You need a signed ACH authorization form while collecting payments on the ACH (Automated Clearing House) network. This form authorizes your business to charge or refund the customer’s bank account.

Table of Contents

What is an ACH authorization form?

An ACH authorization form is a legal agreement between a payer and a payee required while executing an ACH payment. This document specifies the payment terms between the parties that occur using the ACH network. An ACH payment is basically a type of electronic funds transfer that allows bank-to-bank transfer. Furthermore, your business will receive timely payments because of ACH transfers.

The importance of an ACH authorization form:

It is important to have an ACH authorization form while collecting payment directly from a customer’s bank account especially if more than one payment is going to occur. This document makes the payment process much more reliable for the parties.

In addition, the payer’s bank will ask for evidence of authorization from the payee in case a customer questions a debit on their bank account. With the help of this form, it would be easy to distinguish between genuine transactions and fraudulent activity.

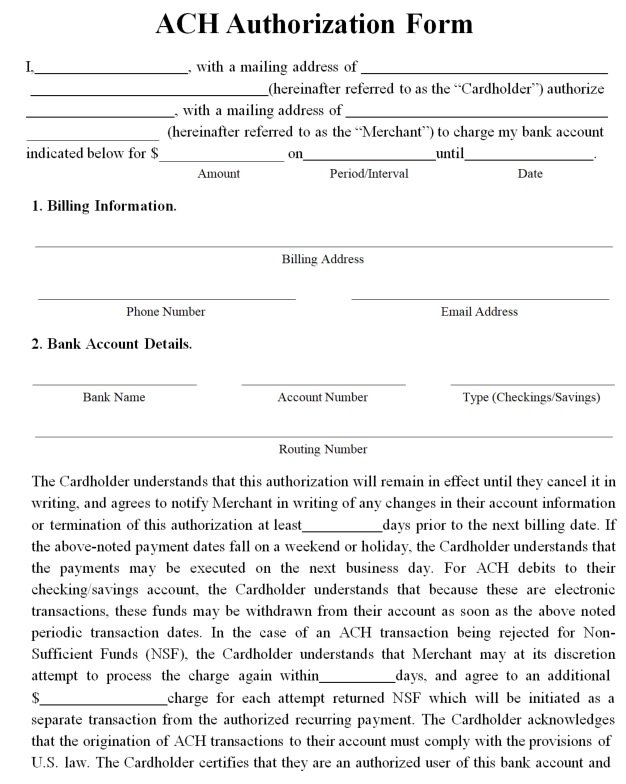

What to include in an ACH authorization form?

An ACH authorization form must include the following details;

- Signature of the accountholder of the bank account (payer)

- A statement acknowledging the permissions given to the ACH payee to debit/credit the payer’s account.

- The amount debited or credited

- Expected time that indicates when the transaction will occur

- Include the terms under which the evidence of authorization might be revoked

- Billing details such as routing number, account number, and financial institution

- Contact details of the payee

Filling out an ACH authorization form:

It is relatively a simple process to fill out an ACH authorization form. You can do this by downloading a prepared form online or ask a lawyer to make and complete the template for you. After printing the form, give it to the client with some or all the necessary information prefilled. However, you can leave blank spaces so that the customer can fill in themselves. Consider the following steps while filling out the form;

- Download and print the form

- Specify how often the payments should be

- Give the personal information requested by the form

- Input billing details required to process payment

- Sign and date the form

Different types of ACH authorization forms:

Here are the two main types of ACH authorization forms;

