A financial power of attorney form is an official document that lets someone else act as one’s legal representative in financial decisions and matters. The financial power of attorney is usually created alongside one’s will. A person who creates the Financial POA is known as the Principal. You can say that the principal is the person whose money is being protected.On the other hand, the Agent or Attorney-in-fact is the person who is selected to act on behalf of the Principal. This document provides the Agent the power to deal with the financial life of the Principal when he/she isn’t able to do so. When the Principal Agent is ill, incapacitated, or is physically not present to sign the necessary paperwork then this document is issued.

How to get a financial power of attorney?

A Financial POA involves several steps to establish. If you are going through this process then you should consult with a lawyer. During establishing a financial power of attorney, here are the steps you will take;

Select an agent

In your financial POA, you have to name one adult who is responsible for making financial decisions on your behalf. So, you should figure out who will best suit this responsibility. To help facilitate this process, you can consult your attorney, family counselor, or faith leader. During selecting the agent, you should select someone who can comfortably carry out these responsibilities.

Determine the powers

A power of attorney may not be necessary under a few certain conditions. Most people hire a trusted adult relative or friend to act as a trustee. A POA provides an agent who is the same individual as the living trust’s trustee to deal with these matters whenever they arise. In order to make your FPOA acceptable, contact to whom you think your Agent would have to deal with. Then, verify from them if your POA is acceptable.

- Pay bills

- Purchase insurance

- Operate a business

- Sell assets

- Pay taxes

- Invest

- Collect retirement benefits

- Banking and other financial institution transactions

- Claims and litigation

- Safe-deposit box access

- Giving donations to individuals or charities

- Estate or business management

- Acquire, lease out, or dispose of property

- Issue out gifts

- Deal and handle motor vehicles

- Handle general healthcare issues

- Health Insurance Portability and Accountability

- Sue third parties

Pursue legal guardianship

You should consider pursuing legal guardianship in case you are unable to obtain this power yourself.

Check the requirements of your state

It is always important to act within the law. You should keep in mind that these agreements and powers governed by laws. Also, they may vary from state to state. Hence, it is important that you check the requirements of your states that manage such powers.

Execute

Fill out your state’s standard forms or financial institution’s custom forms after identifying an agent. Then, by having the written document notarized and witnessed, execute the Financial POA.

Proof-read your document

You have to proofread the document after filing the details. Check whether all the pieces of information you furnish are accurate or not.

Gather some witnesses

To vouch for your own agreement and decision, it is always important that you gather some witnesses.

Notarize the document

This is an optional steps but it is highly recommended to notarize the document to make it acceptable by the state.

Save the document

In the end, each party such as you, the principal, the witnesses, and the agent t should save a copy for yourselves.

Review the FPOA periodically

A FPOA should be made before you actually need it. Periodically reviewing the document together with your loved ones is highly suggested.

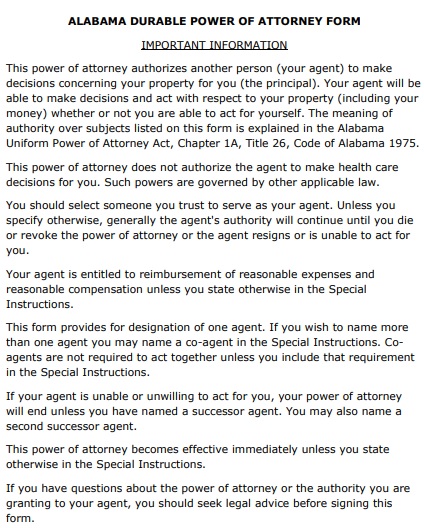

Alabama Durable Power of Attorney Form

Details

File Format

PDF

Size: (88 KB)

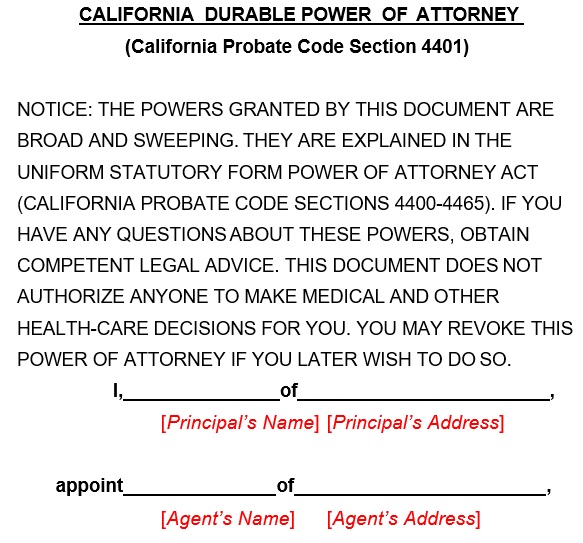

California Financial Power of Attorney Form

Details

File Format

Word (doc, docx)

Size: (53 KB)

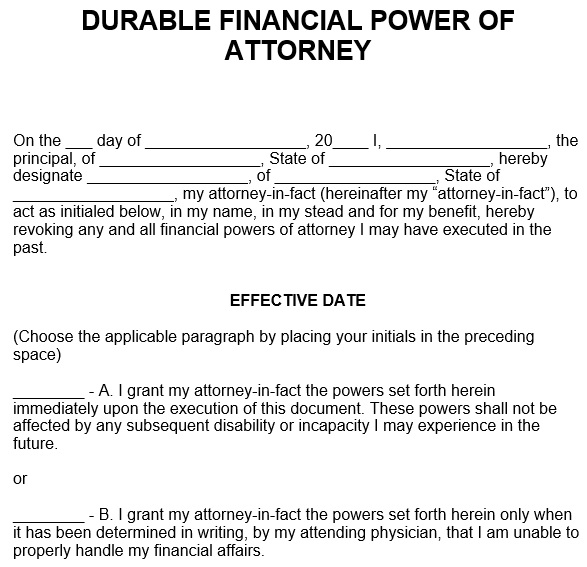

Durable Financial Power of Attorney Form

Details

File Format

Word (doc, docx)

