The property at rent or in your possession is important to check and balance. Whereas the rental property expenses spreadsheet purpose to maintain all records. This isn’t to make organized also offering all legal safety to the tenant. All property requirements are also offering all of the business strategies. As well the security and contribute to the best positive customer experience in property templates.

Whereas the rental properties excel spreadsheet free procedures are for the record of the tenant. With this, you can download and get in print form with a professional way of working. The best templates are designed to customize your all property needs. More important to figure it out all forms which you are using to getting proper legal requirements.

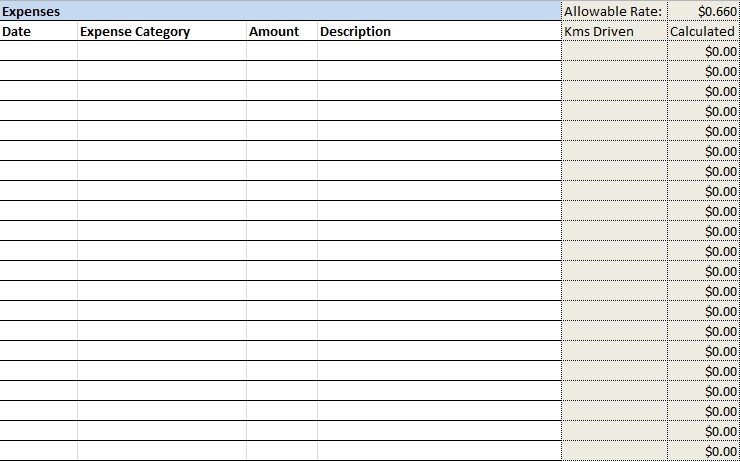

All-time and every single mile that you get the form you property, a rental property analysis spreadsheet makes all records and rent payments. Everyone wants to make their life easy with the rental agreement and payment methods.

Let’s suppose when you aren’t making any deductions of all your expenses so get a rental property, so you are missing the more important income. As far as you should start immediately for your property income and get more effective records.

Table of Contents

What is rental property expenses?

Rental property expenses are the costs incurred by a property owner (landlord or investor) to operate, maintain, and manage a rental property. These expenses are essential for keeping the property habitable, compliant with laws, and generating rental income.

Common Types of Rental Property Expenses

1. Operating Expenses

- Property management fees

- Repairs and maintenance

- Cleaning and landscaping

- Utilities (if paid by landlord)

- Advertising and tenant screening costs

- Insurance premiums

2. Ownership & Financing Costs

Costs that come from owning or financing the property:

- Mortgage interest (the interest portion only, not the principal)

- Property taxes

- Homeowners association (HOA) fees

- Depreciation (a non-cash expense representing wear and tear)

3. Administrative Expenses

Expenses related to managing your rental as a business:

- Legal and accounting fees

- Office supplies or software subscriptions

- Travel or mileage for property visits

- Telephone or internet used for managing rentals

4. Capital Expenses (Improvements)

These are long-term upgrades or replacements that increase the property’s value or extend its life — for example:

- New roof

- Kitchen remodel

- Installing new flooring

- Major plumbing or electrical upgrades

(Note: Capital expenses are usually not deducted immediately; they’re depreciated over time.)

Free examples of rental property record keeping template

Purchase the rental property:

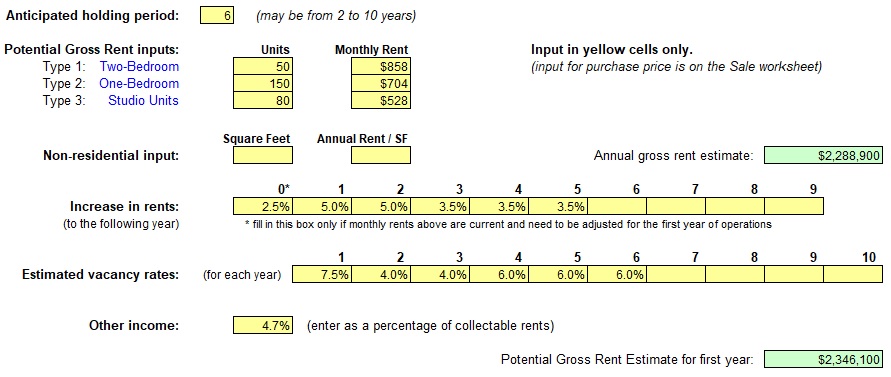

Finally, if you are deciding to give money to real estate, set locations for an easy to assess. Try to make your property value. Also, maintain the all necessary quality factors of local and district quality.

