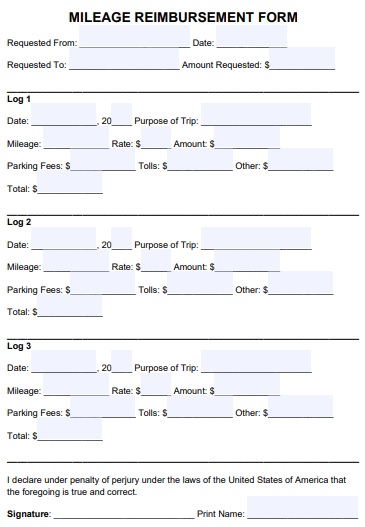

An IRS mileage reimbursement form is used by an employee to keep proper track of the business mileage in order to receive reimbursement. Most businesses give their employees a mileage reimbursement form where they have to fill in the mileage after every complete business-related activity. Moreover, you have to provide the following details regarding the drive in the form;

- The date

- Destination business purpose

- Miles traveled

- Total miles

- Origin

Some companies may ask you to return the form daily and some will collect the form after every month.

Table of Contents

What is a mileage reimbursement?

Mileage reimbursement is a way to compensate your workers for using their automobiles in running your business tasks. It can be used in paying employees for driving for the following purposes;

- To a bank for a business transaction

- To meet clients

- To pick-up office supplies

However, you should keep it in mind that the federal mileage reimbursement rates usually change every year. Usually, businesses use the standard mileage reimbursement rate. But, this may also vary on the basis of the industry.

The items that mileage reimbursement form covers

Mileage rates calculations depend on the common and fixed costs of operating an automobile. Therefore, it includes the following;

- Oil

- Gas

- Depreciation

- Registration fee

- Maintenance due to wear

The reimbursement does not cover

- Lodging Food

- Tolls

- Parking fees

- Minor repairs and accidents

Bear in mind that the mileage reimbursement is only given to the employees when they use vehicle for your business activities.

Mileage reimbursement laws:

Before offering mileage reimbursement, it is important to know the requirements that you must abide by as follows;

- The company that pays mileage reimbursement must comply with the IRS documentation rules. It indicates that the employees have to maintain a good track of all business travel. Also, the employees have to submit it daily.

- If the car was used for a business purpose, it is counted as a business expense and the reimbursement then can be paid.

The federal law will not need any business owner to give a mileage reimbursement to workers. But, you still have to abide by the minimum wage requirements in case you will not give mileage reimbursement to your employees. You should also check Mileage Log Template.

Free IRS Mileage Reimbursement Form

IRS Mileage Reimbursement Form Template

How to reimburse for the mileage?

The payment can be made in various ways on the basis of what suits you and your employees best. However, before settling the reimbursement, it would be best if you identified a few things that includes the following;

- How will you pay the mileage reimbursement either direct deposits or paper checks?

- Will you plan to include the mileage reimbursements together with daily wages or handle each payment differently?

Identifying these factors will assist you in understanding what suits your business best. But, usually, the mileage reimbursement must be settled two weeks after being submitted.

Mileage reimbursement benefits:

For employers

- Enhanced employee fulfillment

- For compensating employees, get a higher opportunity of receiving business mileage deductions.

- Employees wouldn’t have any issue running business-related activities.

- It plays an important role in preventing disgruntled employees

- Improve employee’s satisfaction

- Positively impact your employee’s engagement

For employees

- The worries that come with mileage costs, the mileage reimbursement eliminates them.

- For using your car for business activities, you get compensated

FAQS (Frequently Asked Questions)

On a mileage reimbursement, employees don’t have to pay any taxes only when they have an accountable plan.

It isn’t necessary. You will understand that each employee qualifies separately by using the IRS rates standards. They must also have ample records and have to follow all the rules associated with accountable plans.