Managing payroll in Australia requires strict compliance with Fair Work laws and transparency between employers and employees. One of the most essential documents in this process is the payslip. A well-structured Australian payslip template ensures accuracy, legal compliance, and smooth financial management for any business.

In this post, we’ll explore everything you need to know about payslip templates in Australia — including what they are, what to include, how to design them in Excel or Word, and why every employer should use a professional format.

Table of Contents

What Is an Australian Payslip?

Importance of a Payslip in Australia

1. Legal Compliance

2. Transparency

3. Taxation and Record Keeping

4. Proof of Employment

What Is an Australian Payslip Template?

An Australian payslip template is a pre-formatted document or spreadsheet designed to simplify the payroll process. It contains all legally required fields and ensures that every payslip issued is complete and compliant.

- Microsoft Excel

- Microsoft Word

- Google Sheets

- PDF format

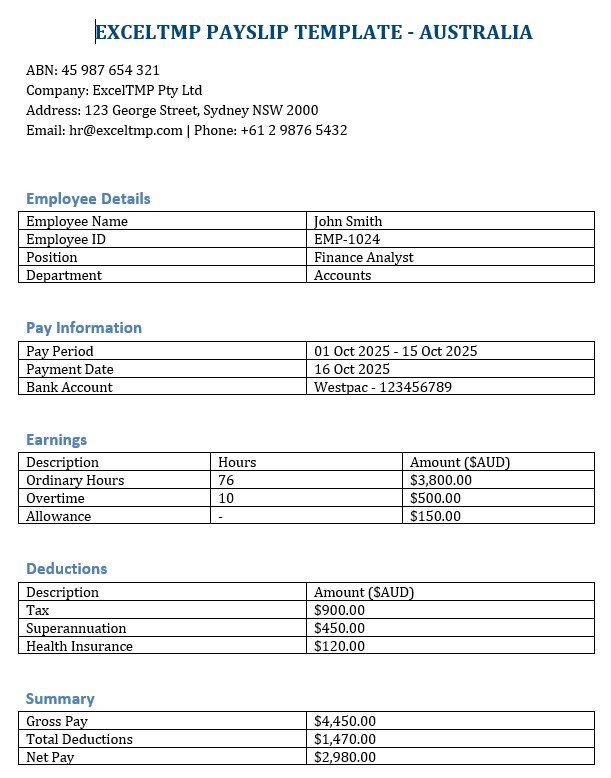

Key Components of an Australian Payslip Template

1. Employer Details

- Business name

- ABN (Australian Business Number)

- Contact details

2. Employee Details

- Full name

- Employee ID or payroll number

- Job title or position

3. Pay Period Information

- Start and end date of the pay period

- Payment date

4. Earnings

- Gross pay (before deductions)

- Hourly rate or salary

- Number of ordinary hours worked

- Overtime hours and rates

- Allowances or bonuses (if any)

5. Deductions

- Income tax (PAYG withholding)

- Superannuation contributions

- Other deductions (union fees, insurance, etc.)

