Bill payment schedule template: Paying bills each month is an essential part of our daily life. We may wind up stuck in an unfortunate situation without paying bills. Without a valid bill-paying framework set up, you can gather obligation, increase stress, and put your accounts and FICO assessment in danger. We should pay off each and every bill on time, unfailingly.

But the question is that how might we ensure our bills are paid in the correct way and on each and every time. Here are some openings which may be helpful for your present bill payment schedule template. You may also like Payment Voucher Template.

Table of Contents

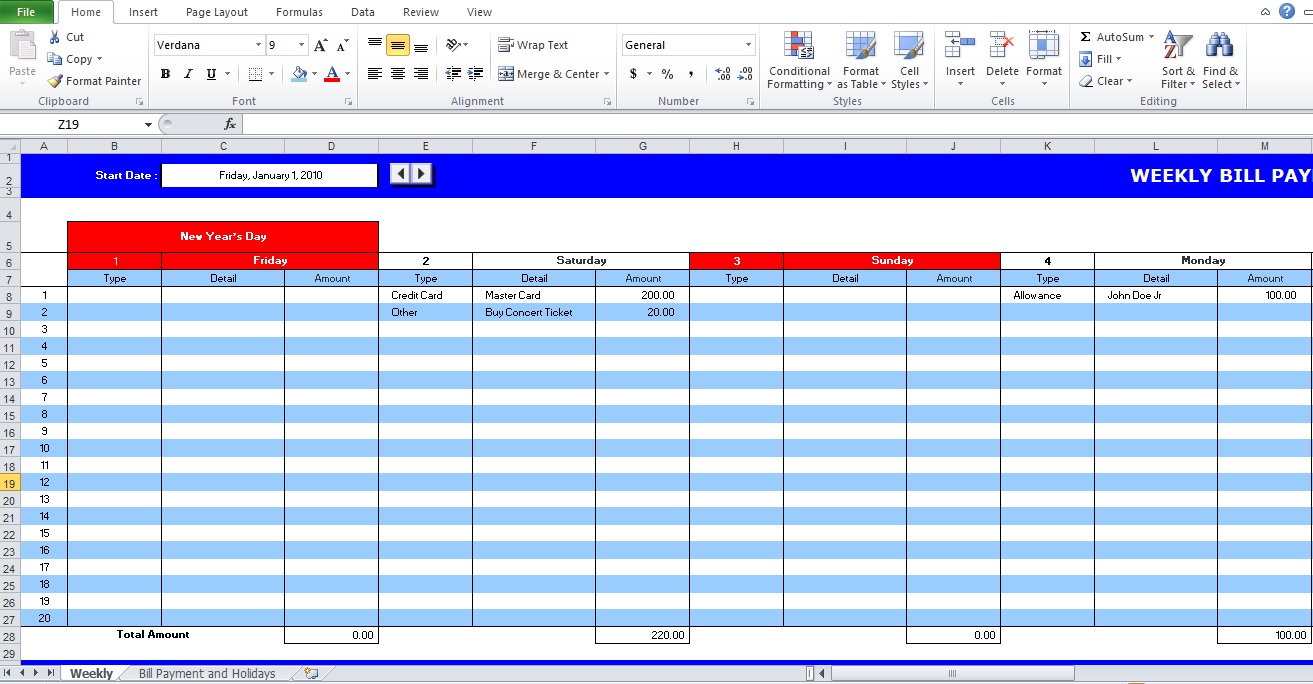

Weekly Bill Payment Schedule Template

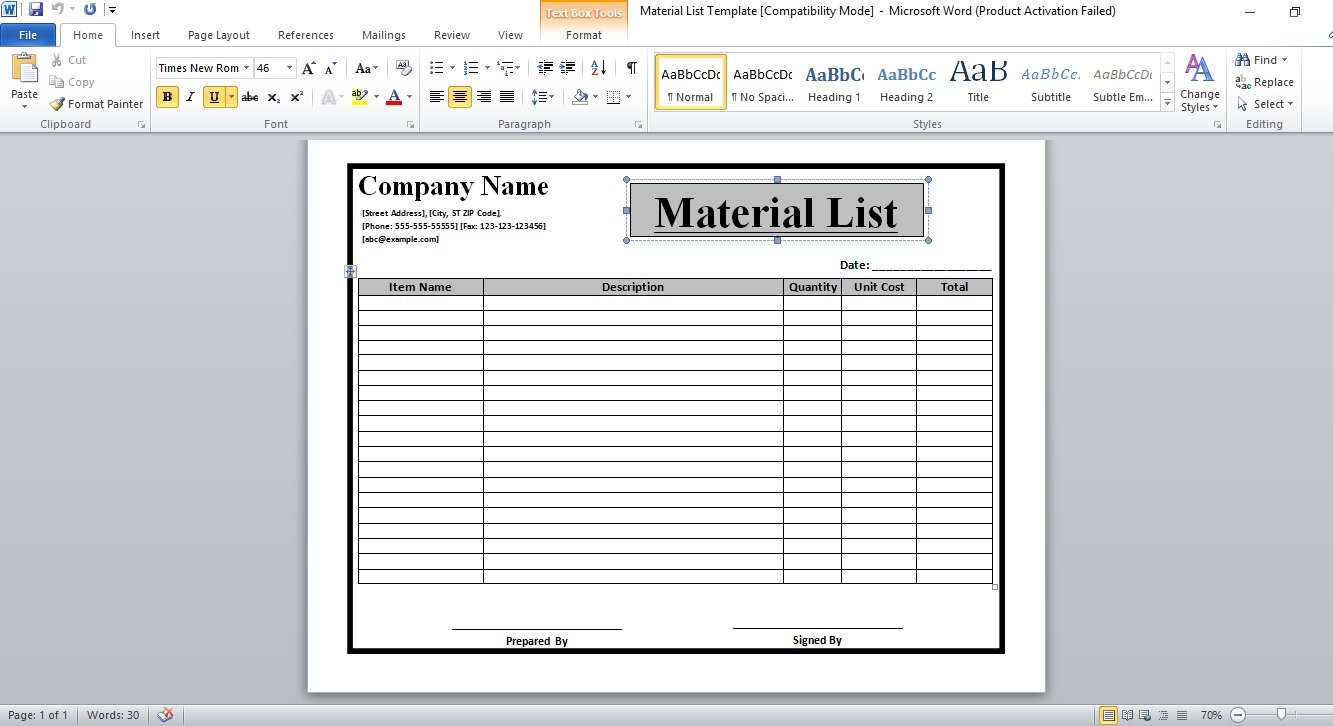

