A direct deposit form template is a document in MS Word, MS Excel, Adobe PDF, Google sheets, and Google docs in different formats. These templates are used by employers for payroll purposes.

Table of Contents

What is a direct deposit form?

A direct deposit form is a document that allows the third party to send money to a bank account. With the help of an ABA routing number and bank account number, money can be sent. However, it is generally used by employers for payroll purposes. Sometimes an employer needs a voided check to make sure that the account is valid. Moreover, it is less expensive and provides many benefits to each employee. You may also like Quickbooks Deposit Slip Template.

The direct deposit form is also known as;

- Direct deposit authorization form

- Employee direct deposit form

- Payroll direct deposit form

- Direct deposit enrollment form.

- Employee direct deposit authorization form.

Different types of direct deposit form:

You have to decide the template of the direct deposit form before asking about the form from your employer or a bank. So, let us discuss the most common types of direct deposit form.

1. Generic direct deposit form:

This type of form is most common and used to set-up your accounts to receive deposits. In addition, it allows you to deposit payments for your monthly bills and obligations from your account.

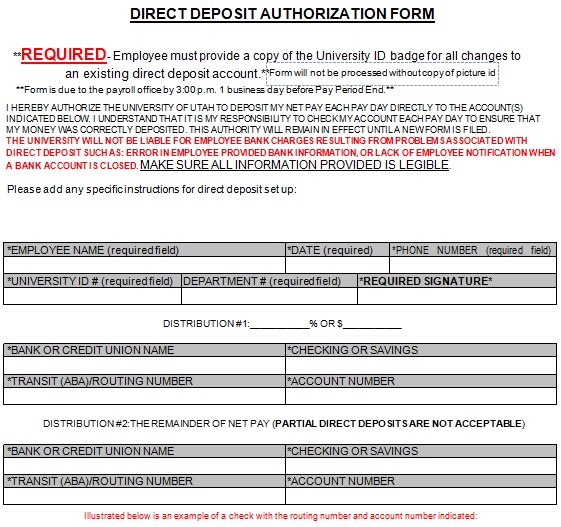

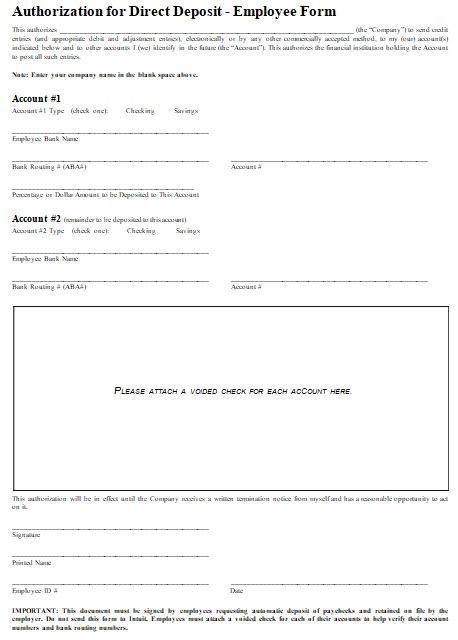

2. Employee direct deposit form:

This form has to be filled by an employee of the company. It gives the employer the authority to direct deposits to his account. Furthermore, this form also includes options such as to authorize, revise, or cancel direct deposit to the account. You may also see the Salary Slip Format in Excel.

3. Payroll direct deposit form:

It is similar to the employee direct deposit form. This form is used for the employee’s paycheck to be deposited directly into his account. It is under the payroll department of a company. So, they used it to keep the record of the employees who have given them authorization for direct deposit.

How do you fill in a direct deposit form?