Select a property:

No doubt you love your property but consequently, need to enable all comparisons related to choosing the property. The included prices are square foot and assessed tax of value or price.

Best real estate cost:

This is an important factor to understand the actual payment of the property. This is part of the potential properties

Property Management:

If you are buying a rental property, besides you need to manage all collection including payments of bills, day to day all rent, and others. Why don’t you hire some rental management experts for the unified portion of your rental income from property?

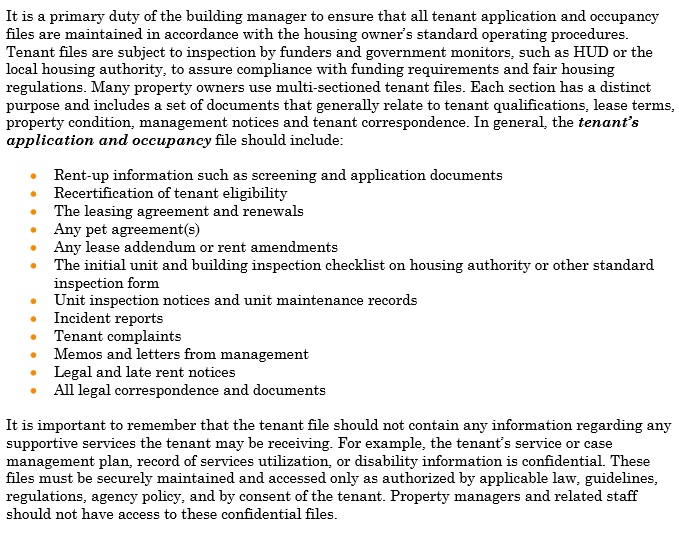

Information of tenant:

You should record all of the information of your tenant before renting a property. As well as the dates when he/she starts on their leases and they make payments of rents. You may also like a new construction home warranty template.

Maintain a record:

This is very necessary for all aspects of property rent and maintenance. One of the most owing properties requests isn’t making equal.

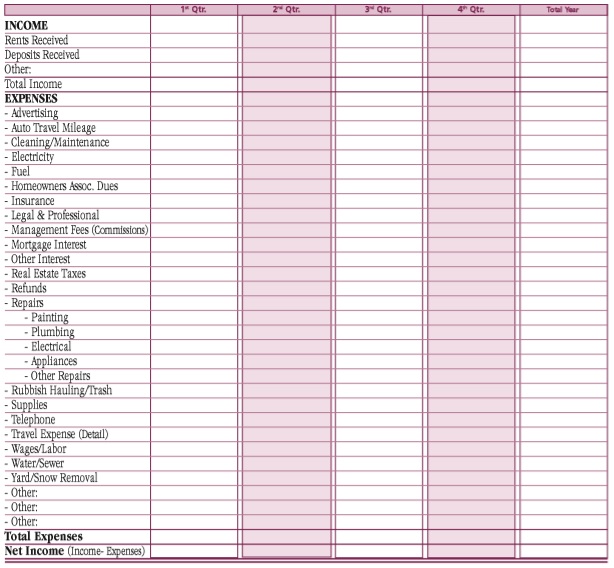

All expenses and income:

At the last stage of the example, you can track all of your income and related property expanses. This is also done with the free rental income and expense worksheet. You should also check the home inspection checklist template.

In case your property is damaged or broken, with this information, you can calculate how to manage all rates. For instance, you can reasonably make money with based on local on some points.

Why You Need a Rental Property Expenses Spreadsheet

Simplifies Financial Visibility

When you can see at a glance what you’ve earned, what you’ve spent and what you still owe, you’re in control. A decent spreadsheet gives you monthly income, total expenses and net profit. According to Landlord Studio, this kind of tracking is essential to run a profitable portfolio and file accurate tax returns.

Helps With Tax Compliance and Deductions

Proper categories mean you’ll maximize allowable deductions and make tax time easier. If your expense categories line up with what your tax authority expects (for example, the U.S. IRS Schedule E), you’ll reduce headaches and risk.

Aids Decision Making & Forecasting

If you’re tracking expenses month-to-month, you’ll spot patterns: maybe the landscaping cost spiked, maybe utilities are higher than expected or maybe vacancy is creeping up. That insight helps you adjust and optimize rather than being surprised.

