A New York last will and testament form is a legal document used to explain how your assets will be distributed after your death. A testator is an individual who makes the document. In New York, you must have your last will and testament in place in case you want to make sure that your children, spouse, or other heirs are cared for as you want.

Furthermore, a last will and testament in New York provides instructions how your property will be distributed between your dependents. Also, it determines who the guardian to look after any minor children. Last wills are used to distribute personal property, real estate, financial accounts, and fiduciary funds.

Table of Contents

Associated laws:

New York state law governs the creation and execution of a last will and testament within the state. The statues like estates, Powers, and Trusts specify the legal requirements of a valid last will. The definition of a last will and testament which is outlined in NY Est. Pow. & Trusts L § 1-2.19 (2014) must satisfy the document. A will made under 3-2.2 or 3-3.3 is a written instrument or oral declaration or codicil to be affected after death according to this provision of the law.

The basic rules and requirements of New York Last Will and Testament:

Let us discuss below the basic considerations of a valid last will in New York are;

Testator’s eligibility

To determine whether a testator is eligible, two factors are taken into account age and mental capacity. The testator must 18 years old and have mental capacity to comprehend the contents of the last will. Hence, it means that the testator must able to make informed decisions and mentally capable.

Executor’s eligibility

An executor must be at least 18 years old as per New York state law. Naming non-residents as executors is strictly prohibited by the law unless a co-executor who is a New York resident is also named. The law also prohibits to name executors who have past felonies, substance abuse issues, or who isn’t able to read or understand English.

Witnesses and notarization

In New York, the signatures of two witnesses are mandatory on the last will and testament forms. The witnesses have to sign the document within 30 days as well as the testator should also sign the will. You can also assign third party to sign the will on your behalf but they don’t count as a witness. The will should also contain the name and address of the third party. In addition, self-proved isn’t requirement for a last will and testament. You can’t challenge a self-proved last will and testament after the death of testator.

Handwritten and oral Wills:

You should write a last will and testament in New York. However, under specific conditions, state laws permit handwritten and oral wills. These conditions are as follow;

- During war or armed conflict, a testator should be a serving member of the armed forces. A year after discharge, it becomes not valid.

- The testator has to be serving or accompanying an armed force and become void after a year out of service.

- A will in which the testator has to be a mariner at sea becomes void three years after discharge.

Likewise a regular and typed last will, the handwritten and oral wills should be witnessed. You have to write the last will and testament without the help of an attorney if they can be used in the court. However, hiring an attorney may be worth the money in case you have a sizable and complex estate and require a comprehensive last will.

