A depreciation schedule template is a spreadsheet or document that indicates the depreciation amount throughout the asset’s life. It is usually used by businesses and organizations to control the asset’s depreciation over time.

Depreciation is a reduction in the value of an asset over the course of its useful life. Planning for asset replacements and keeping accurate financial records are essential for organizations to stay compliant with accounting and tax laws.

Table of Contents

What is the depreciation schedule?

A depreciation schedule is a table that serves as a road map for your finances if you possess assets like vehicles, machinery, or buildings. This schedule indicates how your belongings lose value over time. Moreover, it specifies the amount of annual revenue that can be deducted to cover the depreciation of your assets. It helps a company to make sure that their budget remains on course.

How to calculate the depreciation schedule?

You can compute a depreciation schedule by using each of these techniques;

Straight-line depreciation

The cost of the asset is dispersed evenly across its useful life by using straight-line depreciation. The formula is;

Annual Depreciation amount = (Cost of Asset – Salvage Value) / Useful Life

Declining balance depreciation

Declining balance depreciation is an expedited technique that accelerates the asset’s annual depreciation by a specific percentage. Its formula is;

Annual Depreciation amount = (Book Value at the starting of the year) x (Depreciation Rate)

Where,

Depreciation Rate = 2 / Useful Life

Units of production depreciation

This technique is used when the usage of assets varies from year to year and its formula is;

Annual Depreciation Expense = (Cost of the Asset – Salvage Value) x (Units Produced in the Year / Total Expected Units)

The importance of the depreciation schedule template:

A depreciation schedule template provides various benefits to businesses and people who own assets. It helps them in determining the current worth of an asset. Everything depends on this document including taxes, financial reporting, and making well-informed decisions about replacing assets. In addition, companies use depreciation schedules to compute tax deductions based on depreciation expense.

By providing a clear picture of when assets should be improved or replaced, enables you to plan financially more effectively. It aids in asset management by keeping track of an asset’s initial cost and cumulative depreciation. Having this knowledge allows you to make effective decisions on asset disposal, maintenance scheduling, and insurance.

The depreciation schedule helps boost a company’s credibility by providing stakeholders and investors with accurate depreciation details. Also, it facilitates the acquisition of finance by enhancing the accuracy of these assertions. Since the asset has reached the end of its useful life, the schedule helps you to figure out when an asset has to be replaced. Furthermore, the template provides an organized structure for entering asset data which saves you time.

Different types of depreciation schedule templates:

There are various forms of depreciation schedules and each one meets specific accounting and tax requirements. Let us discuss some forms of it;

Straight-line depreciation schedule template

This form of depreciation schedule template makes an asset’s cost equally dispersed over its expected useful life. Also, it makes the computation and comprehension simple.

Declining balance depreciation schedule template

The assets that lose value quickly and make larger depreciation charges in the starting years of an asset’s life, this method is applied to them.

Dual declining equilibrium depreciation schedule template

This template is helpful for assets with a high initial depreciation rate.

Units of production depreciation schedule template

Assets like machinery or cars usually need this depreciation schedule. The number of units produced is multiplied by the miles driven to compute depreciation.

Custom depreciation schedule template

Companies that have special depreciation needs use this template to design a unique depreciation plan as per their requirements.

