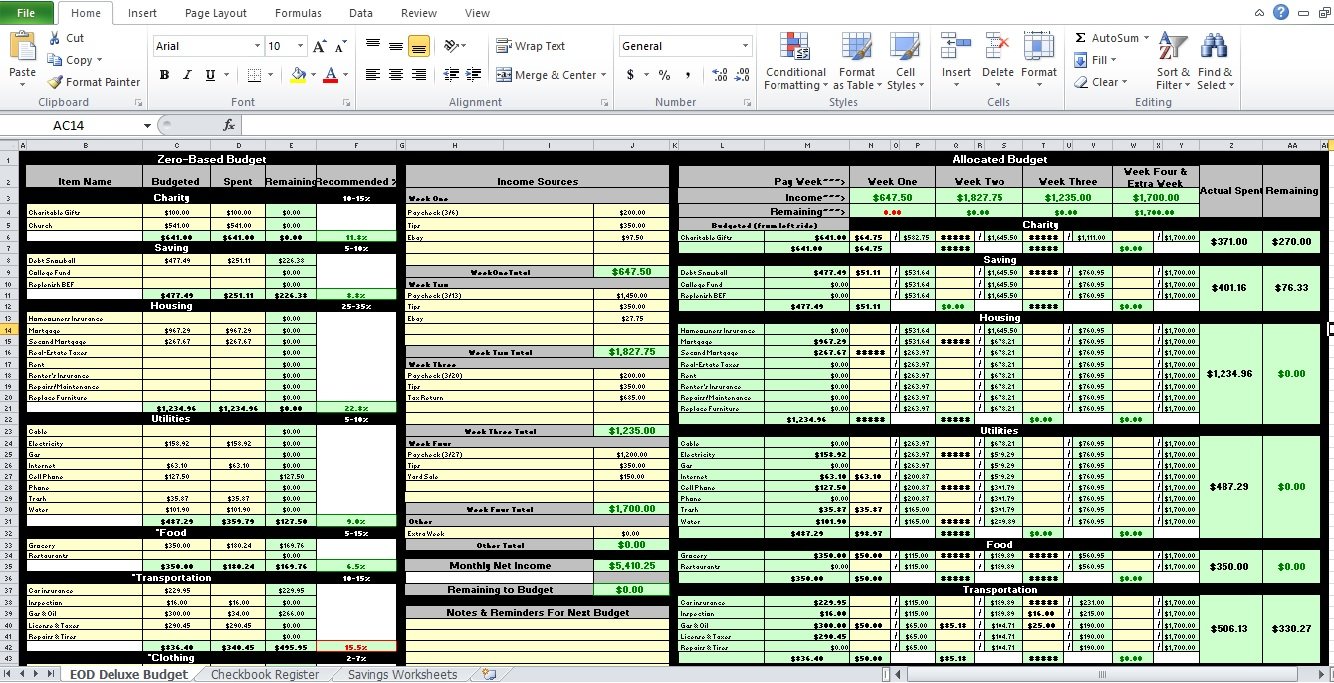

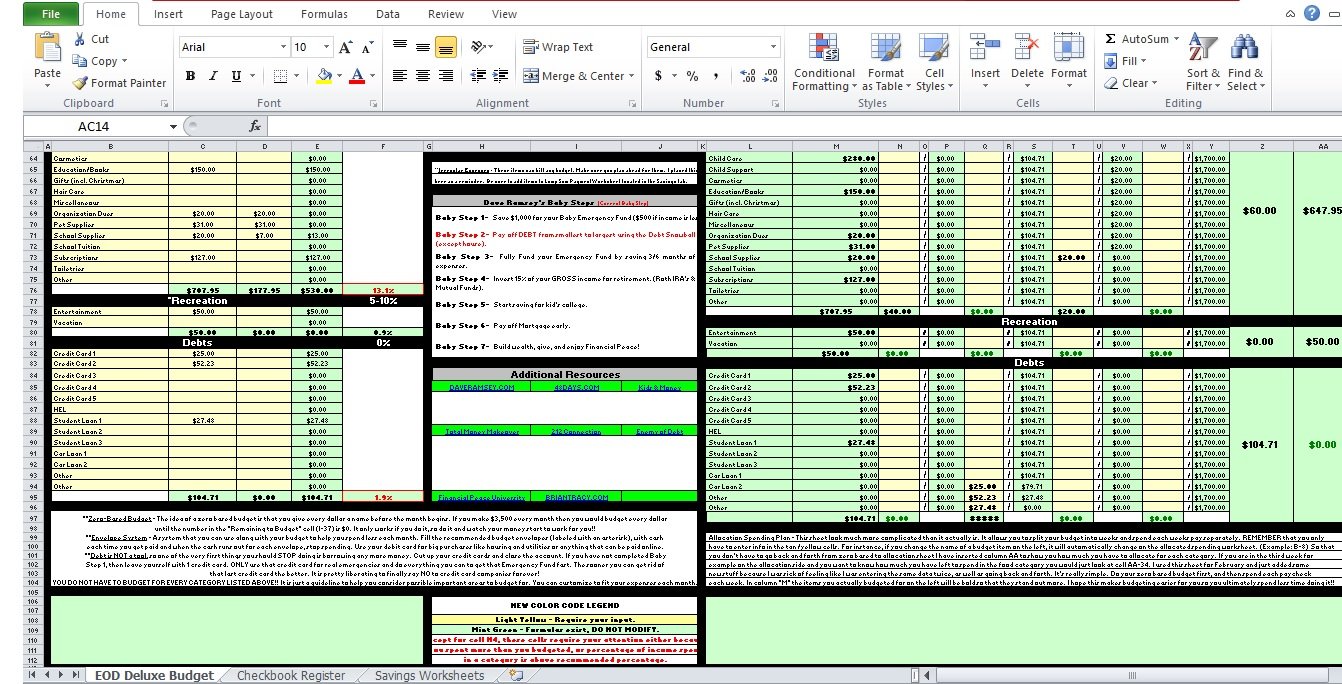

A personal budget worksheet is a tool that helps you manage your finances properly and use your money smartly. With the help of a worksheet, you can organize your finances and plan monthly activities and expenses.

This budget worksheet can readily be downloaded online, making managing your personal finances easier. It contains all the details you need so you can budget your money more appropriately.

Table of Contents

What to include in a personal budget worksheet?

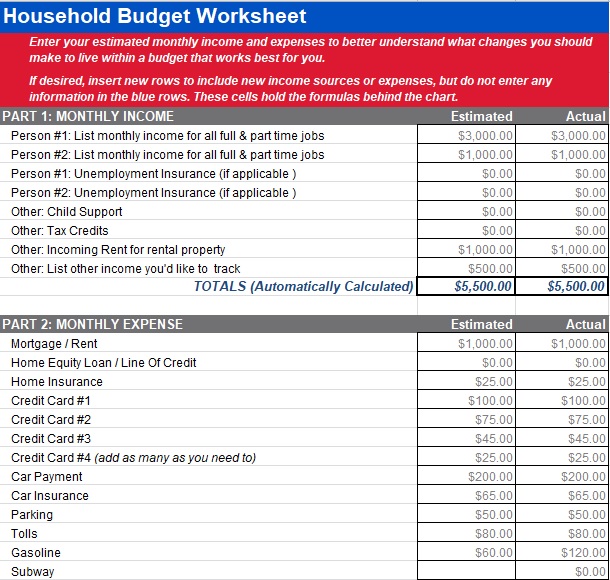

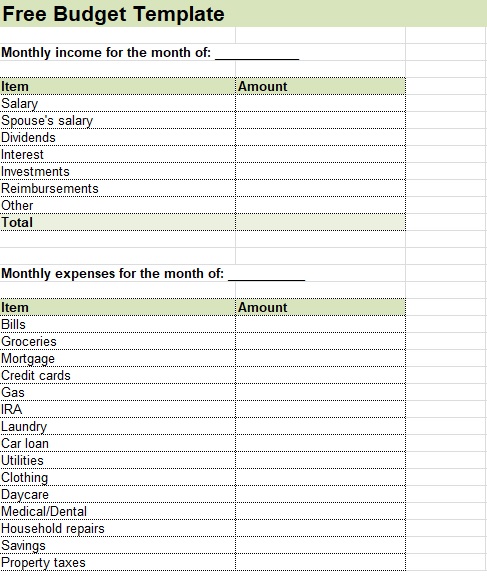

A personal budget worksheet usually contains information about your possible income sources. These may include;

- Business

- Dividends or Interest

- Miscellaneous

- Pension

- Wages or Salary

Moreover, you should include a savings goal in your expenses to achieve successful budgeting. When it comes to your expenditures and savings, a personal budget helps you make better decisions. Some expenses to include in your worksheet are;

- Daily Living

- Entertainment

- Financial Obligations

- Health

- Holidays

- Home

- Miscellaneous Payments

- Personal

- Recreation

- Subscriptions

- Transportation

How to create a personal budget worksheet?

