An Illinois LLC operating agreement template is a legally binding document that serves as a guide for the member(s) of a company. With the help of this agreement, the members prepare detailed information regarding their company’s policies and procedures. This makes sure a uniform and smooth flow of business operations across all the involved parties.

Table of Contents

Reasons for making operating agreement:

Here are the reasons that why companies should create this agreement in Illinois;

Legitimacy

You can prove with an LLC operating agreement that your business is long-term, valid, and legitimate to other interested parties. You can deal with the parties you want to involve in your company by having such legitimacy.

For example, if you want to open a bank account, you must prove you are legit as a business owner in Illinois State. It means this agreement assists you in establishing a good and effective relationship with the bank. If people know that you do a legitimate operation and requiring an LLC operating agreement then they will only invest in your company.

LL status

The Illinois LLC operating agreement will assist in protecting you from the limited liability status. This means for any issues that may arise within your business or company, you will not be personally responsible for them.

Formal agreements

Preparing this LLC operating agreement will prevent disputes and disagreements among the partners in the case of multi-member ownership of a business. Depending on the procedures and policies stipulated in the contract, all partners will manage and operate the business.

Since all partners have a formal agreement to observe and uphold, there is bound to be reduced disputes with such uniformity. Furthermore, a written agreement is more recommended than an oral one. This is because it gives a reference in case of questions or disputes that arises among the partners.

Protects from default state laws

It is important to have an LLC operating agreement in the state of Illinois. The reason behind is that it will secure you from any interference from the default state laws. Also, you will not have any tax benefits you will not have any tax benefits.

Advantages of LL flexibility

The advantage of signing the agreement is the final reason that should prompt you to create and use the Illinois LLC operating agreement. The agreement will make you able to enjoy its benefits fully as LLC is flexible.

How to form operating agreement?

Here are the steps to follow in order to form an operating agreement;

Find a registered agent

Firstly, find a registered agent who legally resides in Illinois. Also, the agent has permission to partake in business activities. This entity is responsible for obtaining government information and notifications on behalf of the company.

Documents

In the next step, collect all the documents that are required for registration. Then, depending on the nature of the agreement that is being prepared, the agent may choose either the domestic LLC or foreign LLC. The agent should observe with the documents in place these filing requirements to complete the filing process.

Filing fee

The agent should look for the filing fee required along with the documents all gathered. The fee will be $500 for filing by mail while filing online will be $600.

Operating Agreement

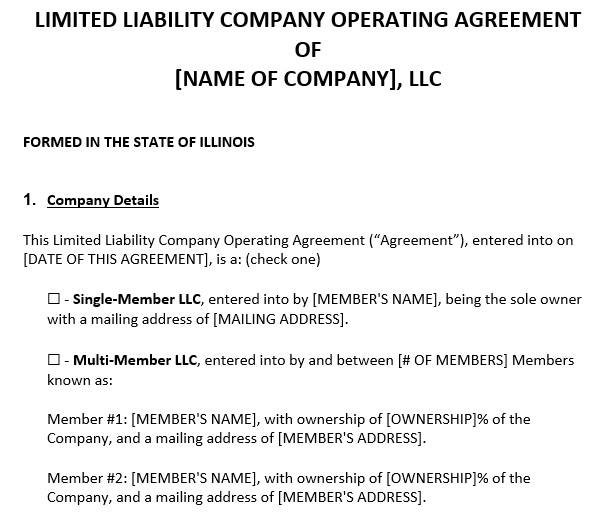

You have to develop in the next step whether the operating agreement required is a single-member or a multi-member Illinois LLC operating agreement.

EIN

In the last step, when creating the operating agreement, include the Employer Identification Number (EIN). This nine-digit number is used by the IRS for tax issues related to businesses.

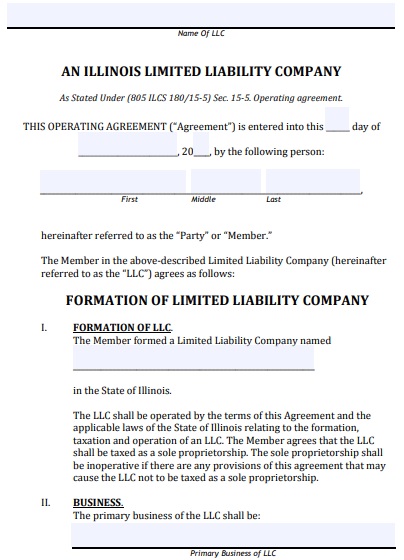

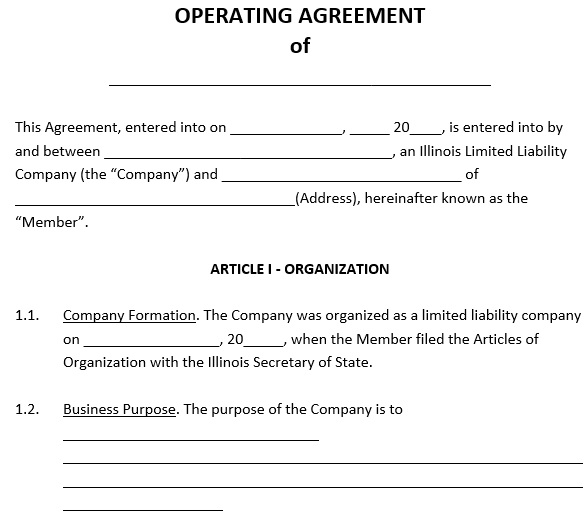

Illinois LLC Operating Agreement

Printable Illinois LLC Operating Agreement Template

Free Illinois LLC Operating Agreement Template

Conclusion:

In conclusion, an Illinois LLC operating agreement template is a legal document that provides company members guidance in their daily business activities. In Illinois State, all businesses have to prepare and sign this contract.