Here are some steps how to fill in a direct deposit form;

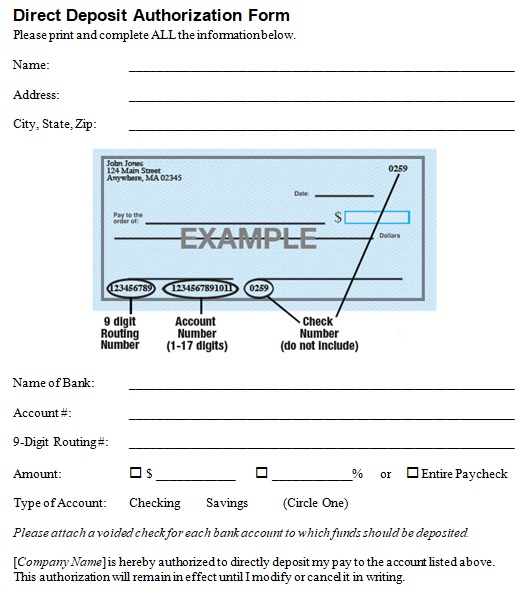

Step#1: At first, you have to complete the Account Holder’s name and address.

Step#2: Next, report the name of your bank on the first line. Enter your account number on the given labeled line. After that, find the 9-digit routing number on your personal check. Enter it on the given blank line labeled ‘9-digit routing#’.

Step#3: Then, choose the type of account that you would like the deposit to be made. You may select Checking or Savings. And, you also have to attach the voided check for each account.

Step#4: Enter your company name on the given blank line. Report the name that you are authorizing to make deposits to your account.

Step#5: After that, sign your name in the ‘Employee’s Signature’ section. Just below this section, enter the date on the given blank line.

Step#6: In the end, submit your form to the employer’s payroll or HR department. You should also check the Deposit Slip Template.

