The bank deposit slip template gives you a more streamlined method for making the store slips yourself at home or in office. A report to be filled by a client, customer, or whatever another individual with regards to store money or a budgetary instrument for a clear design is perceived as store slip. We as a whole every day fill and submit store slips for an assortment of reasons.

For instance, we fill a bank store slip to store money or some other budgetary instrument in the financial balance. It makes the way toward keeping cash simpler and streaming since it gives every essential detail at a place like name of the contributor, estimation of the store, the reason for store and record number, and so forth. You may also like salary slip format in excel.

Table of Contents

What is a Bank Deposit Slip?

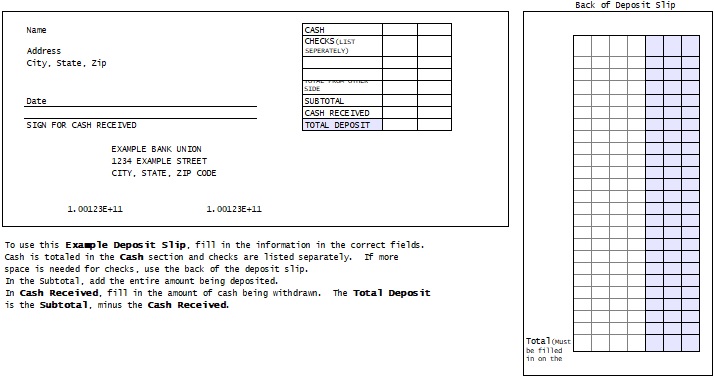

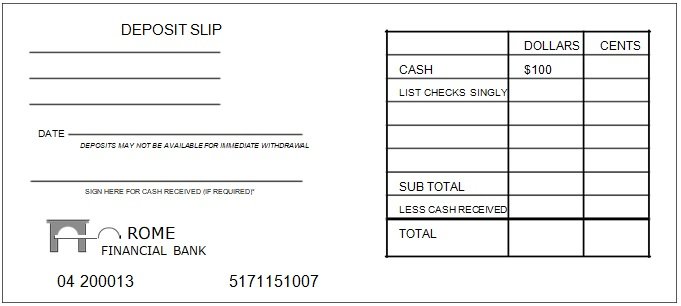

A bank deposit slip is a document used when depositing money—whether cash or checks—into a bank account. It serves as a formal record of the transaction between the depositor and the bank. The deposit slip usually includes:

- Date of deposit

- Account holder’s name and account number

- Details of the deposit (cash, checks, or both)

- Total amount being deposited

- Signature of the depositor

The teller uses this slip to verify the deposit and process it accurately. Once the transaction is complete, a copy of the deposit slip is returned to the depositor as proof of the deposit.

Importance of a Bank Deposit Slip Template

A bank deposit slip template simplifies the process of preparing and recording deposits. Instead of writing slips manually each time, you can use a pre-designed template to fill in relevant details quickly.

Here’s why it’s important:

1. Accuracy and Record-Keeping

Using a deposit slip template reduces human errors that might occur when handwriting multiple deposits. It ensures all fields are filled correctly, keeping the transaction details consistent and accurate.

2. Professional Appearance

Businesses that frequently deposit cash or checks benefit from using a professionally designed deposit slip template. It conveys credibility and helps maintain a standardized record for financial documentation.

3. Time Efficiency

Instead of requesting new slips at the bank every time, a printable or digital deposit slip template can be reused, saving time and effort—especially for businesses handling numerous transactions.

4. Easy Reconciliation

Deposit slips are vital for reconciling bank statements. They help verify whether deposits made have been credited accurately to the account.

5. Legal and Audit Purposes

Deposit slips serve as legal evidence of a financial transaction. In case of discrepancies, they can be used as proof of payment during audits or investigations.

Example Layout of a Deposit Slip Template

Here’s what a simple bank deposit slip template layout might look like:

-----------------------------------------------

BANK DEPOSIT SLIP

-----------------------------------------------

Bank Name: ________________________________

Branch: ___________________________________

Date: ______________________________________

Account Holder Name: _______________________

Account Number: ____________________________

CASH DEPOSIT:

-----------------------------------------------

Notes & Coins: ___________ | Amount: ________

CHECK DEPOSIT:

-----------------------------------------------

Check No. | Bank Name | Amount

-----------------------------------------------

_________ | __________ | ________

_________ | __________ | ________

TOTAL DEPOSIT: _____________________________

Depositor Signature: _______________________

Teller Signature: ___________________________

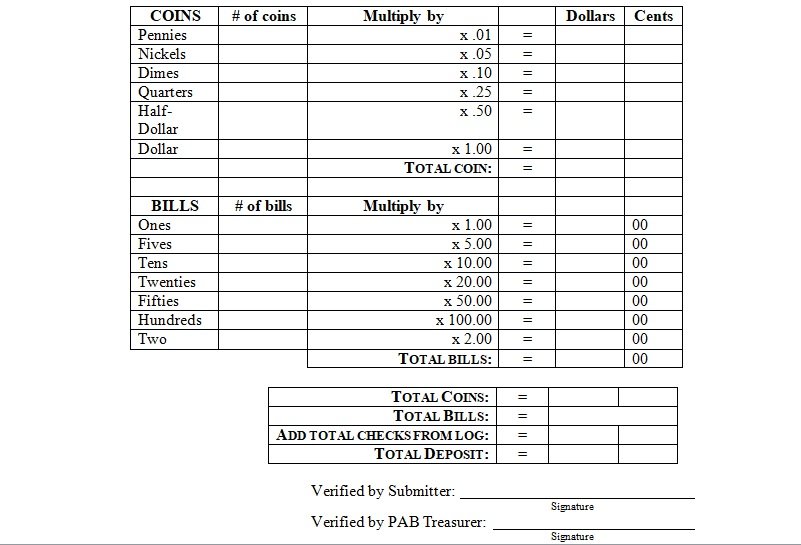

-----------------------------------------------Bank Deposit Slip Template Word Free Download

