A credit report authorization form is an agreement between you (the consenter) and another company (third party). This agreement enables them to look at your consumer credit file for their own business reasons. The form allows the third party to view your credit report only. With the Fair Credit Reporting Act regulations, the request must conform.

Table of Contents

How to fill a credit report authorization form?

Include the following important details in your form;

Complete the authorization statement

In the first section of the authorization form, there is an authorization statement. It is generally a statement of permission from the consumer to give a copy of their credit report for a certain reason. This can include the following;

- Applying for new lines of credit

- Leasing an apartment

- Obtaining financing for a car/business

- Obtaining life insurance or home insurance coverage

- Receiving an employment offer

Date

The date you will mention in this section indicate when the document is signed. But, it is best to give a current date. Furthermore, include a language that states the credit report consent is effective immediately. You may also like the Pre-Employment Background Check Authorization Form.

Your personal information

Provide your personal information in this section include your accurate name as it appears on your credit report.

The statement section

The statement section states that what type of information will be released. Include details regarding who will receive the information.

Disclosing language

In the last section of the authorization statement, indicate the statement that discloses you have the right to have copies of all disclosures.

Include information of the party running a credit check

You have to provide information regarding the third party requesting your consumer credit report. The third’s party full name should be included here.

Specify address for the last 7 years

With additional information, you have to give the credit reporting agency like for identification purpose, your addresses for the last 5-7 years. The credit reporting agency supposes that within the last 7 years, the consumer has lived in three different places. You have to include accurately the essential information like your current building name/number, street, unit number, city, and state in this section. Additionally, on the credit report authorization form, indicate your current residency start date.

Add your driver’s license details

You will have to record your driver’s license details to solidify your identity after giving your residential addresses for the last seven years. Credit reporting agencies often request two forms of government-issued ID for identification verification purposes. One should contain your current address and other involves your driver’s license number. Since the credit reporting agency will verify the information so your driver’s license details should also be accurate. You should also check Tenant Background Check Authorization Form.

Give your social security number

It is important that you include your accurate social security number on the credit report permission form in order to make sure maximum accuracy in processing your consumer credit report. SSN is a unique identifier. It is used for all types of credit reporting purposes. With any other credit report requests that could be placed under your name, it makes sure that there is no confusion with them.

Provide your date of birth

In the next step, include your full date of birth following the Month/Date/Year format. It is an important steps as it prevents any potential fraud.

Sign and date the authorization

You should sign and date your statement of consent after completing all relevant information in writing. You should provide the current date and affix your valid signature on the document. Specify that you are authorizing the release of your consumer credit information for its certain purpose. You may also see Authorization Letter to Collect Documents.

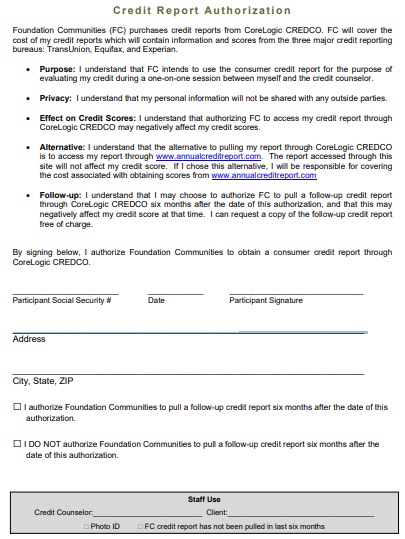

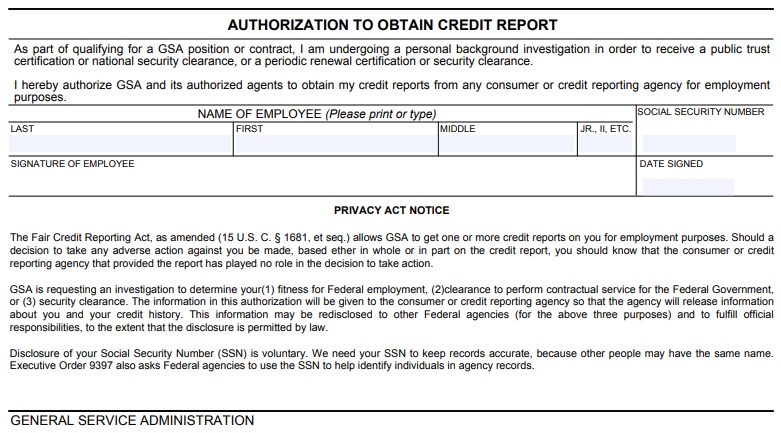

Credit Report Authorization Consent Form

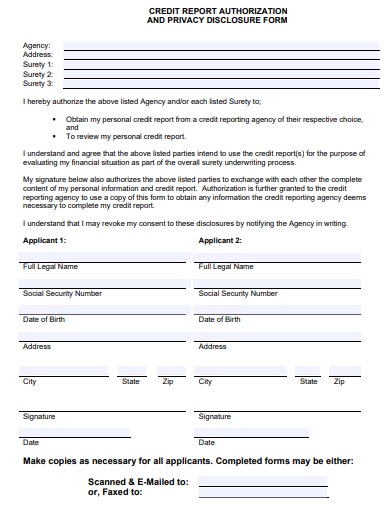

Credit Report Authorization and Privacy Disclosure Form

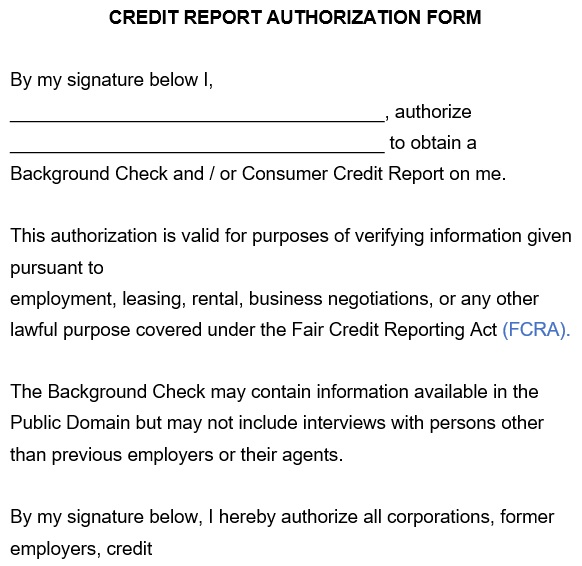

Free Printable Credit Report Authorization Form

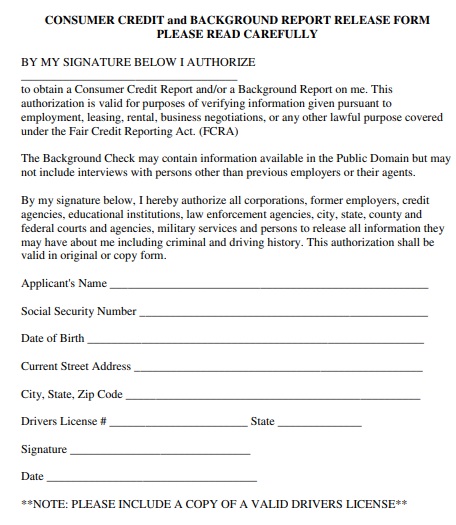

Consumer Credit and Background Report Release Form

Authorization to Obtain Consumer Credit Report Form

Conclusion:

In conclusion, as a consumer, you receive a credit report authorization form by a credit reporting agency. Then, by signing the document you allow the credit reporting agency to release your credit file as required.