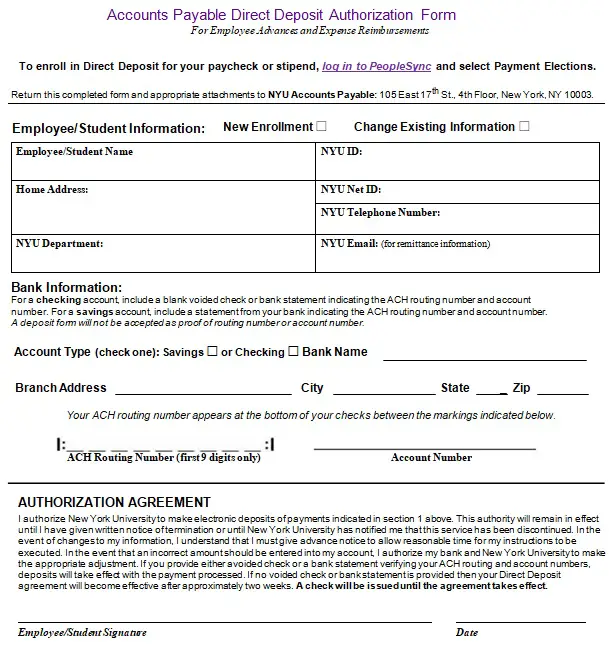

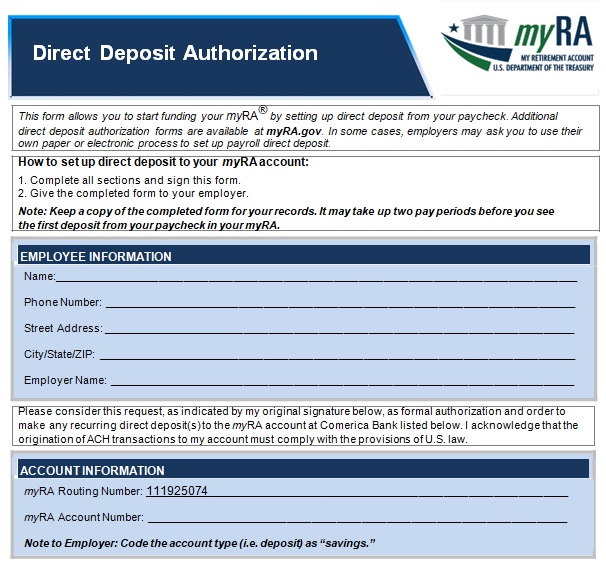

Accounts Payable Direct Deposit Authorization Form

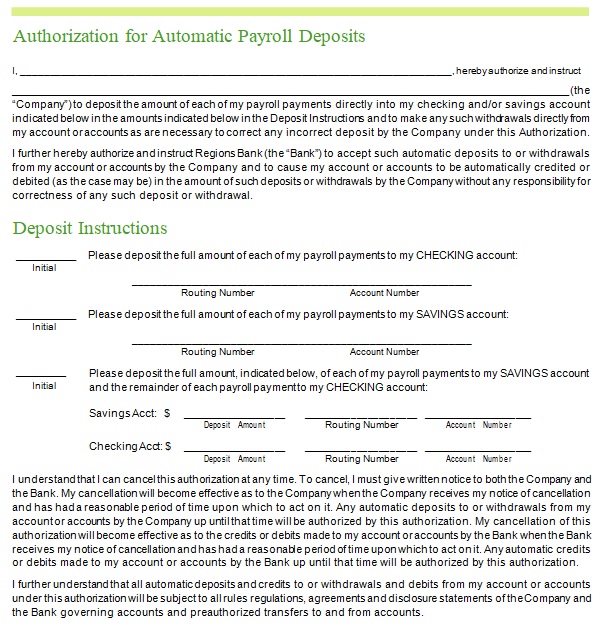

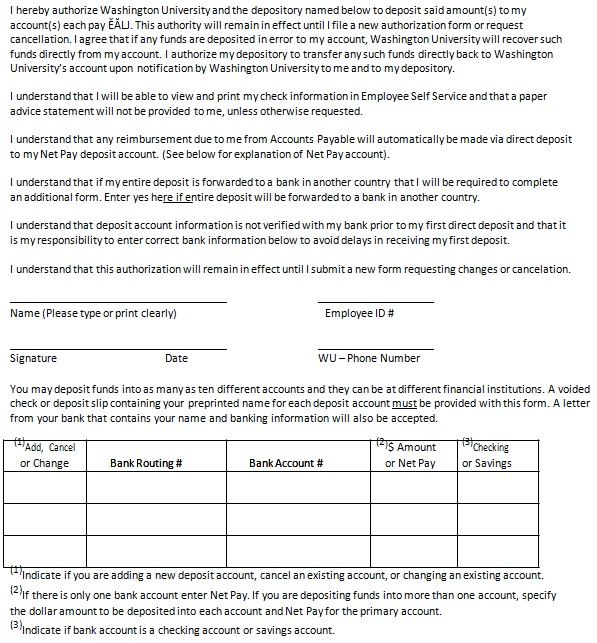

Authorization for Automatic Payroll Deposits Template

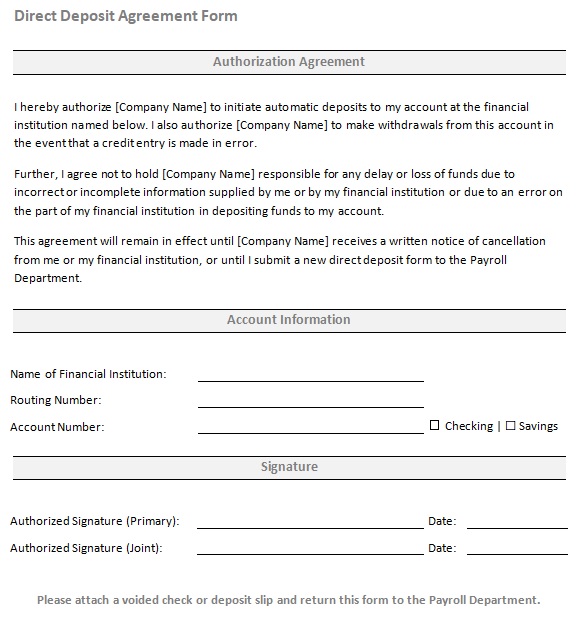

Direct Deposit Agreement Form

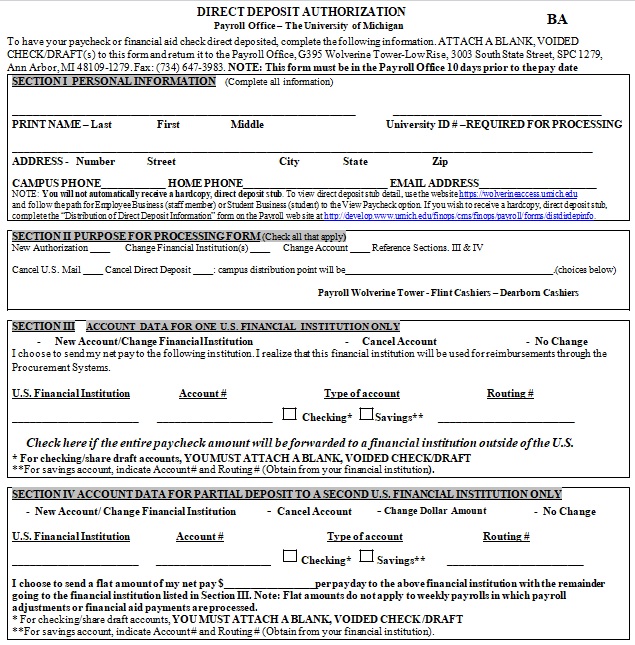

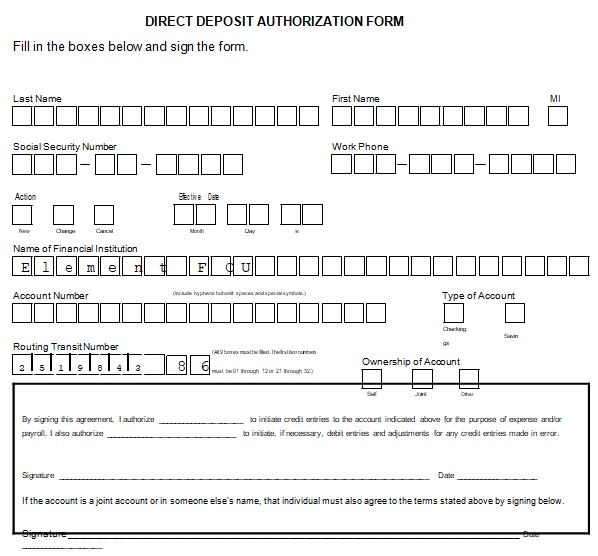

Direct Deposit Authorization Form Template

Direct Deposit Authorization Form

Direct Deposit Form Generic