1. Make an outline of all you’re remarkable costs and obligations. If you have to pay for something, ensure that it gets added to this outline. Arrange the things where conceivable (monthly costs, weekly costs, and one-time costs.) Put the most costly installment at the best and the last one on the base.

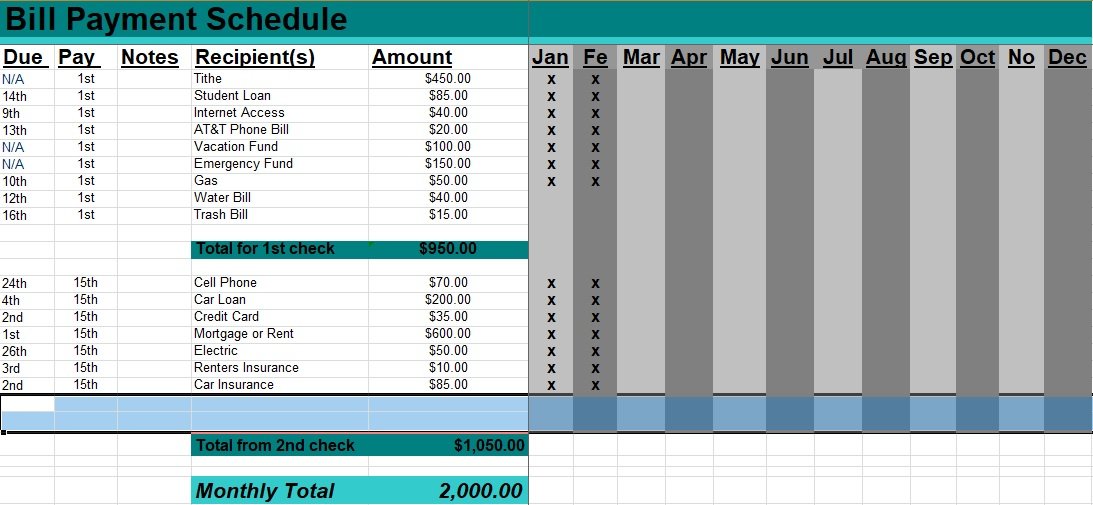

Monthly Bill Payment Schedule Template

2. Build up a list of your spending that guarantees you can pay these bills and costs every month. Make a list of cash you make every month. In the event that your costs indicate more than you’re making, you have to assess your spending. Try to create any new advancement that would bring down your bill. Do likewise for your link charge. At the end of the day, do what it takes to spare cash every month as opposed to discarding it on unnecessary costs. You should also check the Cash Payment Receipt Template.

