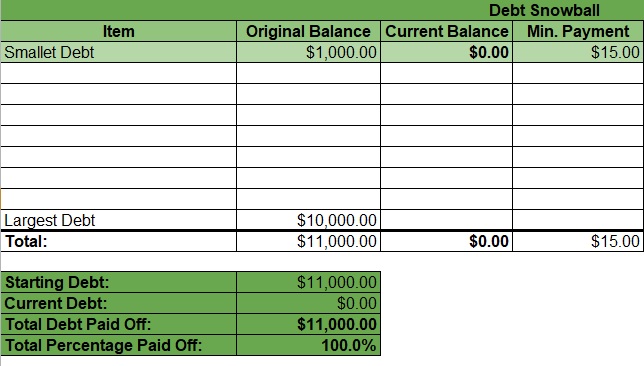

Debt snowball calculator template excel is a Debt lessening procedure, whereby one who owes on more than one record pays off the records beginning with the littlest adjusts in the first place, while paying the base installment on bigger obligations. Once the littlest obligation is paid off, one continues to the following somewhat bigger little obligation over that, et cetera, bit by bit continuing to the bigger ones later.

This technique is here and there appeared differently in relation to the obligation stacking strategy, likewise called the “obligation torrential slide technique”, where one pays off records on the most astounding financing cost first. The obligation snowball strategy is frequently connected to reimbursing rotating acknowledge —, for example, MasterCard. Under the strategy, additional money is committed to paying obligations with the littlest sum owed. You may also like Credit Card Payoff Calculator Template.

Table of Contents

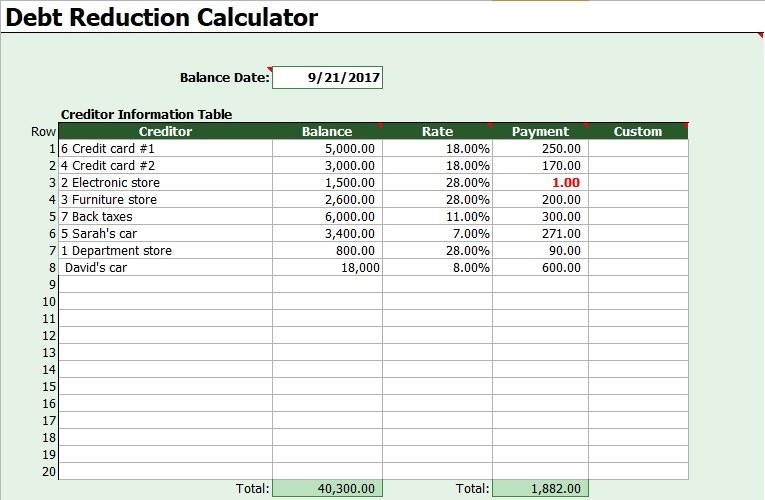

How To Use Debt Snowball Calculator Template?

The fundamental strides in the debt snowball techniques are as per the following:

- Mention all obligations in climbing request from littlest adjust to biggest. This is the technique’s most particular component, in that the request is controlled by sum owed, not the rate of intrigue charged. Be that as it may if two obligations are shut in sum owed, at that point the obligation with the higher financing cost would be moved above in the rundown.

- Resolve to pay the base installment on each obligation.

- Decide how much additional can be connected towards the littlest obligation.

- Pay the base installment in addition to the additional sum towards that littlest obligation until the point that it is paid off. Note that a few loan specialists (contract banks, auto organizations) will apply additional sums towards the following installment; all together for the strategy to work the moneylenders should be reached and informed that additional installments are to go specifically toward the main lessening. Mastercards generally apply the entire installment amid the present cycle.

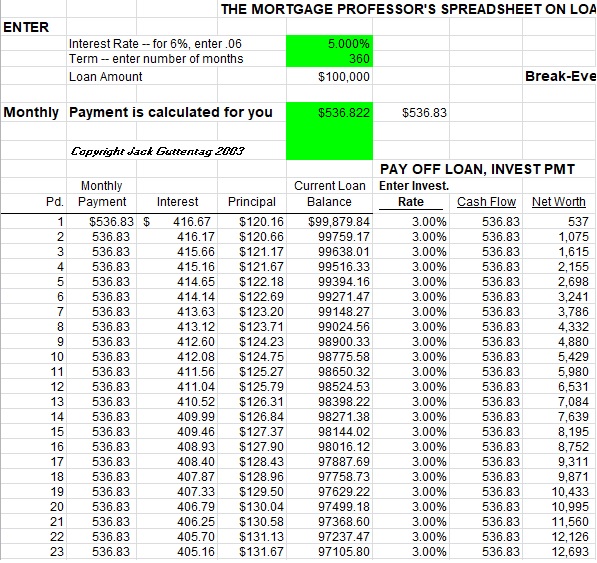

- Once an obligation is divided over the required funds, include the old least installment (in addition to any additional sum accessible) from the primary obligation to the base installment on the second littlest obligation, and apply the new whole to reimbursing the second littlest obligation. You should also check the Break Even Analysis Template.