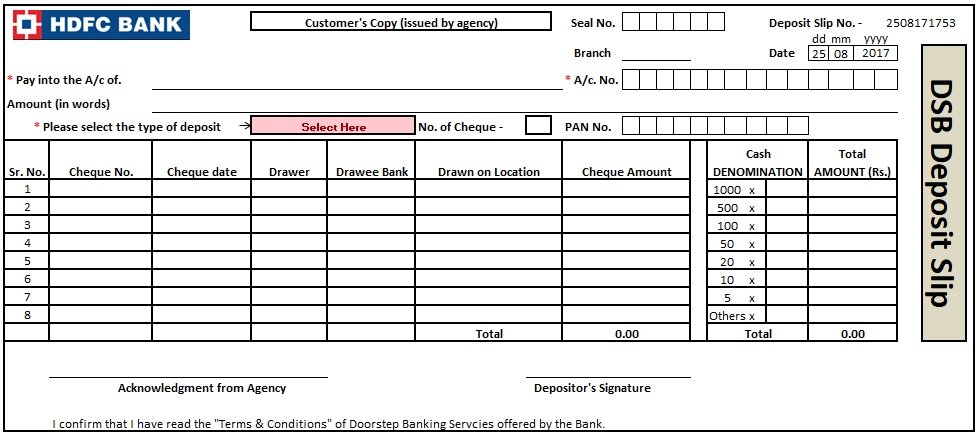

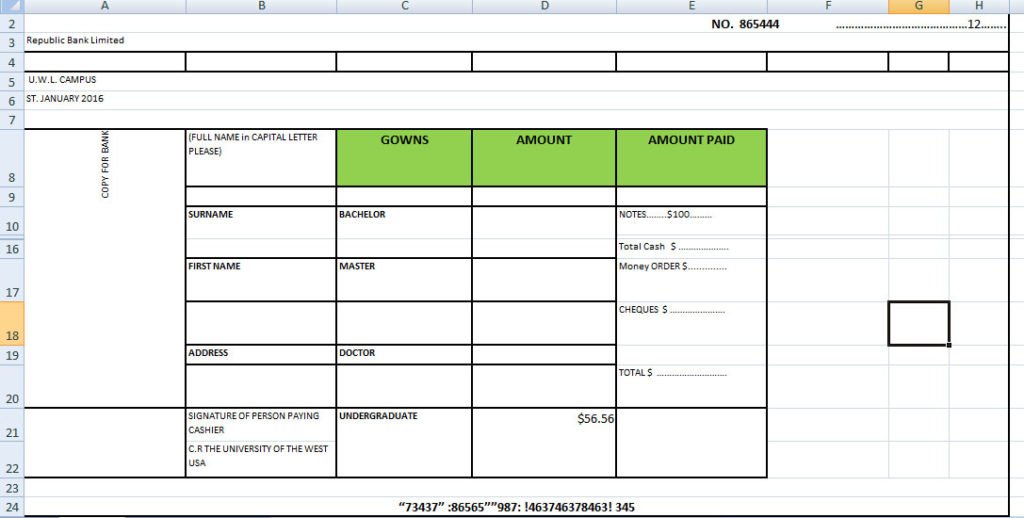

HDFC Bank Deposit Slip Template Excel

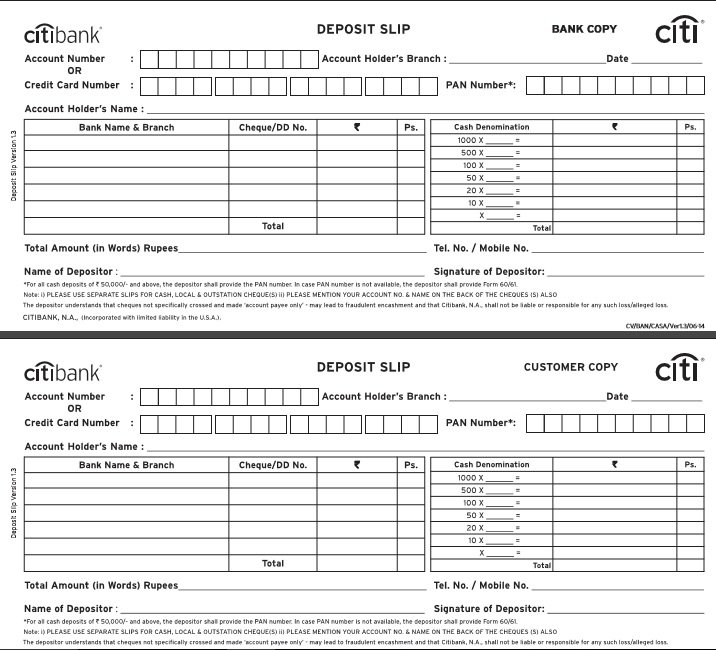

CitiBank Deposit Slip Template in PDF Format

Proper investigation and recording cash kept into the financial balance is a basic vital component of the bookkeeping procedure. In that case, the saving money slip is an imperative bookkeeping source report.

However just the “stub” is held by the individual in case of taking the cash to the bank, the fundamental part is kept by the bank, it is possible to ask for a duplicate from the bank at a later stage. Although banks will for the most part charge an expense for this administration. You may also see the PayPal invoice template.

Regardless of whether you’re saving money, coins, or checks, utilize this bank deposit slip template for your business; it will be able to manage an account’s needs. It is a simple to-utilize bank slip format that will make excursions to the bank faster and easier. The most amazing element of this sheet is that you can download this bank deposit slip totally free.

There is strict control keep up in the banks over operations and exchanges, but with this slip, you can save the record of your account by yourself. Another hand, in the event that any other person is doing for your benefit, you can play out this by rounding out the bank deposit slip format. This slip format can serve a wide range of money related requirements.

Components of a Standard Bank Deposit Slip Template

A well-designed deposit slip includes several key elements. Each section plays a specific role in identifying and validating the transaction:

1. Bank Information

This section usually includes the bank’s name, branch, and address. It helps identify where the deposit was made.

2. Account Holder Information

Here, the depositor’s name, account number, and sometimes the address or contact information are provided.

3. Date of Deposit

The date ensures chronological record-keeping and simplifies tracking deposits for reconciliation or auditing.

4. Cash Deposit Section

This portion specifies the amount of cash (notes and coins) being deposited.

5. Check Deposit Section

If depositing checks, each check’s details—such as check number, bank name, and amount—are listed individually.

6. Total Deposit Amount

At the bottom, the total deposit (cash + checks) is calculated and mentioned clearly.

7. Signature Field

The depositor signs here to confirm the details are correct before handing it over to the teller.

8. Teller Verification

Once processed, the teller stamps or signs the deposit slip, completing the transaction.