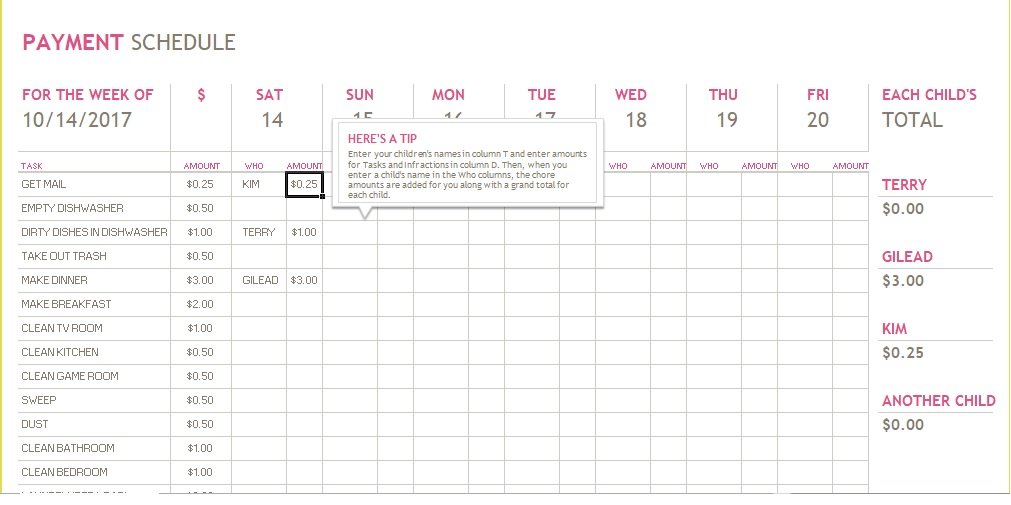

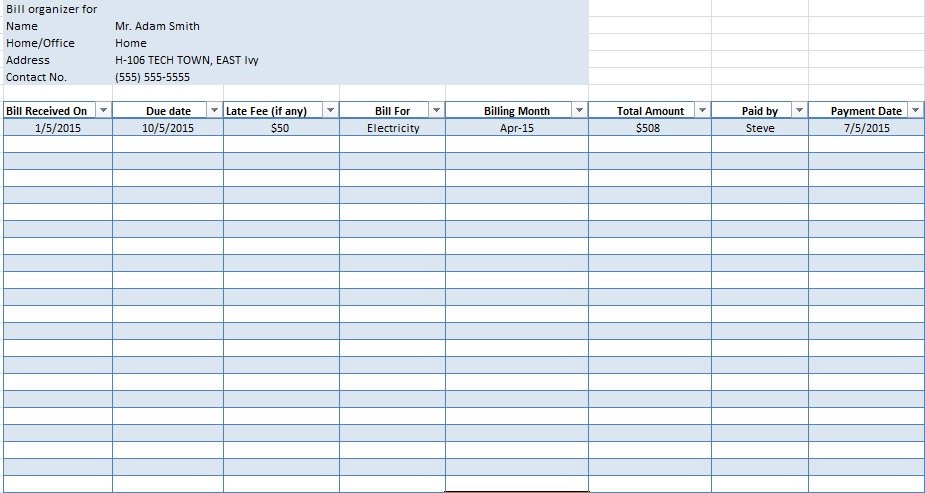

Bill Payment Schedule Excel Template

3. Decide due dates when bills arrive.try to pay a bill on time not to record bills for some other time. Particularly not until you’ve examined and inspected the due date. Rather, do this:

- Open bills instantly upon receipt

- Decide the due date

- Hover the due date so it’s anything but difficult to discover later, and

- Do a fast verify whether the charges look to remedy.