Protects You in an Audit

When you have organized, dated records with receipts and a clean spreadsheet, you’re in a much better position if you’re ever asked for documentation. As one landlord on Reddit put it:

“I use a spreadsheet that has expense columns that match the categories on the IRS Tax forms… At tax time I print the page for each property and hand it to my tax person.”

What to Include in Your Rental Property Expenses Spreadsheet

When building your spreadsheet, think of it as having a few key sections: property details, income, expenses, summary/overview, and optionally notes or misc data. Let’s break these down.

1. Property Details

At the top or in a separate tab you should include:

- Property address or ID

- Purchase date, type (single family, multi-unit, commercial)

- Tenant details (optional)

- Lease start & end dates

- Financing details (mortgage interest, etc.)

This helps you keep each property clearly identified (especially if you manage more than one).

2. Income Section

List all revenue sources associated with the rental. Columns might include:

- Month/Year

- Rent collected

- Late fees

- Other income (parking fees, laundry, pet fees, etc.)

- Vacancy adjustments (if you track a “rentable months” versus “months vacant”)

3. Expenses Section

This is the heart of your spreadsheet. You’ll want columns for: date, vendor/supplier, category (more on categories in the next section), amount, and notes (optional). Categories may include:

- Mortgage interest

- Property taxes

- Insurance

- Utilities

- Repairs & maintenance

- Cleaning

- Property management fees

- Advertising (tenant-finding)

- HOA/Condominium fees

- Depreciation (as a non-cash expense)

- Travel/mileage related to property

- Supplies

- Other (misc)

4. Summary / Dashboard Section

Once you have data for each month and property, set up a summary tab that pulls key metrics:

- Total income year-to-date

- Total expenses year-to-date

- Net operating income (NOI) = Income − Expenses

- Expense breakdown by category (perhaps as a pie chart)

- Vacancy rate

- Cash-on-cash return (if you include investment / financing data)

5. Optional Tabs / Data

You might also include:

- A “maintenance log” tab tracking major improvements, unit identifiers, dates and cost

- A “tenant details” tab (tenant name, contact, lease start/end, deposit)

- A “receipts/archive” reference list if you digitize or scan your paperwork

- A “forecast/budget” tab to estimate future expenditures or large replacements

Example: What a Month Might Look Like

Here is a simplified example of how your monthly spreadsheet might look:

Income Tab (July 2025)

| Month | Property ID | Rent | Late Fees | Other Income | Total Income |

|---|---|---|---|---|---|

| Jul-25 | 101 | 1,200 | 50 | 20 | 1,270 |

Expenses Tab (July 2025)

| Date | Property ID | Vendor | Category | Amount | Notes |

|---|---|---|---|---|---|

| 2025-07-01 | 101 | Electric Co | Utilities | 110 | July bill |

| 2025-07-03 | 101 | Plumber | Repairs | 250 | Fix leaking faucet |

| 2025-07-10 | 101 | HOA | HOA Fees | 200 | Monthly fee |

| 2025-07-15 | 101 | Insurer | Insurance | 42 | Monthly portion |

Dashboard (YTD to July)

- Total Income: $8,900

- Total Expenses: $4,230

- Net Operating Income (NOI): $4,670

- Repairs represent 30% of total expenses

- Warranty/leak incidents up by 40% compared to prior year

With such a setup you see not just “what” you spent, but “why” and how it impacts your business.

Rental Property Excel Spreadsheet

Rental Property Excel Spreadsheet Free

Rental Property Analysis Spreadsheet

Free Rental Income and Expense Worksheet

Rental Property Record Keeping Template

How to Categorize Rental Property Expenses Correctly

Getting your categories right is crucial—for proper tax reporting, understanding your business and minimizing risk.

Key Categories to Use

Here are expense categories you should include, with explanations:

- Advertising: Costs to market a vacant unit (online listings, signs, real-estate agent)

- Auto & Travel: Travel to property, inspections, mileage, fuel if you use your car for rental business

- Cleaning & Maintenance: Routine upkeep, landscaping, cleaning between tenants

- Commissions: Paid to real-estate professionals for finding tenants or managing properties

- Depreciation: A non-cash “expense” representing wear and tear of assets; needs to be tracked separately

- HOA/Condominium Fees: Monthly or annual fees if the property falls under an association

- Insurance: Landlord insurance, property insurance, umbrella policies

- Interest: Mortgage interest, and other interest on loans tied to the rental

- Legal & Professional Fees: CPA fees, attorney fees for lease issues, etc.

