In the modern automotive industry, having a clear, professional, and well-structured automobile invoice template is essential for smooth transactions. Whether you are a car dealer, a mechanic, or a private seller, an invoice not only documents a sale but also ensures transparency between the buyer and seller. In this article, we’ll explore everything about automobile invoice templates, their benefits, essential components, and how to create one efficiently.

Table of Contents

What is an Automobile Invoice Template?

An automobile invoice template is a pre-designed document used to bill customers for vehicles or automobile-related services. It serves as a record of the transaction, outlining details about the vehicle, services rendered, and payment terms. Using a template simplifies the billing process, reduces errors, and maintains consistency across multiple transactions.

Importance of an Automobile Invoice Template

Creating invoices manually can be time-consuming and prone to errors. Here’s why an automobile invoice template is crucial:

1. Professionalism

2. Transparency

3. Legal Protection

4. Efficient Record Keeping

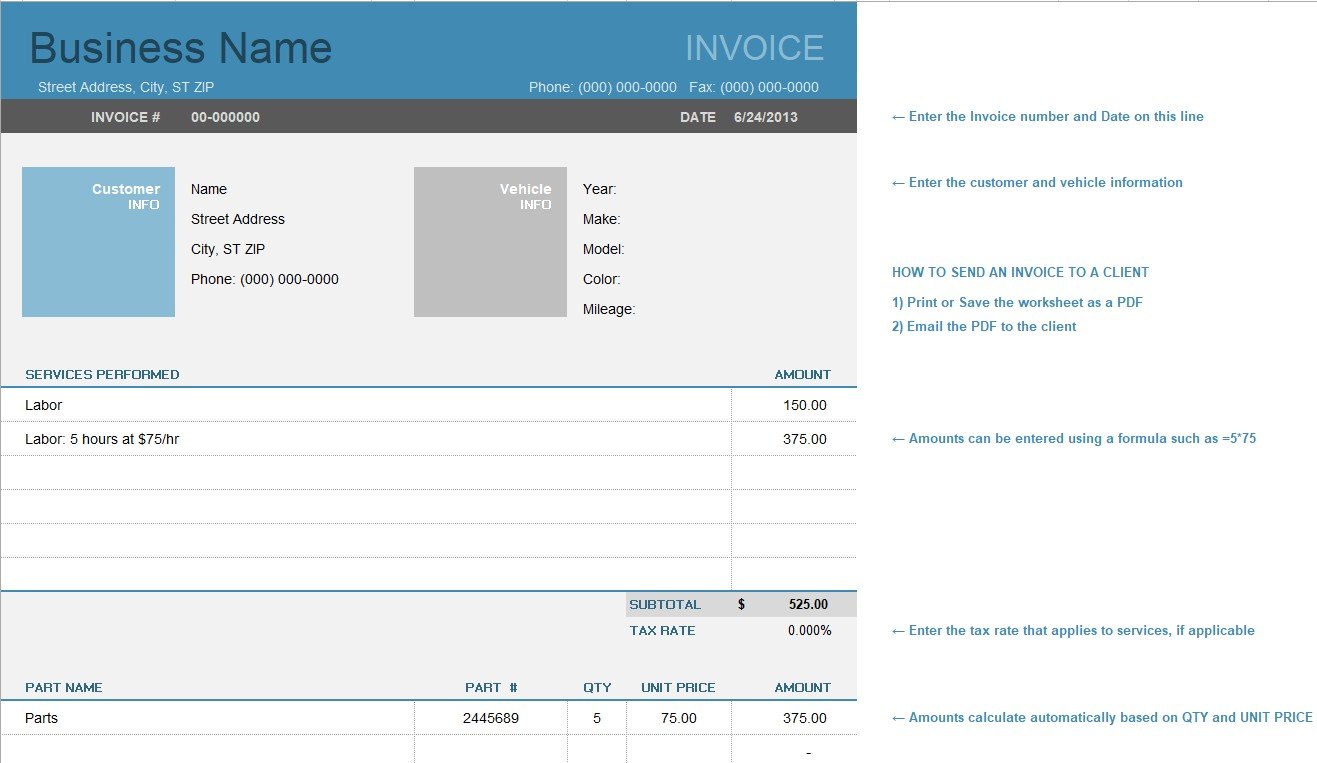

Key Elements of an Automobile Invoice Template

A comprehensive automobile invoice should include the following components:

1. Header Section

- Company name and logo

- Business address

- Contact details

- Invoice number

- Invoice date

2. Buyer Details

- Buyer’s full name

- Address

- Contact number

- Email address

3. Vehicle Details

- Make and model

- Year of manufacture

- Engine number

- Color

- Registration number

4. Description of Services or Products

- Vehicle price

- Additional services (installation, repair, customization)

- Parts or accessories included

- Labor charges

5. Financial Summary

- Subtotal

- Taxes (GST, VAT, or local taxes)

- Discounts (if any)

- Total amount due

6. Payment Terms

- Payment methods accepted

- Due date

- Late payment penalties (if applicable)

7. Additional Notes

- Warranty details

- Return policy

- Special instructions or remarks

Benefits of Using a Ready-Made Automobile Invoice Template

Using a ready-made template has numerous advantages:

1. Time-Saving

2. Consistency

3. Error Reduction

4. Customization

Tips for an Effective Automobile Invoice Template

- Use Clear Language: Avoid jargon and ensure all charges are easily understandable.

- Include Itemized Costs: Break down vehicle price, parts, and service fees.

- Highlight Total Amount: Make it easy for customers to see the final payable amount.

- Use Professional Fonts and Branding: This enhances credibility.

- Keep a Digital Copy: Save all invoices digitally for record-keeping and quick access.

Common Mistakes to Avoid

- Incomplete Vehicle Details: Always include VIN, engine number, and registration details.

- Ignoring Taxes: Make sure all applicable taxes are clearly mentioned.

- Incorrect Payment Terms: Clearly define deadlines, late fees, and accepted payment modes.

- Not Keeping Copies: Keep backups of all invoices for legal and accounting purposes.

auto repair invoice template

automobile invoice template excel

automobile invoice template word

Conclusion

An automobile invoice template is more than just a billing document. It is a professional tool that ensures transparency, improves record-keeping, and enhances trust between buyers and sellers. By using a well-structured template, automotive businesses can save time, reduce errors, and streamline financial transactions. Whether you are a dealer, a mechanic, or a private seller, a standardized invoice template is essential for smooth, hassle-free operations.

Frequently Asked Questions (FAQs):

Can I use a simple Word document as an automobile invoice template?

Yes, Microsoft Word or Google Docs can be used to create invoices. However, using Excel or accounting software is preferable for automatic calculations.

Is an invoice necessary for private vehicle sales?

While not mandatory in all regions, invoices help document the sale and can serve as proof in case of disputes or ownership transfer.

Should taxes be included in the invoice?

Yes, all applicable taxes like GST, VAT, or sales tax should be included to maintain transparency and legal compliance.

How do I number my invoices?

Invoices should be numbered sequentially (e.g., INV001, INV002) for proper record-keeping and tracking.

Can I include warranties in the invoice?

Yes, including warranty details in the invoice is recommended for transparency and customer satisfaction.

Are digital invoices valid legally?

Yes, digital invoices are legally valid in most countries as long as they include all necessary details and are issued by a registered business.

![Letter of Reprimand for Employee Performance [MS Word]](https://exceltmp.com/wp-content/uploads/2021/09/letter-of-reprimand-for-employee-performance-150x150.jpg)