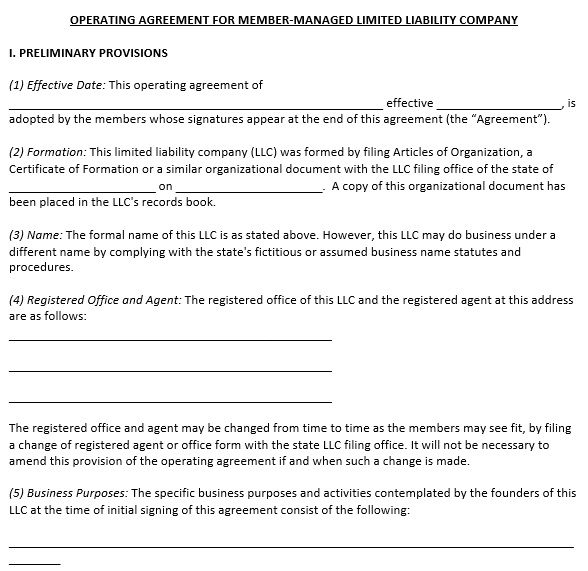

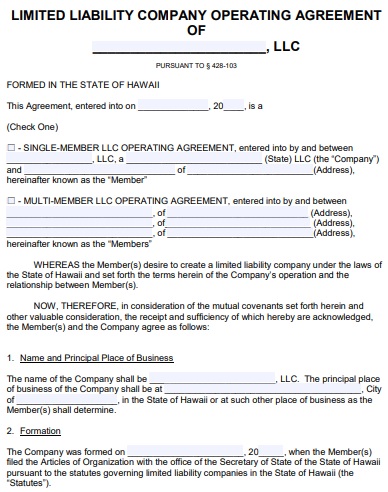

A Hawaii LLC operating agreement template is an internal document that specifies the company’s internal structure. The company’s management, ownership, policies, and procedures of the business are included in the agreement.

In Hawaii State, Hawaii LLC operating agreement is not a requirement, but it is highly recommended for LLCs. Every issue mentioned in the contract, all members must unanimously agree on them before signing as this is legally binding.

Table of Contents

What to include in an LLC operating agreement?

Include the following information in the agreement;

LLC name

The LLC name should be mentioned in the document as it is appeared in the Articles of Organizations. For purposes of company identification, these two documents must have matching names. At the end of the name, you must include the abbreviation LLC or Limited Liability Company. Your company is identified as an LLC with these abbreviations or phrases.

Ownership

All owner’s names must be well written in the document. Also, the percentage of ownership of each member should specify in the document. On the basis of capital investments from each member, the percentage can be equal or split.

Management structure

The operating agreement must indicate whether the business is manager-managed or member-managed for the management structure. The members (owners) who have control of the company’s operations are managed by a member-managed LLC. For the manager-managed LLC, a manager is hired by the members to handle the company’s operations.

Duties of members

In the document, include the duties of all members and owners. Provide particular details and explanations regarding what is expected from each member and owner. Internal conflicts among the company members are prevented by designating duties. The passive duties of the members should also be specified with a manager-managed LLC.

Voting powers and policies

The voting power of all members should be well developed in the agreement. On the basis of the ownership percentage of each member, this can be identified. All the decisions made through voting should be stipulated in the document such as approving new members and distributing profits.

Distributions

Profit distributions between members should be identified to make sure that each member knows the amount they are meant to receive. This can be done on an equal basis or on the basis of the ownership percentage.

Conducting meetings

The document should have all the meeting details as LLC members can hold meetings based on their schedules. This involves the time, place, and the reason that why the meetings are being held.

Succession protocol

In case of the death or retirement of a member, the Hawaii LLC operating agreement should have a succession protocol. There must be a strategy that specify how to replace such members for smoother transitions. Their shares and profits must also be designated to their relatives or other members on the basis of the succession protocol.

Buyout and buy-sell rules

There should be rules for these transitions, no matter whether a member is leaving or a new one is joining. For instance, the new member must know the capital investment to join the LLC.