- Repeat until the point that all obligations are ponied up all the required funds.

Download Professional Debt Snowball Calculator Templates

Guide:

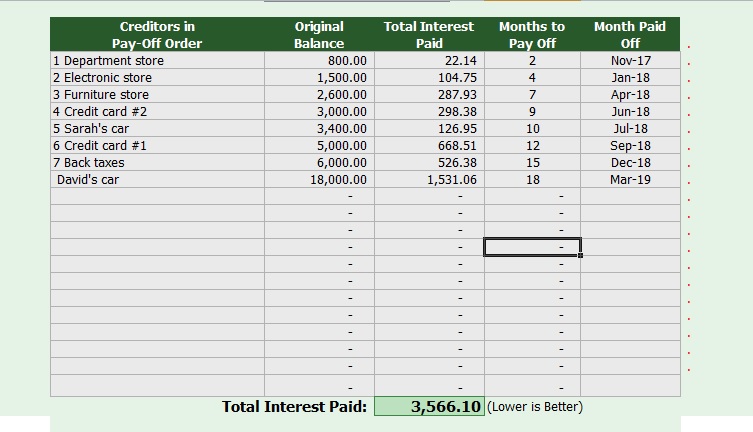

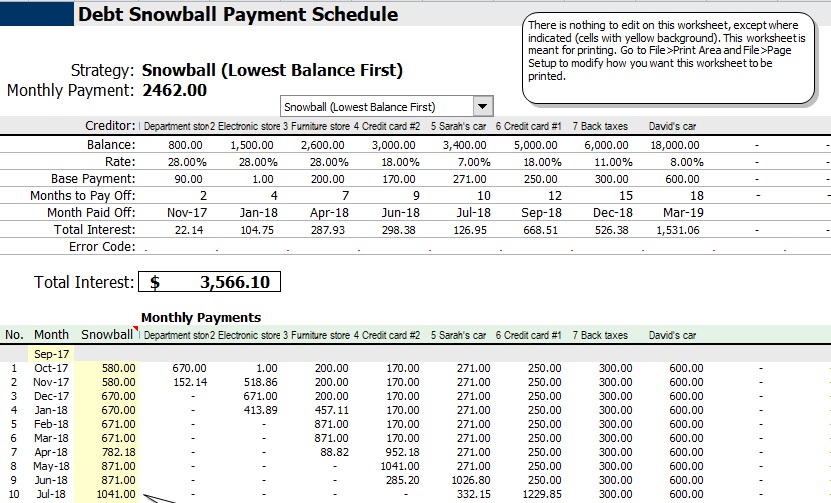

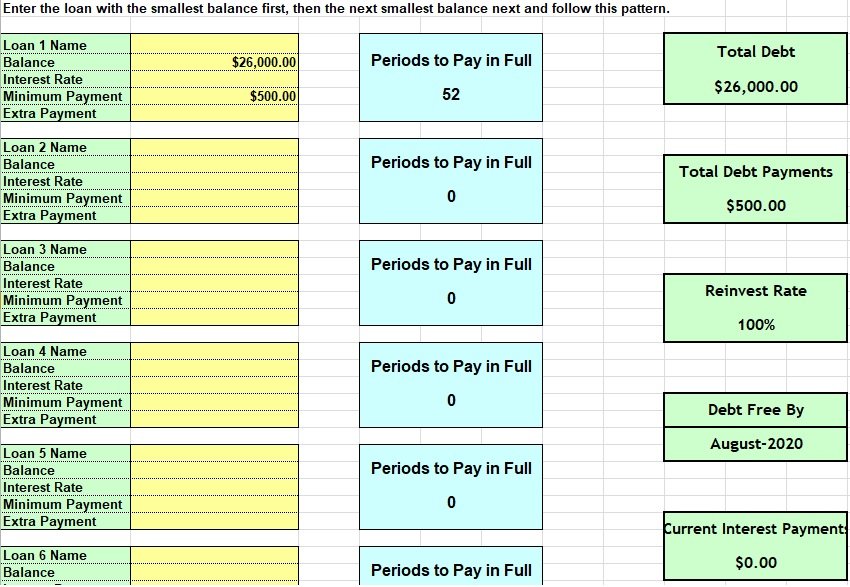

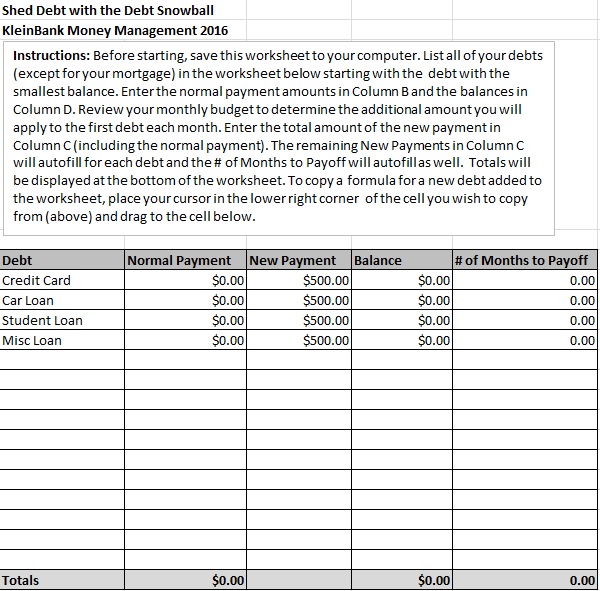

The snowball obligation or debt intends to pay off one obligation at a time with all the money you have until the point when the money is completely paid off and the move to the following obligation and rehash it so the full money may pay off. Usually, the obligations are paid at their base rate until the point when the extraordinary need for a charge card to be snowballed. With the assistance of snowball exceeds