Consider the following steps to create your budget;

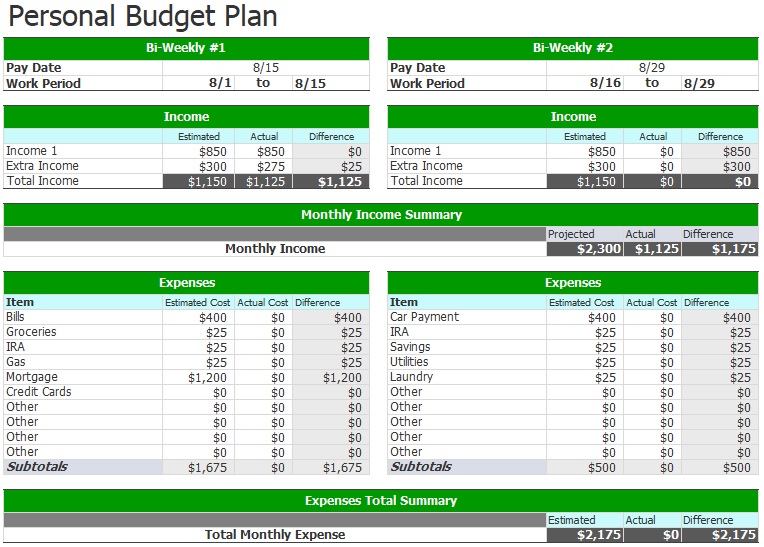

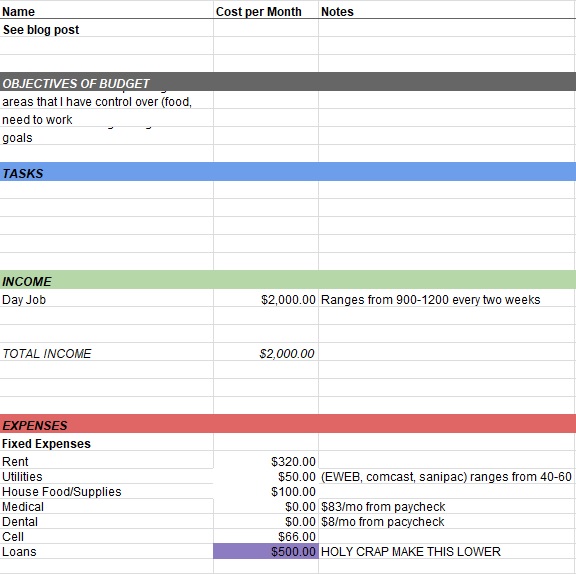

Mention your net income

Identifying how much money you have coming in is the first step while creating your budget. If you consider your entire salary an amount to spend then there is a chance to overestimate what you can afford. In addition, when creating your excel budget spreadsheet, consider subtracting deductions and other spending allocations. Remember that the net income is the amount that you use when creating the budget.

Monitor your spending

Making some adjustments becomes easier when you monitor your spending and categorize them. Doing so also assists you in determining where you’re spending most of your money and how you can cut back on it. Furthermore, you should take note of the expenses that are always changed from one month to the next. This may include gas, entertainment, and even groceries.

Set financial goals

Create a list of short-term and long-term financial goals that you want to achieve before moving forward with the information you have gathered. Short-term goals are usually achieved within one year while long-term goals take years to achieve.

Create your budget

Create your personal budget once you have all of the required information. You get a clearer picture of where you spend or where you can start cutting back by having documentation on both your spending and income. This way, you can also save money to achieve your goals. However, adjust your fixed expenses if the numbers are still not balancing. But, you need greater discipline to do so as it will be difficult.

Keep checking your budget worksheet

To ensure that you are still on the right back, keep checking your budget worksheet regularly. It would be recommended to compare your monthly expenses with the family who have the same lifestyle as you. Always keep in mind that your budget is subject to change every month.

![Free Collection Letter Template [Word, PDF]](https://exceltmp.com/wp-content/uploads/2021/01/debt-collection-letter-template-150x150.jpg)