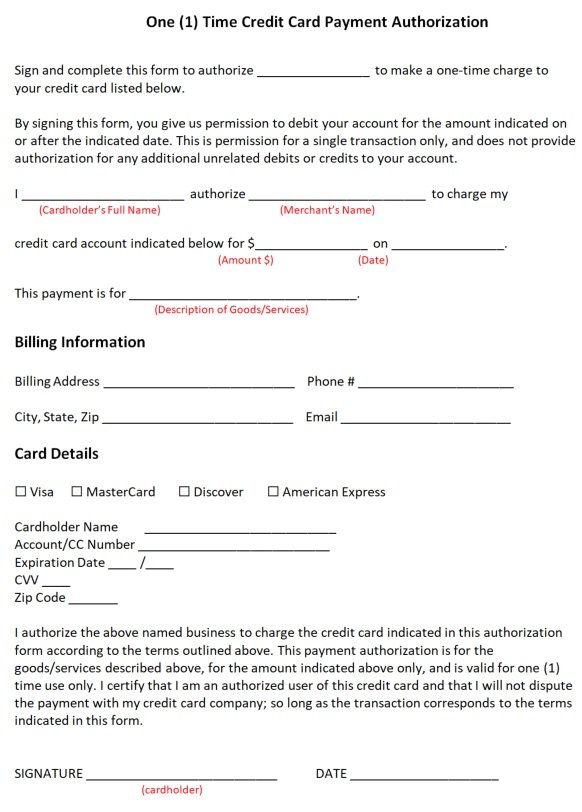

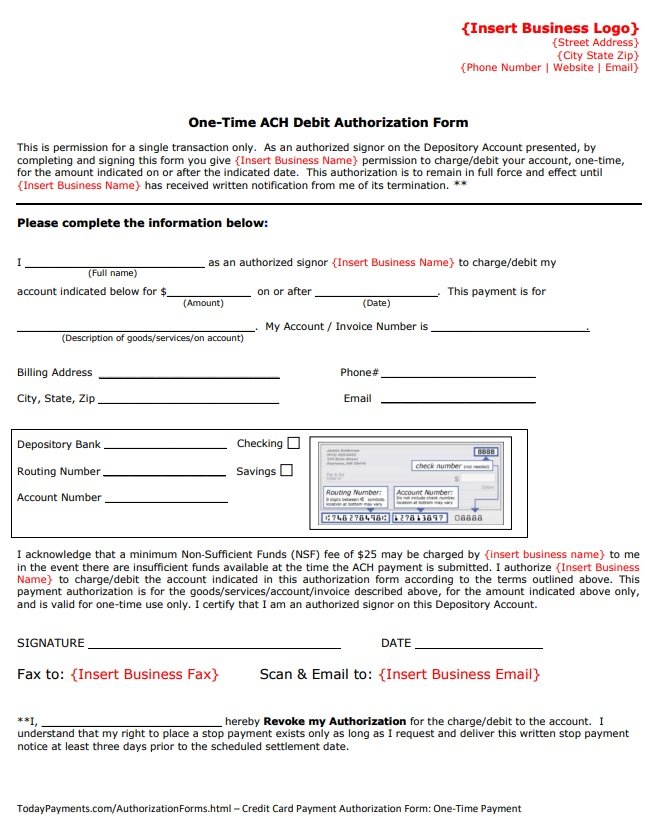

Time ACH Authorization

This type of ACH authorization form comes in handy when a single deduction of an agreed amount is taken from a person’s bank account. This allows a payment to be confirmed in a later transaction on a specified date.

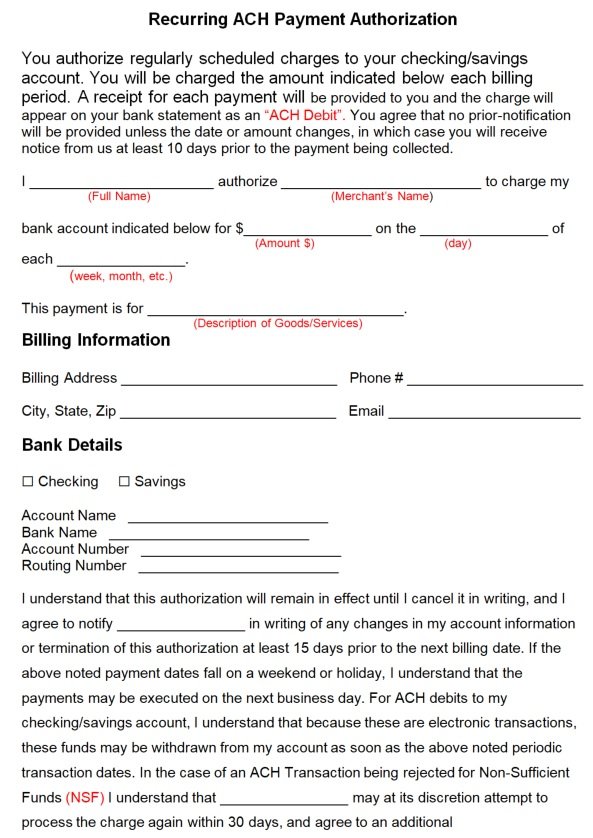

Recurring ACH Authorization

A recurring ACH authorization form allows you to take money on a weekly or monthly basis. Subscription-based businesses usually use this form to make regular payments to someone.

airline credit card authorization form

free printable ach authorization form

hotel credit card authorization form

one (1) time credit card payment authorization form

one time ACH debit authorization form

recurring ach payment authorization form

FAQ’s

Do you need an ACH authorization form?

If you want to collect payment directly from a customer’s bank account then you need an ACH authorization form. With the help of this document, the client gives clear consent for the payment.

How to receive an ACH payment?

The payee has to complete an ACH authorization in order to receive an ACH payment. This form lets the bank know that you have authorization to deduct money from the individual’s account directly. You can carry out transactions when the form has been completed.