All LLC members must have to sign the Arizona LL operating agreement. The copies of agreement should be distributed among the members and one is kept in company files.

EIN

It is necessary that LLC obtain an Employment Identification Number. to make legal, financial transactions and to finalize the formation process, this nine-digit unique number is assigned by the IRS to companies.

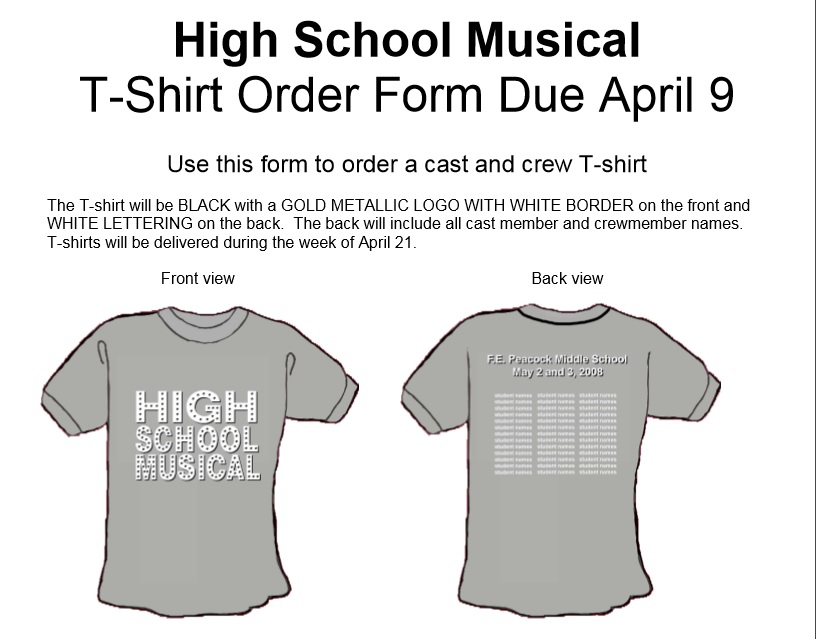

Free Arizona LLC Operating Agreement Template

Arizona LLC Operating Agreement Form

Conclusion:

In conclusion, Arizona LLC operating agreement template is a document that outlines the roles and responsibilities of members and managers. It secures the LLC owner(s) by limiting their liability for the LLC’s financial and legal liabilities.