A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. The charity organization should provide a receipt and fill in their details and a description of the donation in the receipt.

Table of Contents

Why receipts are compulsory?

For the donor’s side:

- The most basic reason is record keeping. The donor should have a record of his/her donations. Moreover, it also assists in keeping a record of his/her financial usage.

- It serves as a communication tool as it provides the donor feedback on his/her donation. It makes sure that their donation was received and accepted.

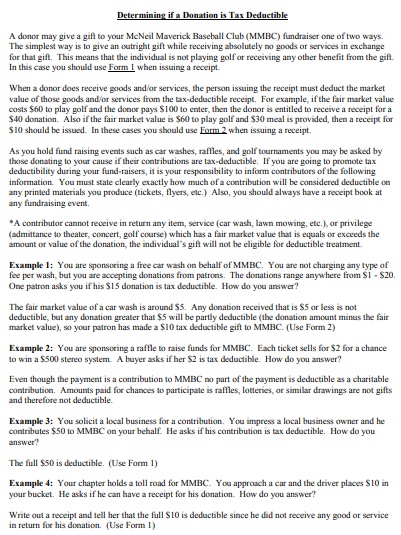

- With the help of this receipt, the donor claims a tax deduction on their federal tax return.

- By receiving the receipt, the donors feel that their struggles have been acknowledged by the organization.

For nonprofits:

- For nonprofits, it also helps in keeping account of finances or other donations received. This also enables the nonprofits to make an accurate end of year/term financial records.

- It is a legal requirement that for donations worth $250 or more then nonprofits have to give a receipt to the donor.

- The receipt helps in keeping a record of their donors. In this way, they can keep track of their donation history.

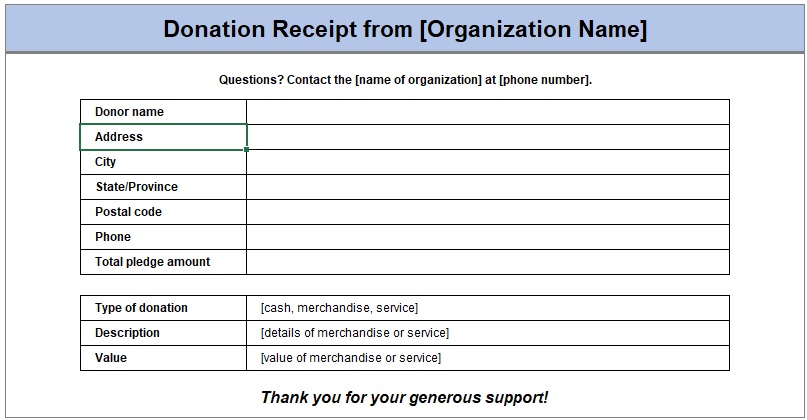

Format of a nonprofit receipt:

The word donation:

At the top of the nonprofit receipt, this word must be included. It indicates that it is a donation receipt.

Details of nonprofit organization:

This section contains the organization logo, name, federal tax ID number, and a statement that clarifies the organization is registered. Include a statement that states the receipt was given because of a donation given to help the nonprofit organization.

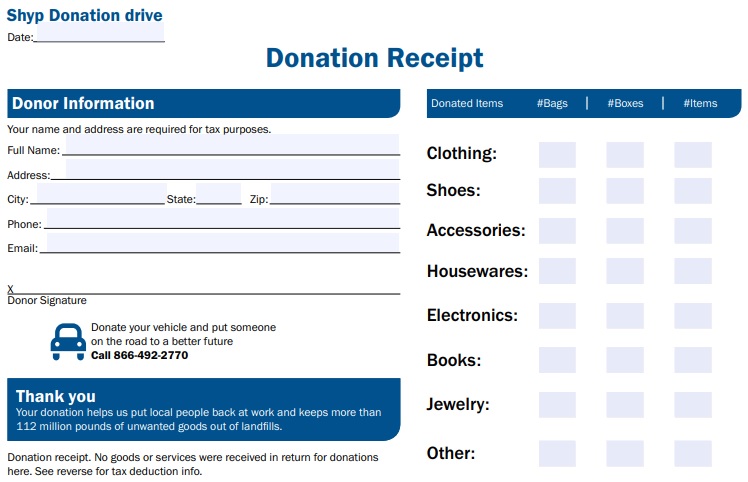

Details of the donor:

This part has the name of the donor, address, email, and any other donor’s details.