Dissolution

If a company dissolves, for this process in the operating agreement, there should also be plans. The agreement have to make a decision whether to dissolve the company should be a unanimous or majority vote.

Changes to the operating agreement

The agreement can be changed. There must be guidelines in the agreement on the issues that can lead to the changes and how these changes will happen.

Severability clause

In case, a section of the agreement is found to be invalid or illegal then there must be a clause that safeguards the agreement from absolute termination. Only the section with the mistake is removed with the severability clause.

Hawaii LLC Operating Agreement

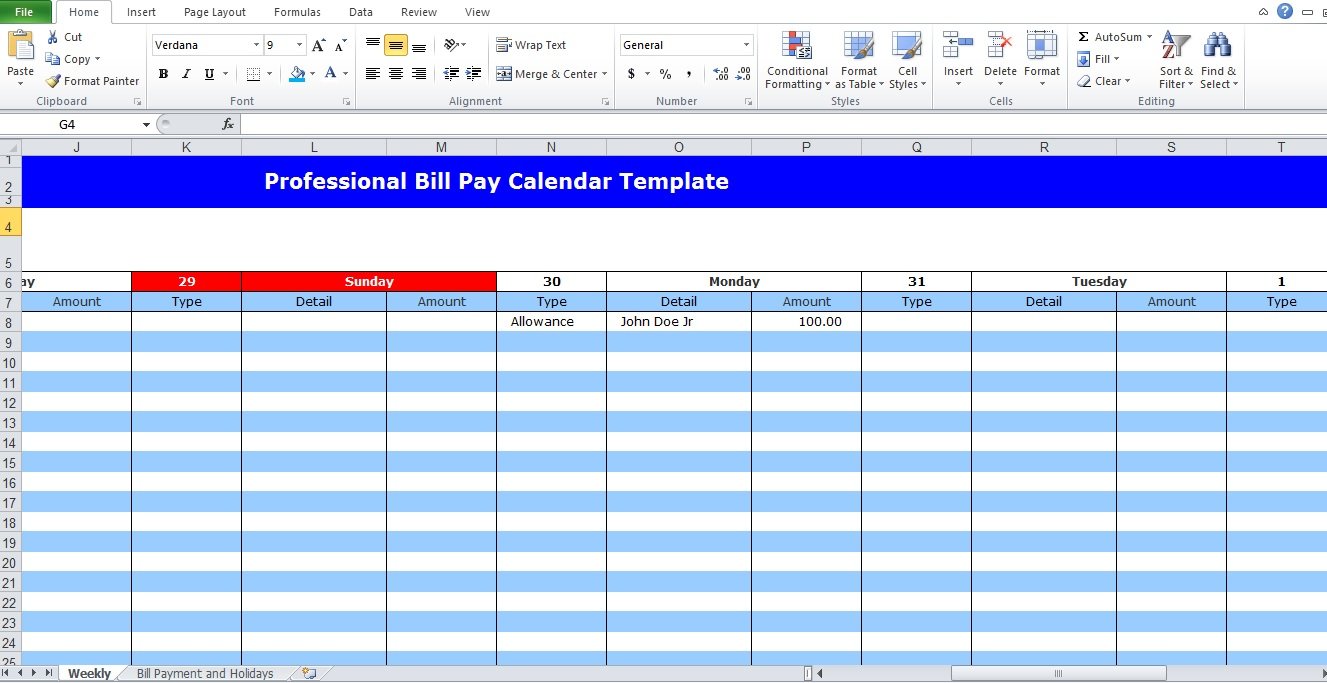

Free Hawaii LLC Operating Agreement Template

Limited Liability Company Operating Agreement of Hawaii LLC

Conclusion:

In conclusion, a Hawaii LLC operating agreement template is a formal document that protects company members from personal liability in case the company is facing bankruptcy or legal problems that might lead to loss of business assets.

![Printable Certificate Border Template Word [Designs & Samples]](https://exceltmp.com/wp-content/uploads/2021/04/certificate-frame-design-free-download-150x150.jpg)