Size: (65 KB)

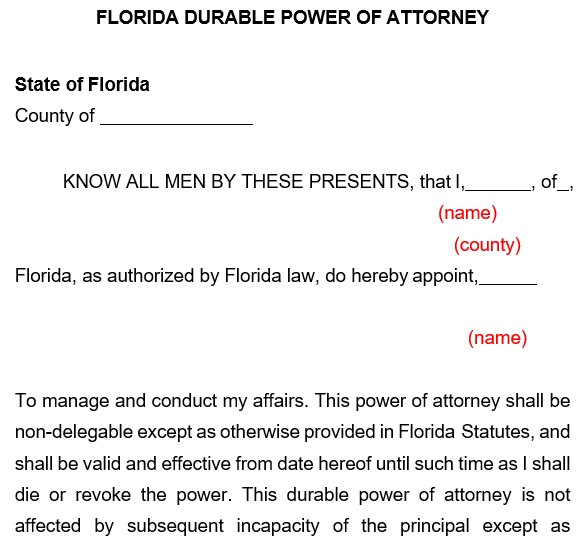

Florida Durable Power of Attorney Form

Details

File Format

Word (doc, docx)

Size: (40 KB)

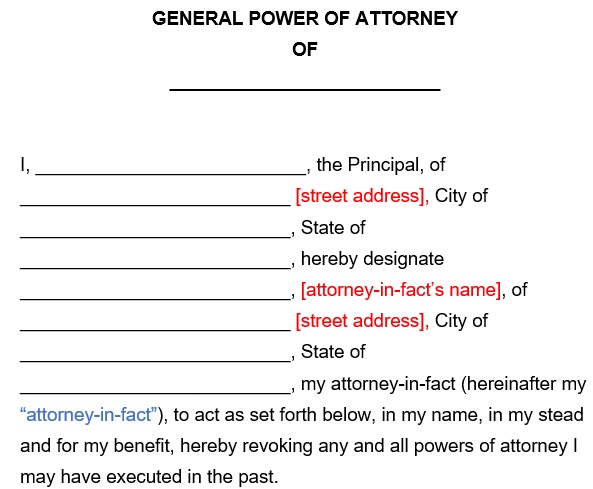

General Power of Attorney Form

Details

File Format

Word (doc, docx)

Size: (22 KB)

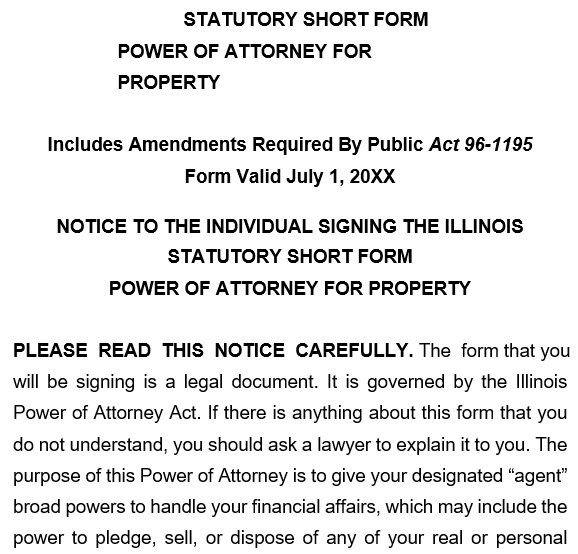

Illinois Financial Power of Attorney Form

Details

File Format

Word (doc, docx)

Size: (65 KB)

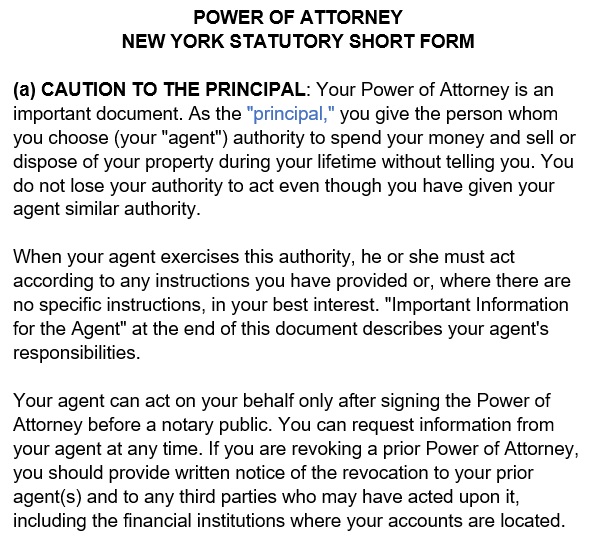

New York Financial Power of Attorney Form

Details

File Format

Word (doc, docx)

Size: (26 KB)

Conclusion:

In conclusion, a financial power of attorney form should be legally binding in order to be effective. This form should be witnessed at the time of signing. In this whole process, the first and most essential step should be filling out your state’s official form.

Sharing is caring!

![Free Letter of Support Template [Word]](https://exceltmp.com/wp-content/uploads/2021/02/letter-of-support-template-150x150.jpg)