- Management Fees: Fees paid to a property management company

- Mortgage Payments: While principal is not deductible, tracking total mortgage payments is still valuable for cash-flow analysis

- Repairs: Fixing broken plumbing, appliances, etc. (distinct from improvements)

- Supplies: Light bulbs, filters, office supplies connected to rental business

- Taxes: Property tax, occupancy tax, licensing fees

- Utilities: Utilities you pay (electricity, water, internet) which are not reimbursed by the tenant

- Other: Any expense that doesn’t fit neatly elsewhere

Why Categorization Matters

- Ensures you don’t miss deductions by placing an expense in the wrong bucket.

- Gives your accountant (or tax preparer) clean data to work with.

- Enables you to generate category-specific reports (e.g., “I spent $4,000 on repairs this year—why did that increase?”)

- Helps you manage cash-flow: for example, if utilities are up, you can investigate or adjust lease terms.

Mistakes to Avoid

- Mixing personal and rental expenses in the same sheet—keep them separate.

- Putting “improvements” (which must be capitalized and depreciated) into “Repairs” (which are usually immediately deductible).

- Leaving receipts unfiled and only entering summary amounts—detailed documentation is important.

- Waiting until year-end to fill in entries—this increases error risk and forgotten expenses. As one template puts it:“It’s easier to remove an expense from your spreadsheet than it is to recall the expense and find the supporting documentation.”

Conclusion

A well-structured rental property expenses spreadsheet is one of the best investments you’ll make as a landlord or property investor. It brings clarity, helps you maximise deductions, supports strategic decisions and protects you from surprises. Start simple, build the sections, stick to the habit of regular entry and review your numbers monthly. Over time the insight you gain will help you not just track your investment, but grow it.

FAQs:

What is a rental property expenses spreadsheet?

A rental property expenses spreadsheet is a digital tool—usually made in Excel or Google Sheets—that helps landlords record and organize all income and expenses related to their rental properties. It tracks rent received, maintenance costs, taxes, insurance, and other financial details, making it easier to calculate profits, file taxes, and manage cash flow.

Why should landlords use a rental property expenses spreadsheet?

Landlords use expense spreadsheets to stay organized, save time, and ensure financial accuracy. It helps them monitor income, identify deductible expenses, plan budgets, and prepare for tax season without scrambling for receipts. Essentially, it turns property management into a clear, data-driven process.

What should be included in a rental property expenses spreadsheet?

A good spreadsheet includes sections for:

- Property details (address, type, tenant info)

- Monthly rental income

- Expense categories (repairs, utilities, insurance, etc.)

- Total income vs. total expenses

- Net operating income (NOI) summaryThis structure gives landlords a full financial overview of each property.

Are rental property expenses tax-deductible?

Yes, most ordinary and necessary rental property expenses are tax-deductible. Examples include repairs, maintenance, property taxes, mortgage interest, insurance, and management fees. Tracking these in a spreadsheet helps ensure you claim every eligible deduction and comply with tax laws.

How often should I update my rental property expenses spreadsheet?

Ideally, you should update your spreadsheet monthly or every time you record a new transaction. Frequent updates prevent missing receipts or forgetting small expenses. Regular maintenance also gives you real-time insight into your property’s performance.

Can I manage multiple properties in one spreadsheet?

Absolutely. You can either create separate tabs for each property or use one master sheet with filters and property IDs. This approach allows you to compare expenses and profitability across your entire portfolio without juggling multiple files.

How do I calculate profit from my rental property using a spreadsheet?

To calculate profit, subtract your total expenses from your total rental income.

For example:

If your rental income for the year is $24,000 and total expenses are $10,000, your Net Operating Income (NOI) equals $14,000.

What are common mistakes landlords make in expense tracking?

The most common mistakes include:

- Mixing personal and rental expenses

- Forgetting small or cash expenses

- Misclassifying capital improvements as repairs

- Failing to back up data or store receipts

- Waiting until year-end to record expenses

![Parking Space Rental Agreement Templates [Word, PDF]](https://exceltmp.com/wp-content/uploads/2021/08/permit-parking-lease-agreement-template-150x150.jpg)