6. Net Pay

7. Superannuation Details

- Name of the super fund

- Employer contribution amount

8. Leave Balances (Optional but Recommended)

- Annual leave

- Sick leave

- Long service leave

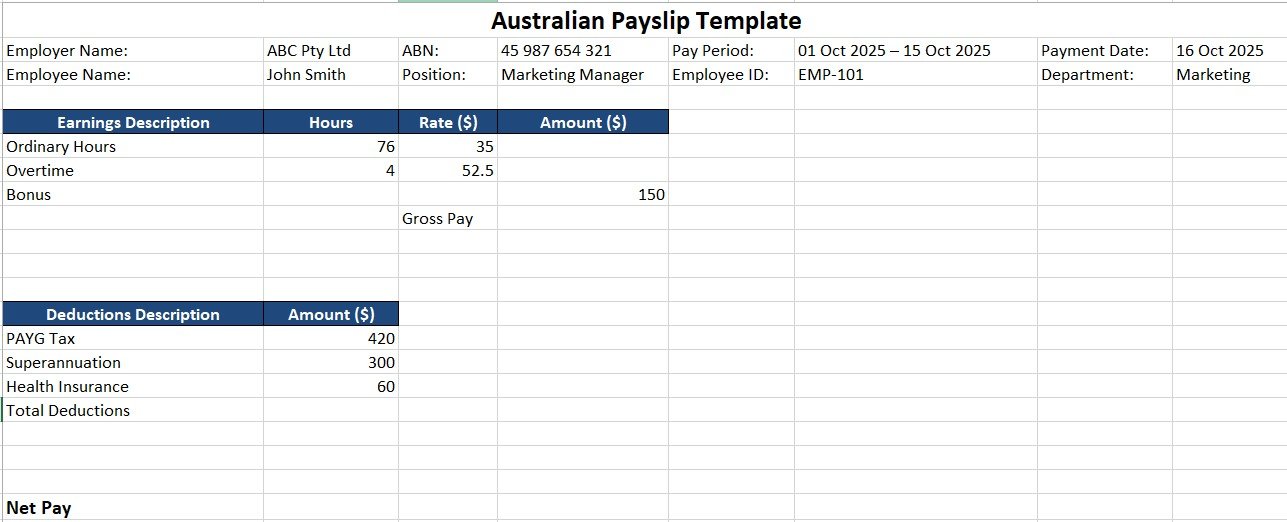

🧮 Example of an Australian Payslip Format

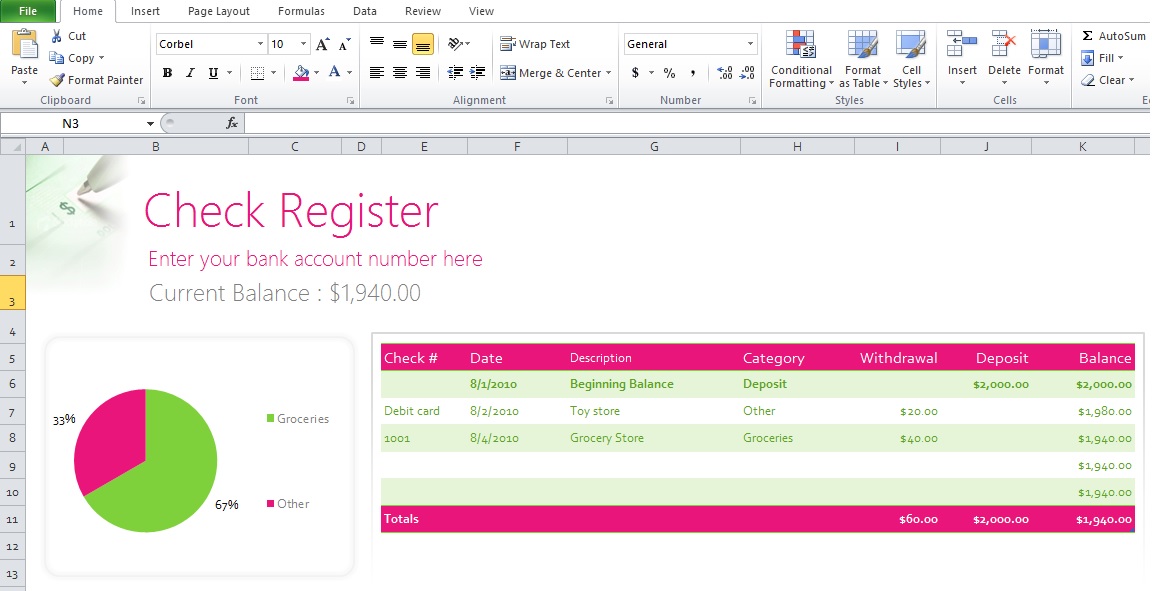

Here’s a simple visual example of how an Australian payslip template might look in Excel or Word:

| Payslip for: | John Smith | Pay Period: | 01 Oct – 15 Oct 2025 |

|---|---|---|---|

| Employer: | ABC Pty Ltd | ABN: | 45 123 456 789 |

| Position: | Marketing Manager | Payment Date: | 16 Oct 2025 |

| Hours Worked: | 76 | Hourly Rate: | $35.00 |

Earnings Summary

| Description | Hours | Rate | Amount |

|---|---|---|---|

| Ordinary Hours | 76 | $35.00 | $2,660.00 |

| Overtime | 4 | $52.50 | $210.00 |

| Gross Pay | $2,870.00 |

Deductions

| Description | Amount |

|---|---|

| PAYG Tax | $430.00 |

| Superannuation | $286.00 |

| Health Insurance | $50.00 |

| Total Deductions | $766.00 |

Net Pay: $2,104.00 (Transferred to employee’s bank account)

Benefits of Using an Australian Payslip Template

1. Saves Time

2. Reduces Payroll Errors

3. Ensures Legal Compliance

4. Professional Presentation

5. Easy Record Management

Different Types of Australian Payslip Templates

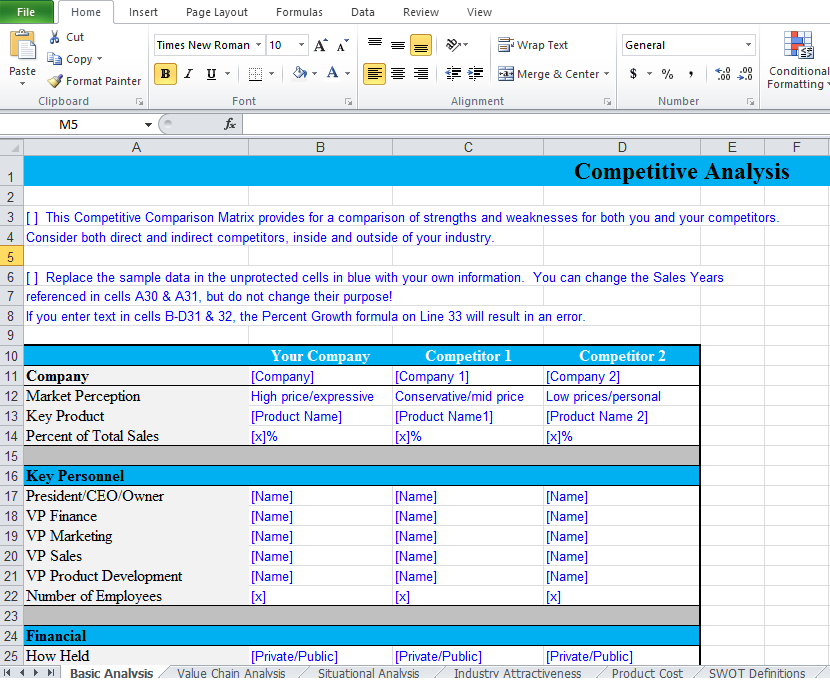

1. Excel Payslip Template

2. Word Payslip Template

3. PDF Payslip Template

4. Google Sheets Payslip Template

5. Automated Payroll Software Templates

Common Mistakes to Avoid When Preparing Payslips

- ❌ Forgetting to include the ABN

- ❌ Not showing superannuation contributions

- ❌ Missing pay period or payment date

- ❌ Incorrect tax or deduction calculations

- ❌ Failing to issue payslips within one working day of payment

Avoiding these errors ensures compliance with Fair Work laws and maintains employee trust.

Fair Work Requirements for Australian Payslips

Under Fair Work Regulation 2009, an employer must:

- Issue a payslip within one business day of paying an employee

- Provide payslips in electronic or paper format

- Include all mandatory details (earnings, deductions, super, etc.)

- Keep employee records for at least seven years

Failure to comply can result in fines or legal action from the Fair Work Ombudsman.

Uses of an Australian Payslip

- Proof of employment for loan or visa applications

- Tax return filing

- Superannuation reconciliation

- Payroll audits

- Financial management and budgeting