Date:

The date that when the donation was received by the organization.

Donation description:

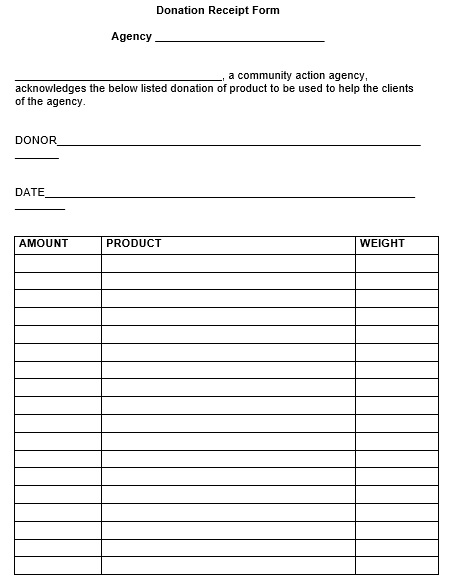

It is the most important section and has laid in rows and columns. Here organization describes the donation received. Furthermore, the organization has no rights to indicate the monetary value of the items. It’s the duty of donor to show the value of the items donated.

Added information:

In this part, the nonprofit includes either the donor received a token for the donation or not. In return, if no goods or services were offered they must say no and if provided then organization indicates the value in good faith.

Signature:

In the end, affix the signature and provide the name that belongs to an authorized organization board member.

IRS laws for Non-profits to Issue Receipts:

If you donate worth more than $250 then you must receive a written document from the nonprofit organization. It helps in claiming a tax deduction. When you donate worth more than $75, you receive goods or services in exchange. You should receive a non-profit receipt with a written disclosure of the amount of the goods or services given in return.

When should nonprofit organizations give receipts?

- The amount of donation doesn’t matter; the organization must issue receipts to their donors. This assists the organization to keep a record of their donations and the details of the donor.

- As we mentioned above that it is a legal requirement to issue nonprofit receipts to the donors.

- It can be given if a donor requests a receipt.