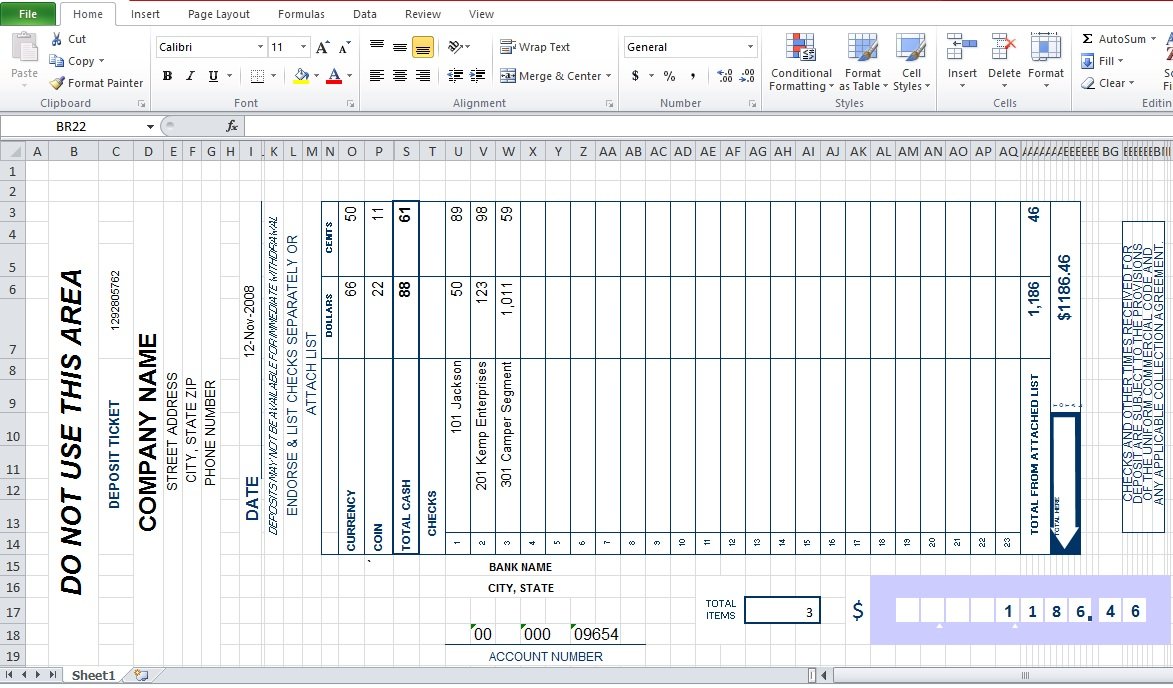

Exceed expectations Template for Banking:

There is a need to utilize bank deposit frames that are given by the bank in the event that you can make a substitute yourself. An exceed expectations spreadsheet can be utilized to make a bank deposit shape. This slip has many favorable circumstances:

- The Excel spreadsheet is very effective and adds up to your saving money.

- The Excel spreadsheet can be held as an electronic record of keeping money.

- You can take the printout of the Excel spreadsheet that the bank will acknowledge as a bank deposit slip.

Types of Bank Deposit Slip Templates

Deposit slip templates vary based on their purpose and format. Below are the most commonly used types:

1. Personal Deposit Slip Template

Ideal for individual account holders who deposit cash or checks occasionally. It includes basic details like account number, date, and total deposit amount.

2. Business Deposit Slip Template

Designed for organizations and companies that manage multiple transactions daily. These templates may include columns for multiple checks, cash denominations, and a company logo.

3. Multiple Account Deposit Slip

Useful for individuals or businesses depositing into different accounts at the same bank. The template provides separate sections for each account.

4. Excel Deposit Slip Template

An Excel deposit slip template allows automatic calculations of totals. It’s ideal for businesses that frequently deal with bulk deposits and want a digital record.

5. Printable Deposit Slip Template (PDF or Word)

Printable templates are convenient for offline use. You can fill them digitally or print and fill them manually before visiting the bank.

Printable Deposit Slips Template Excel

Advantages of Bank Deposit Slip Template

While storing money for your business’ ledger, make certain to utilize this deposit slip. The layout is flexible, it will enable you to put your business’ name and address at the best. This Excel format is sufficiently flexible for any size business. You’ll soon find that these advantageous store slips improve your budget exchanges and make it easier to deal with your cash every day. This layout is easy to utilize and simple to examine, so you’ll invest less energy and additional time going to different business matters. No doubt this bank deposit slip layout for Excel, you’ll see that numerous different formats and outlines that can rearrange your business. You may also check the purchase order template.

There is strict control keep up in the banks overall these phenomena, in this manner on the off chance that you are saving any sum in the record yourself. As a matter of first importance, the best utilization of paper is the guarantee, as three duplicates are created for each store slip. In the event that you can check online records for the exchange too.

Uses of Bank Deposit Slip Template Excel

- It is used as a part of all fields of life.

- When you go for a bank to store trade out your financial balance you may not comprehend what data and points of interest they need to know.

- Finish the saving procedure yet bank store slip disclose to you each and everything in nitty-gritty way.

- A Slip format is a little sheet of paper containing crevices to fill or with completely filled data.

- It goes about as a rule to the client to enter the fundamentally required detail, which could be as short notes and review.

- Diverse associations get ready to separate formats for particular applications. Contingent upon the data, a slip could be transcribed or printed.