Direct Deposit Form Template

Employee Direct Deposit Authorization Template

Free Printable Direct Deposit Form

Harvard University Direct Deposit Authorization Form

Payroll Services Direct Deposit Authorization Form

Printable Direct Deposit Authorization Form

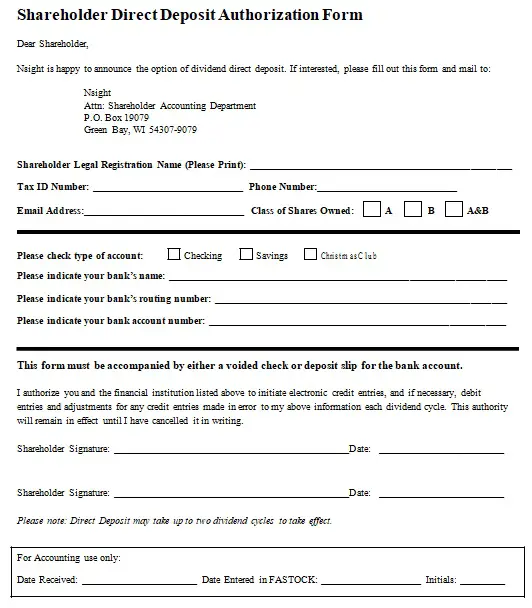

Shareholder Direct Deposit Authorization Form

Conclusion:

In conclusion, a direct deposit form template is a helpful tool for employers. It provides many benefits to them such as reduced labor costs to process payroll, less chance of check fraud, etc.