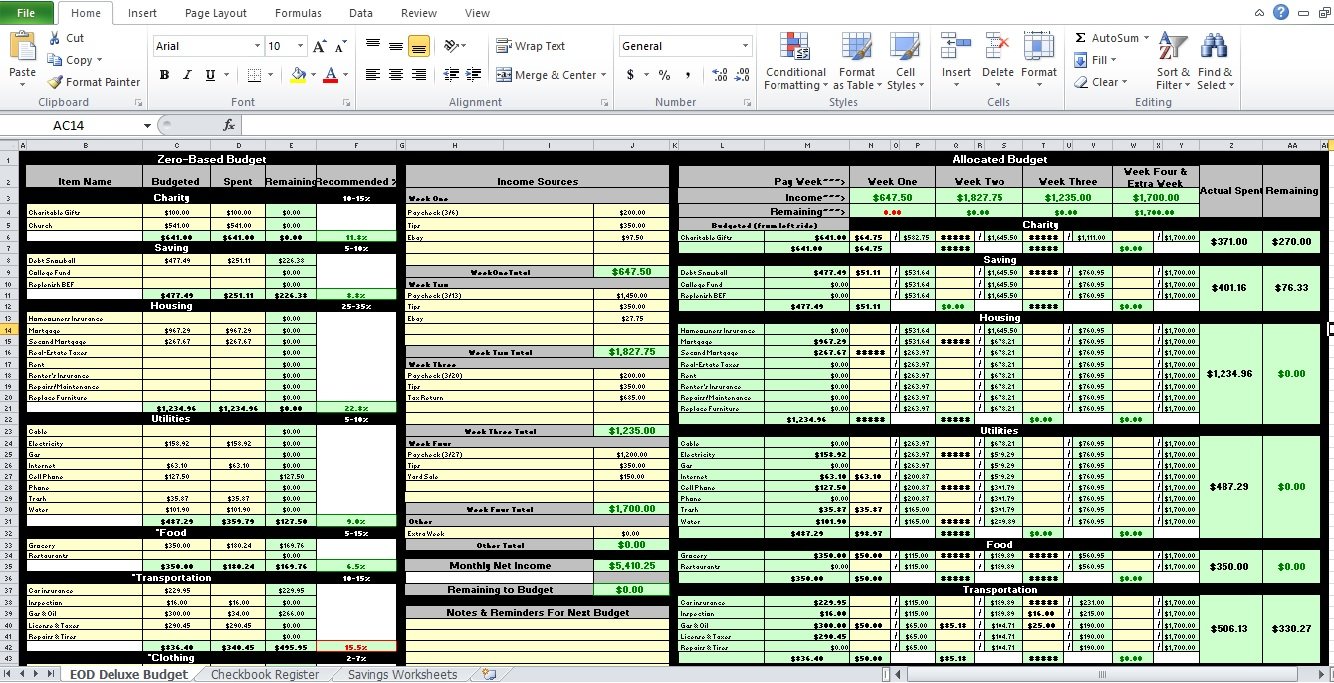

Free Donation Receipt Template Excel

Nonprofit Donation Receipt Form

Free Printable Donation Receipt Template

MMBC Receipt No Goods and Services Received By Donor

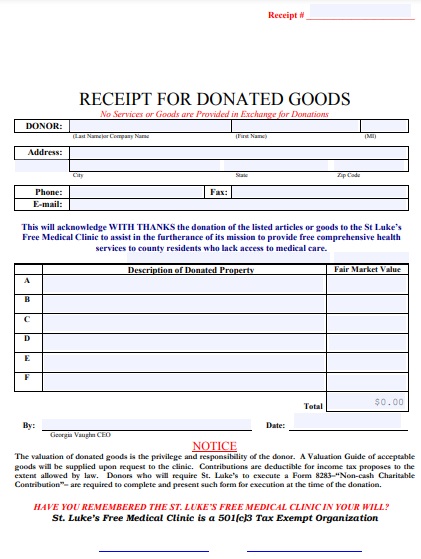

Receipt for Donated Goods Template

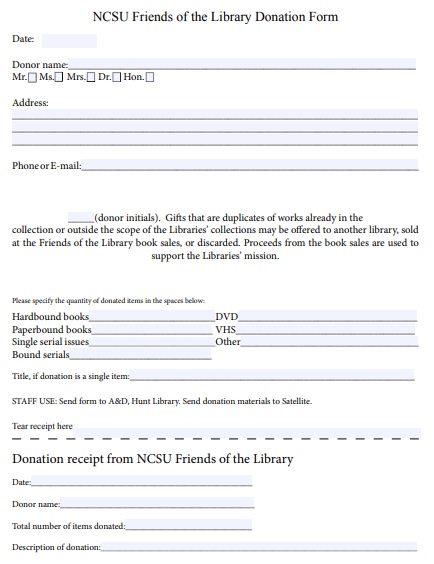

NCSU Friends of the Library Donation Form

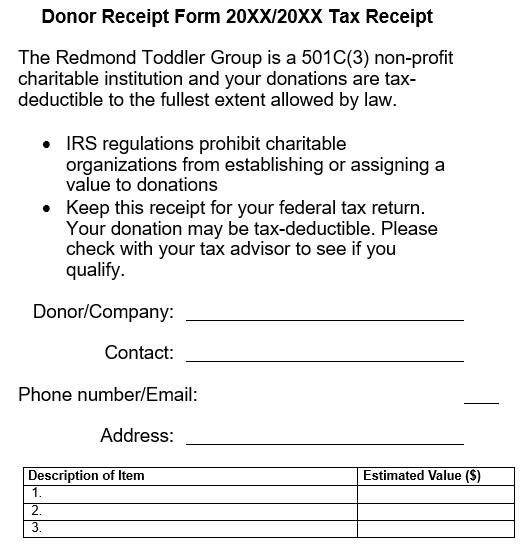

Donor Tax Receipt Template

Conclusion:

In conclusion, a nonprofit receipt template helps the nonprofit organization in drafting an effective nonprofit receipt. This receipt should contain all the important details. It is helpful for both the donor and the nonprofits. In addition, it helps the donor for claiming a tax deduction.