4. Secure the bills to an assigned place for approaching it.

When you exposed your mail, put all bills in an area you’ve allocated for bills as it was. It will prevent you to lose the bill before paying them. Keep in mind that late installment may bring about late expenses or additional charges you can without much of a stretch stay away from. You can likewise agree to accept paperless explanations. It is of most extreme significance that you have a sorted out advanced documenting framework set up.

Bill Payment Schedule Pdf

5. Set up a schedule.

There is some piece of installment alternatives from which to pick. You can:

- Pay the greater part of your bills with paper-like with check or case.

- include your bills with electronic managing an account for a consistent procedure

- Utilize both re-saving money and paper (so the majority of your bills are taken care of on the web while you make a few installments, for example, wage charges, with conventional checks)

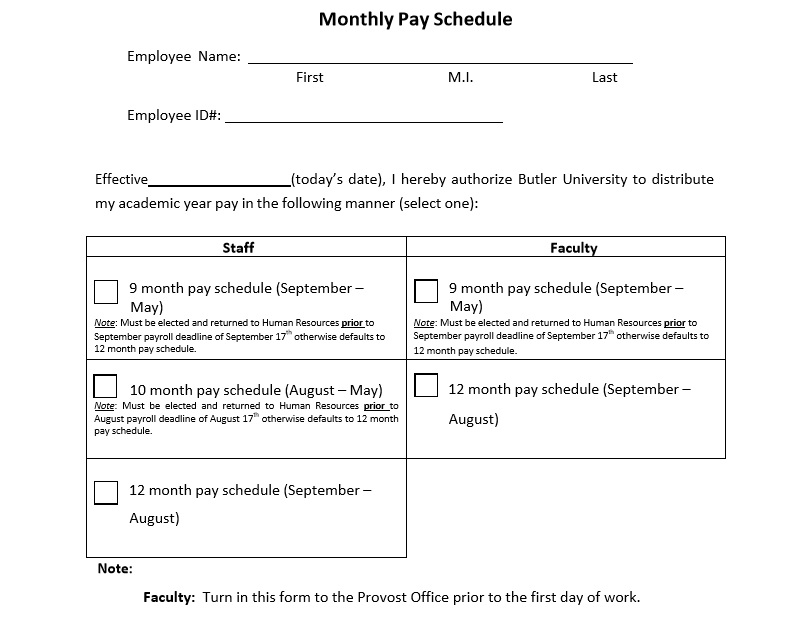

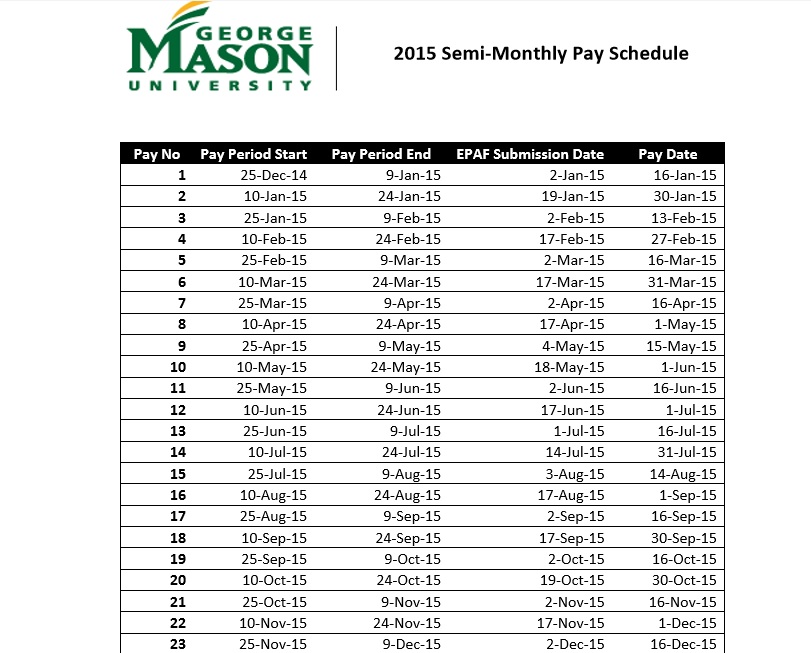

Semi-Monthly Pay Schedule Pdf Template

A few people survey and pay any bills when they get them via the post office. Others like to make a standing arrangement of an hour or two on a particular day to deal with paying it. To guarantee the installments are constantly prepared and paid before their due dates, make sense of what works for you. Keep all bill payment schedule template excel explanations and supplies that can require you to close-by so you can use it when is needed. You may also see Rent Payment Tracker Spreadsheet.