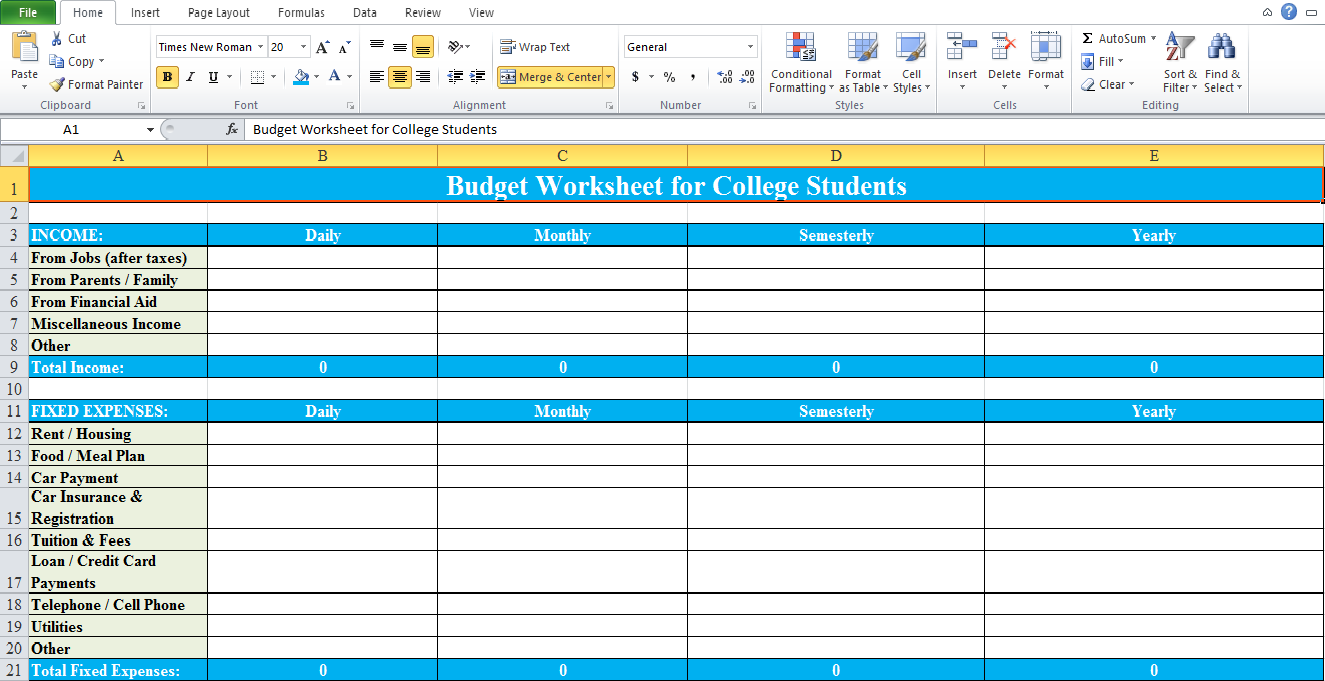

Printable New York Last Will and Testament Form

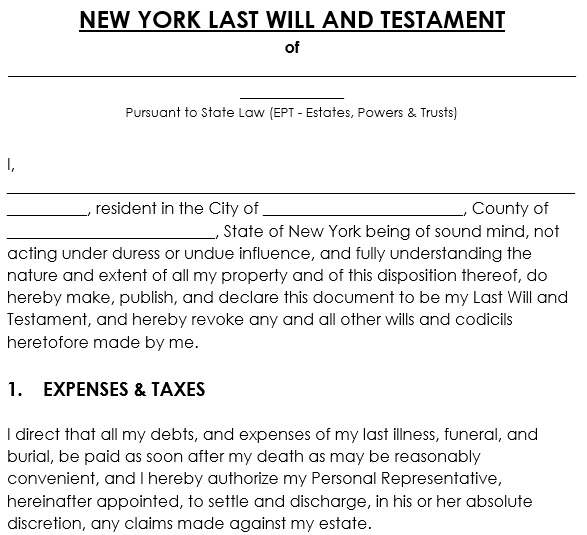

Free New York Last Will and Testament Template

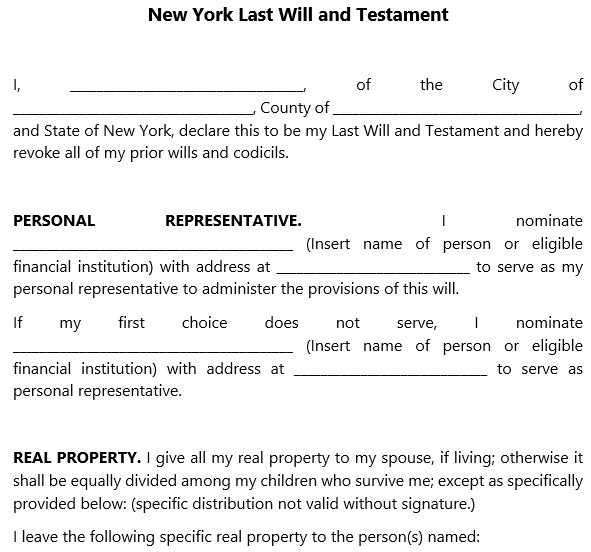

Sample New York Last Will and Testament Form

Conclusion:

In conclusion, a New York Last Will and Testament form protects your heirs from the stress of expensive court procedures for claiming their share of the estate. By having this document, you are free to name anyone you want as beneficiaries of your estate.

![Free Tenant Information Update Forms [PDF]](https://exceltmp.com/wp-content/uploads/2021/07/printable-tenant-information-update-form-150x150.jpg)

![Free Printable Certificate of Recognition Template [Word]](https://exceltmp.com/wp-content/uploads/2021/04/certificate-of-recognition-template-word-150x150.jpg)