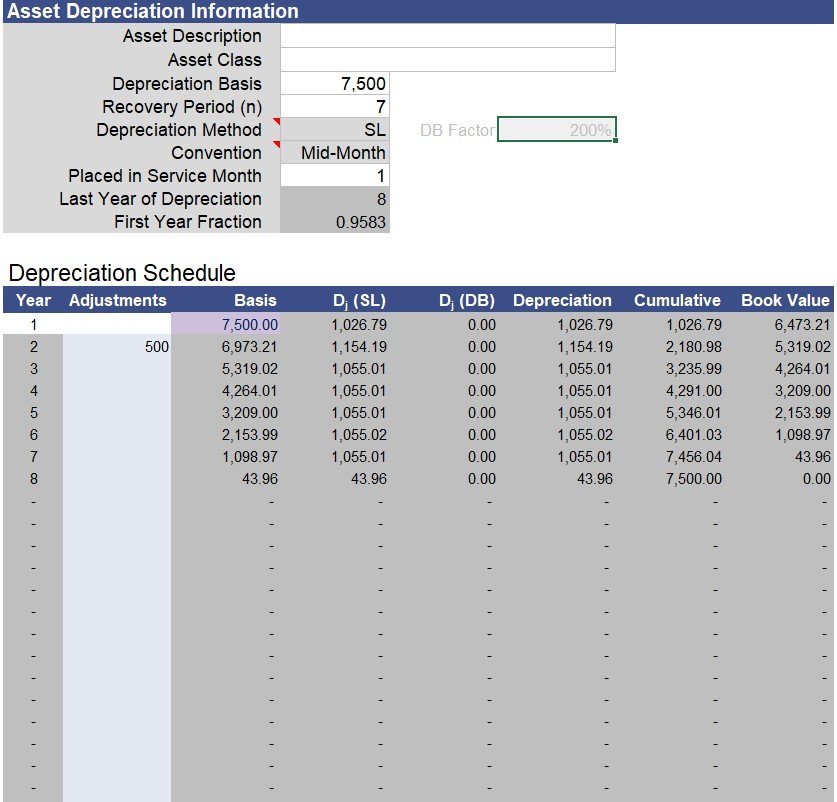

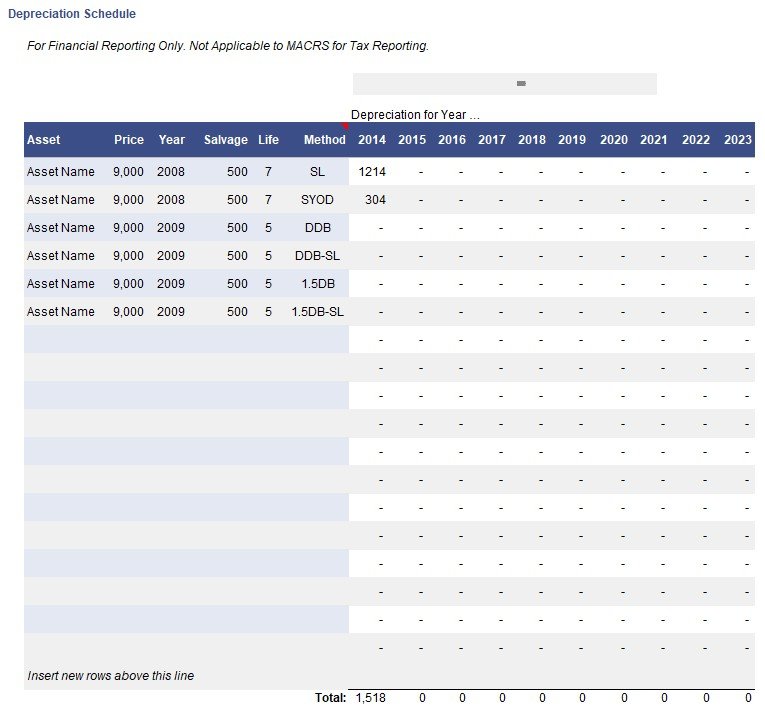

depreciation calculator excel template

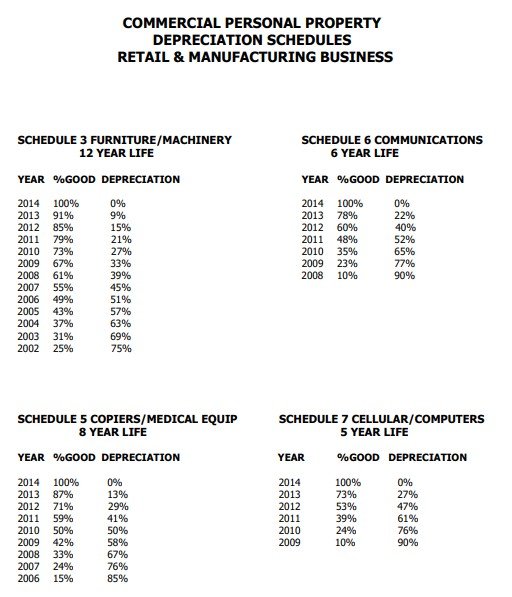

commercial personal property depreciation schedules template

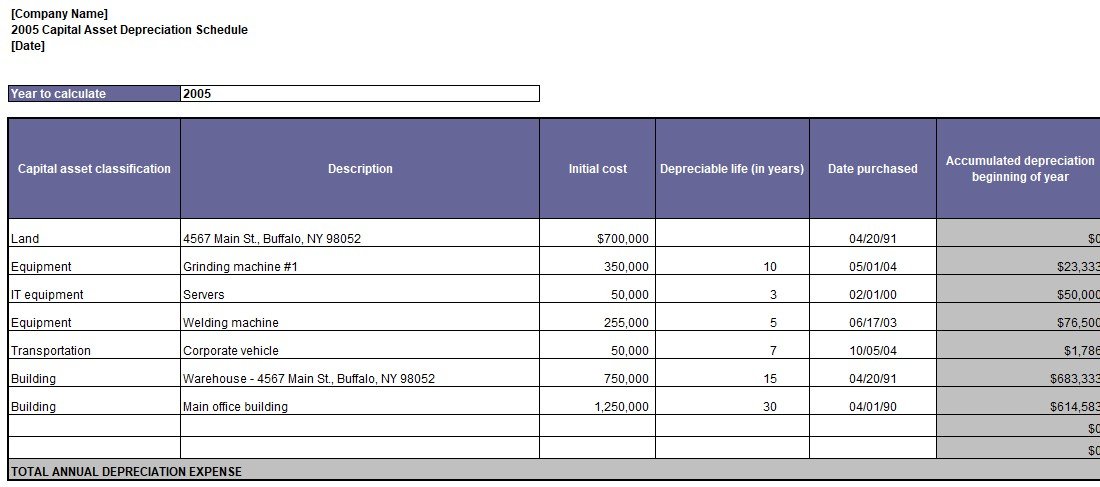

capital asset depreciation schedule template

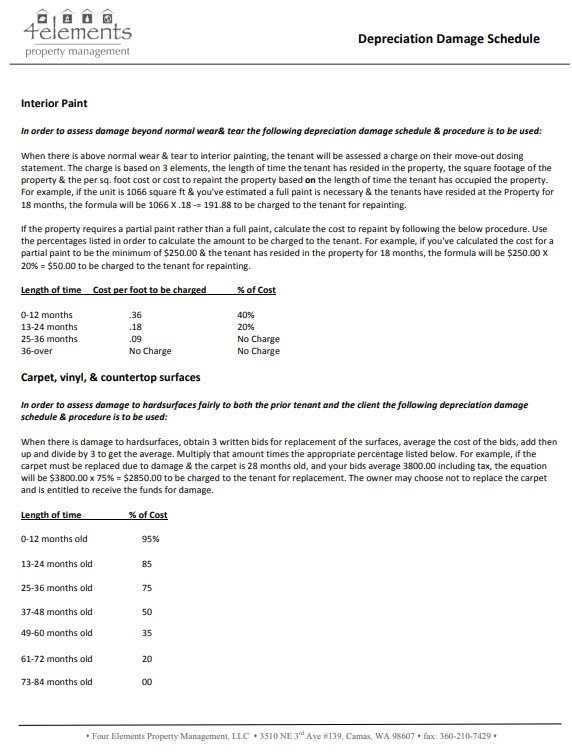

depreciation damage schedule

depreciation schedule report template excel

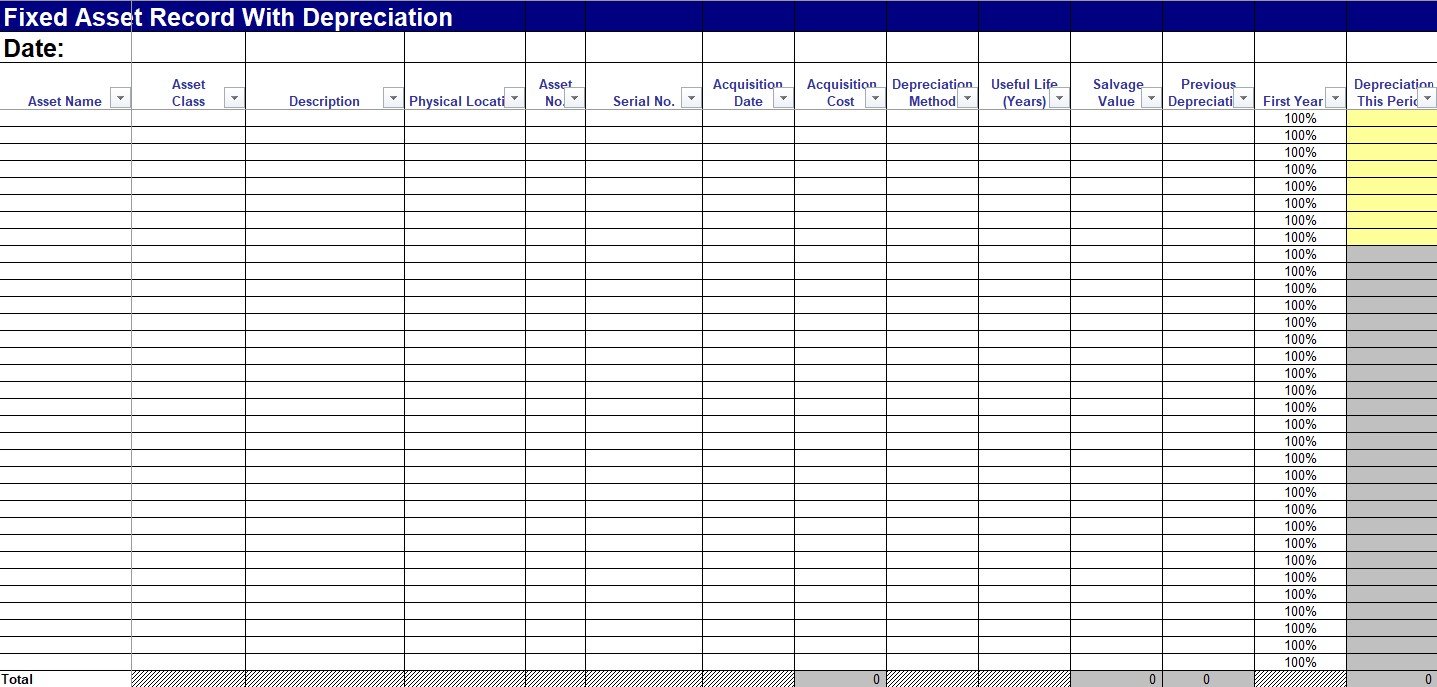

fixed asset depreciation schedule excel template

fixed asset record with schedule for depreciation

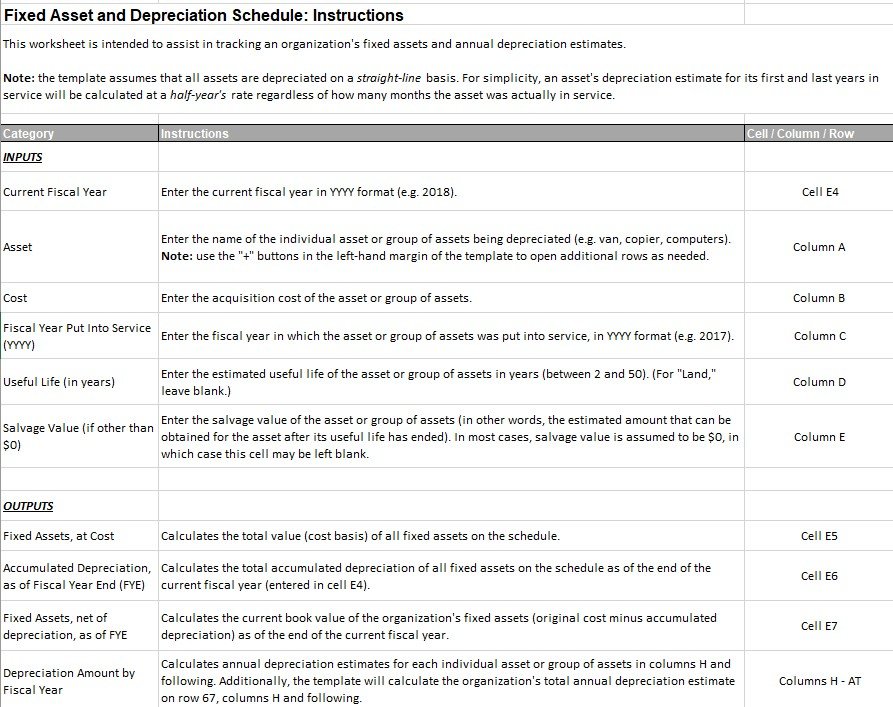

Using a depreciation schedule template:

Consider the following steps to use a depreciation schedule;

- First, download a template that contains fields for the details of the assets. These may include the asset’s name, purchase price, date of purchase, and any other essential information.

- Choose the depreciation technique that you want to apply. Examples of common techniques are straight-line, falling balance, and double-declining balance.

- Specific techniques of depreciation need the asset’s useful life or the approximate time when it will be useful for your company.

- Specify the anticipated salvage value of the asset if relevant. Salvage value refers to an asset’s projected value at the end of its useful life.

- The template automatically calculates the asset’s annual depreciation by using the specified method, salvage value, and usable life.

- For every year when the asset is in use, provide the annual depreciation figures.

- The template also contains a column for cumulative depreciation that shows the entire depreciation of the asset up to that point in time.

- Keep in mind that for depreciation there may be tax ramifications. Consult your financial advisor or accountant to get advice on maximizing potential tax benefits and ensuring that you are using the template accurately for tax reporting.

FAQ’s:

Why should I create a depreciation schedule?

Creating a depreciation schedule helps you pay less tax. It reduces your taxable income by giving you a year-on-year figure that you can claim.

What is the formula to calculate the depreciation?

Use the following formula to determine how much depreciation you deduct each year;

Annual depreciation = asset cost – salvage value) / useful life