Free Printable Bill Schedule Template

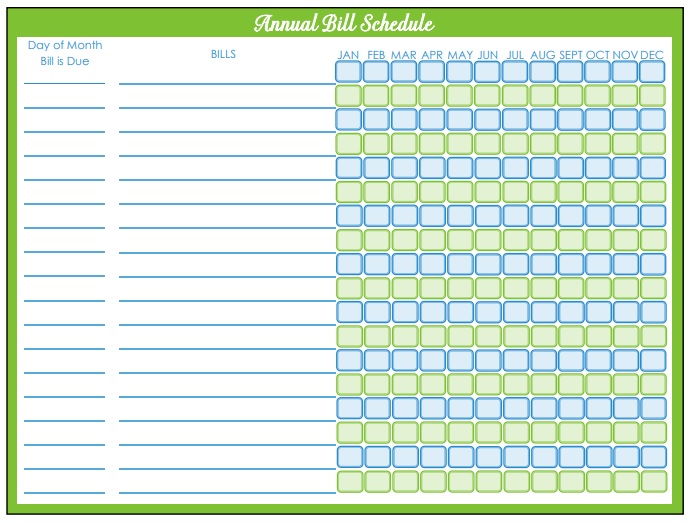

Annual Bill Payment Schedule Template

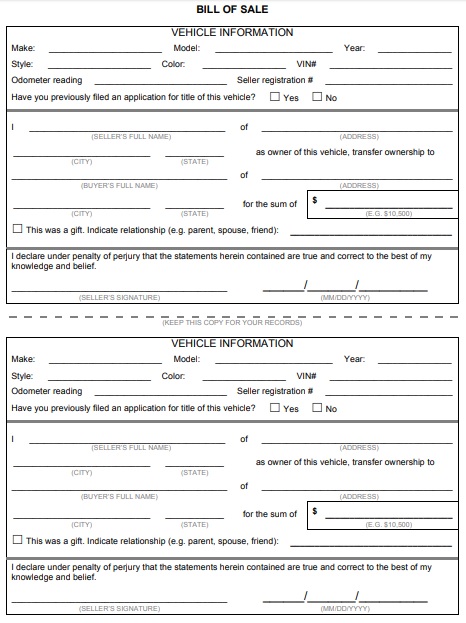

Bill of Sale with Payment Schedule Template

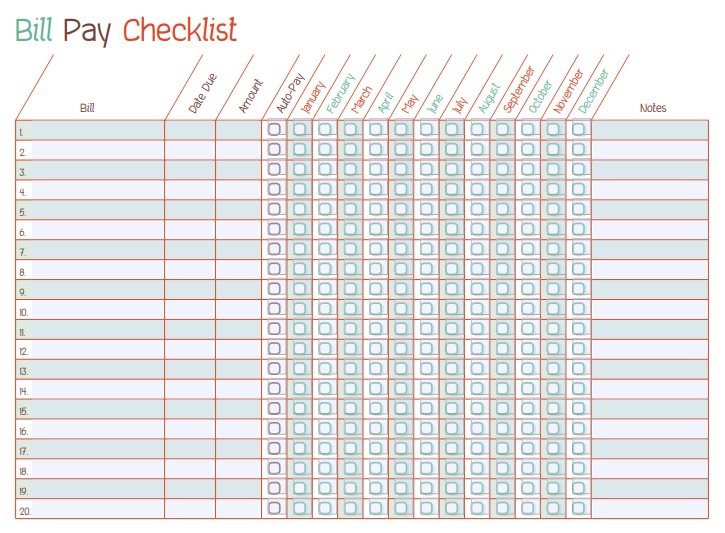

Bill Payment Checklist Template

6. Utilize money related programming to monitor charge paying. Money related programming from bank’s restrictive programming composes your bills and installments. These frameworks additionally enable you to set reasonable spending plans. The use of cell phone applications for paying bills is most popular now a day. Most banks enable you to pay your bills utilizing a cell phone application. They will enable you to exchange reserves with a step by step procedure starting with one record then onto the next and make stores remotely, also.