- Paper slips are a noteworthy spare and a need in any cutting edge association. In view of the data to be filled in, slip layouts are of different sorts in any association.

Paper slips are a noteworthy spare and a need in any cutting edge association. In view of the data to be filled in, slip layouts are of different sorts in any association.

It requires the client to fill the data about the representative’s fundamental pay, less any findings done on the wages lastly demonstrate the net pay. These pay layouts shift, and they are refreshed each month in light of the revisions and individual pay alterations. You may also like the rent payment tracker spreadsheet.

Take the instance of an understudy, who is leaving a foundation, It must be filled and properly marked. It shows the motivation behind why the understudy is leaving and the normal date of return. For instance, at whatever time the understudy leaves the foundation, the individual in control must fill the layout.

Bank deposit slip template excel (XLS) is additionally alluded to as a waybill format. When sending packages starting with one area then onto the next, this is for the most part utilized. Slip layout can either be pre-printed or manually written, bolstered with the data at the season of sending the package. You may also like Printable Quickbooks Deposit Slip Template.

The points of interest to be filled incorporate the name, postal and physical address, the organization, and whatever other significant particulars of the sender and collector of the bundle. Vital to note is that the slip format must contain the subtle elements of the dispatch organization as the header.

Generic Deposit Slip Template

Free Printable Deposit Slips Example

Features of Bank deposit Slip Template

Here are some fundamental elements of this deposit slip making it to a great degree valuable:

- The bank deposit slip format is accessible in the single spreadsheet; still, you can see any data in the particular range.

- According to the client’s point of view, it will be filling effectively by the client.

- It is the most critical bit of paper in regard to certain exchanges made in a particular record.

- Make changes as required for customization.

- Certain activities require a legitimate authorization, and this would now be able to get this format.

How to Fill Out a Bank Deposit Slip Correctly

Even when using a template, accuracy is key. Follow these steps when filling out your deposit slip:

- Write the Date: Always start by entering the current date.

- Add Account Information: Write the name and account number clearly.

- List Cash Deposits: Enter the total cash being deposited (notes and coins separately if required).

- List Check Deposits: Write each check number and amount separately.

- Calculate the Total Deposit: Add up all amounts for the total.

- Sign the Slip: Confirm that the details are correct with your signature.

- Submit to the Teller: Hand over the slip with the cash or checks.

- Retain the Receipt: Always keep your copy for records or reconciliation.

Benefits of Using a Deposit Slip Template for Businesses

1. Enhances Financial Tracking

2. Reduces Manual Errors

3. Improves Audit Readiness

4. Increases Staff Productivity

5. Promotes Professionalism

Tips for Using Deposit Slip Templates Effectively

- Keep digital and printed copies for security and easy reference.

- Use formulas in Excel templates for automatic total calculation.

- Include your business logo for branding consistency.

- Double-check account numbers to avoid transaction errors.

- Record each deposit immediately to maintain accurate financial tracking.

Conclusion

A bank deposit slip template is a simple yet essential financial document that ensures accuracy, accountability, and convenience in handling deposits. Whether you’re an individual managing personal finances or a business dealing with multiple transactions, using a pre-designed deposit slip template can save time, reduce errors, and keep your records organized.

FAQs:

What is a deposit slip used for?

A deposit slip is used to record and verify the details of a deposit made into a bank account. It serves as proof of payment and helps both the depositor and bank keep accurate records.

Can I make my own bank deposit slip?

Yes, you can create your own using Microsoft Excel, Word, or Google Sheets. Just make sure to include all essential details like date, account number, deposit type, and total amount.

What should I include in a deposit slip template?

Include your bank details, account number, depositor’s name, date, deposit breakdown (cash and checks), total amount, and signature fields.

Why should businesses use a deposit slip template?

Businesses benefit from deposit slip templates because they improve accuracy, simplify bookkeeping, and provide a professional appearance for financial documentation.

Is a deposit slip mandatory for all deposits?

Most banks require a deposit slip for in-branch cash or check deposits. However, online or ATM deposits may not require one.

What happens if I make a mistake on my deposit slip?

If the slip hasn’t been submitted yet, simply correct it neatly or fill out a new one. Once submitted, you’ll need to notify the teller immediately to rectify the issue.

Can I reuse a deposit slip template?

Absolutely. Digital templates can be reused indefinitely, allowing you to maintain consistency and save time for future deposits.

![Personal Service Contract Template [Word, PDF]](https://exceltmp.com/wp-content/uploads/2021/08/free-personal-service-contract-template-150x150.jpg)