expectations or snowball number cruncher, the greater part of your obligations that are snowballed may record in it with a request of they paid off.

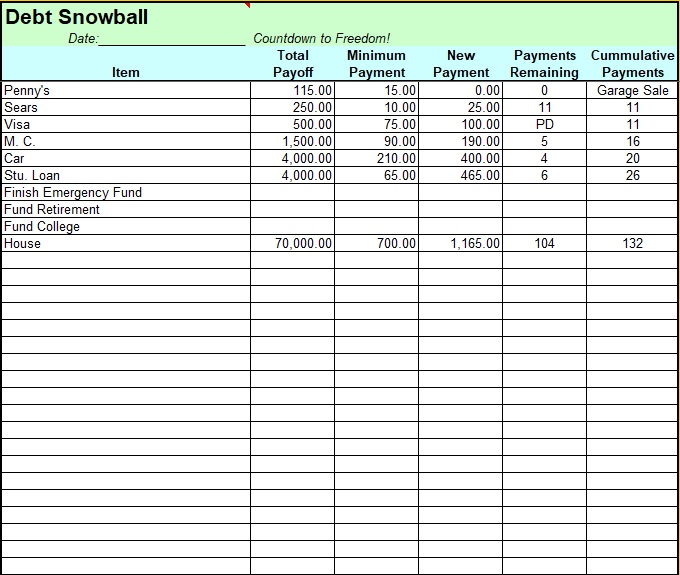

Debt Snowball Payment Schedule Spreadsheet

Debt Payoff Calculator Excel

Debt Snowball Calculator Excel

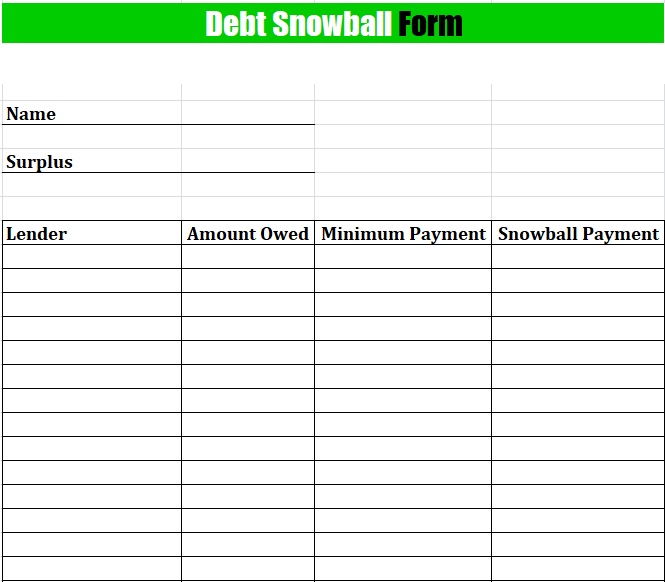

Free Printable Debt Snowball Form

Debt Snowball Template

Debt Tracker Spreadsheet

Free Debt Snowball Calculator

Free Debt Snowball Spreadsheet

Obligations snowball exceed expectations causes you to continue the track of advance of your business and furthermore to organize your imperative and significant obligations.

In conclusion this debt snowball calculator template very helpful in paying off debt.